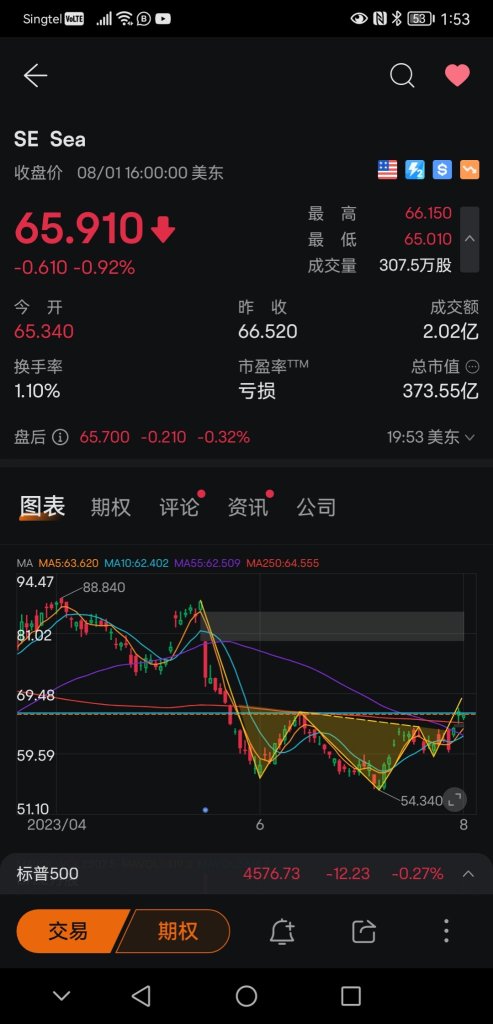

$Sea (SE.US)$

Small head and shoulder bottom pattern, pay close attention to performance near the neckline and annual line

Small head and shoulder bottom pattern, pay close attention to performance near the neckline and annual line

Translated

4

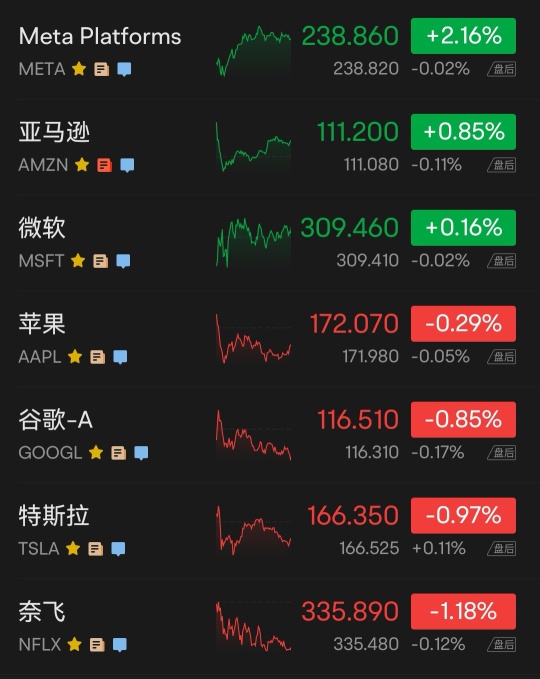

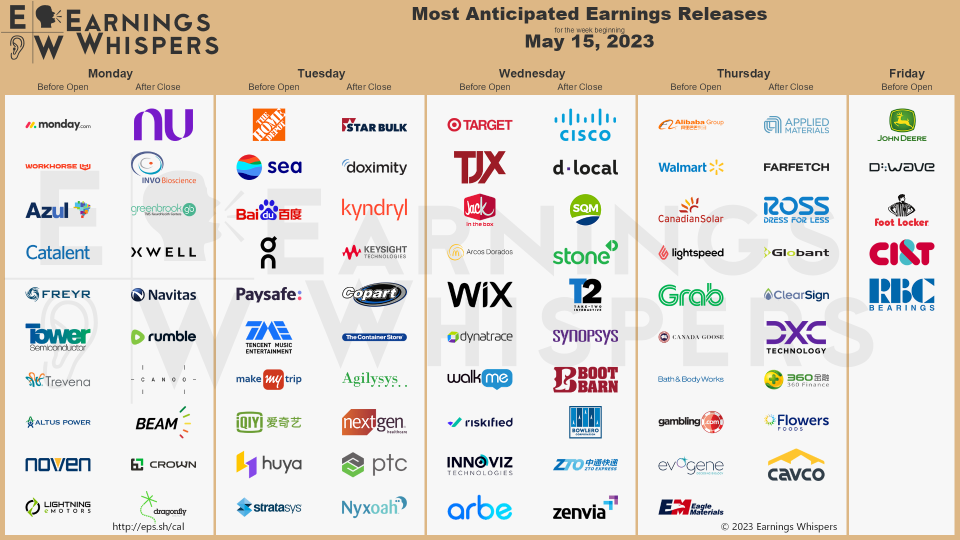

US stocks rose by more than 1%, with the Dow rising more than 400 points, the bank stock benchmark index up 5%, and the regional bank stock index up more than 7%.

On Wednesday, May 17th, optimistic remarks about the progress of US debt ceiling negotiations boosted risk appetite, leading to a collective high open for US stocks. Within the first hour of trading, the Nasdaq briefly turned negative, but then quickly turned positive. By midday, US stocks reached the day's high and all rose by over 1%.

The Dow rose by a maximum of 460 points or 1.4%, having previously fallen by 1% and closed below the 50-day moving average technical key level for the first time since March 30th. The S&P 500 and Nasdaq rose by a maximum of 1.3%, with the Russell small cap stocks leading the way, up over 2%, and the S&P non-essential consumer goods sector leading the rise.

At the close, US stocks lingered near the day's high, with the S&P approaching a complete recovery of the decline since May 1st. The Dow rose for the second day in eight days to achieve the highest level in a week, while the Nasdaq returned to its highest level since August 25th last year. The Nasdaq 100 reached its highest level since August 16th last year and rose for three consecutive days:

$S&P 500 Index (.SPX.US)$ Up 48.87 points, an increase of 1.19%, closing at 4158.77 points. $Dow Jones Industrial Average (.DJI.US)$ Up 408.63 points, an increase of 1.24%, closing at 33420.77 points. $Nasdaq Composite Index (.IXIC.US)$ It closed up 157.51 points...

On Wednesday, May 17th, optimistic remarks about the progress of US debt ceiling negotiations boosted risk appetite, leading to a collective high open for US stocks. Within the first hour of trading, the Nasdaq briefly turned negative, but then quickly turned positive. By midday, US stocks reached the day's high and all rose by over 1%.

The Dow rose by a maximum of 460 points or 1.4%, having previously fallen by 1% and closed below the 50-day moving average technical key level for the first time since March 30th. The S&P 500 and Nasdaq rose by a maximum of 1.3%, with the Russell small cap stocks leading the way, up over 2%, and the S&P non-essential consumer goods sector leading the rise.

At the close, US stocks lingered near the day's high, with the S&P approaching a complete recovery of the decline since May 1st. The Dow rose for the second day in eight days to achieve the highest level in a week, while the Nasdaq returned to its highest level since August 25th last year. The Nasdaq 100 reached its highest level since August 16th last year and rose for three consecutive days:

$S&P 500 Index (.SPX.US)$ Up 48.87 points, an increase of 1.19%, closing at 4158.77 points. $Dow Jones Industrial Average (.DJI.US)$ Up 408.63 points, an increase of 1.24%, closing at 33420.77 points. $Nasdaq Composite Index (.IXIC.US)$ It closed up 157.51 points...

Translated

+3

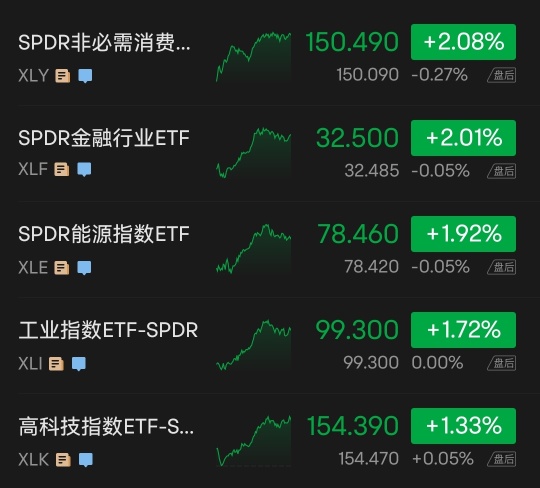

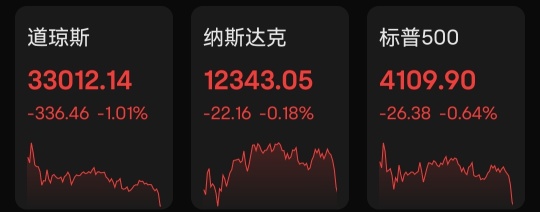

Retail trends were poor under high interest rates and high inflation. US retail sales in April fell short of expectations. US House Republican Speaker McCarthy said overnight debt ceiling negotiations with the White House were “not progressing,” all of which suppressed market risk appetite.

US stocks opened low, with the Dow falling as deep as 260 points or 0.8%. The S&P 500 index, which was also dragged down by Home Depot's stock price, fell the deepest 0.5%. Russell small-cap stocks, which were leading the way by rising more than 1% yesterday, fell more than 1%. Only the NASDAQ index turned up before noon trading, erasing a 0.3% decline. Among the 11 S&P sectors, only technology-related stocks such as information technology and communication services rose. At the end of the session, the decline in US stocks widened, and the NASDAQ fell again. $Dow Jones Industrial Average (.DJI.US)$

By the close, S&P erased all gains since May 5, and the Dow declined for the sixth day in seven days, erasing all gains since April. The NASDAQ fell to its highest level since August 25 last year. The NASDAQ 100 nearly erased 0.6% increase, but it hit the highest level since August 18 last year for two days:

$S&P 500 Index (.SPX.US)$ It closed down 26.38 points, or 0.64%, to 4109.90 points. $Dow Jones Industrial Average (.DJI.US)$ It closed down 336.46 points, or 1.01%, to 33012.14 points. $Nasdaq Composite Index (.IXIC.US)$ It closed down 22.16 points,...

US stocks opened low, with the Dow falling as deep as 260 points or 0.8%. The S&P 500 index, which was also dragged down by Home Depot's stock price, fell the deepest 0.5%. Russell small-cap stocks, which were leading the way by rising more than 1% yesterday, fell more than 1%. Only the NASDAQ index turned up before noon trading, erasing a 0.3% decline. Among the 11 S&P sectors, only technology-related stocks such as information technology and communication services rose. At the end of the session, the decline in US stocks widened, and the NASDAQ fell again. $Dow Jones Industrial Average (.DJI.US)$

By the close, S&P erased all gains since May 5, and the Dow declined for the sixth day in seven days, erasing all gains since April. The NASDAQ fell to its highest level since August 25 last year. The NASDAQ 100 nearly erased 0.6% increase, but it hit the highest level since August 18 last year for two days:

$S&P 500 Index (.SPX.US)$ It closed down 26.38 points, or 0.64%, to 4109.90 points. $Dow Jones Industrial Average (.DJI.US)$ It closed down 336.46 points, or 1.01%, to 33012.14 points. $Nasdaq Composite Index (.IXIC.US)$ It closed down 22.16 points,...

Translated

+4

2

1

On Monday, May 15th, the market continued to focus on the U.S. debt ceiling negotiations and the possibility of a historic default. Risk sentiment was volatile and uneasy.

After a small high opening, the US stocks quickly fell, with the Dow Jones Industrial Average falling nearly 140 points in the first 40 minutes of trading. Only Russell small-cap stocks maintained an upward trend. But during the midday session, US stocks rebounded, with the Nasdaq up 0.7%, leading the major indexes along with the more than 1% rise in Russell small-cap stocks.

At the close, the S&P 500 index ended a two-day decline, approaching a recovery of last Wednesday's decline. The Dow Jones Industrial Average ended a five-day decline, rebounding from a low level of one week. The Nasdaq hit its highest level since August 25 of last year, while the Nasdaq 100 hit its highest level since August 18 of last year:

$S&P 500 Index (.SPX.US)$ It closed up 12.20 points, up 0.30%, at 4136.28 points. $Dow Jones Industrial Average (.DJI.US)$ It closed up 47.98 points, up 0.14%, at 33348.60 points. $Nasdaq Composite Index (.IXIC.US)$ It closed up 80.47 points, up 0.66%, at 12365.21 points. $Invesco QQQ Trust (QQQ.US)$ Up 0.6%. $Ishares Russell 2000 Value Etf (IWN.US)$ Up 1.2%.

After a small high opening, the US stocks quickly fell, with the Dow Jones Industrial Average falling nearly 140 points in the first 40 minutes of trading. Only Russell small-cap stocks maintained an upward trend. But during the midday session, US stocks rebounded, with the Nasdaq up 0.7%, leading the major indexes along with the more than 1% rise in Russell small-cap stocks.

At the close, the S&P 500 index ended a two-day decline, approaching a recovery of last Wednesday's decline. The Dow Jones Industrial Average ended a five-day decline, rebounding from a low level of one week. The Nasdaq hit its highest level since August 25 of last year, while the Nasdaq 100 hit its highest level since August 18 of last year:

$S&P 500 Index (.SPX.US)$ It closed up 12.20 points, up 0.30%, at 4136.28 points. $Dow Jones Industrial Average (.DJI.US)$ It closed up 47.98 points, up 0.14%, at 33348.60 points. $Nasdaq Composite Index (.IXIC.US)$ It closed up 80.47 points, up 0.66%, at 12365.21 points. $Invesco QQQ Trust (QQQ.US)$ Up 0.6%. $Ishares Russell 2000 Value Etf (IWN.US)$ Up 1.2%.

Translated

+2

4

4

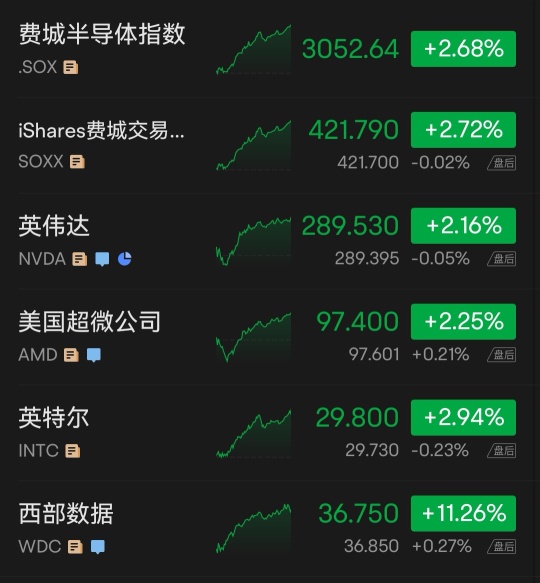

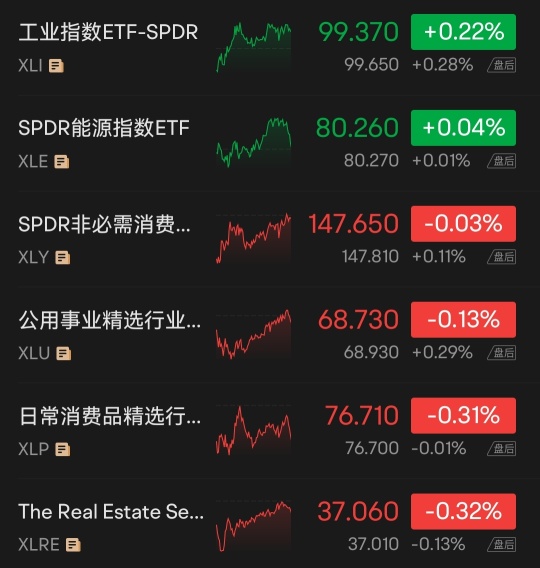

The major financial events and data for this week (5/15-5/19) are as follows:

In terms of economic data, there will be a cluster of U.S. New York Fed Manufacturing Index, Philadelphia Fed Manufacturing Index, U.S. Retail Sales MoM, U.S. API/EIA Crude Oil Inventories, and U.S. Initial Jobless Claims.

As for financial events, this week will feature speeches by Federal Reserve officials, including Minneapolis Fed President Kashkari, Cleveland Fed President Mester, and New York Fed President.WilliamsIn addition, on Friday, Federal Reserve Chairman Powell and former Chairman Bernanke will attend a group discussion on monetary policy.

In terms of financial reports, heavyweight financial reports of Chinese concept stocks are coming this week! $Tencent (TCEHY.US)$ $Alibaba (BABA.US)$ $Baidu (BIDU.US)$ and other technology giants will release their financial reports this week; as for the US stock market, investors should pay attention to the financial report of retail giant $Walmart (WMT.US)$ which will be released on Thursday, investors can focus on it.

On Monday, the economic data is relatively calm, investors need to pay attention to the Empire State Manufacturing Index of the United States Federal Reserve.

In terms of events, on May 15, Minneapolis Federal Reserve Chairman Kashkari will deliver a speech, and investors need to pay attention to his latest views.

5...

In terms of economic data, there will be a cluster of U.S. New York Fed Manufacturing Index, Philadelphia Fed Manufacturing Index, U.S. Retail Sales MoM, U.S. API/EIA Crude Oil Inventories, and U.S. Initial Jobless Claims.

As for financial events, this week will feature speeches by Federal Reserve officials, including Minneapolis Fed President Kashkari, Cleveland Fed President Mester, and New York Fed President.WilliamsIn addition, on Friday, Federal Reserve Chairman Powell and former Chairman Bernanke will attend a group discussion on monetary policy.

In terms of financial reports, heavyweight financial reports of Chinese concept stocks are coming this week! $Tencent (TCEHY.US)$ $Alibaba (BABA.US)$ $Baidu (BIDU.US)$ and other technology giants will release their financial reports this week; as for the US stock market, investors should pay attention to the financial report of retail giant $Walmart (WMT.US)$ which will be released on Thursday, investors can focus on it.

On Monday, the economic data is relatively calm, investors need to pay attention to the Empire State Manufacturing Index of the United States Federal Reserve.

In terms of events, on May 15, Minneapolis Federal Reserve Chairman Kashkari will deliver a speech, and investors need to pay attention to his latest views.

5...

Translated

2

1

The Dow Jones Industrial Average briefly turned higher several times during the day but ultimately fell along with other US stocks in the final session, as regional bank stocks index experienced a two-day decline.

On Tuesday, May 9, US stocks opened low and traded lower throughout the day, with regional bank stocks index declining. Within the first hour of trading, the Dow Jones briefly turned higher before falling again, while the Nasdaq fell 0.5% and the Russell 2000 small-cap stocks fell nearly 1%, leading the decline in major indexes.

During the midday session, the S&P 500 index, the Dow Jones, and the Nasdaq all hit intraday lows, falling 0.5%, nearly 110 points, and 0.7%, respectively. As the closing bell approached, the Dow Jones briefly turned higher multiple times but ultimately closed down along with other indexes, while the Nasdaq closed near its daily low.

At the close, the S&P, Nasdaq, and Nasdaq 100 all ended their two-day gains, while the Dow Jones saw a two-day decline. The Nasdaq fell below its highest level in almost eight months since September 12 last year, and the Nasdaq 100 fell below its highest level in nearly nine months since August 18 last year:

$S&P 500 Index (.SPX.US)$ It fell 18.95 points, or 0.46%, to close at 4119.17 points. $Dow Jones Industrial Average (.DJI.US)$ It fell 56.88 points, or 0.17%, to close at 33561.81 points. $Nasdaq Composite Index (.IXIC.US)$ It fell 77.36 points, or 0.63%, to close at 12179.55 points. $Invesco QQQ Trust (QQQ.US)$ Fell 0.7%, .....

On Tuesday, May 9, US stocks opened low and traded lower throughout the day, with regional bank stocks index declining. Within the first hour of trading, the Dow Jones briefly turned higher before falling again, while the Nasdaq fell 0.5% and the Russell 2000 small-cap stocks fell nearly 1%, leading the decline in major indexes.

During the midday session, the S&P 500 index, the Dow Jones, and the Nasdaq all hit intraday lows, falling 0.5%, nearly 110 points, and 0.7%, respectively. As the closing bell approached, the Dow Jones briefly turned higher multiple times but ultimately closed down along with other indexes, while the Nasdaq closed near its daily low.

At the close, the S&P, Nasdaq, and Nasdaq 100 all ended their two-day gains, while the Dow Jones saw a two-day decline. The Nasdaq fell below its highest level in almost eight months since September 12 last year, and the Nasdaq 100 fell below its highest level in nearly nine months since August 18 last year:

$S&P 500 Index (.SPX.US)$ It fell 18.95 points, or 0.46%, to close at 4119.17 points. $Dow Jones Industrial Average (.DJI.US)$ It fell 56.88 points, or 0.17%, to close at 33561.81 points. $Nasdaq Composite Index (.IXIC.US)$ It fell 77.36 points, or 0.63%, to close at 12179.55 points. $Invesco QQQ Trust (QQQ.US)$ Fell 0.7%, .....

Translated

+4

4

On Monday, May 8th, the Dow and S&P 500 indexes opened slightly higher under the boost of regional bank stocks, but quickly turned downward within the first hour of trading. The Dow fell by nearly a hundred points, while the Nasdaq opened and remained low throughout.

During the midday session, the Dow maintained a decline and fell by 124 points or 0.4%, while the S&P and Nasdaq turned higher. Earlier, they fell by 0.2% and 0.5% respectively. The S&P was mainly boosted by a nearly 1% increase in the energy sector.

As of the close, the S&P 500 index rose for two consecutive days and recovered the losses since last Tuesday, while the Dow fell from its high of nearly a week ago, and the Nasdaq rose for two consecutive days to its highest level in almost eight months since September 12 last year. The Nasdaq 100 hit its highest level in almost nine months since August 18 last year.

$S&P 500 Index (.SPX.US)$ It closed up 1.87 points, an increase of 0.05%, at 4138.12 points. $Dow Jones Industrial Average (.DJI.US)$ It closed down 55.69 points, a decrease of 0.17%, at 33618.69 points. $Nasdaq Composite Index (.IXIC.US)$ It closed up 21.50 points, an increase of 0.18%, at 12256.92 points. $Invesco QQQ Trust (QQQ.US)$ It closed up 0.25%. The Russell 2000 small-cap index. $Ishares Russell 2000 Value Etf (IWN.US)$ It fell by 0.36%.

During the midday session, the Dow maintained a decline and fell by 124 points or 0.4%, while the S&P and Nasdaq turned higher. Earlier, they fell by 0.2% and 0.5% respectively. The S&P was mainly boosted by a nearly 1% increase in the energy sector.

As of the close, the S&P 500 index rose for two consecutive days and recovered the losses since last Tuesday, while the Dow fell from its high of nearly a week ago, and the Nasdaq rose for two consecutive days to its highest level in almost eight months since September 12 last year. The Nasdaq 100 hit its highest level in almost nine months since August 18 last year.

$S&P 500 Index (.SPX.US)$ It closed up 1.87 points, an increase of 0.05%, at 4138.12 points. $Dow Jones Industrial Average (.DJI.US)$ It closed down 55.69 points, a decrease of 0.17%, at 33618.69 points. $Nasdaq Composite Index (.IXIC.US)$ It closed up 21.50 points, an increase of 0.18%, at 12256.92 points. $Invesco QQQ Trust (QQQ.US)$ It closed up 0.25%. The Russell 2000 small-cap index. $Ishares Russell 2000 Value Etf (IWN.US)$ It fell by 0.36%.

Translated

+3

2

1

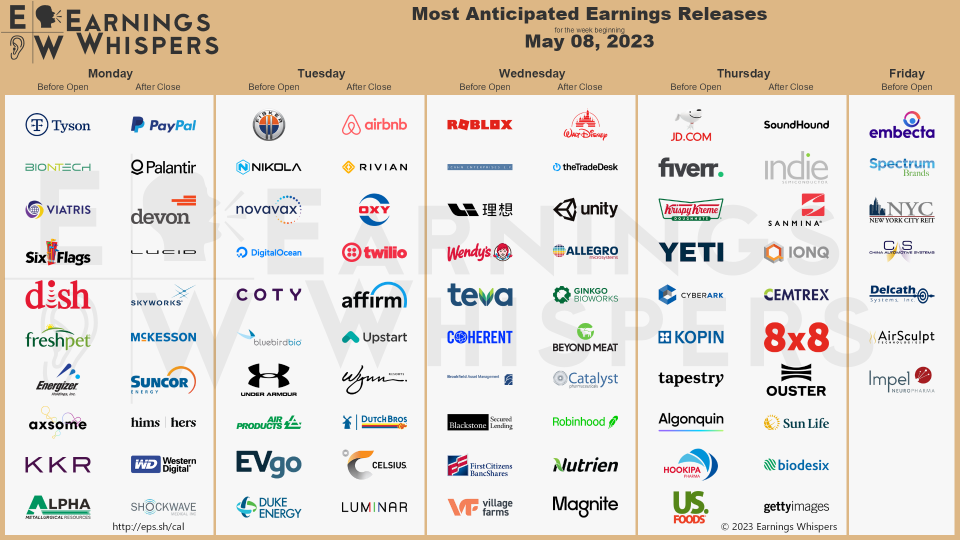

This week's key economic data, US April CPI data, initial jobless claims, and the preliminary value of the May University of Michigan Consumer Confidence Index are all coming out in a cluster.

On the financial events front, Federal Reserve officials will take turns speaking, including Director Jefferson, New York Fed President Williams, Director Waller, and others. In addition, the risk of debt default is looming, and US President Biden will meet with four senior congressional leaders to discuss the debt ceiling issue.

In terms of financial reports, although the peak of the Q1 earnings season for US stocks has passed, some important companies are still releasing their performances, including Chinese concept stocks like Li Auto and JD.com. US new energy auto brands $Lucid Group (LCID.US)$ 、 $Rivian Automotive (RIVN.US)$ As well as the legendary investor Buffett's frequent bets on $Occidental Petroleum (OXY.US)$ Quarterly reports will be released post-market on Monday and Tuesday in the US.

On Monday, economic data is relatively flat, investors should pay attention to the US March wholesale sales monthly rate.

On the financial report side, $Palantir (PLTR.US)$ 、 $Lucid Group (LCID.US)$ 、 $PayPal (PYPL.US)$ will announce its financial results post-market.

On Tuesday, in terms of economic data, investors need to pay attention to China's April trade data, China's April trade data in US dollars, and China's...

On the financial events front, Federal Reserve officials will take turns speaking, including Director Jefferson, New York Fed President Williams, Director Waller, and others. In addition, the risk of debt default is looming, and US President Biden will meet with four senior congressional leaders to discuss the debt ceiling issue.

In terms of financial reports, although the peak of the Q1 earnings season for US stocks has passed, some important companies are still releasing their performances, including Chinese concept stocks like Li Auto and JD.com. US new energy auto brands $Lucid Group (LCID.US)$ 、 $Rivian Automotive (RIVN.US)$ As well as the legendary investor Buffett's frequent bets on $Occidental Petroleum (OXY.US)$ Quarterly reports will be released post-market on Monday and Tuesday in the US.

On Monday, economic data is relatively flat, investors should pay attention to the US March wholesale sales monthly rate.

On the financial report side, $Palantir (PLTR.US)$ 、 $Lucid Group (LCID.US)$ 、 $PayPal (PYPL.US)$ will announce its financial results post-market.

On Tuesday, in terms of economic data, investors need to pay attention to China's April trade data, China's April trade data in US dollars, and China's...

Translated

+1

2

1

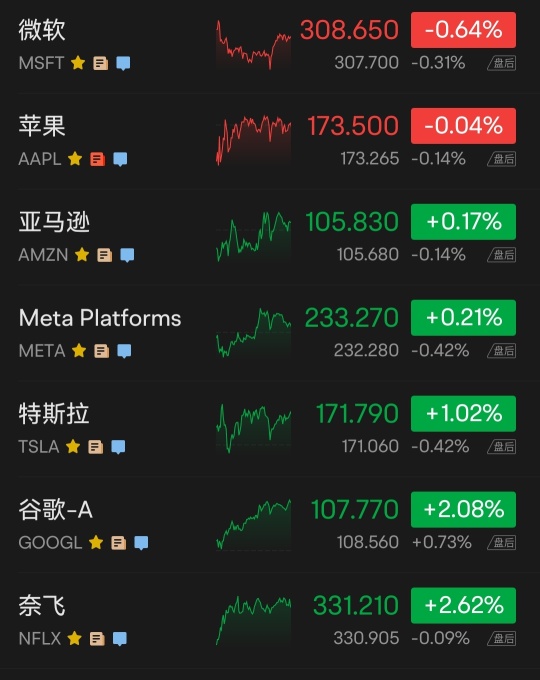

Nasdaq hits near eight-month high, while S&P and Dow are still down for the week. Intraday, Tesla and Apple surge over 5%, offsetting the double-digit declines of several regional bank stocks on Thursday.

Overall, the three major US stock indexes opened higher and maintained an upward trend, with all rising more than 1% in early trading. They hit intraday highs at midday. $Nasdaq Composite Index (.IXIC.US)$ Rising nearly 2.5%, $S&P 500 Index (.SPX.US)$ Rising over 2.1%, $Dow Jones Industrial Average (.DJI.US)$ Rising over 620 points, up nearly 1.9%. In the end, the three major indexes rebounded after collectively falling for four consecutive days.

The Nasdaq, which hit a low since Wednesday, April 26th for two consecutive days, closed up 2.25% at 12,235.41, setting a new high since last September 12th that was set last Friday. The S&P rose by 1.85%, with both the Nasdaq and S&P marking their largest gains since last Thursday at 4,136.25, after hitting new lows since April 26th for two consecutive days, without getting closer to the closing low since March 30th set on April 26th. The Dow gained 546.64 points, a 1.65% increase, marking the largest gain since the announcement of the December U.S. non-farm payroll report on January 6th, reaching 33,674.38 and bidding farewell to the closing low since March 30th set on Thursday.

Small-cap stock indexes dominated by value stocks $Ishares Russell 2000 Value Etf (IWN.US)$ US stocks closed with all three major indexes rising, with the Nasdaq up more than 2% and Apple rising 4.7% after its performance. Regional bank stocks rebounded violently.

Overall, the three major US stock indexes opened higher and maintained an upward trend, with all rising more than 1% in early trading. They hit intraday highs at midday. $Nasdaq Composite Index (.IXIC.US)$ Rising nearly 2.5%, $S&P 500 Index (.SPX.US)$ Rising over 2.1%, $Dow Jones Industrial Average (.DJI.US)$ Rising over 620 points, up nearly 1.9%. In the end, the three major indexes rebounded after collectively falling for four consecutive days.

The Nasdaq, which hit a low since Wednesday, April 26th for two consecutive days, closed up 2.25% at 12,235.41, setting a new high since last September 12th that was set last Friday. The S&P rose by 1.85%, with both the Nasdaq and S&P marking their largest gains since last Thursday at 4,136.25, after hitting new lows since April 26th for two consecutive days, without getting closer to the closing low since March 30th set on April 26th. The Dow gained 546.64 points, a 1.65% increase, marking the largest gain since the announcement of the December U.S. non-farm payroll report on January 6th, reaching 33,674.38 and bidding farewell to the closing low since March 30th set on Thursday.

Small-cap stock indexes dominated by value stocks $Ishares Russell 2000 Value Etf (IWN.US)$ US stocks closed with all three major indexes rising, with the Nasdaq up more than 2% and Apple rising 4.7% after its performance. Regional bank stocks rebounded violently.

Translated

+3

2

Truly successful traders, their trades are simply repetitive. They take one pattern to the extreme, and with one look, they know whether they have their own trading signal. They only trade within their own knowledge range, no longer pursuing difficult trades.

The masters, always doing simple and repetitive things, repeating to the extreme. Only when you focus and repeat the training, can you become an expert and winner in this pattern.

The masters, always doing simple and repetitive things, repeating to the extreme. Only when you focus and repeat the training, can you become an expert and winner in this pattern.

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)