Sptanwoo

liked

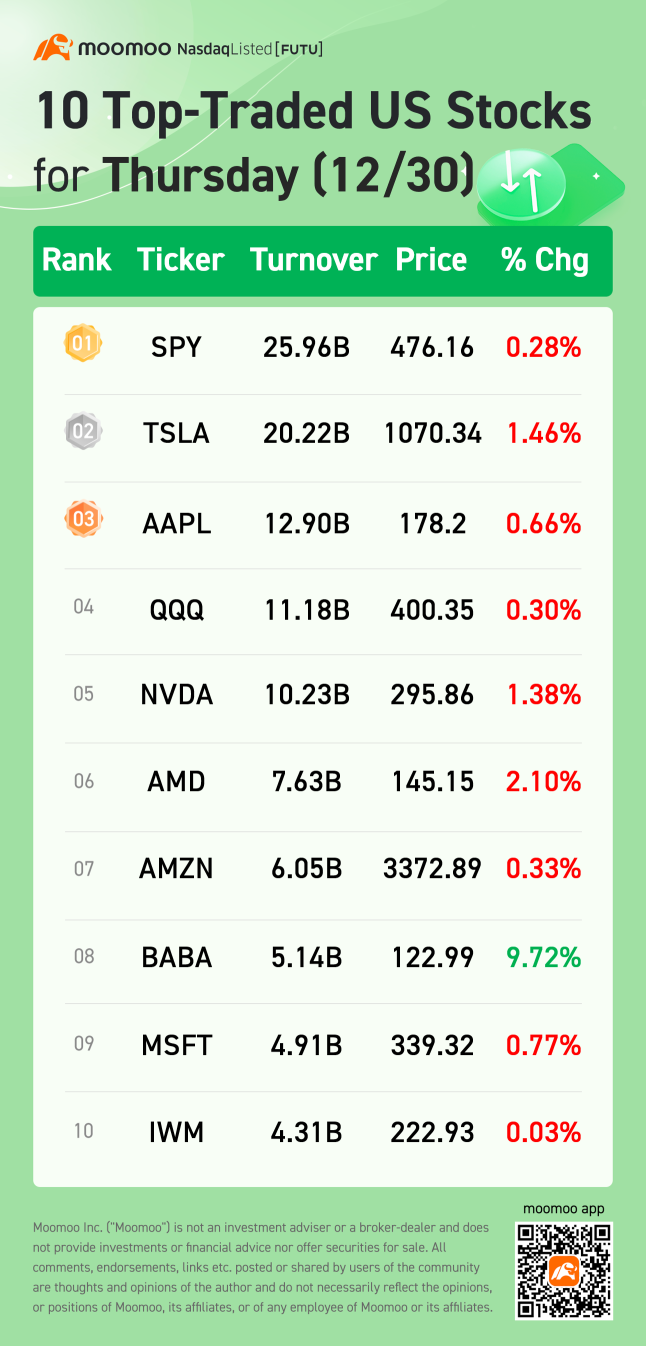

Were you tuned into our "Invest with Sarge" livestream which demystifies the art of trending stocks? If not, no worries — we've got a balanced recap to keep you in the loop and ready to tackle the market trends like a pro!

Insights into Trending Stocks

In our recent session, Sarge explored the dynamics of trending stocks such as $NVIDIA (NVDA.US)$ and $Tesla (TSLA.US)$. These stocks often gain significant attention and can present opportunitie...

65

13

16

Sptanwoo

commented on

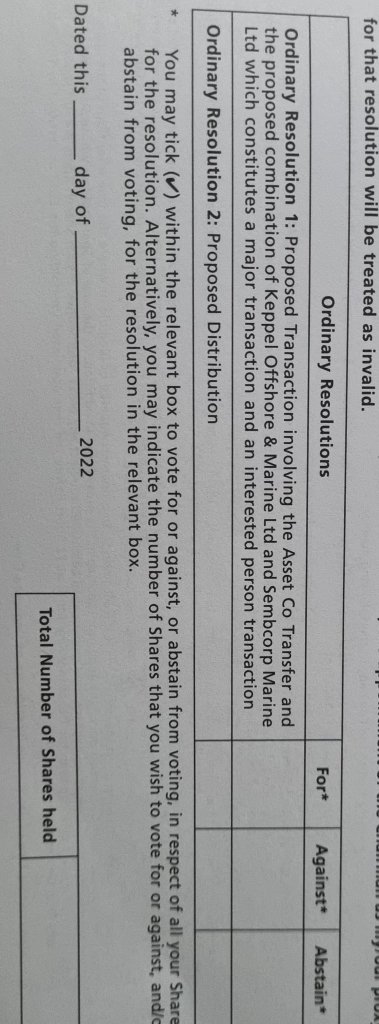

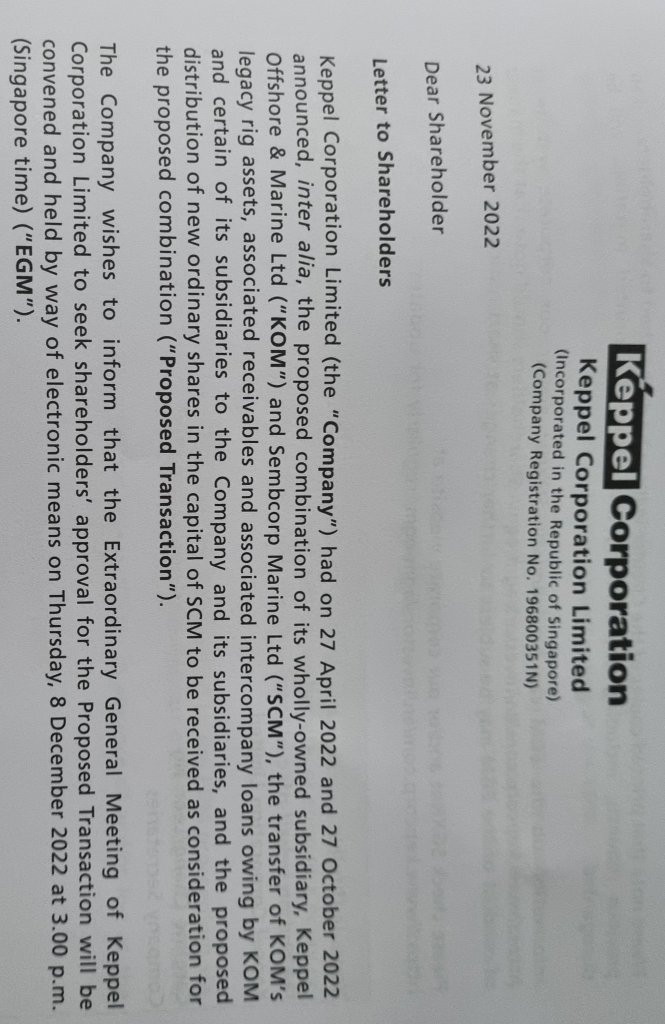

$Keppel (BN4.SG)$ Well done. 752

7

24

Sptanwoo

commented on

7

18

Sptanwoo

liked

36

3

1

Sptanwoo

liked

Stocks sink in late-day selloff as big tech falls

U.S. stocks fell in thin trading a day after notching another all-time high in the final days of the year. Treasuries ticked higher.

The S&P 500 sank to session lows in the last few minutes of trading Thursday, a day after posting its 70th record close of the year. Big-tech stocks including $Microsoft (MSFT.US)$ and $Apple (AAPL.US)$ helped drag the $Nasdaq Composite Index (.IXIC.US)$ lower, wh...

U.S. stocks fell in thin trading a day after notching another all-time high in the final days of the year. Treasuries ticked higher.

The S&P 500 sank to session lows in the last few minutes of trading Thursday, a day after posting its 70th record close of the year. Big-tech stocks including $Microsoft (MSFT.US)$ and $Apple (AAPL.US)$ helped drag the $Nasdaq Composite Index (.IXIC.US)$ lower, wh...

66

15

13

Sptanwoo

liked

Even beyond the launch of the first U.S. Bitcoin futures ETF, cryptocurrency funds notched some notable global milestones in 2021.

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020. Assets soared to $63 billion, compared to $24 billion at the start of the year.

--- according to Bloomberg Intelligence data

Globally, it's obviously a phenomenon that's starting to take off. If you look at inflows on a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you're seeing a lot of institutions jump in.”

--- Leah Wald, chief executive of crypto asset manager Valkyrie Investments, said on Bloomberg's "QuickTake Stock" streaming program.

Grayscale Investments LLC is the largest asset manager in the digital-assets space, with the $30 billion $Grayscale Bitcoin Trust (GBTC.US)$ ranking as the world's largest crypto fund.

The First U.S. bitcoin-linked ETF $ProShares Bitcoin ETF (BITO.US)$ incepted in October, which recevied a lot of attention. It only took two days for the fund to accumulate $1 billion.

Unlike an ETF directly connected to spot Bitcoin, the futures-backed products such as BITO are vulnerable to so-called associated with managing contracts. It's likely that investor demand would be even higher if physically backed funds were allowed to launch in the U.S., according to Bloomberg Intelligence.

I can't help but think that the assets in this space would be even larger if we had more efficient structures, like spot ETFs, in the U.S.”

--- said James Seyffart, Bloomberg Intelligence ETF analyst.

Watch now: What crypto's breakout year means for the market in 2022

Indeed, flows into the ProShares fund have stalled, with the ETF down more than 30% since its mid-October launch. Meanwhile, similar products from Valkyrie and VanEck have less than $70 million in assets combined.

Valkyrie's Wald is optimistic that flows will pick up in 2022. Institutional money managers are likely waiting to see how the U.S. futures-backed ETF handle the roll costs, she said.

That specific vehicle, I think a lot of money managers want to look at the metrics before jumping in. We're excited about what next year has to hold.”

--- Wald said.

Source: Bloomberg

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020. Assets soared to $63 billion, compared to $24 billion at the start of the year.

--- according to Bloomberg Intelligence data

Globally, it's obviously a phenomenon that's starting to take off. If you look at inflows on a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you're seeing a lot of institutions jump in.”

--- Leah Wald, chief executive of crypto asset manager Valkyrie Investments, said on Bloomberg's "QuickTake Stock" streaming program.

Grayscale Investments LLC is the largest asset manager in the digital-assets space, with the $30 billion $Grayscale Bitcoin Trust (GBTC.US)$ ranking as the world's largest crypto fund.

The First U.S. bitcoin-linked ETF $ProShares Bitcoin ETF (BITO.US)$ incepted in October, which recevied a lot of attention. It only took two days for the fund to accumulate $1 billion.

Unlike an ETF directly connected to spot Bitcoin, the futures-backed products such as BITO are vulnerable to so-called associated with managing contracts. It's likely that investor demand would be even higher if physically backed funds were allowed to launch in the U.S., according to Bloomberg Intelligence.

I can't help but think that the assets in this space would be even larger if we had more efficient structures, like spot ETFs, in the U.S.”

--- said James Seyffart, Bloomberg Intelligence ETF analyst.

Watch now: What crypto's breakout year means for the market in 2022

Indeed, flows into the ProShares fund have stalled, with the ETF down more than 30% since its mid-October launch. Meanwhile, similar products from Valkyrie and VanEck have less than $70 million in assets combined.

Valkyrie's Wald is optimistic that flows will pick up in 2022. Institutional money managers are likely waiting to see how the U.S. futures-backed ETF handle the roll costs, she said.

That specific vehicle, I think a lot of money managers want to look at the metrics before jumping in. We're excited about what next year has to hold.”

--- Wald said.

Source: Bloomberg

46

7

7

Sptanwoo

liked

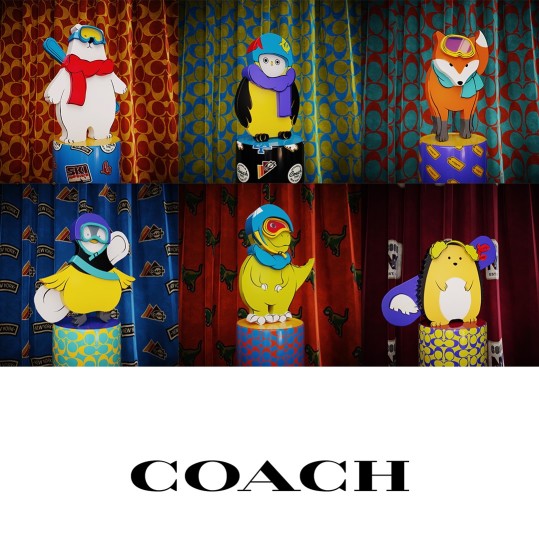

Coach has launched its first collection of NFTs, featuring eight Coach holiday animals from the fashion house. The release of the NFTs marks the finale of Coach's 80 years anniversary with digital innovation.

It also celebrates the house's holiday message to "Give A Little Love". The 80 one-of-a-kind pieces of digital art will include Coach's beloved mascot Rexy, Fuzz the polar bear, Belle the penguin, Holly the deer, Ginger the fox, Paddles the goose, Luna the owl, and Spike the hedgehog. All of the characters were also launched in the fashion's house latest digital game, Snow City.

According to the fashion house, 10 unique NFTs of each of the eight characters will be given away over eight days. There will be one animal per day from today, December 17th through Christmas Eve on the 24th.

The drop will be announced through Coach's Twitter account. Additionally, each Coach NFT grants consumers the right to receive one complimentary Made-to-Order Rogue bag gifted to the initial holders of the Coach NFTs in 2022.

Source: Coach.com, Marketing Interactive

It also celebrates the house's holiday message to "Give A Little Love". The 80 one-of-a-kind pieces of digital art will include Coach's beloved mascot Rexy, Fuzz the polar bear, Belle the penguin, Holly the deer, Ginger the fox, Paddles the goose, Luna the owl, and Spike the hedgehog. All of the characters were also launched in the fashion's house latest digital game, Snow City.

According to the fashion house, 10 unique NFTs of each of the eight characters will be given away over eight days. There will be one animal per day from today, December 17th through Christmas Eve on the 24th.

The drop will be announced through Coach's Twitter account. Additionally, each Coach NFT grants consumers the right to receive one complimentary Made-to-Order Rogue bag gifted to the initial holders of the Coach NFTs in 2022.

Source: Coach.com, Marketing Interactive

41

8

6

Sptanwoo

liked

+1

72

1

3

Sptanwoo

liked

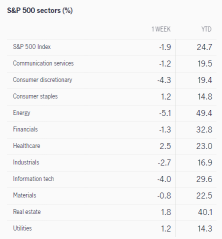

Weekly market recap

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

The major averages are coming off a negative week, with the $S&P 500 Index (.SPX.US)$ declining 1.9%. The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average (.DJI.US)$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology (MU.US)$ and $Nike (NKE.US)$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry (BB.US)$, $FactSet Research Systems (FDS.US)$, and $General Mills (GIS.US)$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax (KMX.US)$, $Cintas (CTAS.US)$, and $Paychex (PAYX.US)$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

The major averages are coming off a negative week, with the $S&P 500 Index (.SPX.US)$ declining 1.9%. The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average (.DJI.US)$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology (MU.US)$ and $Nike (NKE.US)$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry (BB.US)$, $FactSet Research Systems (FDS.US)$, and $General Mills (GIS.US)$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax (KMX.US)$, $Cintas (CTAS.US)$, and $Paychex (PAYX.US)$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

+2

113

7

14

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)