stevencky

reacted to

$Tesla (TSLA.US)$ $Bitcoin (BTC.CC)$ $SPDR S&P 500 ETF (SPY.US)$ We're in a pullback phase right now. Buy a little as it dips, build your position in batches. No one can time the bottom perfectly. I think before Trump takes office, stock prices might drop to the 60-day EMA, or even break below the 120-day EMA in a more extreme scenario. Let's prepare for the worst. Don't let emotions cloud your judgment when the market's down. Hopefully, things will start looking up...

Translated

543

208

48

stevencky

commented on

Investors should consider opportunities in utilities and construction stocks related to energy transition and infrastructure, such as TNB, GAM, and IJM; tech stocks benefiting from AI developments, like NATGATE; healthcare stocks with defensive growth, such as IHH; and recovering glove manufacturers, like TOPG. REITs like IGB REIT and KLCC offer long-term investment value.(JP Morgan)

The Malaysian market closed out 2024 wit...

The Malaysian market closed out 2024 wit...

408

153

145

stevencky

liked

As AI technology advances, top investment banks have recently shared reports on which chip stocks could perform well in 2025.

Bank of America: AI to Supercharge the Semiconductor Market

Bank of America predicts that AI will drive strong growth in the semiconductor industry. The market is expected to reach $725 billion by 2025, growing at an annual rate of over 15%. AI GPUs, memory chips (like DRAM and NAND), and ASIC custom chips are leadi...

Bank of America: AI to Supercharge the Semiconductor Market

Bank of America predicts that AI will drive strong growth in the semiconductor industry. The market is expected to reach $725 billion by 2025, growing at an annual rate of over 15%. AI GPUs, memory chips (like DRAM and NAND), and ASIC custom chips are leadi...

117

12

76

stevencky

voted

Hi mooers! ![]()

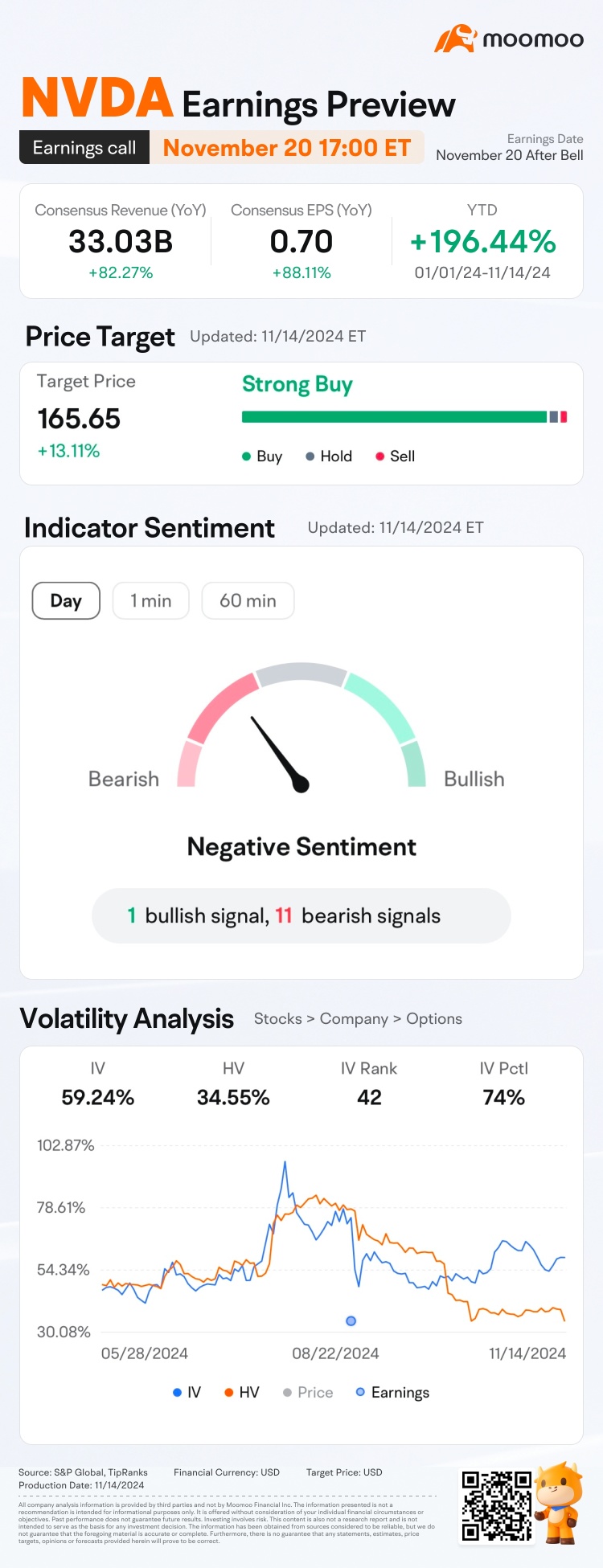

The world's most valuable company, $NVIDIA (NVDA.US)$, is set to release its Q3 FY2025 financial results on November 20 after the bell. Unlock insights with NVDA Earnings Hub>>

As of 14 November, share prices of $NVIDIA (NVDA.US)$ have increased +196.44% in this year.![]() It is now the world's most valuable company with a $3.6 trillion market cap

It is now the world's most valuable company with a $3.6 trillion market cap![]() .

.

As big tech companies like $Amazon (AMZN.US)$, $Alphabet-A (GOOGL.US)$ and $Meta Platforms (META.US)$ all poise...

The world's most valuable company, $NVIDIA (NVDA.US)$, is set to release its Q3 FY2025 financial results on November 20 after the bell. Unlock insights with NVDA Earnings Hub>>

As of 14 November, share prices of $NVIDIA (NVDA.US)$ have increased +196.44% in this year.

As big tech companies like $Amazon (AMZN.US)$, $Alphabet-A (GOOGL.US)$ and $Meta Platforms (META.US)$ all poise...

73

100

12

stevencky

voted

1. PDD Holdings: $PDD Holdings (PDD.US)$ Some may think the financial report will cause a drop, but looking at the distribution of call and put options, it's clear that most people are optimistic.

2. Nvidia: $NVIDIA (NVDA.US)$ Continue to increase positions, not predicting financial reports, not predicting stock prices, mainly for arbitrage, and add some put options for a perfect strategy.

3. NIO Xiaopeng: $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ Occasionally playing in the short term is fine, but it's better not to play long term, it's exhausting and costly.

2. Nvidia: $NVIDIA (NVDA.US)$ Continue to increase positions, not predicting financial reports, not predicting stock prices, mainly for arbitrage, and add some put options for a perfect strategy.

3. NIO Xiaopeng: $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ Occasionally playing in the short term is fine, but it's better not to play long term, it's exhausting and costly.

Translated

3

1

stevencky

voted

Recap: S&P 500 Recent Performance: November 1–17, 2024

The $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ has demonstrated strong gains this year, but November has seen mixed momentum: November 1–8: The index surpass past 6,000 (ATH: 6017🥳🥳🥳), supported by solid earnings reports, improved consumer sentiment, and optimism about future Federal reserve rate cuts. November 11–17: The $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ retreated...

The $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ has demonstrated strong gains this year, but November has seen mixed momentum: November 1–8: The index surpass past 6,000 (ATH: 6017🥳🥳🥳), supported by solid earnings reports, improved consumer sentiment, and optimism about future Federal reserve rate cuts. November 11–17: The $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ retreated...

+1

32

9

1

stevencky

voted

Portfolio diversification is the strategy of spreading investments across different assets, sectors, industries, and geographical regions to reduce the overall risk of the portfolio. The idea is that by holding a variety of investments, the overall performance of the portfolio will be less dependent on the performance of any single investment, reducing the risk of large losses.

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

39

1

36

stevencky

voted

Blockchain technology is a decentralized, distributed ledger system that records transactions across multiple computers in a way that ensures security, transparency, and immutability. Unlike traditional databases, where a central authority controls the data, a blockchain is a peer-to-peer network that enables participants to verify and record transactions without the need for a trusted intermediary (like a bank or government).

At its core, bloc...

At its core, bloc...

2

4

1

stevencky

Set a live reminder

After the dust settles from the election, how will political changes in the USA affect the Malaysian market? Let's delve into the adjustments and opportunities it brings. Stay tuned on November 13 (Wednesday) at 8 pm, when Nanyang Commercial will join moomoo guests to provide live commentary on the US presidential election situation, market reactions, dynamic tracking, and forward-looking analysis of the Malaysian market.

Translated

特朗普重掌白宫,探亚洲马股喜忧

Nov 13 06:00

184

80

14

stevencky

voted

I think it is going to be a mixed bag for the next four years.

On the positive side, the US stock market will probably do well as Trump is pro-business and will implement tax cuts for US companies. Banks $JPMorgan (JPM.US)$ $Citigroup (C.US)$ $Bank of America (BAC.US)$ $Morgan Stanley (MS.US)$ will benefit from more lenient regulations under Trump’s administration. He is also supportive of cryptocurrency, military funding and traditional energy like oil and gas.

However, i...

On the positive side, the US stock market will probably do well as Trump is pro-business and will implement tax cuts for US companies. Banks $JPMorgan (JPM.US)$ $Citigroup (C.US)$ $Bank of America (BAC.US)$ $Morgan Stanley (MS.US)$ will benefit from more lenient regulations under Trump’s administration. He is also supportive of cryptocurrency, military funding and traditional energy like oil and gas.

However, i...

23

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)