$Micron Technology (MU.US)$The most promising target to achieve a Davis double-click in the past two years.

Translated

4

$Micron Technology (MU.US)$ In the 2025 fiscal quarter, the earnings per share are likely to be more than $6. It can have a pe ratio ranging from 12 to 40. A reasonable stock price would fall between 72 and 240. It primarily depends on the position of semiconductors in the cycle. 😁😁😁

Translated

Translated

$Micron Technology (MU.US)$ In the future, the status of Al U is unknown. But high-speed memory will definitely not be absent. Sinking to the application end, high-capacity memory is also standard. In the long run, Micron is the preferred choice.![]()

Translated

$Apple (AAPL.US)$ It's understandable to have fantasies about next year. If you have fantasies about this season's financial report, then it's over for him.![]()

Translated

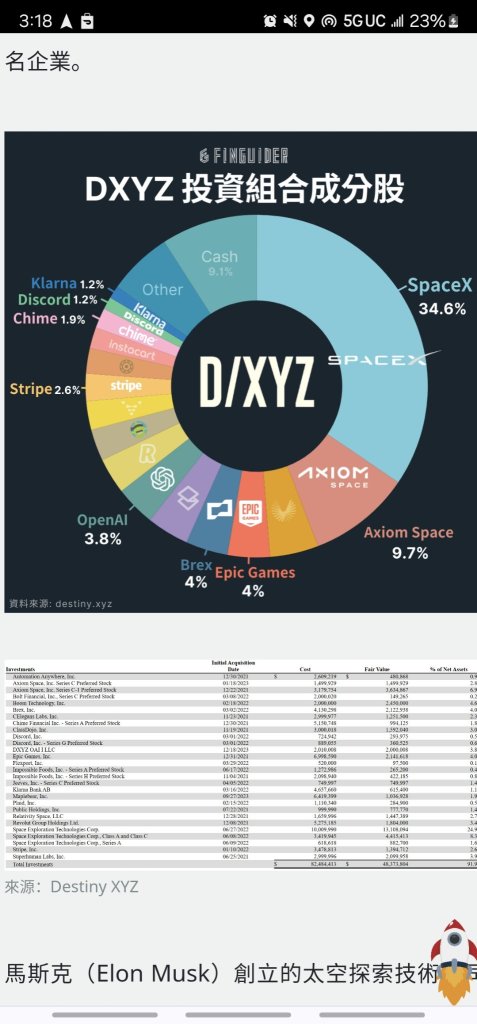

$Destiny Tech100 (DXYZ.US)$

Closed-end funds have a real capital of more than 50 million yuan with a 30% premium of 8 yuan. The ideal buying point is actually unlikely to be 10-15, but you can try it out a bit.

Closed-end funds have a real capital of more than 50 million yuan with a 30% premium of 8 yuan. The ideal buying point is actually unlikely to be 10-15, but you can try it out a bit.

Translated

3

3

$Tesla (TSLA.US)$Where is the data?

Translated

3

$QuantumScape (QS.US)$ The target customers of solid state batteries are not primarily EV. The main market is Al robots.![]()

Translated

$Arm Holdings (ARM.US)$It will definitely be shipped before next quarter's earnings report. Al's battlefield arm fringe characters haven't been popular for long.![]()

Translated

5

If all the benefits have not declined, the 30-35 forward price-earnings ratio will be consolidated until next quarter's earnings report.![]()

Translated

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)