Wong Hong Sing

liked

TENAGA is considering nuclear energy and hydrogen energy for power generation.

National Energy $TENAGA (5347.MY)$ The CEO Datuk Megat Jalaluddin said that TENAGA is considering nuclear energy and hydrogen as long-term energy sources.

He revealed today in Kuala Lumpur at a summit that they are collaborating with the national oil company to explore a 'new' fuel to enhance their power mix.

However, he also added that the company's current focus is on transitioning to Henry Hub Natural Gas in the mid-term first.

Last year, Malaysia raised its renewable energy deployment target to 70% of total electricity generation capacity by 2050, up from the previous target of 40%.

To achieve this goal, an investment of 637 billion Ringgit (approximately 142.5 billion US dollars) is expected, for investment in renewable energy generation resources, strengthening electrical grid infrastructure, enhancing transmission lines, energy storage system integration, and strengthening power grid system network operations.

Megajalaluddin stated that TNB plans to reduce carbon dioxide emissions concentration by five percentage points annually until 2050.

As of November, our country's Electrical Utilities consumption has increased by 7% year-on-year, exceeding the economic growth rate.

Data Source:

Nanyang Commercial Daily disclaimer: This content is for reference and Education purposes only, and does not constitute any specific investment, investment strategy, or endorsement. Readers should bear any risks and liabilities arising from reliance on this content by themselves. Before making any investment decisions, please conduct your own independent research and evaluation, and consult with professionals if necessary. The author and related parties disclaim all responsibility for any use or reliance on the content ...

National Energy $TENAGA (5347.MY)$ The CEO Datuk Megat Jalaluddin said that TENAGA is considering nuclear energy and hydrogen as long-term energy sources.

He revealed today in Kuala Lumpur at a summit that they are collaborating with the national oil company to explore a 'new' fuel to enhance their power mix.

However, he also added that the company's current focus is on transitioning to Henry Hub Natural Gas in the mid-term first.

Last year, Malaysia raised its renewable energy deployment target to 70% of total electricity generation capacity by 2050, up from the previous target of 40%.

To achieve this goal, an investment of 637 billion Ringgit (approximately 142.5 billion US dollars) is expected, for investment in renewable energy generation resources, strengthening electrical grid infrastructure, enhancing transmission lines, energy storage system integration, and strengthening power grid system network operations.

Megajalaluddin stated that TNB plans to reduce carbon dioxide emissions concentration by five percentage points annually until 2050.

As of November, our country's Electrical Utilities consumption has increased by 7% year-on-year, exceeding the economic growth rate.

Data Source:

Nanyang Commercial Daily disclaimer: This content is for reference and Education purposes only, and does not constitute any specific investment, investment strategy, or endorsement. Readers should bear any risks and liabilities arising from reliance on this content by themselves. Before making any investment decisions, please conduct your own independent research and evaluation, and consult with professionals if necessary. The author and related parties disclaim all responsibility for any use or reliance on the content ...

Translated

27

1

1

Wong Hong Sing

liked

What are Space concept stocks?

Space concept stocks encompass companies involved in space exploration, launch services, defense, sate...

98

22

36

Wong Hong Sing

commented on

$CIMB (1023.MY)$ if i sell tmr can still get dividend?

1

1

Wong Hong Sing

voted

Happy Friday, Mooers! ![]()

![]()

It's once again time for the annual major event—the new iPhone launch from Apple. This year's iPhone might introduce "Apple Intelligence," which has been highly anticipated by many analysts. In fact, Citi analysts have listed Apple as their "Top AI Pick" for 2025.

So, what do you think, Mooers?![]()

![]()

Join the discussion below to win points rewards!

🎯Predicting time!

Come and participate in predicting $Apple (AAPL.US)$'...

It's once again time for the annual major event—the new iPhone launch from Apple. This year's iPhone might introduce "Apple Intelligence," which has been highly anticipated by many analysts. In fact, Citi analysts have listed Apple as their "Top AI Pick" for 2025.

So, what do you think, Mooers?

Join the discussion below to win points rewards!

🎯Predicting time!

Come and participate in predicting $Apple (AAPL.US)$'...

82

139

18

Wong Hong Sing

voted

Hi, mooers!

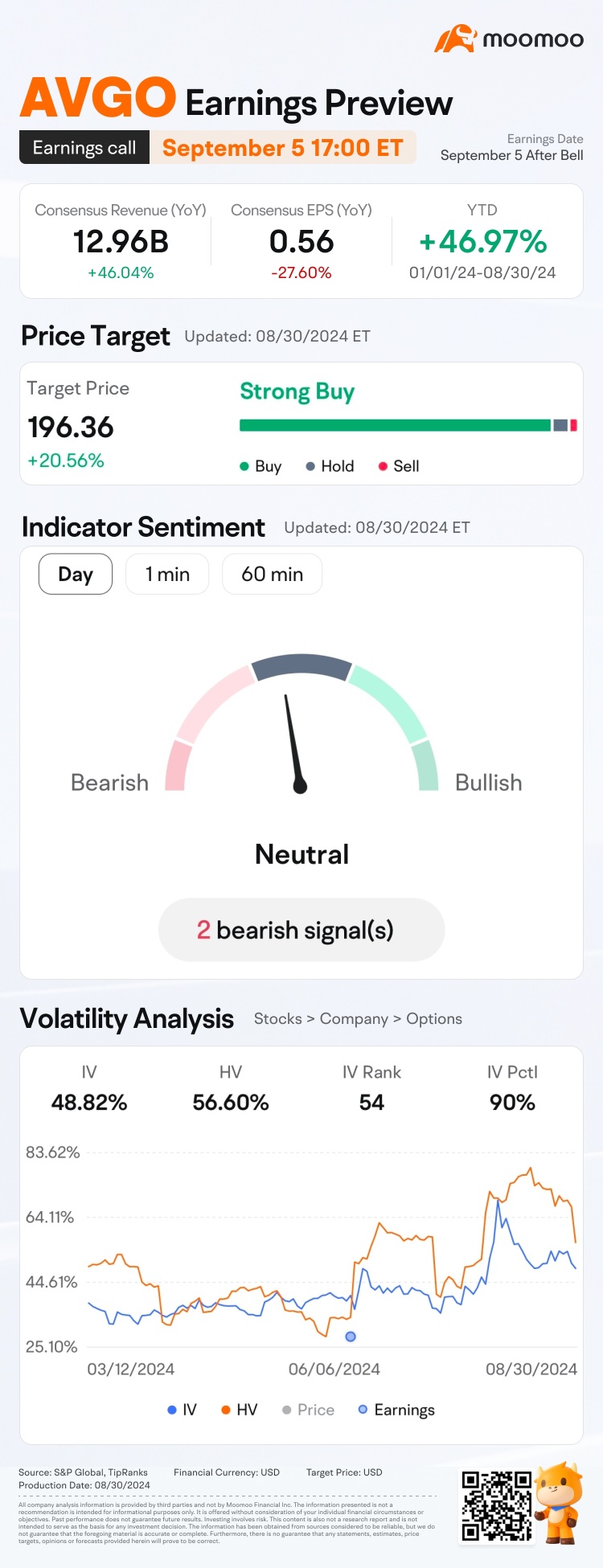

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

Expand

Expand 80

114

12

Wong Hong Sing

voted

Hi, mooers! ![]()

Malayan Banking Bhd $MAYBANK (1155.MY)$ is expected to release its quarterly earnings on August 28*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $MAYBANK (1155.MY)$'s closing price on 29 August!

An equal share of 5,000 points: For mooers who correctly guess the price range of $MAYBANK (1155.MY)$'s closing price on 29 August!

(Vote will close a...

Malayan Banking Bhd $MAYBANK (1155.MY)$ is expected to release its quarterly earnings on August 28*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will close a...

78

142

23

Wong Hong Sing

voted

Another major international investment bank is bullish on the prospects of the Chinese stock market. Japan's Nomura Securities believes that investors should reduce their holdings of Chinese stocks and instead invest in Malaysian and Indonesian stocks.

According to analysts from Nomura Securities, including Chettan Setti and others, in a recent report, Malaysian and Indonesian stock markets are expected to benefit from the trend of accelerated rate cuts in the United States, one of the reasons for upgrading the stock market ratings of both countries from "neutral" to "buy."

Nomura Securities has also downgraded the rating of the MSCI China Index from "buy" to "neutral."

"Now is the time to make a major move into the ASEAN stock market. With the Federal Reserve about to cut interest rates and investors reigniting their interest in emerging markets, investing in the Indonesian stock market may be the best bet."

Last week, Federal Reserve Chairman Powell has issued a clear signal of interest rate cuts starting in September.

Bloomberg pointed out that before Nomura Securities raised its ratings on Malaysia's and Indonesia's stock markets, foreign capital had shown increased interest in the two countries' stock markets, with two consecutive months of inflow of foreign capital.

"Investors have good reasons to take Nomura Securities' comments seriously. In December last year, they upgraded the Taiwan stock market, and the Taiwan Weighted Index has risen by 25% this year, while the MSCI Asia Pacific Index has increased by 9.8% during the same period."

Before Nomura Securities, many internationally renowned investment banks or financial media, including JP Morgan Chase, Goldman Sachs, and Forbes, had already turned optimistic about the Malaysian market outlook.

$FTSE Taiwan50 Index (.FTTW50.TW)$

���������...

According to analysts from Nomura Securities, including Chettan Setti and others, in a recent report, Malaysian and Indonesian stock markets are expected to benefit from the trend of accelerated rate cuts in the United States, one of the reasons for upgrading the stock market ratings of both countries from "neutral" to "buy."

Nomura Securities has also downgraded the rating of the MSCI China Index from "buy" to "neutral."

"Now is the time to make a major move into the ASEAN stock market. With the Federal Reserve about to cut interest rates and investors reigniting their interest in emerging markets, investing in the Indonesian stock market may be the best bet."

Last week, Federal Reserve Chairman Powell has issued a clear signal of interest rate cuts starting in September.

Bloomberg pointed out that before Nomura Securities raised its ratings on Malaysia's and Indonesia's stock markets, foreign capital had shown increased interest in the two countries' stock markets, with two consecutive months of inflow of foreign capital.

"Investors have good reasons to take Nomura Securities' comments seriously. In December last year, they upgraded the Taiwan stock market, and the Taiwan Weighted Index has risen by 25% this year, while the MSCI Asia Pacific Index has increased by 9.8% during the same period."

Before Nomura Securities, many internationally renowned investment banks or financial media, including JP Morgan Chase, Goldman Sachs, and Forbes, had already turned optimistic about the Malaysian market outlook.

$FTSE Taiwan50 Index (.FTTW50.TW)$

���������...

Translated

29

5

6

Wong Hong Sing

voted

Hey, mooers!

The global financial community is gearing up for the Jackson Hole Symposium taking place from August 22-24. Attention is focused on Powell's speech at 10:00 a.m. ET on August 23 (tap here to reserve your spot for the live stream), which typically offers insights into the Federal Reserve's monetary policy outlook. This year's gathering is themed "Reevaluating the Effectiveness and Transmission Mechanisms of Monetary Policy."...

The global financial community is gearing up for the Jackson Hole Symposium taking place from August 22-24. Attention is focused on Powell's speech at 10:00 a.m. ET on August 23 (tap here to reserve your spot for the live stream), which typically offers insights into the Federal Reserve's monetary policy outlook. This year's gathering is themed "Reevaluating the Effectiveness and Transmission Mechanisms of Monetary Policy."...

96

71

9

Wong Hong Sing

voted

Timetable of IPO

Figure 1: IPO timetable of EEHB

Source: $ELRIDGE (0318.MY)$ IPO prospectus

-Will be listed on the ACE Board

Full IPO Video on YouTube (Chinese version): - YouTube

Info of IPO

Enlarged no. of shares upon listing: 2000M

IPO price: RM0.29

Market capitalization: RM580M

Estimated funds to raise from Public Issue: RM101.5M

PE ratio = 24.6x (based on FY2023)

Business Model

Figure 2: Business model of EEHB

S...

Figure 1: IPO timetable of EEHB

Source: $ELRIDGE (0318.MY)$ IPO prospectus

-Will be listed on the ACE Board

Full IPO Video on YouTube (Chinese version): - YouTube

Info of IPO

Enlarged no. of shares upon listing: 2000M

IPO price: RM0.29

Market capitalization: RM580M

Estimated funds to raise from Public Issue: RM101.5M

PE ratio = 24.6x (based on FY2023)

Business Model

Figure 2: Business model of EEHB

S...

+6

18

1

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)