thiemlee

voted

Market Rebounds from Yesterday’s Weakness

The market rebounded today following yesterday’s weakness, with the Market Momentum Tracker climbing back close to positive territory.

The short-term trend has returned to a healthy level, with over 50% of stocks now holding above their short-term moving averages. However, both the medium- and long-term trends remain in a downward trajectory.

Additionally, the breakdown count still exceeds breakouts, indicatin...

The market rebounded today following yesterday’s weakness, with the Market Momentum Tracker climbing back close to positive territory.

The short-term trend has returned to a healthy level, with over 50% of stocks now holding above their short-term moving averages. However, both the medium- and long-term trends remain in a downward trajectory.

Additionally, the breakdown count still exceeds breakouts, indicatin...

17

thiemlee

voted

Hi, mooers! ![]()

$GAMUDA (5398.MY)$ is expected to release its quarterly and fiscal year earnings on September 26*. How will the market react to the company's results? Vote your answer to guess!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $GAMUDA (5398.MY)$'s closing price on 27 Sep.

An equal share of 5,000 points: For mooers who correctly guess the price range of $GAMUDA (5398.MY)$'s closing price on 27 Sep.

(Vote will close at 12:30 am MYT...

$GAMUDA (5398.MY)$ is expected to release its quarterly and fiscal year earnings on September 26*. How will the market react to the company's results? Vote your answer to guess!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will close at 12:30 am MYT...

36

71

9

thiemlee

voted

I feel that this rate cut against an uncertain recessionary and un/under-employment backdrop, on top other bad govermental policies = volatility. To add to this, there is too much hot money in the market, not just from US investors/ traders, but from all over the world, further contributing to the chaos.

My current strategy is defensive.

1) 50% of my portfolio is high dividend stock such as:

$Stellantis NV (STLA.US)$

$GlaxoSmithKline (GSK.US)$

$Ecopetrol (EC.US)$

���������...

My current strategy is defensive.

1) 50% of my portfolio is high dividend stock such as:

$Stellantis NV (STLA.US)$

$GlaxoSmithKline (GSK.US)$

$Ecopetrol (EC.US)$

���������...

12

2

thiemlee

voted

The big question now is can the YTL and YTLP recover and bring KLCI back to 1700 level? Does anyone want to believe so?

1

thiemlee

voted

(Kuala Lumpur, 17th news) The US imposes higher tariffs on Chinese gloves than expected, stimulating a surge in local glove stocks, among which the most favored by the market. $HARTA (5168.MY)$ Harta (HARTA, 5168, main board health care stock) is also at the limit up!

Industrial Investment Bank's research report today states that the United States has confirmed a substantial increase in commodity tariffs on China, with the tariff rate for gloves set to increase to 50% from 2025 and further increase to 100% in 2026.

Analysts believe that the punitive measures against China by the United States will bring significant spill-over effects for Malaysian glove manufacturers, and the average selling price of Chinese gloves may exceed Malaysia's as early as next year.

Previously, the proposed import tariff on Chinese gloves by the United States is set to increase to 25% in 2026, which is much lower than the current adjustment level.

Analysts further said that this could lead to an average selling price of Chinese gloves rising from the current $17 to $25.50 in 2025, or even $34 in 2026.

Therefore, this will bring price advantages to Malaysian glove manufacturers, as the comprehensive average selling price of industry players is only between 20 to 21 US dollars."

As a result, analysts do not rule out the possibility that Chinese operators may consider expanding into overseas markets to avoid high tariffs.

However, we believe that this expansion will cause Chinese operators to lose their cost competitiveness, as they cannot achieve cost savings through coal production overseas.

...

Industrial Investment Bank's research report today states that the United States has confirmed a substantial increase in commodity tariffs on China, with the tariff rate for gloves set to increase to 50% from 2025 and further increase to 100% in 2026.

Analysts believe that the punitive measures against China by the United States will bring significant spill-over effects for Malaysian glove manufacturers, and the average selling price of Chinese gloves may exceed Malaysia's as early as next year.

Previously, the proposed import tariff on Chinese gloves by the United States is set to increase to 25% in 2026, which is much lower than the current adjustment level.

Analysts further said that this could lead to an average selling price of Chinese gloves rising from the current $17 to $25.50 in 2025, or even $34 in 2026.

Therefore, this will bring price advantages to Malaysian glove manufacturers, as the comprehensive average selling price of industry players is only between 20 to 21 US dollars."

As a result, analysts do not rule out the possibility that Chinese operators may consider expanding into overseas markets to avoid high tariffs.

However, we believe that this expansion will cause Chinese operators to lose their cost competitiveness, as they cannot achieve cost savings through coal production overseas.

...

Translated

24

2

2

thiemlee

voted

Happy Monday, Mooers!![]()

![]()

The September FOMC meeting is approaching, and the market generally believes that a rate cut is highly likely, which will be a significant turning point in this year's monetary policy.![]()

![]()

How will interest rate cuts affect the stock market? How will the S&P 500 index react? Come on mooers,![]() let's try to predict its possible direction!

let's try to predict its possible direction!![]()

Prediction time!

Drop your insights in the comments section:

– What impact would a ...

The September FOMC meeting is approaching, and the market generally believes that a rate cut is highly likely, which will be a significant turning point in this year's monetary policy.

How will interest rate cuts affect the stock market? How will the S&P 500 index react? Come on mooers,

Prediction time!

Drop your insights in the comments section:

– What impact would a ...

2024 FOMC Meeting

Sep 19 02:30

109

115

7

thiemlee

voted

YTL, the infrastructure developer, is getting investigated under Section 18 (MACC Act) by the Malaysian Anti-Corruption Commission (MACC) regarding payment claims involving false information totaling up to 2.7 billion ringgit in relation to the 1Bestarinet service tender that was given to YTL Communications in 2011. Investigations have raised concerns about the project's execution and financial handling, leading to a significant drop in in...

47

3

21

thiemlee

voted

Hi, mooers!

$99SMART (5326.MY)$ is expected to officially start trading on Sep 9.

For the balloting in respect of applications received from the Malaysian public, a total of 49,354 applications for

678,585,100 IPO Shares were received, resulting in an overall oversubscription rate of 3.04 times.

How will the market react to the IPO results? Make your guess now!

(Vote will close at 14:30 am M...

$99SMART (5326.MY)$ is expected to officially start trading on Sep 9.

For the balloting in respect of applications received from the Malaysian public, a total of 49,354 applications for

678,585,100 IPO Shares were received, resulting in an overall oversubscription rate of 3.04 times.

How will the market react to the IPO results? Make your guess now!

(Vote will close at 14:30 am M...

125

305

26

thiemlee

liked

thiemlee

commented on and voted

Hi, mooers!

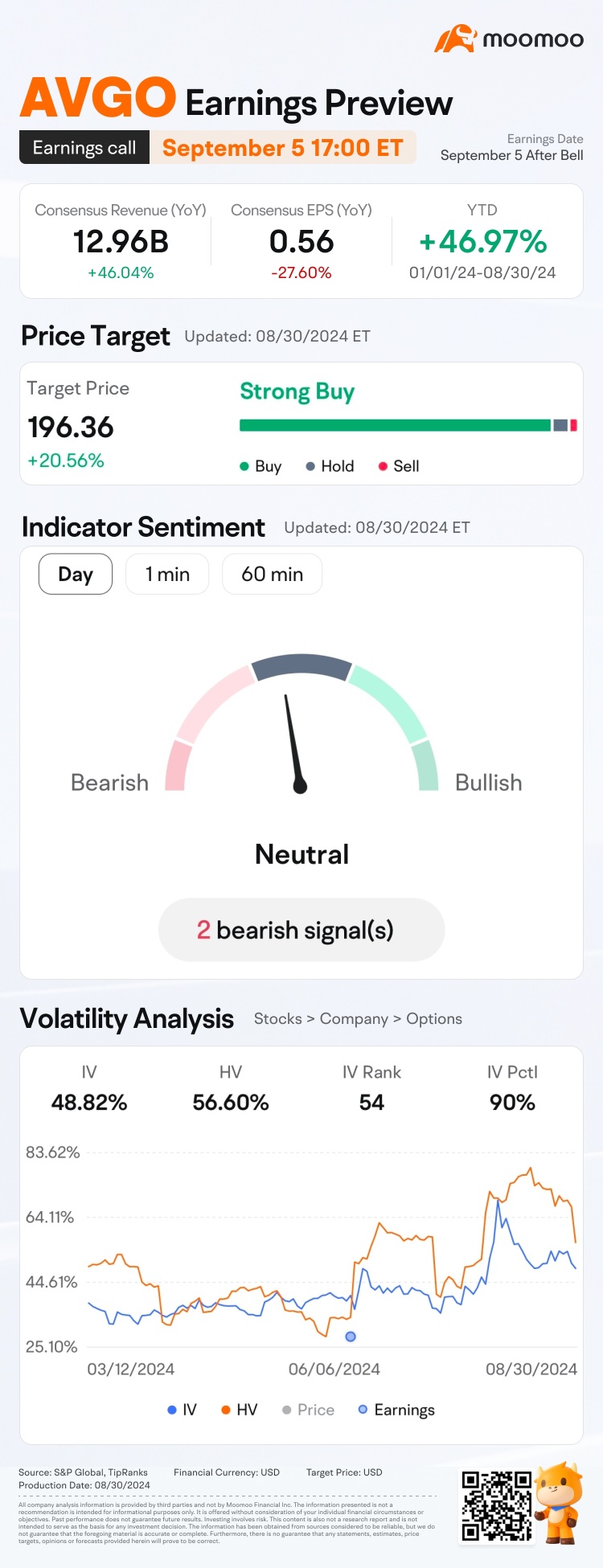

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

Expand

Expand 80

114

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)