WlilyW

liked

moomoo annual ceremony is happening right now!

Check it out here:

2021 in Review: Grow Together to the Moon!

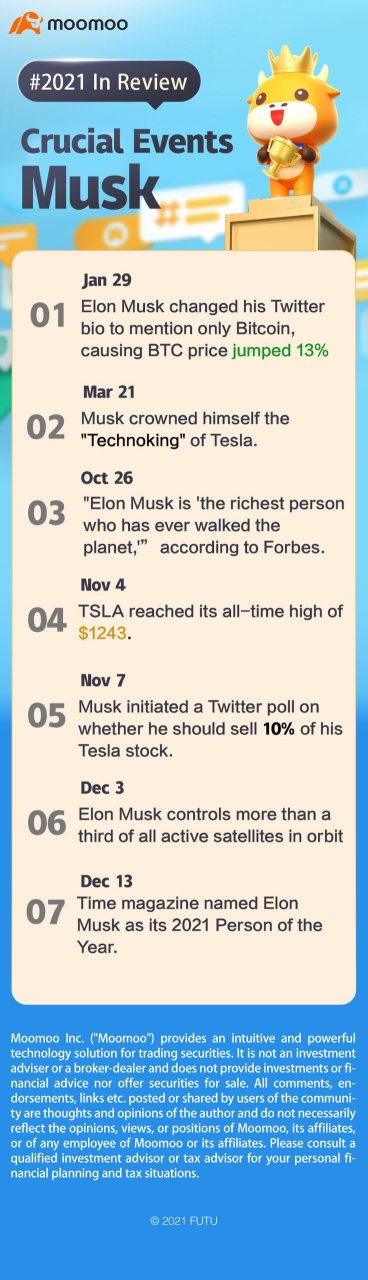

Elon Musk is not just an entrepreneur who starts businesses but a dreamer who wants to accomplish great things.

He wanted to reduce the carbon footprints, so $Tesla (TSLA.US)$ came out.

He also wanted to help humankind "colonize" Mars, so he established SpaceX.

He fulfills his dreams step by step and takes human civilization to the next level.

Apart from all the great works, he's like the Thanos in real life. He is visionary but controversial. His tweets are so powerful that they may cause significant damage or make quite a contribution (IDK) to our portfolio. Let's see how did he "snap" in 2021.

If you follow Musk to invest, you may find yourself playing the game of "He loves me... He loves me not. He loves me. He loves me not… "![]()

![]()

![]()

The tag of being capricious has been slapped on his back since a long time ago. Well, his unpredictable actions indeed came to us with big shocks. However, we can't deny that his companies give decent returns to shareholders.

Do you think this dude can keep surprising us and making his name the word of the year again in 2022?

Do you agree or disagree with the word "Musk" here?

Which words do you think could best describe the 2022 stock market?

Comment below with your word of the year "candidates" to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Vaccine

Check it out here:

2021 in Review: Grow Together to the Moon!

Elon Musk is not just an entrepreneur who starts businesses but a dreamer who wants to accomplish great things.

He wanted to reduce the carbon footprints, so $Tesla (TSLA.US)$ came out.

He also wanted to help humankind "colonize" Mars, so he established SpaceX.

He fulfills his dreams step by step and takes human civilization to the next level.

Apart from all the great works, he's like the Thanos in real life. He is visionary but controversial. His tweets are so powerful that they may cause significant damage or make quite a contribution (IDK) to our portfolio. Let's see how did he "snap" in 2021.

If you follow Musk to invest, you may find yourself playing the game of "He loves me... He loves me not. He loves me. He loves me not… "

The tag of being capricious has been slapped on his back since a long time ago. Well, his unpredictable actions indeed came to us with big shocks. However, we can't deny that his companies give decent returns to shareholders.

Do you think this dude can keep surprising us and making his name the word of the year again in 2022?

Do you agree or disagree with the word "Musk" here?

Which words do you think could best describe the 2022 stock market?

Comment below with your word of the year "candidates" to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Vaccine

113

13

WlilyW

liked

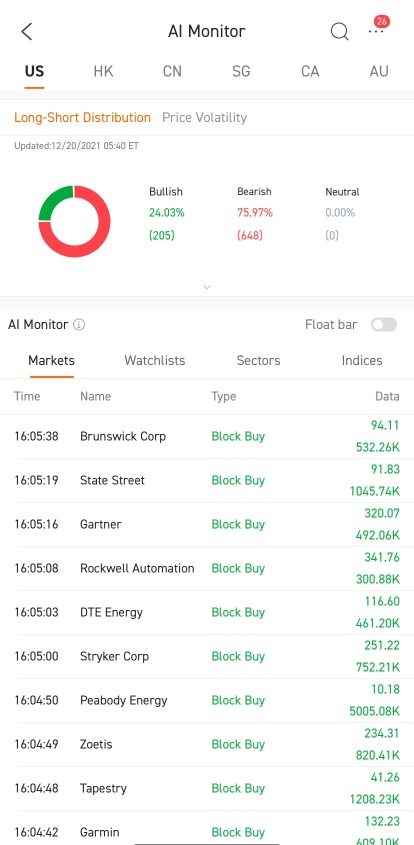

Are you always missing out on great opportunities? Try moomoo's AI Monitor feature. Our system will automatically monitor the market sentiment and alert you on the stocks you may find interesting.

![]() What is AI Monitor

What is AI Monitor

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

202

8

WlilyW

liked

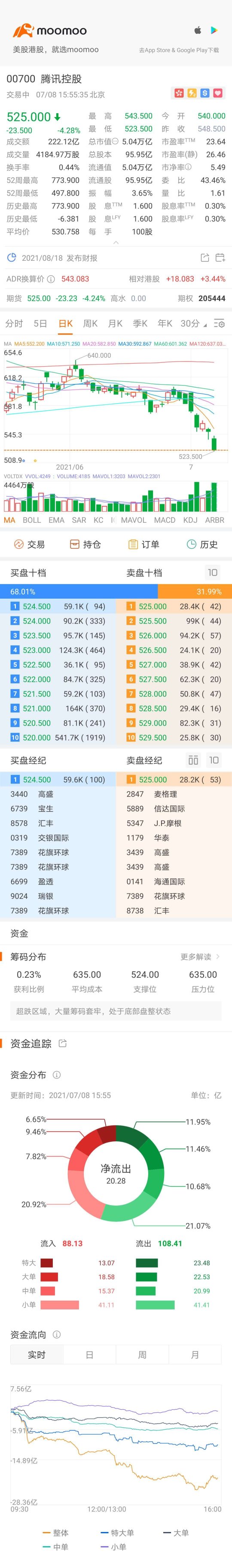

This documents my current observations, research and analysis of Chinese tech stocks and how the speculators are using various instruments to impact on the pricing of the share price of Chinese tech stocks like Alibaba, Tencent, Meituan, JD, Xiaomi, Kuaishou Tech, Bilibili, Za Online, Trip.com, Pinduoduo, etc. I have also laid out some predictions on what could potentially happen in 2022. However, in the battle of two systems like US and China, the exact impact on pricing is extremely tough as sentiments sway the price rather than real fundamental value affect the share price. So all in all, I personally manage my portfolio on a portfolio management basis to manage my risks.

my YouTube video link:

https://www.youtube.com/watch?v=TCBmvV2MNvA

Do subscribe and like my youtube channel so that you can be updated on quality research and analysis. Thanks for your support!

$Alibaba (BABA.US)$ $Meituan(ADR) (MPNGF.US)$ $TENCENT (00700.HK)$ $Baidu (BIDU.US)$ $BIDU-SW (09888.HK)$ $PDD Holdings (PDD.US)$ $ZA ONLINE N2507 (40304.HK)$ $XIAOMI-W (01810.HK)$ $Xiaomi Corp. Unsponsored ADR Class B (XIACY.US)$ $UP Fintech (TIGR.US)$ $Futu Holdings Ltd (FUTU.US)$ $Trip.com (TCOM.US)$ $TRIP.COM-S (09961.HK)$ $JD.com (JD.US)$ $JD-SW (09618.HK)$ $JD HEALTH (06618.HK)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $iShares Hang Seng TECH ETF (03067.HK)$ $KUAISHOU-W (01024.HK)$ $Haier Smart Home (600690.SH)$ $Lenovo (05562.HK)$ $Bilibili (BILI.US)$ $BILIBILI-W (09626.HK)$ $NetEase (NTES.US)$ $NTES-S (09999.HK)$ $KE Holdings (BEKE.US)$ $HKE HOLDINGS (01726.HK)$

As always, this should not be construed as any investment or trading advice.

my YouTube video link:

https://www.youtube.com/watch?v=TCBmvV2MNvA

Do subscribe and like my youtube channel so that you can be updated on quality research and analysis. Thanks for your support!

$Alibaba (BABA.US)$ $Meituan(ADR) (MPNGF.US)$ $TENCENT (00700.HK)$ $Baidu (BIDU.US)$ $BIDU-SW (09888.HK)$ $PDD Holdings (PDD.US)$ $ZA ONLINE N2507 (40304.HK)$ $XIAOMI-W (01810.HK)$ $Xiaomi Corp. Unsponsored ADR Class B (XIACY.US)$ $UP Fintech (TIGR.US)$ $Futu Holdings Ltd (FUTU.US)$ $Trip.com (TCOM.US)$ $TRIP.COM-S (09961.HK)$ $JD.com (JD.US)$ $JD-SW (09618.HK)$ $JD HEALTH (06618.HK)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $iShares Hang Seng TECH ETF (03067.HK)$ $KUAISHOU-W (01024.HK)$ $Haier Smart Home (600690.SH)$ $Lenovo (05562.HK)$ $Bilibili (BILI.US)$ $BILIBILI-W (09626.HK)$ $NetEase (NTES.US)$ $NTES-S (09999.HK)$ $KE Holdings (BEKE.US)$ $HKE HOLDINGS (01726.HK)$

As always, this should not be construed as any investment or trading advice.

54

1

WlilyW

liked

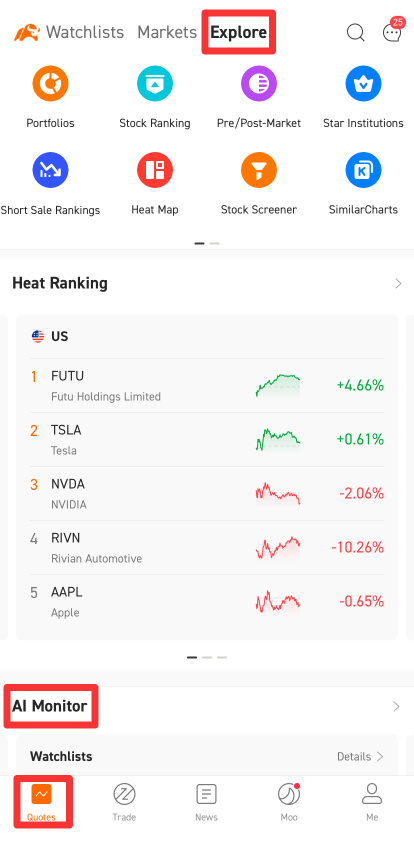

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

WlilyW

liked

$Apple (AAPL.US)$ Opened a short position today, don't believe in daily positive candles. It's highly unlikely to have 9 consecutive positive candles, maybe it will end tomorrow.

Translated

2

WlilyW

liked

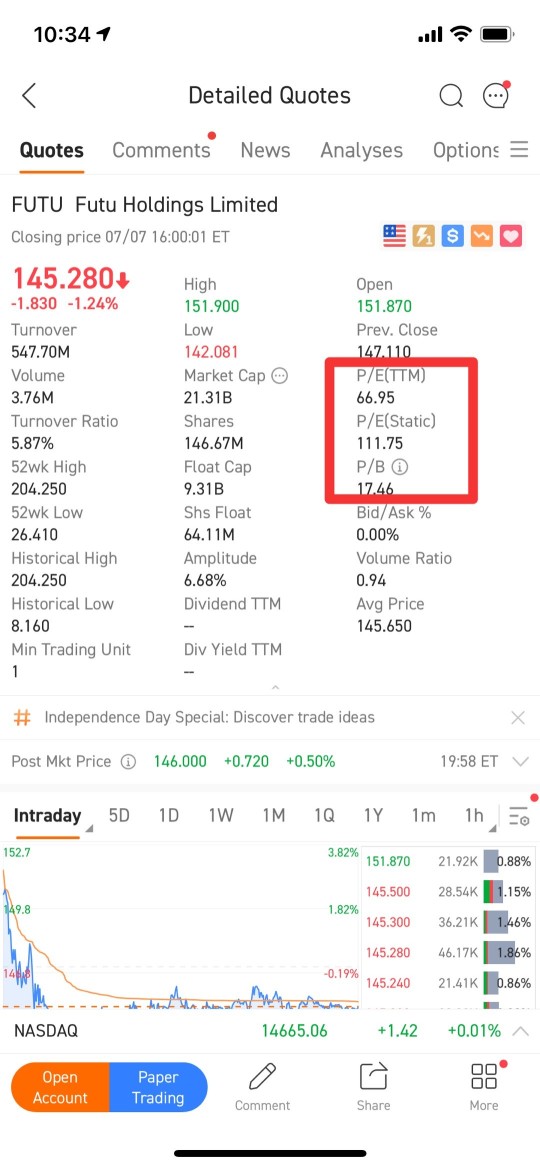

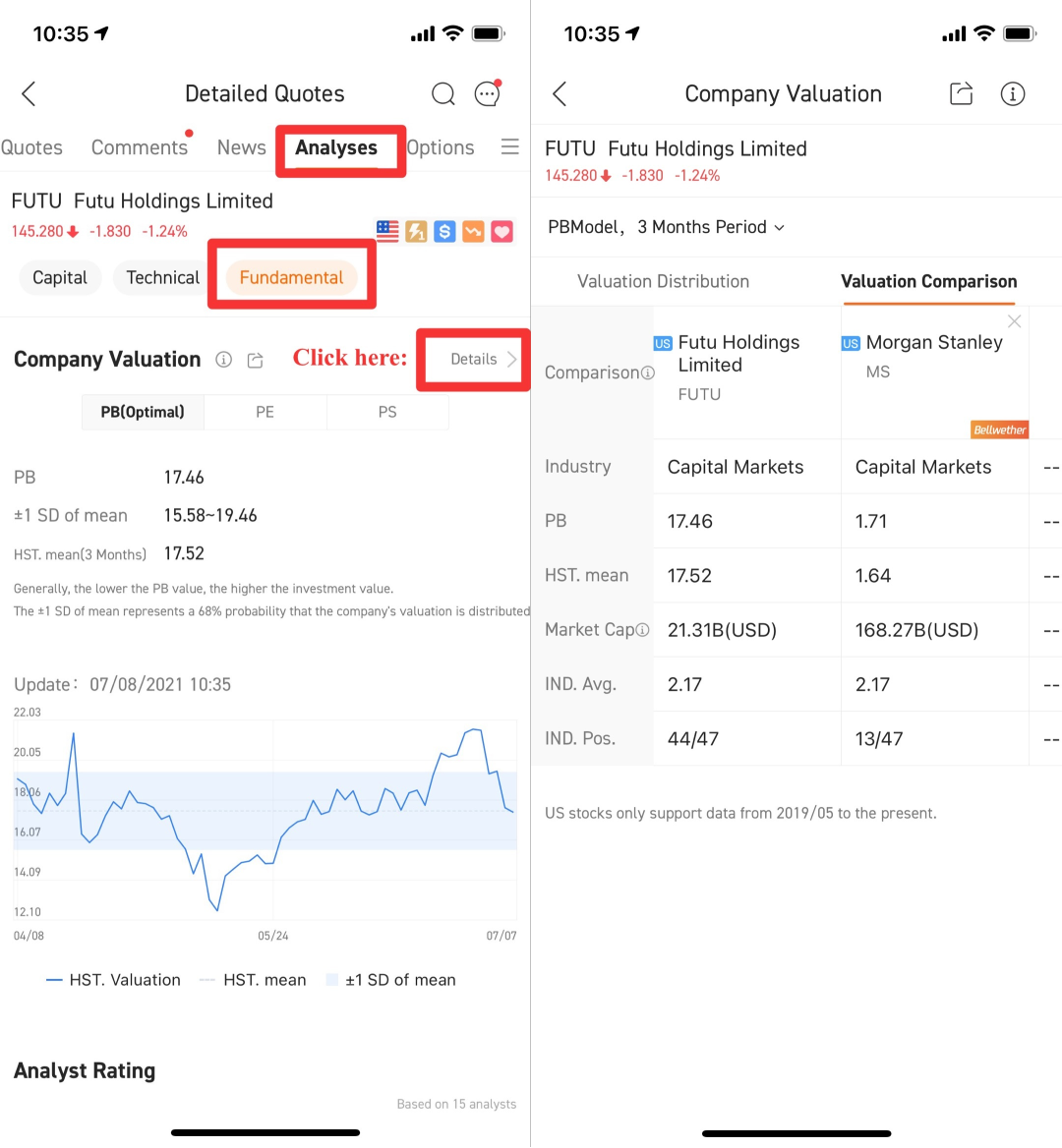

Previously:

Stock valuation methods

Absolute valuation: Analysts’ secret weapon

To value a company, we can apply many different techniques, such as the absolute valuation method we've talked about before.

Relative value is the opposite of absolute value. Absolute value looks for the intrinsic value of an asset or company, relative value is based on the value of other similar companies.

Types of relative valuation models

There are ma...

Stock valuation methods

Absolute valuation: Analysts’ secret weapon

To value a company, we can apply many different techniques, such as the absolute valuation method we've talked about before.

Relative value is the opposite of absolute value. Absolute value looks for the intrinsic value of an asset or company, relative value is based on the value of other similar companies.

Types of relative valuation models

There are ma...

+1

64

17

WlilyW

commented on

6

3

Here we go again...

Translated

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)