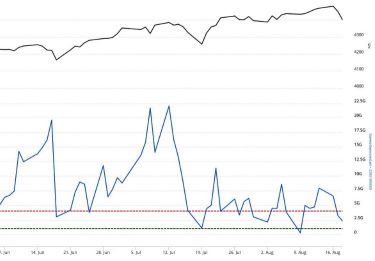

1. The S&P 500 is Expected to Stay in a Range But Continue to Outperform on a Global Basis

The $S&P 500 Index (.SPX.US)$ is seen to remain in a state of consolidation.

The first resistance is from its 200-day average at 4496, and more importantly below retracement resistance at 4637/68. If S&P 500 rises above 4668, an upward bias might be reasserted to 4748/58, or even the 4819 high.

The first support is at 4370, then 4315/14. If...

The $S&P 500 Index (.SPX.US)$ is seen to remain in a state of consolidation.

The first resistance is from its 200-day average at 4496, and more importantly below retracement resistance at 4637/68. If S&P 500 rises above 4668, an upward bias might be reasserted to 4748/58, or even the 4819 high.

The first support is at 4370, then 4315/14. If...

+1

10

2

3

Columns August position replacement

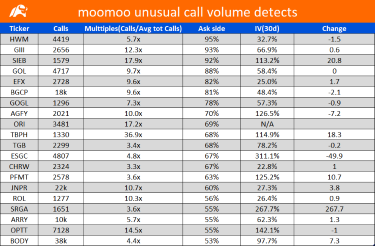

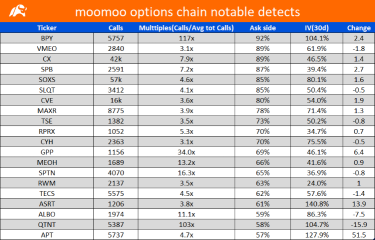

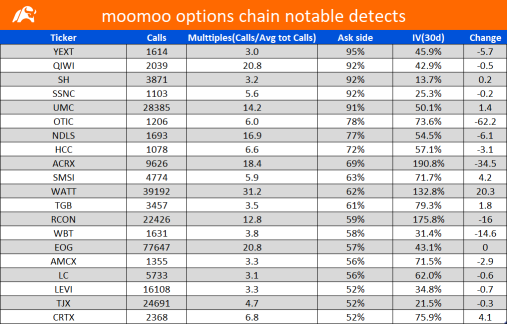

Overall sweeper activity was mixed on Wednesday. The flow had a bullish print in most of the session, then protection started to mix in throughout the afternoon. Most of the order flow Wednesday, especially the size, likely was August position replacement. Every round of buying that looked interesting, and multiple August positions in open interest are set to expire on Friday. What does that mean? Doesn't mean much of anything, not a bullish or bearish bias, so we can look for post-August expiration buying in any of this week's activity that may be interesting or confirmation.

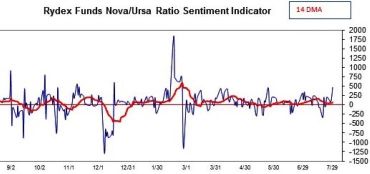

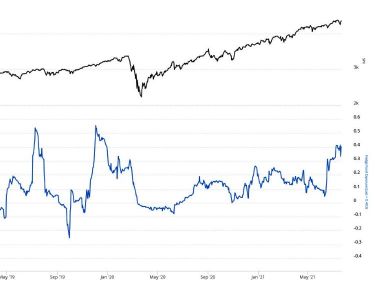

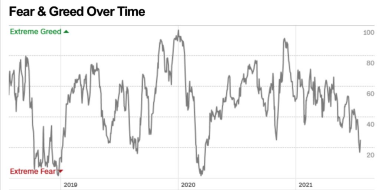

On the sentiment front...

On the sentiment front...

20

8

Overall sweeper activity started mixed on Monday with buyers predominantly focused on $Apple (AAPL.US)$, but activity started to pick up significantly as the indices bottomed and volatility began to roll over. No noticeable sector rotation out there on Monday aside from just more "defensive" positioning with a focus on Healthcare, Pharma, and utility plays.

Flow also included speculative action in a few weekly plays, $Apple (AAPL.US)$

Flow also included speculative action in a few weekly plays, $Apple (AAPL.US)$

34

2

15

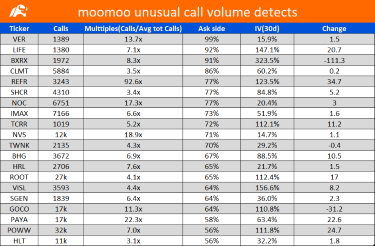

We are in a very tough trading environment. There is not much edge being provided by options flow, indicators, and entries. With indices, specifically $S&P 500 Index (.SPX.US)$, continually pushing to new highs in a healthy matter, one would think that all names are moving the same way. However, that has not been the case, there is still no full participation in the market. We have seen rotation continually into and out of specific sectors. Usually, these types of Fed-induced bull markets end poorly.

With this tricky atmosphere, we continue to emphasize that the best way to stay involved in the market is to play very tactically and play short-term signals such as tactical sentiment.

...

With this tricky atmosphere, we continue to emphasize that the best way to stay involved in the market is to play very tactically and play short-term signals such as tactical sentiment.

...

+2

66

13

24

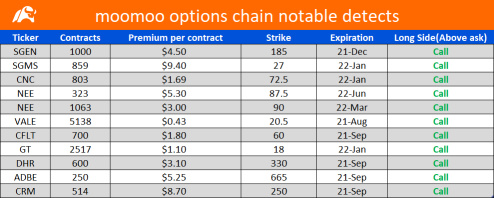

Overall flow started Thursday's session off strong with a solid pace off the opening bell. Gold, metals, miners and selective tech names were a part of the early session buying, $Advanced Micro Devices (AMD.US)$ has bombed once again last morning as bulls have been extremely aggressive in the name off of earnings. The action did die down into the afternoon, a big reason for that was likely the HOOD IPO. The

+2

64

10

36

It's the good news that will ultimately put a fork in this bull market by forcing the Fed to pull away from markets. FOMC meeting Wednesday and how much damage all this has had on their plan to taper will be wisely watched.

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$

1

Options flow started the Friday session extremely messy as both call and put buyers were active nearly at an even pace. That being said, a big chunk of morning protection steemed from China-related issues and once that activity dried up, flow had a much cleaner look to it into the afternoon.

Mega-cap tech and secular growth(lower rates related) were once again where buyers maintained focus. Players were on the hunt for that lower yields theme needing more exposure into tech earnings, but also because of an expectation for a more dovish Fed this week, coming off a spike in worldwide health conditions.

On the sentiment front

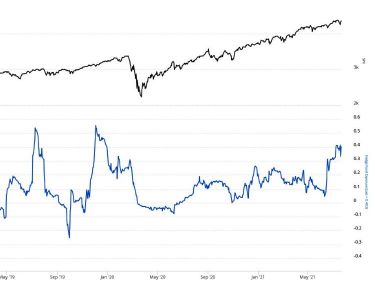

Short-term sentiment finally pushed higher off Friday's rally but finished short of landing in the "caution zone", many intermediate-term indicators hardly budged last week.

...

Mega-cap tech and secular growth(lower rates related) were once again where buyers maintained focus. Players were on the hunt for that lower yields theme needing more exposure into tech earnings, but also because of an expectation for a more dovish Fed this week, coming off a spike in worldwide health conditions.

On the sentiment front

Short-term sentiment finally pushed higher off Friday's rally but finished short of landing in the "caution zone", many intermediate-term indicators hardly budged last week.

...

+2

74

20

151

Wednesday's overall institutional activity was bullish, flow was dominated by earnings positioning and buying in the more speculative names, playing off the 2nd day of strength in small caps.

We are currently in the heart of earnings season, so our only edge from the flow is as a source of momentum over the extreme short term. Keep a closer eye on the buying in post-earnings plays to see if they can supply some clues for rotation, once we get through the next couple of weeks, as is usually the case, buying on red days will tell us more than forced buying into green.

On the sentiment front

...

We are currently in the heart of earnings season, so our only edge from the flow is as a source of momentum over the extreme short term. Keep a closer eye on the buying in post-earnings plays to see if they can supply some clues for rotation, once we get through the next couple of weeks, as is usually the case, buying on red days will tell us more than forced buying into green.

On the sentiment front

...

+2

67

12

72

The bulls

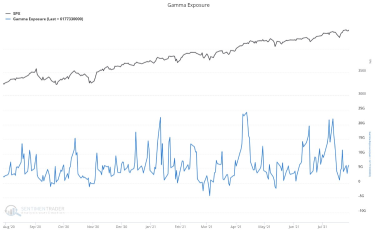

Healthy rinse late-week took some risk off the table. July expiration and Friday selling removed elevated gamma risk, although it didn't get to that normal level for a potential snap-back squeeze.

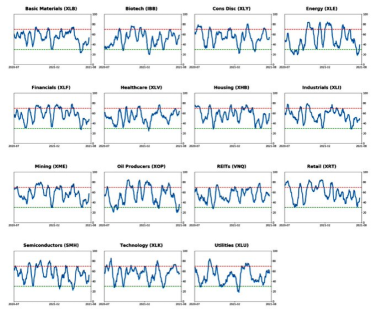

Crowded inflation and cyclical plays are not crowded anymore but bulls have certainly been stubborn, which lengthens the process. Small caps as well saw a solid shake, some of these groups are at or close to sentiment bounce signals, but not all.

Now with July expiration in the rear view mirror, we will officially see if the current price action is indeed a "tightening" phase ( similar to late 2018) or it was more about the greater forces at play from July expiration, like liquidity and dealer positioning.

The bears

Price action has resembled late 2018 and this rolling bear market that we are seeing take place underbelly will eventually find quality mega-cap and the indices.

Even with Friday's selloff, short-term sentiment didn't quite get there yet. Sectors that have seen the brunt of the selling have shown an improvement in sentiment but not all flashing bull signals just yet. This rotation has been so aggressive this year, do they all need to get to bull signal territory before we see a legit bounce?

July expiration is now behind us but earnings season is officially her...

Healthy rinse late-week took some risk off the table. July expiration and Friday selling removed elevated gamma risk, although it didn't get to that normal level for a potential snap-back squeeze.

Crowded inflation and cyclical plays are not crowded anymore but bulls have certainly been stubborn, which lengthens the process. Small caps as well saw a solid shake, some of these groups are at or close to sentiment bounce signals, but not all.

Now with July expiration in the rear view mirror, we will officially see if the current price action is indeed a "tightening" phase ( similar to late 2018) or it was more about the greater forces at play from July expiration, like liquidity and dealer positioning.

The bears

Price action has resembled late 2018 and this rolling bear market that we are seeing take place underbelly will eventually find quality mega-cap and the indices.

Even with Friday's selloff, short-term sentiment didn't quite get there yet. Sectors that have seen the brunt of the selling have shown an improvement in sentiment but not all flashing bull signals just yet. This rotation has been so aggressive this year, do they all need to get to bull signal territory before we see a legit bounce?

July expiration is now behind us but earnings season is officially her...

51

9

34

Overall order flow was mixed on Wednesday, likely leaned net bearish on the day. Hedge funds and momentum players continue to chase $Apple (AAPL.US)$ higher for some exposure ahead of earnings. Institutional put sweepers were a bit more aggressive than we've been seeing in selective names but it is hard to put much weight on the put action during a monthly expiration week and the start of earnings season.

Similar to market breadth, the flow has been pretty...

Similar to market breadth, the flow has been pretty...

10

2

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)