supermoney

liked

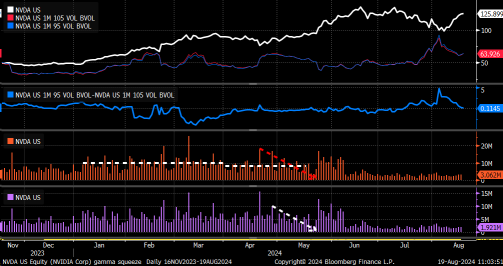

#Investing in US stocks: Buying into NVIDA's pre-earnings strategy

Today is the 21st, and on the 28th is the highly anticipated NVIDA Q2 earnings report. Various major institutional funds and investment banks have been buying in heavily and giving positive comments. In theory, the earnings should be quite good. After dropping from 140 to the lowest at 99, then back up to 130, with a 30% increase, daily trading volume is in the billions of US dollars. Without a sufficient number of participating professional institutional funds, it is impossible to achieve this scale based solely on retail investors. Therefore, I estimate that after 8/28, it will hit a new high, possibly reaching the price range of 140 to 160. Once it reaches this price range, it will be time to start selling for cash (at least that's what I would do), and then wait for a pullback to re-enter the market.

🌞Uncle's Opinion: The stock market cannot always go up because there are short-selling institutions making big profits through short selling. The higher the stock price, the easier it is to trigger the FOMO effect in the market sentiment. Any slight volatility will lead to panic selling, everyone rushing to the exit. 🫵 As soon as you reach a certain level of profit, don't try to squeeze out the last bit of profit and end up losing money. The market collapses in optimism and is reborn in despair.

Today is the 21st, and on the 28th is the highly anticipated NVIDA Q2 earnings report. Various major institutional funds and investment banks have been buying in heavily and giving positive comments. In theory, the earnings should be quite good. After dropping from 140 to the lowest at 99, then back up to 130, with a 30% increase, daily trading volume is in the billions of US dollars. Without a sufficient number of participating professional institutional funds, it is impossible to achieve this scale based solely on retail investors. Therefore, I estimate that after 8/28, it will hit a new high, possibly reaching the price range of 140 to 160. Once it reaches this price range, it will be time to start selling for cash (at least that's what I would do), and then wait for a pullback to re-enter the market.

🌞Uncle's Opinion: The stock market cannot always go up because there are short-selling institutions making big profits through short selling. The higher the stock price, the easier it is to trigger the FOMO effect in the market sentiment. Any slight volatility will lead to panic selling, everyone rushing to the exit. 🫵 As soon as you reach a certain level of profit, don't try to squeeze out the last bit of profit and end up losing money. The market collapses in optimism and is reborn in despair.

Translated

6

1

supermoney

voted

$GBP/USD (GBPUSD.FX)$ What platforms can I use to trade forex?

Translated

supermoney

commented on

$Mullen Automotive (MULN.US)$ drop before flying?

2

4

supermoney

voted

What's the biggest thing in the market this year?

Guess that every investor would mention the rising interest rate and its side effects.

It's hard to say whether the measure is right or wrong, but finding someone to blame may be the quickest way to let off steam.

Let's feel their rage together:

@Rann New: Must be a simulation

@MHfin: The Real Joker $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

@Stitch-fu: No comments $SPDR S&P 500 ETF (SPY.US)$

@zcole1101: Neo Amer...

Guess that every investor would mention the rising interest rate and its side effects.

It's hard to say whether the measure is right or wrong, but finding someone to blame may be the quickest way to let off steam.

Let's feel their rage together:

@Rann New: Must be a simulation

@MHfin: The Real Joker $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

@Stitch-fu: No comments $SPDR S&P 500 ETF (SPY.US)$

@zcole1101: Neo Amer...

+10

54

57

8

supermoney

commented on

$Mullen Automotive (MULN.US)$ earnings out someone better than me tell me what it’s lookin like

1

9

supermoney

commented on and voted

supermoney

commented on

5

2

4

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)