zhiyee

liked

As Federal Reserve Chairman Powell gave the clearest signal yet of a potential rate cut last Friday, the market has fully priced in the possibility rate cut in September. The recent report by OCBC Investment Research (OIR) pointed out that the Singapore Real Estate Investment Trust(S-REIT) sector, which was once significantly impacted by the COVID-19 pandemic, high inflation, and high interest rates, stands to benefit from ...

294

73

zhiyee

reacted to and signed up for the Live

Dear Mooers,

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Unlock the Secrets of ETFs with Our Upcoming Live Stream!

Sep 4 07:00

288

103

zhiyee

reacted to

Good morning mooers! Here are things you need to know about today's market:

●Tech Sector Rallies with Historic Gains Following Strong AMD and Meta Earnings

●Malaysia's MOF Confirms Diesel Subsidy Policy Unlikely to Impact Inflation and Growth Forecasts

●Malaysia's MSME Sector Shows Robust Growth, Poised to Meet Economic Targets

●Malaysia's Manufacturing Sector Hits RM1.89 Trillion in 2022

●Stocks to watch: Celco...

●Tech Sector Rallies with Historic Gains Following Strong AMD and Meta Earnings

●Malaysia's MOF Confirms Diesel Subsidy Policy Unlikely to Impact Inflation and Growth Forecasts

●Malaysia's MSME Sector Shows Robust Growth, Poised to Meet Economic Targets

●Malaysia's Manufacturing Sector Hits RM1.89 Trillion in 2022

●Stocks to watch: Celco...

26

2

zhiyee

liked

The second earnings season will officially kick off release on July 12. As usual, bank stocks will lead the earnings season— $JPMorgan (JPM.US)$, $Wells Fargo & Co (WFC.US)$, $Citigroup (C.US)$,and $Bank of New York Mellon (BK.US)$will report their earnings later.

Prior to this, the $S&P 500 Index (.SPX.US)$ has reached new highs for the 34th time this year since hitting its low last October, driven by the AI boom and bets on Federal Reserve ...

Prior to this, the $S&P 500 Index (.SPX.US)$ has reached new highs for the 34th time this year since hitting its low last October, driven by the AI boom and bets on Federal Reserve ...

+1

608

188

zhiyee

liked

$EKOVEST (8877.MY)$

Ekovest project detailed report: RTS and River of Life.

【RTS Project】

Total contract amount - 3.482 billion Malaysian Ringgit

**Payment received**

- Q1 FY2024 (July 1, 2023 - September 30, 2023): 165,259,000 Malaysian Ringgit

- Q2 FY2024 (October 1, 2023 - December 31, 2023): 184,929,000 Malaysian Ringgit

- Q3 FY2024 (January 1, 2024 - March 31, 2024): 138,409,000 Malaysian Ringgit

**Not received payment**

- Total contract amount - Total amount received = 3.482 billion Malaysian Ringgit - 488,597,000 Malaysian Ringgit = 2.993403 billion Malaysian Ringgit

【River of Life Project】

Contract total amount - 0.22 billion Malaysian Ringgit

**Payment received**

- Q1 FY2024 (July 1, 2023 - September 30, 2023): 76,611,000 Malaysian Ringgit

- Q2 FY2024 (October 1, 2023 - December 31, 2023): 76,933,000 Malaysian Ringgit

- Q3 FY2024 (January 1, 2024 - March 31, 2024): 67,561,...

Ekovest project detailed report: RTS and River of Life.

【RTS Project】

Total contract amount - 3.482 billion Malaysian Ringgit

**Payment received**

- Q1 FY2024 (July 1, 2023 - September 30, 2023): 165,259,000 Malaysian Ringgit

- Q2 FY2024 (October 1, 2023 - December 31, 2023): 184,929,000 Malaysian Ringgit

- Q3 FY2024 (January 1, 2024 - March 31, 2024): 138,409,000 Malaysian Ringgit

**Not received payment**

- Total contract amount - Total amount received = 3.482 billion Malaysian Ringgit - 488,597,000 Malaysian Ringgit = 2.993403 billion Malaysian Ringgit

【River of Life Project】

Contract total amount - 0.22 billion Malaysian Ringgit

**Payment received**

- Q1 FY2024 (July 1, 2023 - September 30, 2023): 76,611,000 Malaysian Ringgit

- Q2 FY2024 (October 1, 2023 - December 31, 2023): 76,933,000 Malaysian Ringgit

- Q3 FY2024 (January 1, 2024 - March 31, 2024): 67,561,...

Translated

4

zhiyee

liked

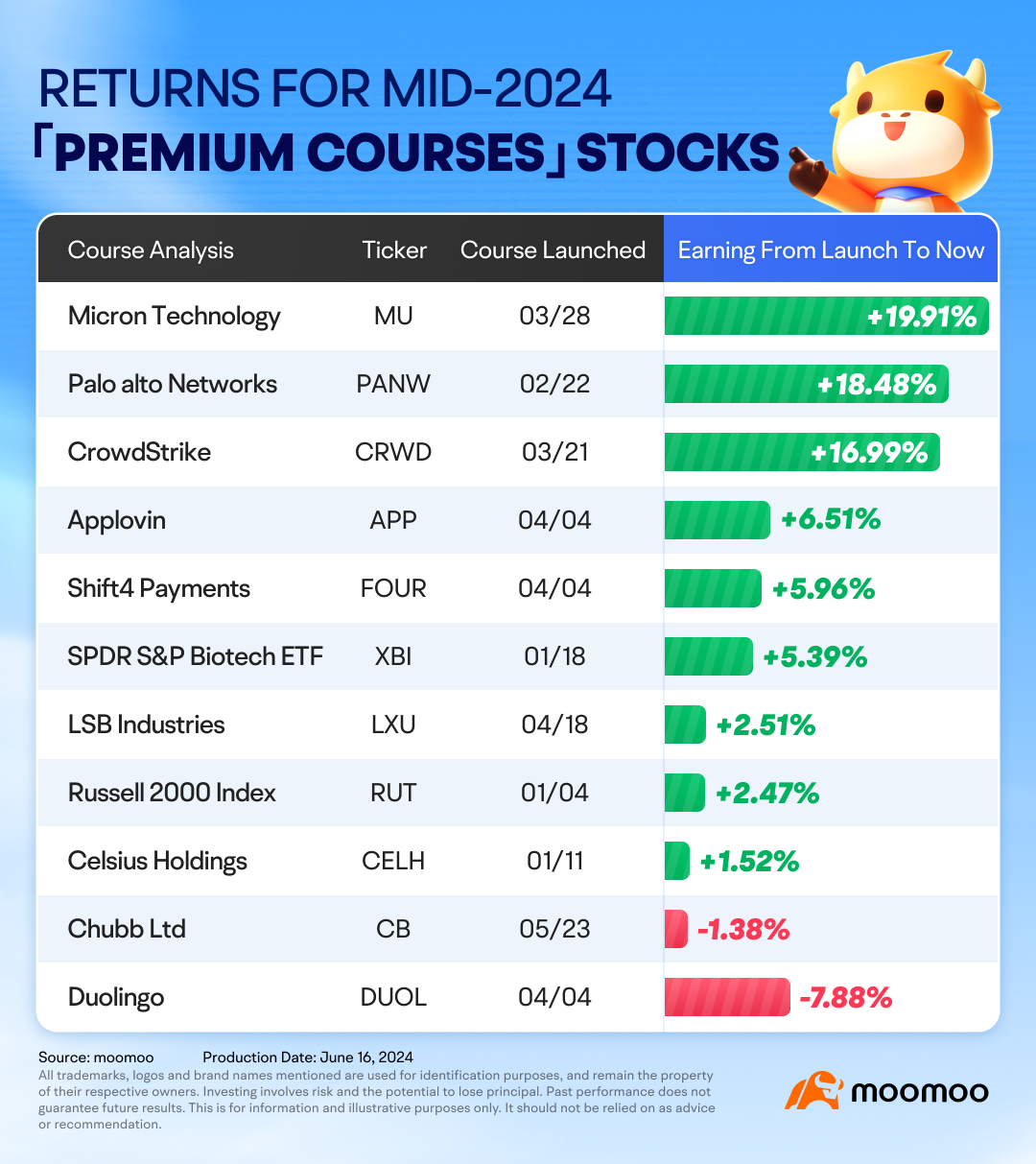

The U.S. stock market has hit new highs again! Congrats!👏 If you started investing in the US market at the beginning of the year and haven't made any major mistakes, you've probably seen some gains! 🎉

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

+5

436

226

zhiyee

Set a live reminder

Johor Plantations Group Berhad ("JPG") is targeting to debut on the Bursa main market on 7/9/2024 as the largest initial public offering ("IPO") so far in year 2024. The IPO subscription takes place from 6/12/2024 to 6/24/2024!

To provide investors with a better understanding of the company's development and future plans,Moomoo Malaysia has the opportunity to conduct a live session with the senior management of JPG on 6/21/2024 Fri 14:30 - 15:31 MYT.

Managing Director of JPG Mohd. Faris Adli Shu...

To provide investors with a better understanding of the company's development and future plans,Moomoo Malaysia has the opportunity to conduct a live session with the senior management of JPG on 6/21/2024 Fri 14:30 - 15:31 MYT.

Managing Director of JPG Mohd. Faris Adli Shu...

Moo-Live! Exclusive Online Q&A Session With JOHOR PLANTATIONS GROUP

Jun 21 01:30

300

116

zhiyee

liked

$FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$

#绿油油

Entering June 2024, Malaysian stocks quickly recovered from the previous pullback. Mainly because after the opening of trading in May, the bad ones were liquidated, and those with good results were also recovered. Moreover, judging from the performance of 30 blue-chip stocks, the future of the index will be driven by a northern advance.

The composite index rose 11.2% in 2024. Only 5 areas performed less than the market, all with an increase of less than 10%. They are planting, industrial trusts, telecommunications media, consumer, and financial services.

Compared to FCPO's price fluctuations, the performance of planting stocks in Q1 was mixed, so the index increase temporarily came to an end. However, when the stock market is good, industrial trusts, which are defensive dividends, cannot attract much capital, and the market will be more biased towards popular and growth stocks. The consumer and telecommunications industries rose 8.1%, seeking merit but seeking nothing more.

The financial sector, due to its huge market capitalization, rose by only 8.2%, but it was the sector that drove the index to rise the most. Because before SUNWAY entered blue-chip stocks, bank stocks dominated 7 seats in the top 30, accounting for more than 40%.

The top 3 are still utilities (electricity infrastructure), construction, and industry. The energy sector, which had previously broken into the top 3, fell to 6th place because the market feared that oil prices would fall due to weak oil demand. Transportation and logistics due to the increase in freight rates over the past 2 months, plus Malaysian port students...

#绿油油

Entering June 2024, Malaysian stocks quickly recovered from the previous pullback. Mainly because after the opening of trading in May, the bad ones were liquidated, and those with good results were also recovered. Moreover, judging from the performance of 30 blue-chip stocks, the future of the index will be driven by a northern advance.

The composite index rose 11.2% in 2024. Only 5 areas performed less than the market, all with an increase of less than 10%. They are planting, industrial trusts, telecommunications media, consumer, and financial services.

Compared to FCPO's price fluctuations, the performance of planting stocks in Q1 was mixed, so the index increase temporarily came to an end. However, when the stock market is good, industrial trusts, which are defensive dividends, cannot attract much capital, and the market will be more biased towards popular and growth stocks. The consumer and telecommunications industries rose 8.1%, seeking merit but seeking nothing more.

The financial sector, due to its huge market capitalization, rose by only 8.2%, but it was the sector that drove the index to rise the most. Because before SUNWAY entered blue-chip stocks, bank stocks dominated 7 seats in the top 30, accounting for more than 40%.

The top 3 are still utilities (electricity infrastructure), construction, and industry. The energy sector, which had previously broken into the top 3, fell to 6th place because the market feared that oil prices would fall due to weak oil demand. Transportation and logistics due to the increase in freight rates over the past 2 months, plus Malaysian port students...

Translated

53

1

zhiyee

liked and set a live reminder

Join our webinar to decode Malaysia's stock market trends in H1 2024. Stay informed, stay ahead! Register now.

Table of Content

1. MY H1 2024 Performance Review

2. Main Economic Factors Influencing the MY Market

3. Global Influences on the MY Market

4. Economic Event Focus on H2 2024

5. Q&A Session

Table of Content

1. MY H1 2024 Performance Review

2. Main Economic Factors Influencing the MY Market

3. Global Influences on the MY Market

4. Economic Event Focus on H2 2024

5. Q&A Session

Malaysia H1 Stock Review: Will Trends and Growth Last in H2 2024?

Jun 6 07:00

169

46

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)