$TOTO (5332.JP)$

'Amateur investors' ramblings'

Is the performance of #5332_TOTO crossing the 200-day moving average in a sideways pattern poor? Did an analyst's lack of knowledge lead to a slip of the tongue?

There may still be short sellers emerging.

If I can keep selling until the end of March, the short sellers might win, right?

This is a discussion of what happens if the performance is really bad... Maybe the countdown to losing the future has started for analysts who lack study.

It's common for predictions to be wrong. Incorrect explanations...

Will the management continue to ignore the stock price decline so far? Will the 'postponement of upfront investment' alone cause the 'elimination of downward revisions'?

Management may need to provide supplementary explanations soon, don't you think?Currently, the 'interim report' has been released, but it may not be readable to amateurs...

There may still be short sellers and sellers coming out.

Is it a few months where grip strength is tested?

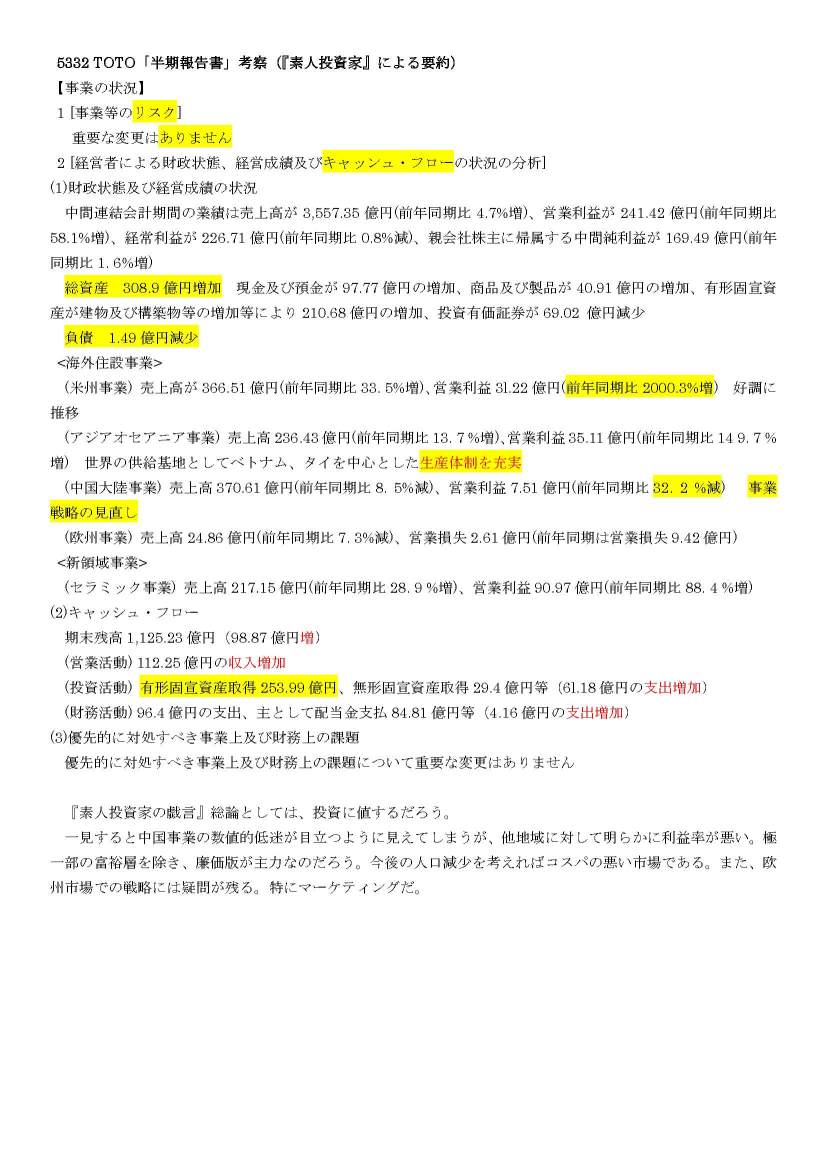

Summary of the 'interim report' by 'amateur investors'. It becomes a funny story...

Investment decisions are at your own risk. I hope you can laugh.

'Amateur investors' ramblings'

Is the performance of #5332_TOTO crossing the 200-day moving average in a sideways pattern poor? Did an analyst's lack of knowledge lead to a slip of the tongue?

There may still be short sellers emerging.

If I can keep selling until the end of March, the short sellers might win, right?

This is a discussion of what happens if the performance is really bad... Maybe the countdown to losing the future has started for analysts who lack study.

It's common for predictions to be wrong. Incorrect explanations...

Will the management continue to ignore the stock price decline so far? Will the 'postponement of upfront investment' alone cause the 'elimination of downward revisions'?

Management may need to provide supplementary explanations soon, don't you think?Currently, the 'interim report' has been released, but it may not be readable to amateurs...

There may still be short sellers and sellers coming out.

Is it a few months where grip strength is tested?

Summary of the 'interim report' by 'amateur investors'. It becomes a funny story...

Investment decisions are at your own risk. I hope you can laugh.

Translated

5

$TOTO (5332.JP)$

5332TOTO While many companies are experiencing double-digit declines in profits, is TOTO becoming excessively undervalued?

Having redirected expected profits towards proactive investments, it was harshly criticized by uninformed analysts...

For those with knowledge, they may have a different view towards proactive investments... that's the stock market, where stock prices are the ultimate verdict.

Those with knowledge should buy in at the lowest price only.

Without haste, just wait for the financial results for March. Now, with a price range of over 1250 yen to the highest point,

If a reversal begins, a continuous smile may follow.

When the financial results are complete, will you reassess its value?

Investment decisions are your own responsibility. I would be happy if you could smile.

5332TOTO While many companies are experiencing double-digit declines in profits, is TOTO becoming excessively undervalued?

Having redirected expected profits towards proactive investments, it was harshly criticized by uninformed analysts...

For those with knowledge, they may have a different view towards proactive investments... that's the stock market, where stock prices are the ultimate verdict.

Those with knowledge should buy in at the lowest price only.

Without haste, just wait for the financial results for March. Now, with a price range of over 1250 yen to the highest point,

If a reversal begins, a continuous smile may follow.

When the financial results are complete, will you reassess its value?

Investment decisions are your own responsibility. I would be happy if you could smile.

Translated

9

$TOTO (5332.JP)$

Code Company Name Securities Company Previous Updated

<5332> TOTO CLSA "Outperform" → "Hold"

<5332> TOTO Mizuho Securities "Buy" → "Buy" 5300 yen→5100 yen

Code Company Name Securities Company Previous Updated

<5332> TOTO CLSA "Outperform" → "Hold"

<5332> TOTO Mizuho Securities "Buy" → "Buy" 5300 yen→5100 yen

Translated

$Verb Technology (VERB.US)$

From MooMooAI

Verb Technology Company reported a significant increase in revenue for the quarter ending on September 30, 2024.

Year 2023 quarter3四半期の0.029 millionドルから2024年第3四半期の0.128 millionドルへの上昇で、前年同期比341%の成長を記録しました。

This increase is due to the partnership between the company's MARKEt.live business unit and TikTok, as well as revenue from the Go Fund Yourself unit.

Operating expenses decreased, while depreciation and intangible asset expensesAsset life extensionresulted in a decrease from 0.564 million dollars to 0.273 million dollars,general and administrative expenses decreased by 26% to 2.113 million dollarsdecreased.

The net profit of the company from continued operations improved by 1.576 million dollars.A loss of 1.965 million dollars.became

Verb Technology'sCash balance is 10.5 million dollars.and, Short-term investments amount to 5.1 million dollarsand it is in a solid situation.

The company offers interactive video-based social commerce, and...

From MooMooAI

Verb Technology Company reported a significant increase in revenue for the quarter ending on September 30, 2024.

Year 2023 quarter3四半期の0.029 millionドルから2024年第3四半期の0.128 millionドルへの上昇で、前年同期比341%の成長を記録しました。

This increase is due to the partnership between the company's MARKEt.live business unit and TikTok, as well as revenue from the Go Fund Yourself unit.

Operating expenses decreased, while depreciation and intangible asset expensesAsset life extensionresulted in a decrease from 0.564 million dollars to 0.273 million dollars,general and administrative expenses decreased by 26% to 2.113 million dollarsdecreased.

The net profit of the company from continued operations improved by 1.576 million dollars.A loss of 1.965 million dollars.became

Verb Technology'sCash balance is 10.5 million dollars.and, Short-term investments amount to 5.1 million dollarsand it is in a solid situation.

The company offers interactive video-based social commerce, and...

Translated

5

3

$TOTO (5332.JP)$

#5332TOTO Buy signal obtained a doji candle the next day rose by 100 yen.

It's according to the anomaly. Congratulations to the person who bought it first thing in the morning.

The result of many analysts retroactively attributing reasons for the decline to the inability to read B/S is a 20% off bargain price.20% OFF bargain price.

The responsibility of incompetent analysts who expressed reduced capital investment as a decline is heavy.

What is expected isBefore the crash on 10/28, it was ¥4,924, anda good financial performanceThe stock price determined correctly is just the beginning.

Today's result is +¥100, there is still over ¥500 remaining to reach the first target of ¥4,924.

Investment decisions are the responsibility of the individual.I would be glad if you could laugh.

#5332TOTO Buy signal obtained a doji candle the next day rose by 100 yen.

It's according to the anomaly. Congratulations to the person who bought it first thing in the morning.

The result of many analysts retroactively attributing reasons for the decline to the inability to read B/S is a 20% off bargain price.20% OFF bargain price.

The responsibility of incompetent analysts who expressed reduced capital investment as a decline is heavy.

What is expected isBefore the crash on 10/28, it was ¥4,924, anda good financial performanceThe stock price determined correctly is just the beginning.

Today's result is +¥100, there is still over ¥500 remaining to reach the first target of ¥4,924.

Investment decisions are the responsibility of the individual.I would be glad if you could laugh.

Translated

9

1

$TOTO (5332.JP)$

#5332TOTO The day after obtaining the buy signal dojithe price started to rise

The result of many analysts determining the reason for the decline without being able to read the B/S is,20% off bargain price

The responsibility of incompetent analysts who expressed capital investment as reduced earnings is heavy

4924 yen before the market crash on 10/28evaluated the good earnings properlyThe stock price beyond that

Investment decisions are the responsibility of the individual. I would be glad if you could laugh.

#5332TOTO The day after obtaining the buy signal dojithe price started to rise

The result of many analysts determining the reason for the decline without being able to read the B/S is,20% off bargain price

The responsibility of incompetent analysts who expressed capital investment as reduced earnings is heavy

4924 yen before the market crash on 10/28evaluated the good earnings properlyThe stock price beyond that

Investment decisions are the responsibility of the individual. I would be glad if you could laugh.

Translated

5

1

$TOTO (5332.JP)$

'Amateur investors' 5332 TOTO 11/6 hot stocks Focus your remaining power?

24/11/02 07:30Excerpt from Minkabu.

<November 1 Cross Candle Signals Revealed Stocks (Buy Signal)> 5332 TOTO [Closing Price 4,250.0 | Change from Previous Day -0.93%]

Explanation: A "cross candle" refers to a stock where the opening and closing prices are the same. It is also known as a "doji line" and is a signal of change. A cross candle appearing in the low price range is considered a buy signal, while one in the high price range is regarded as a sell signal. Source: Minkabu PressDoji line」とも呼ばれ、変化シグナルで、A doji appearing in the low price range is a buy signal.Conversely, showing a presence in the high price range is considered a sell signal. Source: MINKABU PRESS

24/10/28 18:33Excerpt from SBI.

TOTO announced on the 28th...Revenue increased by 4.7% year-on-year to 355.7 billion yen.Record high as interim results.The overseas residential construction business such as warm water toilet seats in the USA and Taiwan expanded, and the price revision of the domestic residential construction business pushed up the revenue.China businesshascontinues to be affected by the sluggish market.Decrease in revenue and net profitIt was.

Net profit increased by 1.6% to 16.9 billion yenIt has become. In recent years, the ceramics business focusing on semiconductors has been affected by the semiconductor market...

'Amateur investors' 5332 TOTO 11/6 hot stocks Focus your remaining power?

24/11/02 07:30Excerpt from Minkabu.

<November 1 Cross Candle Signals Revealed Stocks (Buy Signal)> 5332 TOTO [Closing Price 4,250.0 | Change from Previous Day -0.93%]

Explanation: A "cross candle" refers to a stock where the opening and closing prices are the same. It is also known as a "doji line" and is a signal of change. A cross candle appearing in the low price range is considered a buy signal, while one in the high price range is regarded as a sell signal. Source: Minkabu PressDoji line」とも呼ばれ、変化シグナルで、A doji appearing in the low price range is a buy signal.Conversely, showing a presence in the high price range is considered a sell signal. Source: MINKABU PRESS

24/10/28 18:33Excerpt from SBI.

TOTO announced on the 28th...Revenue increased by 4.7% year-on-year to 355.7 billion yen.Record high as interim results.The overseas residential construction business such as warm water toilet seats in the USA and Taiwan expanded, and the price revision of the domestic residential construction business pushed up the revenue.China businesshascontinues to be affected by the sluggish market.Decrease in revenue and net profitIt was.

Net profit increased by 1.6% to 16.9 billion yenIt has become. In recent years, the ceramics business focusing on semiconductors has been affected by the semiconductor market...

Translated

5

$Tokai Tokyo Financial Holdings (8616.JP)$

8616 Tokai Tokyo The dividend yield has sharply risen by 6.17% due to the decline in the stock price. Fiscal year ending March 25The consolidated operating profit for the cumulative second quarter (April-September) decreased by 10.8% compared to the same period last year is the reason for this, but it is unclear whether dividends will be reduced.The reason for this is the decrease in the consolidated operating profit for the cumulative second quarter (April-September) by 10.8% compared to the same period last year, but it is unclear whether dividends will be reduced... PBR 0.63, PER 9.89

Now, it seems like a perfect opportunity to enjoy deliciously.

If you consider owning it permanently at 6.17%, it's a covetable item.Becoming.

'Amateur Investor's Nonsense' Investment decisions are the responsibility of the individual. I would be glad if you could laugh.

Tokai Tokyo Financial Holdings <8616> [TSE P] announced its earnings on the morning of October 31st at 11:00 AM. The consolidated ordinary profit for the cumulative second quarter of the fiscal year ending March 2025 (April-September) decreased by 10.8% year-on-year to 7.36 billion yen.

The consolidated financial results for the second quarter (2Q) of July-September, the most recent 3 months...

8616 Tokai Tokyo The dividend yield has sharply risen by 6.17% due to the decline in the stock price. Fiscal year ending March 25The consolidated operating profit for the cumulative second quarter (April-September) decreased by 10.8% compared to the same period last year is the reason for this, but it is unclear whether dividends will be reduced.The reason for this is the decrease in the consolidated operating profit for the cumulative second quarter (April-September) by 10.8% compared to the same period last year, but it is unclear whether dividends will be reduced... PBR 0.63, PER 9.89

Now, it seems like a perfect opportunity to enjoy deliciously.

If you consider owning it permanently at 6.17%, it's a covetable item.Becoming.

'Amateur Investor's Nonsense' Investment decisions are the responsibility of the individual. I would be glad if you could laugh.

Tokai Tokyo Financial Holdings <8616> [TSE P] announced its earnings on the morning of October 31st at 11:00 AM. The consolidated ordinary profit for the cumulative second quarter of the fiscal year ending March 2025 (April-September) decreased by 10.8% year-on-year to 7.36 billion yen.

The consolidated financial results for the second quarter (2Q) of July-September, the most recent 3 months...

Translated

11

$Mitsui O.S.K. Lines (9104.JP)$

'Amateur Investor's Nonsense'Mitsui O.S.K. Lines 9104 Already increased its annual dividend further in the second quarter financial results

Currently, the year-end dividend is 60 yen lower than the September interim dividend, but the announcement of an increase without waiting for the 3rd and 4th quarters is undoubtedly expected to be at least +20 yen.

If the year-end dividend becomes 180 yen in March, the annual dividend will be 360 yen. Expectations are rising.

Should I take profit once and then repurchase around the end of the period?Should I increase my purchase here?Amateur investorsIt's a difficult decision.

[TSE P] announced its financial results on October 31 at noon (12:00). The consolidated ordinary profit for the cumulative second quarter of the fiscal year ending March 2025 (April-September) increased by 61.2% year-on-year to 249 billion yen.

In addition, the annual operating income forecast was revised upward by 4.3%, from the previous estimate of 350 billion yen to 365 billion yen (the previous year was 258.9 billion yen), and the profit growth rate is expected to expand from 35.1% to 40.9%.

Based on the interim results announced by the company and the full-year plan, the estimated consolidated ordinary profit for the October-March period (second half) calculated by the company increased by 11.0% year-on-year to 115.9 billion yen...

'Amateur Investor's Nonsense'Mitsui O.S.K. Lines 9104 Already increased its annual dividend further in the second quarter financial results

Currently, the year-end dividend is 60 yen lower than the September interim dividend, but the announcement of an increase without waiting for the 3rd and 4th quarters is undoubtedly expected to be at least +20 yen.

If the year-end dividend becomes 180 yen in March, the annual dividend will be 360 yen. Expectations are rising.

Should I take profit once and then repurchase around the end of the period?Should I increase my purchase here?Amateur investorsIt's a difficult decision.

[TSE P] announced its financial results on October 31 at noon (12:00). The consolidated ordinary profit for the cumulative second quarter of the fiscal year ending March 2025 (April-September) increased by 61.2% year-on-year to 249 billion yen.

In addition, the annual operating income forecast was revised upward by 4.3%, from the previous estimate of 350 billion yen to 365 billion yen (the previous year was 258.9 billion yen), and the profit growth rate is expected to expand from 35.1% to 40.9%.

Based on the interim results announced by the company and the full-year plan, the estimated consolidated ordinary profit for the October-March period (second half) calculated by the company increased by 11.0% year-on-year to 115.9 billion yen...

Translated

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)