Trump's policies may accelerate bitcoin breaking through the $150,000 price. Bitcoin is currently fluctuating around $95,000, with a slight overall market increase in recent days. Although bitcoin is currently consolidating, many people are bullish on its potential to break the six-figure price next year.

In recent days, some traders have been discussing that if Trump's policies can bring more crypto-friendly measures, such as some states starting to build bitcoin reserves, then there could be significant room for bitcoin to rise. If such policies become a reality, it may even trigger other countries to start accumulating bitcoin, leading to a surge in bitcoin demand.

Of course, bitcoin currently faces short-term adjustment pressure, especially as its 30-day moving average is close to falling below the 200-day moving average, which means it might retest the support around $98,000. Overall, the chances of bitcoin breaking $100,000 by the end of the year are still high. Looking at it from various aspects, bitcoin still has great potential for a significant increase in December.

The Christmas rally in the US stock market has driven market optimism. In the past few years, the Christmas rally typically boosts the stock market, which also has a positive impact on the crypto market. The strong performance of the US stock market provides a stable external environment for the crypto market.

The historical performance after Bitcoin halving is also noteworthy. Following each halving, Bitcoin in December has shown considerable gains, achieving significant returns in the past few instances, this time...

In recent days, some traders have been discussing that if Trump's policies can bring more crypto-friendly measures, such as some states starting to build bitcoin reserves, then there could be significant room for bitcoin to rise. If such policies become a reality, it may even trigger other countries to start accumulating bitcoin, leading to a surge in bitcoin demand.

Of course, bitcoin currently faces short-term adjustment pressure, especially as its 30-day moving average is close to falling below the 200-day moving average, which means it might retest the support around $98,000. Overall, the chances of bitcoin breaking $100,000 by the end of the year are still high. Looking at it from various aspects, bitcoin still has great potential for a significant increase in December.

The Christmas rally in the US stock market has driven market optimism. In the past few years, the Christmas rally typically boosts the stock market, which also has a positive impact on the crypto market. The strong performance of the US stock market provides a stable external environment for the crypto market.

The historical performance after Bitcoin halving is also noteworthy. Following each halving, Bitcoin in December has shown considerable gains, achieving significant returns in the past few instances, this time...

Translated

8

1

TTF自營交易先鋒

commented on

South Korea had a sudden move last night, where Yoon Suk-yeol directly announced a "state of emergency". As soon as this news came out, the market immediately went into chaos.

The South Korean won plunged directly, reaching 1430 won to one US dollar, a two-year low. The South Korean stock market was also unstable, with Samsung Electronics falling 4.4% in London. Even the ETF (EWY) in the US stock market opened low and dropped by 7% at one point.

As for the South Korean cryptocurrency market, this wave is even more stimulating. On Upbit, BTC dropped by as much as 30%, while XRP was halved directly from $2.9 to $1.16. This has a significant impact on short-term trading.

However, the South Korean Ministry of Finance and the central bank immediately launched market rescue measures, narrowing the depreciation of the Korean won by half. Today's early trading in South Korean stocks opened normally, although the composite index opened down by 1.97%, at least there was no collapse situation.

The South Korean won plunged directly, reaching 1430 won to one US dollar, a two-year low. The South Korean stock market was also unstable, with Samsung Electronics falling 4.4% in London. Even the ETF (EWY) in the US stock market opened low and dropped by 7% at one point.

As for the South Korean cryptocurrency market, this wave is even more stimulating. On Upbit, BTC dropped by as much as 30%, while XRP was halved directly from $2.9 to $1.16. This has a significant impact on short-term trading.

However, the South Korean Ministry of Finance and the central bank immediately launched market rescue measures, narrowing the depreciation of the Korean won by half. Today's early trading in South Korean stocks opened normally, although the composite index opened down by 1.97%, at least there was no collapse situation.

Translated

1

4

Columns It's been a lot of fun lately.

likeness $Super Micro Computer (SMCI.US)$ The company, which has been run out of business, has seen its stock skyrocket by 30% as a result of an independent report. They say there are no financial problems, but the reliability of their own conclusions is really not high. Looking back at the stock price rally, it's more about empty stomping, and it's hard to say that the fundamentals can't hold up. I feel that the $50 position may be empty, but the volatility of the stock is too large and the position must be well controlled.

$Tesla (TSLA.US)$ It rushed to $360, but the verdict in the pay case dropped after the round. The case looks bad for TSLA in law, but Musk won't admit it, and it's estimated there's a lot of drama behind it. Technically, if this wave breaks above $360, the target should look at $414, but after my own diversion of the call opportunity, the overall market trend is still strong right now.

Moreover $Credo Technology (CRDO.US)$ And the reported expectations were too inflated, causing the stock price to rise by 30% directly after the close. The trend for small-cap stocks around this type of AI looks good, but the odds are likely to enter the crossbar or adjust after a rally. If you participate now, a Sell Put may be safer than a follow up. Market funds are still flowing towards these marks now, but the volatility is increasing and every pullback in the next few weeks could be an opportunity to lay out.

$Tesla (TSLA.US)$ It rushed to $360, but the verdict in the pay case dropped after the round. The case looks bad for TSLA in law, but Musk won't admit it, and it's estimated there's a lot of drama behind it. Technically, if this wave breaks above $360, the target should look at $414, but after my own diversion of the call opportunity, the overall market trend is still strong right now.

Moreover $Credo Technology (CRDO.US)$ And the reported expectations were too inflated, causing the stock price to rise by 30% directly after the close. The trend for small-cap stocks around this type of AI looks good, but the odds are likely to enter the crossbar or adjust after a rally. If you participate now, a Sell Put may be safer than a follow up. Market funds are still flowing towards these marks now, but the volatility is increasing and every pullback in the next few weeks could be an opportunity to lay out.

Translated

9

1

Recently, the biomedical industry in the US and European markets completed a lot of financing in October, with a total amount exceeding 3 billion US dollars, returning to pre-pandemic levels. It truly is back on track.

First, let's talk about a few key areas. In terms of cancer treatment, several biomedical companies completed financing in October, including Orano Med and Alpha-9, these substantial financing deals reignited sparks in the field of cancer. Especially with technologies like Orano Med's radiotherapy, this is also a direction worth paying attention to in the coming years.

Next is the field of siRNA drugs, which has recently attracted a lot of investment. City Therapeutics and Judo Bio have both completed financing of over a hundred million US dollars, which makes people look forward to more breakthroughs with siRNA in the future. This technology has always been a hotspot in the biomedical industry, especially with Arrowhead Pharmaceuticals recently collaborating with major pharmaceutical companies, it feels like there's a potential for a market explosion in the future.

There are also some cutting-edge technologies, such as Car-T therapy, KCC2 potentiators, macrophage therapy, etc., all of which have received significant funding support. I personally believe that if these new technologies can really be implemented, they will have a breakthrough impact on the treatment of major diseases.

These financing activities demonstrate the market's confidence in the biomedical industry, especially in areas such as cancer treatment, neuroscience, RNAi, etc. The inflow of funds indicates the long-term potential of these areas. However, this also reminds us, the industry competition...

First, let's talk about a few key areas. In terms of cancer treatment, several biomedical companies completed financing in October, including Orano Med and Alpha-9, these substantial financing deals reignited sparks in the field of cancer. Especially with technologies like Orano Med's radiotherapy, this is also a direction worth paying attention to in the coming years.

Next is the field of siRNA drugs, which has recently attracted a lot of investment. City Therapeutics and Judo Bio have both completed financing of over a hundred million US dollars, which makes people look forward to more breakthroughs with siRNA in the future. This technology has always been a hotspot in the biomedical industry, especially with Arrowhead Pharmaceuticals recently collaborating with major pharmaceutical companies, it feels like there's a potential for a market explosion in the future.

There are also some cutting-edge technologies, such as Car-T therapy, KCC2 potentiators, macrophage therapy, etc., all of which have received significant funding support. I personally believe that if these new technologies can really be implemented, they will have a breakthrough impact on the treatment of major diseases.

These financing activities demonstrate the market's confidence in the biomedical industry, especially in areas such as cancer treatment, neuroscience, RNAi, etc. The inflow of funds indicates the long-term potential of these areas. However, this also reminds us, the industry competition...

Translated

Recently I saw some news about asia vets phones, and I found it quite interesting. $Apple (AAPL.US)$ Both Huawei and Apple are making efforts in this area, and their asia vets capabilities are gradually emerging. The AI features of iPhone 16 are becoming stronger and stronger. In December, more AI functions will be released, such as the Picture Park generating images, visual smart tools that can recognize objects through the camera, and translation capabilities. Although Apple's AI progress is slower than other manufacturers, their strategy is very clear: to gradually improve AI functionality through system upgrades, driving demand for iPhones.

In addition, domestic mobile phone manufacturers are not lagging behind. For example, the 'Messages on the Go' feature of the Huawei Mate 70 series is very cool, as it can actively sense the outside world and protect user privacy. OPPO and Xiaomi have also made many innovations at the system level. With features such as OPPO's ColorOS 15 and Xiaomi's SurgeOS 2 supported by asia vets, they aim to simplify operations and make phones smarter.

Currently, asia vets phones are progressing quite rapidly, with many new features designed to enhance user experience. 2024 is expected to be a key year for the rapid development of asia vets phones, as most manufacturers have already prepared their own asia vets operating systems and started to launch new phone products. With the improvement of chips and computing power, asia vets phones will perform better in various fields, especially in translation, photo editing, and search capabilities.

TTF trader

In addition, domestic mobile phone manufacturers are not lagging behind. For example, the 'Messages on the Go' feature of the Huawei Mate 70 series is very cool, as it can actively sense the outside world and protect user privacy. OPPO and Xiaomi have also made many innovations at the system level. With features such as OPPO's ColorOS 15 and Xiaomi's SurgeOS 2 supported by asia vets, they aim to simplify operations and make phones smarter.

Currently, asia vets phones are progressing quite rapidly, with many new features designed to enhance user experience. 2024 is expected to be a key year for the rapid development of asia vets phones, as most manufacturers have already prepared their own asia vets operating systems and started to launch new phone products. With the improvement of chips and computing power, asia vets phones will perform better in various fields, especially in translation, photo editing, and search capabilities.

TTF trader

Translated

6

Although it is still a plan now, once this trend emerges, it is enough to stir the market. In addition, he also wants to buy the digital asset trading platform Bakkt, indicating a real intention to turn the USA into a center for cryptos.

Also, MSTR is doing well in this wave, holding over 0.33 million bitcoins. As the price rises, institutions are entering crazily, and retail investors are also taking a share.

Although there was a slight incident in between, such as Trump mentioning imposing tariffs, which heightened market risk aversion sentiment, this emotional impact was not significant. Everyone still has great confidence in the future. After all, if the USA does relax regulations on cryptos, bitcoin reaching six digits is just a matter of time.

Continue to watch the show.![]()

Also, MSTR is doing well in this wave, holding over 0.33 million bitcoins. As the price rises, institutions are entering crazily, and retail investors are also taking a share.

Although there was a slight incident in between, such as Trump mentioning imposing tariffs, which heightened market risk aversion sentiment, this emotional impact was not significant. Everyone still has great confidence in the future. After all, if the USA does relax regulations on cryptos, bitcoin reaching six digits is just a matter of time.

Continue to watch the show.

Translated

6

TTF自營交易先鋒

voted

– Wall Street investment research firm Fundstrat believes that bitcoin will triple in value this year, rising to0.15 million US dollars

– Senior investor (Mark Mobius)Mobius told CNBC that Bitcoin may reach by the end of the year0.06 million US dollars

– Cryptocurrency mining companiesChief economist Youwei Yang of Bit Mining believes that the trading price of Bitcoin in 2024 will be in0.025 million to 0.075 million US dollarsBy 2025, between $0.045 million and $0.13 millionLeft and right.

– CoinSharesResearch director James Butterfill stated that under the promotion of a bitcoin ETF, the investor base for cryptos is expected to expand, estimating a 20% increase in assets under management may push the bitcoin price to $80,000。

– Professor of Finance at the University of Sussex. (Carol Alexander) told CNBC that the price of bitcoin trading is expected to be between $40,000 and $55,000 in the first quarter of 2024, after which etfs will be approved, and the price of bitcoin will rise.0.07 million US dollars, reaching a historical high.

How much do you guys think it will rise?![]()

– Senior investor (Mark Mobius)Mobius told CNBC that Bitcoin may reach by the end of the year0.06 million US dollars

– Cryptocurrency mining companiesChief economist Youwei Yang of Bit Mining believes that the trading price of Bitcoin in 2024 will be in0.025 million to 0.075 million US dollarsBy 2025, between $0.045 million and $0.13 millionLeft and right.

– CoinSharesResearch director James Butterfill stated that under the promotion of a bitcoin ETF, the investor base for cryptos is expected to expand, estimating a 20% increase in assets under management may push the bitcoin price to $80,000。

– Professor of Finance at the University of Sussex. (Carol Alexander) told CNBC that the price of bitcoin trading is expected to be between $40,000 and $55,000 in the first quarter of 2024, after which etfs will be approved, and the price of bitcoin will rise.0.07 million US dollars, reaching a historical high.

How much do you guys think it will rise?

Translated

2

3

Historical data shows that pre-Thanksgiving week consumption often boosts the performance of retail trade companies, driving up their stock prices, and the s&p 500 index tends to rise.![]()

Translated

This may lead to an increase in fuel prices in the usa, but I think the implementation is less likely because Trump focuses on reducing energy costs, possibly just a negotiating tactic.![]()

Translated

TTF自營交易先鋒

commented on

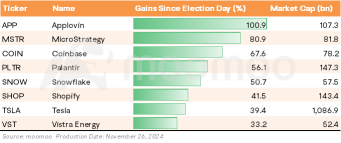

Three weeks after the election, investors are zeroing in on the Trump administration’s policy trajectory. The Trump 2.0 cabinet is nearly set, with nominees for key economic roles like Treasury and Commerce Secretary mostly decided.

In this environment, U.S. equities have been volatile. The 'Trump trade' initially surged, pulled back on concerns about reflation, and then began to rebound. Since election day, the $S&P 500 Index (.SPX.US)$ has risen...

In this environment, U.S. equities have been volatile. The 'Trump trade' initially surged, pulled back on concerns about reflation, and then began to rebound. Since election day, the $S&P 500 Index (.SPX.US)$ has risen...

+1

95

13

86

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)