tigress888

liked

Translated

1

tigress888

voted

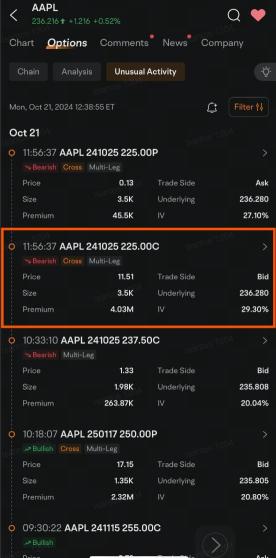

$Apple (AAPL.US)$ options market signals investors and speculators are divided over whether iPhone 16 could spark a massive upgrade cycle that may accelerate the company's revenue growth.

Unusual activities in the Apple stock options market showed three bearish positions and two bullish ones just before noon in New York Monday. The bearish trades were posted even as the stock headed for a closing record high.

The bigge...

Unusual activities in the Apple stock options market showed three bearish positions and two bullish ones just before noon in New York Monday. The bearish trades were posted even as the stock headed for a closing record high.

The bigge...

+1

45

16

tigress888

liked

$Hang Seng Index (800000.HK)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$

The reason for the stock market's rise this time is the practice of converting equity into bonds, which is the first time in the history of human finance. Objectively reducing the number of stocks, similar to the concept of companies repurchasing stocks to raise stock prices, but in reality, the companies did not spend money to repurchase, instead they used stocks as collateral, leveraging commercial banks to handle the bonds, and the banks did not actually withhold money or bear risks because the bonds were issued by the central bank.

This perfectly solves the problem that the central bank issues bonds to inject liquidity into the market but cannot directly give money to companies. It also solves the problem that companies want to repurchase stocks to increase stock value but do not have the funds. By leveraging the entire stock market with minimal cost (500 billion yuan in national bonds) without violating financial rules.

If commercial banks hold onto stocks and do not release them, the number of stocks in the stock market will not increase, and appreciation is inevitable, rather than undergoing large-scale devaluation. Since Chinese commercial banks are state-owned, they can hold onto stocks without any cost.

This approach is the first of its kind for mankind, aimed at increasing the value of stocks that have lost value due to the sluggish stock market. The premise is that objectively, the A-share market in China is sluggish due to psychological factors, rather than a lack of actual economic investment, as the Chinese social savings amounts...

The reason for the stock market's rise this time is the practice of converting equity into bonds, which is the first time in the history of human finance. Objectively reducing the number of stocks, similar to the concept of companies repurchasing stocks to raise stock prices, but in reality, the companies did not spend money to repurchase, instead they used stocks as collateral, leveraging commercial banks to handle the bonds, and the banks did not actually withhold money or bear risks because the bonds were issued by the central bank.

This perfectly solves the problem that the central bank issues bonds to inject liquidity into the market but cannot directly give money to companies. It also solves the problem that companies want to repurchase stocks to increase stock value but do not have the funds. By leveraging the entire stock market with minimal cost (500 billion yuan in national bonds) without violating financial rules.

If commercial banks hold onto stocks and do not release them, the number of stocks in the stock market will not increase, and appreciation is inevitable, rather than undergoing large-scale devaluation. Since Chinese commercial banks are state-owned, they can hold onto stocks without any cost.

This approach is the first of its kind for mankind, aimed at increasing the value of stocks that have lost value due to the sluggish stock market. The premise is that objectively, the A-share market in China is sluggish due to psychological factors, rather than a lack of actual economic investment, as the Chinese social savings amounts...

Translated

35

12

tigress888

liked

US-China relations play a significant role in shaping the performance of Chinese concept stocks. Trade tensions, tariffs, and political developments can introduce heightened volatility. Therefore, closely monitoring these geopolitical factors is crucial.

Despite short-term fluctuations, investing in Chinese concept stocks generally requires a long-term perspective, given their strong growth potential, especially in sectors aligned with China’s strategic objectives like tech...

Despite short-term fluctuations, investing in Chinese concept stocks generally requires a long-term perspective, given their strong growth potential, especially in sectors aligned with China’s strategic objectives like tech...

3

tigress888

liked

$Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ The FTSE China ETF and the index of China moved in opposite directions, showing no correlation, indicating that there must be a company committing fraud.

Translated

1

6

tigress888

liked

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$Is this stock tracking the Futu50? Why can't I see any connection?

Translated

1

$Invesco QQQ Trust (QQQ.US)$ Burnt a little of my gains but 还是看好你!

$Invesco QQQ Trust (QQQ.US)$ Such a lovely dip for new entry

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)