Tressala Grogan

reacted to

$Meta Platforms (META.US)$

Key Details:

📍 Mark Zuckerberg sold 1.28 million Meta shares for approximately $428 million in the last two months of 2023.

📍 Sales occurred every trading day from Nov. 1 to year-end, averaging $10.4 million per session.

📍 This marks Zuckerberg’s first Meta share sale since November 2021.

📍 Meta’s stock price saw a significant rebound, increasing 194% from a seven-year low.

📍 Meta's stock performance was second only to Nvidia C...

Key Details:

📍 Mark Zuckerberg sold 1.28 million Meta shares for approximately $428 million in the last two months of 2023.

📍 Sales occurred every trading day from Nov. 1 to year-end, averaging $10.4 million per session.

📍 This marks Zuckerberg’s first Meta share sale since November 2021.

📍 Meta’s stock price saw a significant rebound, increasing 194% from a seven-year low.

📍 Meta's stock performance was second only to Nvidia C...

5

1

Tressala Grogan

reacted to

If the Fed speaks of rate cuts again, then the "Fed Put" will be in play, and the market might rip. If they are any bit hawkish due to the fact that interest rates are not at 2%, then some of the recent gains over the past couple of months might get erased.

$Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $SPDR S&P 500 ETF (SPY.US)$

$Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $SPDR S&P 500 ETF (SPY.US)$

1

2

Tressala Grogan

reacted to

$NIO Inc (NIO.US)$ different year same result this will continue if we keep the management common sense folks we’re down on the days were even down more on the down days

2

Tressala Grogan

reacted to

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$

Its very volatile now. $CBOE Volatility S&P 500 Index (.VIX.US)$ had also gone up. but 2 days of deep red should see some form of short "recovery" before another leg down.. Profit taking when done together is like a bank run..

Its very volatile now. $CBOE Volatility S&P 500 Index (.VIX.US)$ had also gone up. but 2 days of deep red should see some form of short "recovery" before another leg down.. Profit taking when done together is like a bank run..

1

Tressala Grogan

reacted to

The "Magnificent Seven" stocks propelled the S&P 500 higher in 2023 and there's reason to hope the party could get going this year if analysts' estimates hold true.The Magnificent Seven, a term coined by Bank of America analyst Michael Hartnett in a research note in May, gained prominence this year as investors flocked to Apple, Alphabet, Amazon, Microsoft, Meta Platforms, Tesla and Nvidia amid economic uncertainty.

The mega-cap stocks' solid cash...

The mega-cap stocks' solid cash...

28

2

Tressala Grogan

commented on

RECAP

Stocks declined for a second day, weighed down by declines in tech giants that previously lifted major indices higher in 2023.

The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ lost 1.2% to 14,592.21, building on its worst daily performance since October. The $S&P 500 Index (.SPX.US)$ declined 0.8% to 4,704.81, while the $Dow Jones Industrial Average (.DJI.US)$ fell 0.8% to 37,430.19.

Software stocks tracked by moomoo slid...

Stocks declined for a second day, weighed down by declines in tech giants that previously lifted major indices higher in 2023.

The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ lost 1.2% to 14,592.21, building on its worst daily performance since October. The $S&P 500 Index (.SPX.US)$ declined 0.8% to 4,704.81, while the $Dow Jones Industrial Average (.DJI.US)$ fell 0.8% to 37,430.19.

Software stocks tracked by moomoo slid...

39

2

Tressala Grogan

reacted to

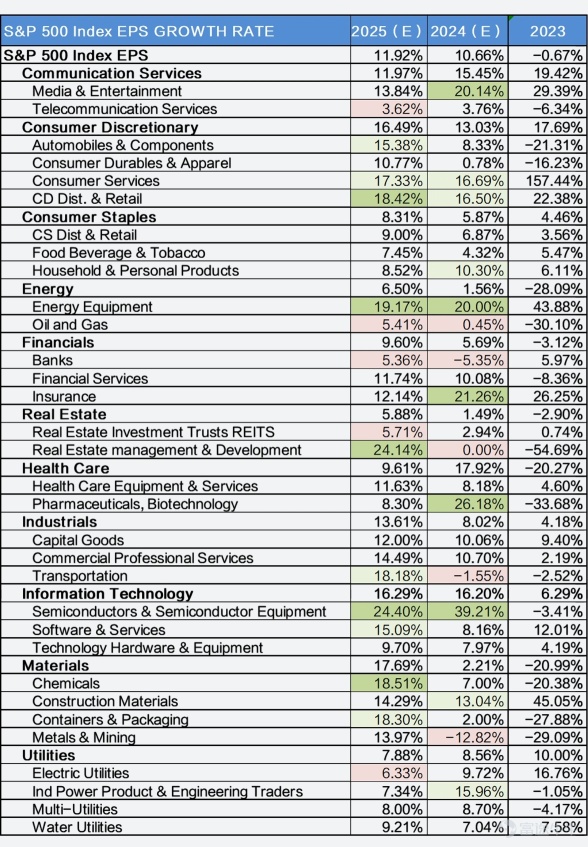

EPS growth is the main driving force for growth in U.S. stocks. Based on Bloomberg data, we have organized the expected EPS growth rates for the S&P 500 index's sub-sectors for 2024 and 2025 to provide a reference for investment.

For 2024, the most noteworthy sub-sectors with the highest expected EPS growth rates are Semiconductors & Semiconductor Equipment (+39.21%), Pharmaceuticals & Biotechnology (+26.18%), Insurance (+21.26%), ...

For 2024, the most noteworthy sub-sectors with the highest expected EPS growth rates are Semiconductors & Semiconductor Equipment (+39.21%), Pharmaceuticals & Biotechnology (+26.18%), Insurance (+21.26%), ...

8

Tressala Grogan

reacted to

Hey, come and join me on moomoo! Moomoo provides easier access to pro-grade investment analytics and is used by over 20 million people globally! Sign up via my referral link now and claim up to 15 FREE stocks! https://j.moomoo.com/00DpI9

2

Tressala Grogan

reacted to

Jinlongyu Group's low P/E ratio could reflect investor concerns over continued growth rates, with expectations of only limited future earnings. Therefore, if recent medium-term earnings trends persist, significant near-future share price growth appears unlikely.

1

Tressala Grogan

liked

The market is predicted to focus on Jianglong Shipbuilding's top line growth despite its small profit last year. The rise in stock price and recent improvements suggest an accelerating growth trend and a potential investment opportunity.

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)