Tonyoh

commented on

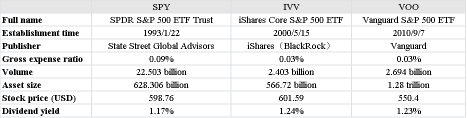

What ETFs track the S & P 500 index?

When considering index investment strategies, especially for large-cap stocks in the U.S. stock market, Exchange-Traded Funds (ETFs) that track the Standard & Poor's 500 Index (S&P 500 Index) are a popular choice among many investors.

The $S&P 500 Index (.SPX.US)$was created by Standard & Poor's in 1957. It is a market-capitalization-weighted index that incl...

When considering index investment strategies, especially for large-cap stocks in the U.S. stock market, Exchange-Traded Funds (ETFs) that track the Standard & Poor's 500 Index (S&P 500 Index) are a popular choice among many investors.

The $S&P 500 Index (.SPX.US)$was created by Standard & Poor's in 1957. It is a market-capitalization-weighted index that incl...

382

118

237

I also can………..

Tonyoh

liked

On March, Buffett spent US$470 million to buy 7.9 million shares of $Occidental Petroleum (OXY.US)$, and then it rose by more than 2%, which attracted the attention of many investors.

If you want to make reference but worry about the risks, or stay on the sidelines but are afraid of missing the opportunity to potentially make money![]() , come and test what kind of investor persona you are!

, come and test what kind of investor persona you are!

![]()

![]() There are also surprise rewards w...

There are also surprise rewards w...

If you want to make reference but worry about the risks, or stay on the sidelines but are afraid of missing the opportunity to potentially make money

177

617

37

Tonyoh

liked

PFE $Pfizer (PFE.US)$ appears to be doing everything right. They have a solid stable of approved drugs, a strong pipeline, and billions of dollars in COVID related vaccines and treatments. They are using the money to add on promising biotechs to support their drug development efforts. Keeping their solid dividend is also a plus as they originally were going to reduce it by what VTRS $Viatris (VTRS.US)$ was going to pay after acquiring PFE's generic business. $60 a share seems like a conservative estimate in 22.![]()

![]()

![]()

5

Tonyoh

commented on

As the Fed starts to talk of its tapering timeline, traders are also looking for stocks that can survive, and even thrive from the impact.

According to Gina Sanchez, CEO of Chantico Global and chief market strategist at Lido Advisors.

“We think probably the most taper-resistant pick right now is something happening in the infrastructure play. “The thing about tapering is as soon as you hear taper, you start worrying about stocks that are overpriced. And since the infrastructure sector has long been overlooked. It supposes to be one of the good choices.

Some evidence has been shown on North Carolina-based steel producer ...

According to Gina Sanchez, CEO of Chantico Global and chief market strategist at Lido Advisors.

“We think probably the most taper-resistant pick right now is something happening in the infrastructure play. “The thing about tapering is as soon as you hear taper, you start worrying about stocks that are overpriced. And since the infrastructure sector has long been overlooked. It supposes to be one of the good choices.

Some evidence has been shown on North Carolina-based steel producer ...

29

4

7

Tonyoh

commented on

Tonyoh

commented on

Tuesday, August 10, 2021

By Mia

![]() You found me! Today's password is : "jax"

You found me! Today's password is : "jax"

By Mia

+1

65

551

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Tonyoh :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)