sunny4v

liked

Dollar-Cost Averaging (DCA):

Monitor Entry Points:

#GOOG: Wait for pullbacks below $165 if possible.

#Uber: Look for dips around $70.

#ASML: Target dips under $650 if feasible.

Monitor Entry Points:

#GOOG: Wait for pullbacks below $165 if possible.

#Uber: Look for dips around $70.

#ASML: Target dips under $650 if feasible.

12

1

sunny4v

liked

NOTE: NFA. Do not open position without buy pressure, volume. Check indicators, chart.

I see more Quantum play this week.

$Quantum (QMCO.US)$ AWS launched QuantumEmbark. Up after hours. Small float. 0 shares LTB.

$Arqit Quantum (ARQQ.US)$ AWS launched Quantum Embark.Increased market cap which translates to stock increasing in stock value and increased confidence in the stock. Low floa...

I see more Quantum play this week.

$Quantum (QMCO.US)$ AWS launched QuantumEmbark. Up after hours. Small float. 0 shares LTB.

$Arqit Quantum (ARQQ.US)$ AWS launched Quantum Embark.Increased market cap which translates to stock increasing in stock value and increased confidence in the stock. Low floa...

57

8

sunny4v

voted

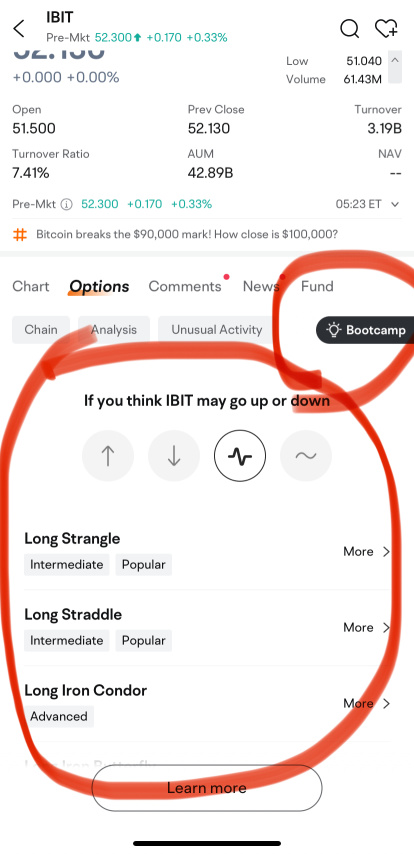

The SEC’s approval of options trading on $iShares Bitcoin Trust (IBIT.US)$ is more than just a headline—it’s a goldmine of opportunity for savvy investors. With Bitcoin's legendary volatility now married to the precision of options, we can play the game smarter, not riskier. Let’s explore some standout strategies in a fun and engaging way.

1. Selling Covered Calls: Turn Your ETF into a Payday

Got $iShares Bitcoin Trust (IBIT.US)$ shares or $Bitcoin (BTC.CC)$ sitting i...

1. Selling Covered Calls: Turn Your ETF into a Payday

Got $iShares Bitcoin Trust (IBIT.US)$ shares or $Bitcoin (BTC.CC)$ sitting i...

14

1

sunny4v

voted

$Alphabet-A (GOOGL.US)$'s options volume trading surged Thursday as the stock headed for its worst decline this year amid concerns the company may be forced to sell its Chrome business.

Call options that give the holders the right to buy the stock at $170 attracted the heaviest trading as investors and speculators unload them after the stock tumbled below that strike price. The share price slump boosted the odds that the con...

Call options that give the holders the right to buy the stock at $170 attracted the heaviest trading as investors and speculators unload them after the stock tumbled below that strike price. The share price slump boosted the odds that the con...

22

5

sunny4v

voted

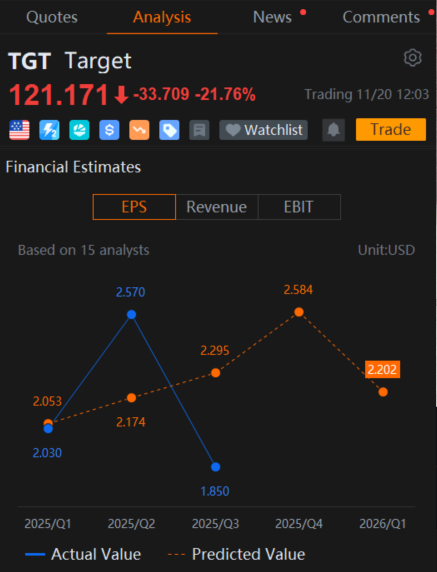

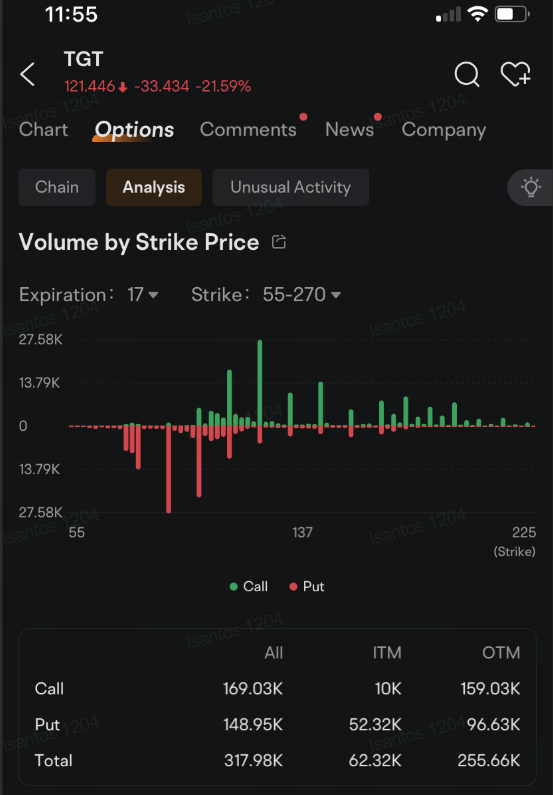

$Target (TGT.US)$ options trading jumped amid increasing demand for protection against continued slump for a stock that has already plunged by more than 21% after posting its biggest earnings miss since 2022.

Shares tumbled to $121.18 at 12:02 p.m., poised for the lowest close in a year, after the company reported Wednesday morning a 12% decline in adjusted earnings to $1.85 for its fiscal third quarter that ended Nov. 2 af...

Shares tumbled to $121.18 at 12:02 p.m., poised for the lowest close in a year, after the company reported Wednesday morning a 12% decline in adjusted earnings to $1.85 for its fiscal third quarter that ended Nov. 2 af...

+1

20

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)