TonyChu0331

liked

Hi, mooers!

Welcome back to the SG Guidebook series! In the previous part: "SG Guidebook: Why should we invest in US stocks?", we received so much valuable feedback that means a lot to us.

On this page, we will introduce some must-known and frequently-asked questions that you probably don't wanna miss.

Here are the key takeaways:

The US market has pre-market and post-market to extend trading hours.

You can buy or sell 1 share each time.

Taxes on dividends is 30%. But you are exempt from the US capital gains tax.

1. Different Market Rules

Market trading hours:

Unlike the Singapore stock market, the US stock market has pre-market and post-market, which expends the trading time of the day.

Note: During the US winter time (US standard time starts on the 1st Sunday in November and ends on the 2nd Sunday in March), the trading time shifts to SGT 10:30 pm to 5 am.

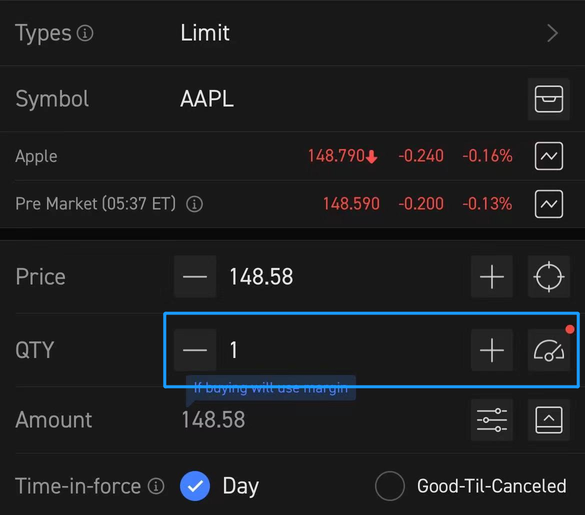

Minimum share:

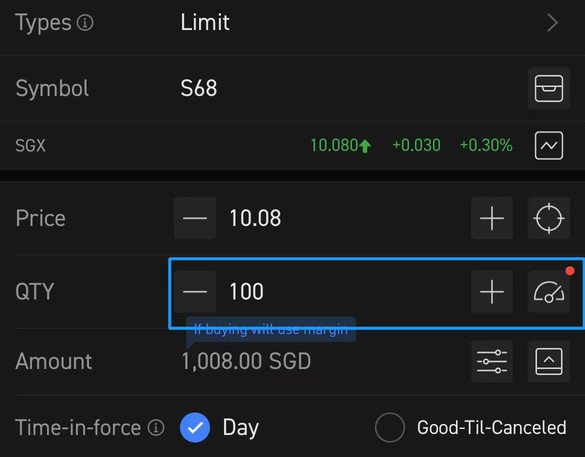

On the US stock market, you can buy or sell 1 share for every single trade, while in the Singapore stock market, you can onlybuy or sell100 shares or the integer multiples of 100 shares each time.

Take $Apple (AAPL.US)$ as an example: you can buy 1 share for US$145.58.

Take $SGX (S68.SG)$ as another example: you have to buy at least 100 shares for SG$1,008.

2. Taxes and fees:

As people always say, there are two things that we can't get rid of, which are tax and breath.

What do you have to pay for taxes on US stocks? Let's check it out!

Taxes on dividends

Non-resident aliens are subject to a dividend tax rate of 30% on dividends paid out by US companies.

Capital gains tax

If you are a non-resident alien of the US, then you are exempt from the US capital gains taxes without being a tax-slayer. Normally, a US citizen needs to pay capital gains taxes (up to 37% of gains) when selling the shares for a profit.

Note:

Non-Resident Alien (NRA) includes people who are not US citizens, green card holders, nor living in the US for 183 days during the year.

The above information is quoted from US Tax Guide for Aliens and made available for informational purposes only. Futu does not provide tax advisory services. Please consult a licensed professional for details.

Miscellaneous fees

Besides brokerage fees, there are other miscellaneous fees collected by the SEC or Settlement Agencies.

On the US market, those fees include:

On the SG market, those fees includes:

To get more details about commission&fees, please go to "Me-HelpCenter-Fees".

3. How to start trading?

Join the US Stock Paper Trading to win up to SGD8,888

A good start is half success. Without risking your own money, you can improve your investing skills & trading strategies before you enter and beat the market.

Your $1,000,000 Virtual Cash is fully loaded. Join Now and Win Big >>

Have fun in your investing journey! Please leave your comment below for any ideas or questions.

You may also be interested in:

SG Guidebook: Why should we invest in US stocks? (Part 1)

Singapore User Guide: How to trade stocks on moomoo?

Welcome back to the SG Guidebook series! In the previous part: "SG Guidebook: Why should we invest in US stocks?", we received so much valuable feedback that means a lot to us.

On this page, we will introduce some must-known and frequently-asked questions that you probably don't wanna miss.

Here are the key takeaways:

The US market has pre-market and post-market to extend trading hours.

You can buy or sell 1 share each time.

Taxes on dividends is 30%. But you are exempt from the US capital gains tax.

1. Different Market Rules

Market trading hours:

Unlike the Singapore stock market, the US stock market has pre-market and post-market, which expends the trading time of the day.

Note: During the US winter time (US standard time starts on the 1st Sunday in November and ends on the 2nd Sunday in March), the trading time shifts to SGT 10:30 pm to 5 am.

Minimum share:

On the US stock market, you can buy or sell 1 share for every single trade, while in the Singapore stock market, you can onlybuy or sell100 shares or the integer multiples of 100 shares each time.

Take $Apple (AAPL.US)$ as an example: you can buy 1 share for US$145.58.

Take $SGX (S68.SG)$ as another example: you have to buy at least 100 shares for SG$1,008.

2. Taxes and fees:

As people always say, there are two things that we can't get rid of, which are tax and breath.

What do you have to pay for taxes on US stocks? Let's check it out!

Taxes on dividends

Non-resident aliens are subject to a dividend tax rate of 30% on dividends paid out by US companies.

Capital gains tax

If you are a non-resident alien of the US, then you are exempt from the US capital gains taxes without being a tax-slayer. Normally, a US citizen needs to pay capital gains taxes (up to 37% of gains) when selling the shares for a profit.

Note:

Non-Resident Alien (NRA) includes people who are not US citizens, green card holders, nor living in the US for 183 days during the year.

The above information is quoted from US Tax Guide for Aliens and made available for informational purposes only. Futu does not provide tax advisory services. Please consult a licensed professional for details.

Miscellaneous fees

Besides brokerage fees, there are other miscellaneous fees collected by the SEC or Settlement Agencies.

On the US market, those fees include:

On the SG market, those fees includes:

To get more details about commission&fees, please go to "Me-HelpCenter-Fees".

3. How to start trading?

Join the US Stock Paper Trading to win up to SGD8,888

A good start is half success. Without risking your own money, you can improve your investing skills & trading strategies before you enter and beat the market.

Your $1,000,000 Virtual Cash is fully loaded. Join Now and Win Big >>

Have fun in your investing journey! Please leave your comment below for any ideas or questions.

You may also be interested in:

SG Guidebook: Why should we invest in US stocks? (Part 1)

Singapore User Guide: How to trade stocks on moomoo?

+2

89

17

TonyChu0331

commented on

Stocks closed on Friday with losses for the week.

- $Dow Jones Industrial Average (.DJI.US)$ slipped less than 0.1% this week, for its third straight week of declines.

- The $S&P 500 Index (.SPX.US)$ fell nearly 0.6% since Monday for its second straight week of losses.

- The $Nasdaq Composite Index (.IXIC.US)$ dropped close to 0.5% this week.

The market is not in its best shape right now. You might be wondering what are the best stocks to buy. Luckily, top investment banks identified the following stocks' potential.

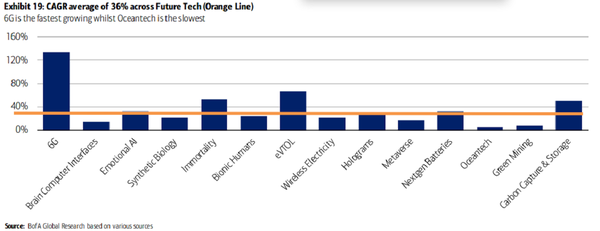

BofA Securities considers 14 industries to be future tech

$Bank of America (BAC.US)$ strategists just came out with a fresh list of what they call technology "moonshots" to help guide investors in their search for the next $Amazon (AMZN.US)$ or $Apple (AAPL.US)$.

Failure to identify future tech today could mean missing out on the next big revolution. The pace at which themes are transforming businesses is blistering, but the adoption of many technologies -- like smartphones or renewable energy -- have surpassed experts' forecasts by decades because we often think linearly, but progress occurs exponentially.

- Israel, BofA's head of global thematic investing reseach

Morgan Stanley's Slimmon sees value stocks coming back to life

Stocks tied to the economic reopening had a banner 2020 before their performance petered out a few months ago. But Andrew Slimmon, a senior portfolio manager at Morgan Stanley Investment Management who oversees around $7.5 billion, is making big bets on reopening plays, banks and other value stocks.

For example, you could look at $Airbnb (ABNB.US)$, $Restaurant Brands International (QSR.US)$, $American Airlines (AAL.US)$ and other reopening plays.

Goldman Sachs loves these stocks, but the rest of Wall Street does not

In a note to investors this week, Goldman Sachs shared several stocks with a buy rating, which most people on Wall Street rated as neutral or sell.

- $Expedia (EXPE.US)$ is one of GS's favorite Internet stocks recently, The company says that it is optimistic about the mid-to-long-term operating profit margin of the travel site because management has resolved its inefficient cost structure and pre-pandemic expenditures level. The stock has risen about 13% this year.

- Calvin Klein and Tommy Hilfiger's parent company $PVH Corp (PVH.US)$, has a 26% upside. Its stock has risen by more than 16% this year.

- $Hyatt Hotels (H.US)$ is expected to have 39% upside. The hotel chain's stock has risen by about 1% this year as the pandemic continues to bring various setbacks to the tourism industry. This stock has only been affirmed by 6% of analysts from Wall Street institutions.

Source: Bloomberg, CNBC

- $Dow Jones Industrial Average (.DJI.US)$ slipped less than 0.1% this week, for its third straight week of declines.

- The $S&P 500 Index (.SPX.US)$ fell nearly 0.6% since Monday for its second straight week of losses.

- The $Nasdaq Composite Index (.IXIC.US)$ dropped close to 0.5% this week.

The market is not in its best shape right now. You might be wondering what are the best stocks to buy. Luckily, top investment banks identified the following stocks' potential.

BofA Securities considers 14 industries to be future tech

$Bank of America (BAC.US)$ strategists just came out with a fresh list of what they call technology "moonshots" to help guide investors in their search for the next $Amazon (AMZN.US)$ or $Apple (AAPL.US)$.

Failure to identify future tech today could mean missing out on the next big revolution. The pace at which themes are transforming businesses is blistering, but the adoption of many technologies -- like smartphones or renewable energy -- have surpassed experts' forecasts by decades because we often think linearly, but progress occurs exponentially.

- Israel, BofA's head of global thematic investing reseach

Morgan Stanley's Slimmon sees value stocks coming back to life

Stocks tied to the economic reopening had a banner 2020 before their performance petered out a few months ago. But Andrew Slimmon, a senior portfolio manager at Morgan Stanley Investment Management who oversees around $7.5 billion, is making big bets on reopening plays, banks and other value stocks.

For example, you could look at $Airbnb (ABNB.US)$, $Restaurant Brands International (QSR.US)$, $American Airlines (AAL.US)$ and other reopening plays.

Goldman Sachs loves these stocks, but the rest of Wall Street does not

In a note to investors this week, Goldman Sachs shared several stocks with a buy rating, which most people on Wall Street rated as neutral or sell.

- $Expedia (EXPE.US)$ is one of GS's favorite Internet stocks recently, The company says that it is optimistic about the mid-to-long-term operating profit margin of the travel site because management has resolved its inefficient cost structure and pre-pandemic expenditures level. The stock has risen about 13% this year.

- Calvin Klein and Tommy Hilfiger's parent company $PVH Corp (PVH.US)$, has a 26% upside. Its stock has risen by more than 16% this year.

- $Hyatt Hotels (H.US)$ is expected to have 39% upside. The hotel chain's stock has risen by about 1% this year as the pandemic continues to bring various setbacks to the tourism industry. This stock has only been affirmed by 6% of analysts from Wall Street institutions.

Source: Bloomberg, CNBC

+2

86

18

TonyChu0331

commented on

For beginners, placing an order sometimes can be a difficult task.

In this video, we will guide you on how to place a market/limit order.

Follow us for more tutorials.

For more guides, please refer to moomoo courses at https://live.moomoo.com/college

![]() Have fun with your financial journey on moomoo!

Have fun with your financial journey on moomoo!

$AMC Entertainment (AMC.US)$ $Tesla (TSLA.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Nasdaq Composite Index (.IXIC.US)$

In this video, we will guide you on how to place a market/limit order.

Follow us for more tutorials.

For more guides, please refer to moomoo courses at https://live.moomoo.com/college

$AMC Entertainment (AMC.US)$ $Tesla (TSLA.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Nasdaq Composite Index (.IXIC.US)$

![[Video Tutorial] How to place an order on moomoo?](https://ussnsimg.moomoo.com/202106170000078178e2dd5e936.jpg/thumb)

6131

6909

$TENCENT (00700.HK)$ good tech stock

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)