Stephen Zheng

voted

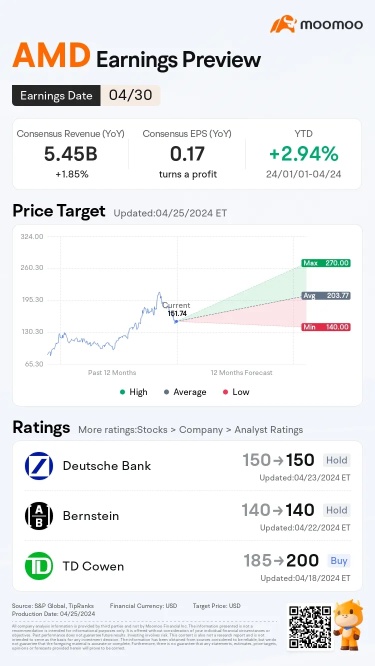

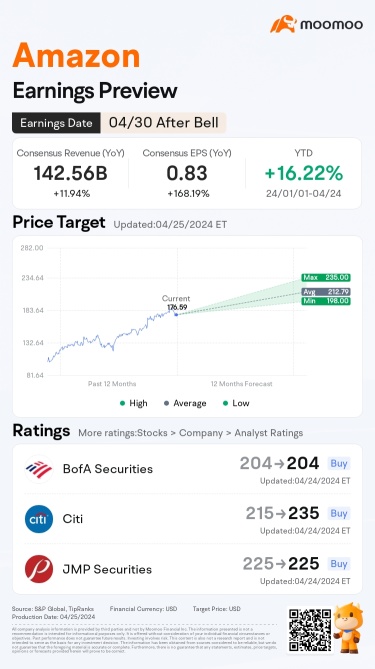

AMD and Amazon are releasing their Q1 earnings after the market closes on April 30. Who will please the market more, the e-commerce giant or the AI darling? Make your prediction to grab point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest gains in Wednesday's intraday trading (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at 9:3...

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest gains in Wednesday's intraday trading (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at 9:3...

62

48

Stephen Zheng

voted

Formula:

Buffett Indicator = Aggregate US Market Value ÷ Annualized GDP

$Apple (AAPL.US)$ $Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Berkshire Hathaway-A (BRK.A.US)$

12

24

Stephen Zheng

voted

$Intel (INTC.US)$ $Taiwan Semiconductor (TSM.US)$ Technology is evolving at an insane rate.We've been able to observe a dramatic upward curve, especially over the last decade, and it doesn't look like it's going to slow down in the coming years. Among other things, he told us that TSMC may not be the first company to bring this advanced production process to market.

Will Intel be the first manufacturer to bring a 2 nanometer chip to marke?

It's ...

Will Intel be the first manufacturer to bring a 2 nanometer chip to marke?

It's ...

11

Stephen Zheng

liked

$NIO Inc (NIO.US)$ good time to invest 😊

13

1

$Apple (AAPL.US)$ Stable

Translated

8

Stephen Zheng

liked

Columns Value and Growth Stocks

Growth stocks are those companies that are considered to have the potential to outperform the overall market over time because of their future potential.

Value stocks are classified as companies that are currently trading below what they are really worth and will thus provide a superior return.

The concept of a growth stock versus one that is considered to be undervalued generally comes from the fundamental stock analysis. Growth stocks are considered by analysts to have the potential to outperform either the overall markets or else a specific subsegment of them for a period of time.

...

Value stocks are classified as companies that are currently trading below what they are really worth and will thus provide a superior return.

The concept of a growth stock versus one that is considered to be undervalued generally comes from the fundamental stock analysis. Growth stocks are considered by analysts to have the potential to outperform either the overall markets or else a specific subsegment of them for a period of time.

...

89

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)