syo998

commented on

This article uses automatic translation in some parts.

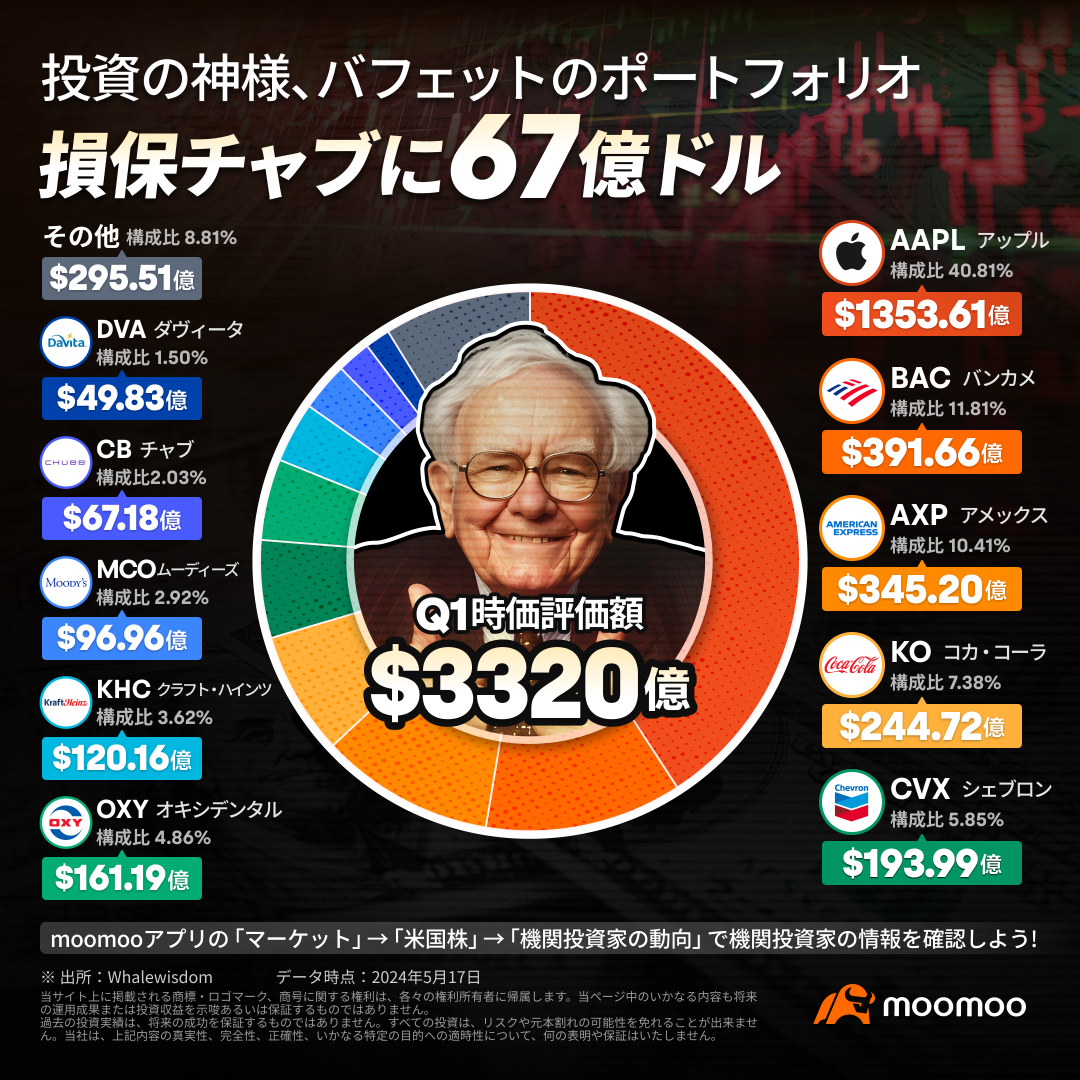

According to the 13F filing, $Berkshire Hathaway-A (BRK.A.US)$ the top 5 holdings are $Apple (AAPL.US)$(135.4 billion dollars), $Bank of America (BAC.US)$ (39.2 billion dollars), $American Express (AXP.US)$ (34.5 billion dollars), $Coca-Cola (KO.US)$ ($24.5 billion) and ($19.4 billion), respectively, are the top two holdings, accounting for about 75% of the portfolio. $Chevron (CVX.US)$What are the secret positions of the "Stock God"?

![]() Warren Buffett's Berkshire Hathaway revealed its secret positions?

Warren Buffett's Berkshire Hathaway revealed its secret positions?

On the 15th, after the close of the US stock market, Warren Buffett's Berkshire Hathaway filed with the US Securities and Exchange Commission (SEC)...

According to the 13F filing, $Berkshire Hathaway-A (BRK.A.US)$ the top 5 holdings are $Apple (AAPL.US)$(135.4 billion dollars), $Bank of America (BAC.US)$ (39.2 billion dollars), $American Express (AXP.US)$ (34.5 billion dollars), $Coca-Cola (KO.US)$ ($24.5 billion) and ($19.4 billion), respectively, are the top two holdings, accounting for about 75% of the portfolio. $Chevron (CVX.US)$What are the secret positions of the "Stock God"?

On the 15th, after the close of the US stock market, Warren Buffett's Berkshire Hathaway filed with the US Securities and Exchange Commission (SEC)...

Translated

108

8

56

syo998

voted

backgrounds

・The stock prices of small and medium-sized enterprises, which have continued to be delayed for most of 2023, are attracting investors on both sides of the Atlantic by balancing the benefits of interest rate declines expected next year with concerns about the financial crisis.

・Small cap stocks in the US $Russell 2000 Index (.RUT.US)$ has risen more than 13% from the October low, and the MSCI European Small and Medium Cap Index has risen 12% since the end of last month.

・The recent surge in small-cap stocks is in contrast to previous years. $S&P 500 Index (.SPX.US)$ While it has risen 19% since the beginning of the year, the Russell 2000 Index has only risen 5%. Meanwhile, European small-cap stocks rose more than 6% in 2023, while the broader MSCI European Equity Index rose 12%.

・According to the LSEG data stream, the value of small-cap stocks in the US is close to a record low in terms of relative value to large stocks. The expected PER for the small-cap S&P 600 is 13.7 times the long-term average of 18 times, which is well below 19 times the current level of the S&P 500.

・The expected price-earnings ratio (PER) for European small-cap stocks is 12.2 times, which is excessive...

・The stock prices of small and medium-sized enterprises, which have continued to be delayed for most of 2023, are attracting investors on both sides of the Atlantic by balancing the benefits of interest rate declines expected next year with concerns about the financial crisis.

・Small cap stocks in the US $Russell 2000 Index (.RUT.US)$ has risen more than 13% from the October low, and the MSCI European Small and Medium Cap Index has risen 12% since the end of last month.

・The recent surge in small-cap stocks is in contrast to previous years. $S&P 500 Index (.SPX.US)$ While it has risen 19% since the beginning of the year, the Russell 2000 Index has only risen 5%. Meanwhile, European small-cap stocks rose more than 6% in 2023, while the broader MSCI European Equity Index rose 12%.

・According to the LSEG data stream, the value of small-cap stocks in the US is close to a record low in terms of relative value to large stocks. The expected PER for the small-cap S&P 600 is 13.7 times the long-term average of 18 times, which is well below 19 times the current level of the S&P 500.

・The expected price-earnings ratio (PER) for European small-cap stocks is 12.2 times, which is excessive...

Translated

2

syo998

reacted to

It's a 27% increase in 2 days 😁 The fall in interest rates is taking effect, isn't it?

$Direxion Daily Regional Banks Bull 3X Shares ETF (DPST.US)$

$Direxion Daily Regional Banks Bull 3X Shares ETF (DPST.US)$

Translated

6

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

syo998 : Japanese investment is really boring... as conservative and boring as the economy that has been suspended for the past 30 years; they actually value corporate dividends rather than corporate growth...![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)