Trader10169406O

liked

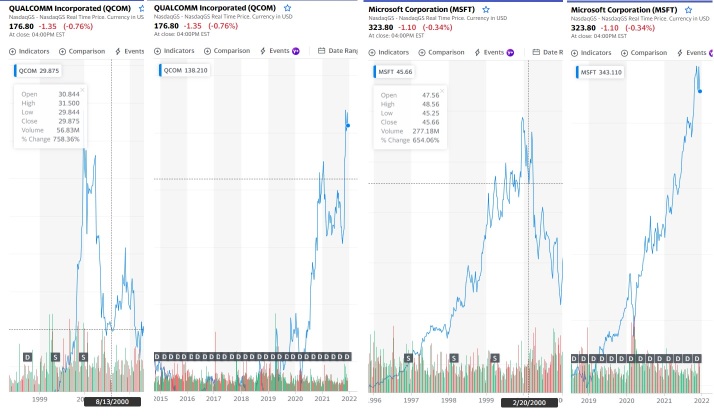

$Qualcomm (QCOM.US)$ $Microsoft (MSFT.US)$

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $Coca-Cola (KO.US)$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $Coca-Cola (KO.US)$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

30

2

Trader10169406O

commented on

Bitcoin has no underlying value and no underlying asset. Bitcoin is not a company that can regenerate investments. Bitcoin has no underlying asset that people needs like Silver, Gold nor Oranges or Pork bellies. Bitcoin is just a transfer system of "real" money. However this system has huge maintenance costs and in the end systems that cost a lot of money without REAL return dies.

2

Trader10169406O

liked

Nov 15 $JPMorgan (JPM.US)$ has sued $Tesla (TSLA.US)$ for $162.2 million, accusing Elon Musk's electric car company of "flagrantly" breaching a contract the two corporate giants agreed in 2014 relating to warrants Tesla sold to the bank.

Tesla in 2014 sold warrants to JPMorgan that would pay off if their "strike" price was below Tesla's share price when the warrants expired in June and July 2021.

Musk's Aug 7, 2018 tweet that he might take Tesla private at $420 per share and had "funding secured," and his subsequent announcement 17 days later that he was abandoning the plan, created significant volatility in the share price, the bank said.

On both occasions, JPMorgan adjusted the strike price "to maintain the same fair market value" as prior to the tweets.

Tesla's share price rose approximately 10-fold by the time the warrants expired this year, and JPMorgan said this required Tesla under its contract to hand over shares of its stock or cash. The bank said Tesla's failure to do that amounted to a default.

Any thoughts? Or maybe someone can explain what's going on in the case?

Source:

JPMorgan sues Tesla for $162 mln after Musk tweets soured warrant deal

Tesla in 2014 sold warrants to JPMorgan that would pay off if their "strike" price was below Tesla's share price when the warrants expired in June and July 2021.

Musk's Aug 7, 2018 tweet that he might take Tesla private at $420 per share and had "funding secured," and his subsequent announcement 17 days later that he was abandoning the plan, created significant volatility in the share price, the bank said.

On both occasions, JPMorgan adjusted the strike price "to maintain the same fair market value" as prior to the tweets.

Tesla's share price rose approximately 10-fold by the time the warrants expired this year, and JPMorgan said this required Tesla under its contract to hand over shares of its stock or cash. The bank said Tesla's failure to do that amounted to a default.

Any thoughts? Or maybe someone can explain what's going on in the case?

Source:

JPMorgan sues Tesla for $162 mln after Musk tweets soured warrant deal

57

8

$Pfizer (PFE.US)$ Why the spike? I don’t understand why it went up to 5.83 this morning!?

9

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)