T_shares

liked

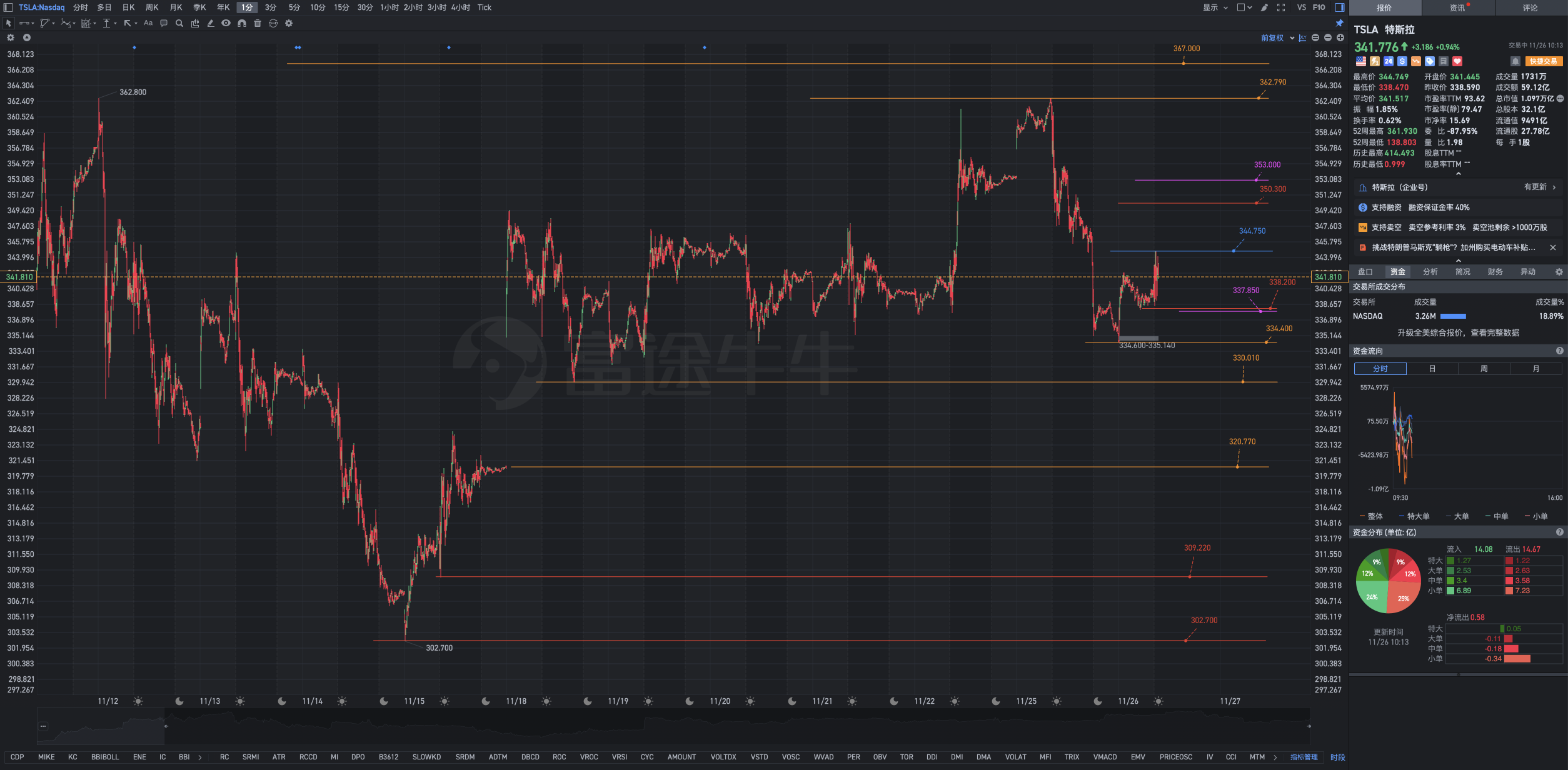

$Tesla (TSLA.US)$

Life-changing events often appear disguised as bad news.

When you learn to be humble and stop being self-centered, you will find yourself becoming stronger!

Life-changing events often appear disguised as bad news.

When you learn to be humble and stop being self-centered, you will find yourself becoming stronger!

Translated

7

T_shares

liked

$YTLPOWR (6742.MY)$

The financial report analysis is as follows:

1. Income and Profit Performance

Income: As of September 30, 2024, YTL Electrical Utilities' quarterly revenue was 5.68 billion ringgit, an increase of 4.4% year-on-year.

Electrical utilities revenue decreased by 13.9%, mainly due to lower market prices.

Water affairs business revenue surged by 43.1%, reflecting price adjustments and additional revenue sources allowed by UK regulatory institutions.

Telecom business and investment holding activities increased by 26.8% and 77.1% respectively.

Profit: Quarterly pre-tax profit was 0.665 billion ringgit, a 35.6% year-on-year decrease.

Electricity business contribution decreased by 27.2%, reflecting the decrease in retail and market prices.

Water affairs business achieved positive growth, attributed to price increases and new projects.

Telecom business reduced losses by 65.6%, mainly due to increased project revenue.

Investment holding losses widened due to the increase in foreign exchange losses related to the Jordan project.

2. Comprehensive income

Net income: The net income attributable to equity holders is 0.471 billion ringgit, a decrease of 44.5% year-on-year.

Other comprehensive income: The company incurred a net loss of 1.96 billion ringgit on foreign exchange and cash flow hedge projects, resulting in a total comprehensive income of -1.45 billion ringgit.

3. Financial Condition

Assets: Total assets are 63.9 billion ringgit, a decrease of 4.2% compared to June 2024. The decrease is mainly due to the decline in fixed assets and accounts receivable.

Liabilities: Total liabilities are 45.5 billion ringgit, slightly decreased, mainly due to the repayment of some short-term debts...

The financial report analysis is as follows:

1. Income and Profit Performance

Income: As of September 30, 2024, YTL Electrical Utilities' quarterly revenue was 5.68 billion ringgit, an increase of 4.4% year-on-year.

Electrical utilities revenue decreased by 13.9%, mainly due to lower market prices.

Water affairs business revenue surged by 43.1%, reflecting price adjustments and additional revenue sources allowed by UK regulatory institutions.

Telecom business and investment holding activities increased by 26.8% and 77.1% respectively.

Profit: Quarterly pre-tax profit was 0.665 billion ringgit, a 35.6% year-on-year decrease.

Electricity business contribution decreased by 27.2%, reflecting the decrease in retail and market prices.

Water affairs business achieved positive growth, attributed to price increases and new projects.

Telecom business reduced losses by 65.6%, mainly due to increased project revenue.

Investment holding losses widened due to the increase in foreign exchange losses related to the Jordan project.

2. Comprehensive income

Net income: The net income attributable to equity holders is 0.471 billion ringgit, a decrease of 44.5% year-on-year.

Other comprehensive income: The company incurred a net loss of 1.96 billion ringgit on foreign exchange and cash flow hedge projects, resulting in a total comprehensive income of -1.45 billion ringgit.

3. Financial Condition

Assets: Total assets are 63.9 billion ringgit, a decrease of 4.2% compared to June 2024. The decrease is mainly due to the decline in fixed assets and accounts receivable.

Liabilities: Total liabilities are 45.5 billion ringgit, slightly decreased, mainly due to the repayment of some short-term debts...

Translated

28

5

T_shares

liked

ARMADA has a lot of trapped plates at the top!

$ARMADA (5210.MY)$

ARMADA has a lot of trapped plates at the top!

$ARMADA (5210.MY)$

ARMADA has a lot of trapped plates at the top!

Translated

From YouTube

26

4

T_shares

liked

15 to 20x here I come 📈⬆️🚀

33

5

T_shares

liked

Click Here: TYNKR LAB™

Bursa Malaysia is anticipated to trade within a tight range of 1,600 to 1,610 in the near term, reflecting cautious optimism among investors. $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$ fell 2.66 points week-on-week to 1,589.78, maintaining resilience despite external pressures. Malaysia’s steady economic fundamentals, including manageable inflation, low unemployment, and robust trade performance, have provided a s...

Bursa Malaysia is anticipated to trade within a tight range of 1,600 to 1,610 in the near term, reflecting cautious optimism among investors. $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$ fell 2.66 points week-on-week to 1,589.78, maintaining resilience despite external pressures. Malaysia’s steady economic fundamentals, including manageable inflation, low unemployment, and robust trade performance, have provided a s...

+1

5

T_shares

liked

Tesla sure has been an up and down week, still fighting another day.

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)