Yeap2019

voted

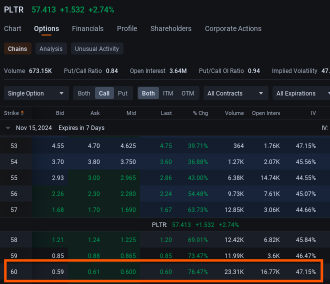

$Palantir (PLTR.US)$ bulls are piling onto call options that give the holders the right to buy the stock at $60 by the end of next week amid the stock's record-breaking rally.

The stock has been climbing to an all-time high everyday since reporting third-quarter results that blew past analysts' estimates last Monday. Over the past four days, the stock rallied 39% to a $57.08. That more than $15 advance increased the prob...

The stock has been climbing to an all-time high everyday since reporting third-quarter results that blew past analysts' estimates last Monday. Over the past four days, the stock rallied 39% to a $57.08. That more than $15 advance increased the prob...

43

14

24

Yeap2019

voted

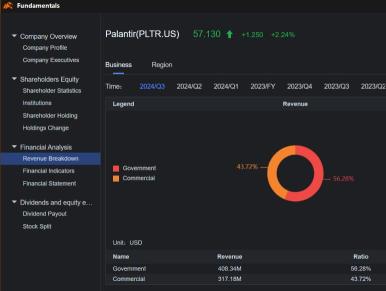

Happy weekend, investors! Welcome back to Weekly Buzz, where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

+10

83

28

4

Yeap2019

voted

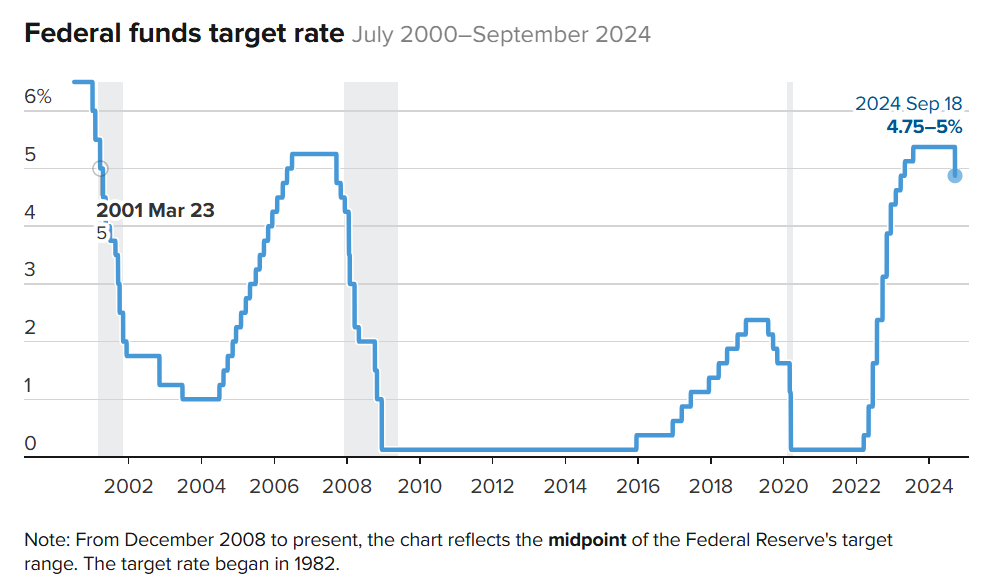

Next week could be one of the most exciting times for global stock markets! Two major events— the U.S. election and the US Fed FOMC meeting - could significantly impact market trends.

Before these events, we have an important economic announcement this Friday: the U.S. October Non-Farm Payroll (NFP) report.

1. Why is this Non-Farm Payroll report important?

2. What indicators should investors pay attention to?

3. How should t...

Before these events, we have an important economic announcement this Friday: the U.S. October Non-Farm Payroll (NFP) report.

1. Why is this Non-Farm Payroll report important?

2. What indicators should investors pay attention to?

3. How should t...

292

136

43

Yeap2019

voted

Author: toby siew

Upload coordinator: @Jungle lee

The 60th US presidential election will kick off on November 5th this year. At that time, the Republican Trump and the Democrat Harris will compete for the US presidency.

Due to its leading global position in economy, technology, and military power, coupled with the significant role of the US dollar, this election is not a domestic affair of the United States alone, but a crucial subject affecting global political and economic changes.

As for Malaysia, due to the close economic and trade ties with the United States over the years, it cannot remain indifferent and must closely monitor and consider the changes in this election, strategically positioning for opportunities and risks early.

What impact will the tight US presidential election have on Malaysia's economy? After discussions with political and economic experts, and comprehensive analysis of various data, "Nanyang Business Paper" will dissect it for readers.

The United States is Malaysia's second largest export market

Analyze the advantages and disadvantages from three perspectives.

On November 5 of this year, the United States will welcome the 60th presidential election. This election is being closely watched globally, and Malaysia is no exception.

What potential impacts will this election bring to Malaysia? What should the political and business communities as well as investors pay attention to?

As time passes, the presidential race intensifies. The representative sent by the Republican Party is the former president, Trump, who is known for his exaggerated and sharp language.

During his tenure from 2017 to early 2021, Donald Trump also occasionally communicated...

Upload coordinator: @Jungle lee

The 60th US presidential election will kick off on November 5th this year. At that time, the Republican Trump and the Democrat Harris will compete for the US presidency.

Due to its leading global position in economy, technology, and military power, coupled with the significant role of the US dollar, this election is not a domestic affair of the United States alone, but a crucial subject affecting global political and economic changes.

As for Malaysia, due to the close economic and trade ties with the United States over the years, it cannot remain indifferent and must closely monitor and consider the changes in this election, strategically positioning for opportunities and risks early.

What impact will the tight US presidential election have on Malaysia's economy? After discussions with political and economic experts, and comprehensive analysis of various data, "Nanyang Business Paper" will dissect it for readers.

The United States is Malaysia's second largest export market

Analyze the advantages and disadvantages from three perspectives.

On November 5 of this year, the United States will welcome the 60th presidential election. This election is being closely watched globally, and Malaysia is no exception.

What potential impacts will this election bring to Malaysia? What should the political and business communities as well as investors pay attention to?

As time passes, the presidential race intensifies. The representative sent by the Republican Party is the former president, Trump, who is known for his exaggerated and sharp language.

During his tenure from 2017 to early 2021, Donald Trump also occasionally communicated...

Translated

+4

37

4

11

Yeap2019

reacted to

On October 18, 2024, Malaysia presented its largest-ever budget in Parliament, with the theme "Revitalising the Economy, Generating Change, Prospering the Rakyat." Here's a brief breakdown of the key highlights from Budget 2025:

· The total allocation for Budget 2025 is RM421 billion, an increase from the revised RM407.5 billion in 2024. Of this, RM335 billion is earmarked for operational expenditures, and RM86 billion for development expenditures.

· ...

· The total allocation for Budget 2025 is RM421 billion, an increase from the revised RM407.5 billion in 2024. Of this, RM335 billion is earmarked for operational expenditures, and RM86 billion for development expenditures.

· ...

194

66

76

Yeap2019

voted

$GENM (4715.MY)$ got some flak today for reduced foreign tourists, which account for 20% of its business. This was no thanks to MYR value appreciation, which adversely affects local tourism.

It's was also criticised for the high utilisation of debt. For this reason, even though it pays a good dividend, it might not be the ideal long-hold stock I initially thought it to be. Something on my monitoring to-do list now to see if this metric improves.

How would you view GEN...

It's was also criticised for the high utilisation of debt. For this reason, even though it pays a good dividend, it might not be the ideal long-hold stock I initially thought it to be. Something on my monitoring to-do list now to see if this metric improves.

How would you view GEN...

4

1

Yeap2019

reacted to

$GENM (4715.MY)$ No matter how bad you are, I'm still holding you.

Translated

24

Yeap2019

voted

Good morning, traders. Happy Friday, October 4th. The new jobs numbers came in hot- 254k new payrolls in September, compared to estimates of 147k. That and the lower BLS Unemployment rate sent the market back into a climb with nine out of 11 sectors of the S&P 500 in the green.

It has been a volitile week, my name is Kevin Travers; here stonks and stories you have to know about on Wall Street Today.

$ZIM Integrated Shipping (ZIM.US)$...

It has been a volitile week, my name is Kevin Travers; here stonks and stories you have to know about on Wall Street Today.

$ZIM Integrated Shipping (ZIM.US)$...

50

21

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)