Zus0505

voted

$NVIDIA (NVDA.US)$ ended the week with its shares at $141, boosting its market value to $3.47 trillion, making it the world's second-largest company after $Apple (AAPL.US)$. $Microsoft (MSFT.US)$ follows with a market cap of $3.18 trillion as of last Friday. These tech giants are all poised for the next major milestone in market cap, and investors are likely seeing discussions about which companies could reach $4 trillion.

Apple's Advancements

Appl...

Apple's Advancements

Appl...

33

16

Zus0505

voted

Author: toby siew

Upload coordinator: @Jungle lee

The 60th US presidential election will kick off on November 5th this year. At that time, the Republican Trump and the Democrat Harris will compete for the US presidency.

Due to its leading global position in economy, technology, and military power, coupled with the significant role of the US dollar, this election is not a domestic affair of the United States alone, but a crucial subject affecting global political and economic changes.

As for Malaysia, due to the close economic and trade ties with the United States over the years, it cannot remain indifferent and must closely monitor and consider the changes in this election, strategically positioning for opportunities and risks early.

What impact will the tight US presidential election have on Malaysia's economy? After discussions with political and economic experts, and comprehensive analysis of various data, "Nanyang Business Paper" will dissect it for readers.

The United States is Malaysia's second largest export market

Analyze the advantages and disadvantages from three perspectives.

On November 5 of this year, the United States will welcome the 60th presidential election. This election is being closely watched globally, and Malaysia is no exception.

What potential impacts will this election bring to Malaysia? What should the political and business communities as well as investors pay attention to?

As time passes, the presidential race intensifies. The representative sent by the Republican Party is the former president, Trump, who is known for his exaggerated and sharp language.

During his tenure from 2017 to early 2021, Donald Trump also occasionally communicated...

Upload coordinator: @Jungle lee

The 60th US presidential election will kick off on November 5th this year. At that time, the Republican Trump and the Democrat Harris will compete for the US presidency.

Due to its leading global position in economy, technology, and military power, coupled with the significant role of the US dollar, this election is not a domestic affair of the United States alone, but a crucial subject affecting global political and economic changes.

As for Malaysia, due to the close economic and trade ties with the United States over the years, it cannot remain indifferent and must closely monitor and consider the changes in this election, strategically positioning for opportunities and risks early.

What impact will the tight US presidential election have on Malaysia's economy? After discussions with political and economic experts, and comprehensive analysis of various data, "Nanyang Business Paper" will dissect it for readers.

The United States is Malaysia's second largest export market

Analyze the advantages and disadvantages from three perspectives.

On November 5 of this year, the United States will welcome the 60th presidential election. This election is being closely watched globally, and Malaysia is no exception.

What potential impacts will this election bring to Malaysia? What should the political and business communities as well as investors pay attention to?

As time passes, the presidential race intensifies. The representative sent by the Republican Party is the former president, Trump, who is known for his exaggerated and sharp language.

During his tenure from 2017 to early 2021, Donald Trump also occasionally communicated...

Translated

+4

31

3

Zus0505

liked

8

Zus0505

liked

9

Zus0505

liked

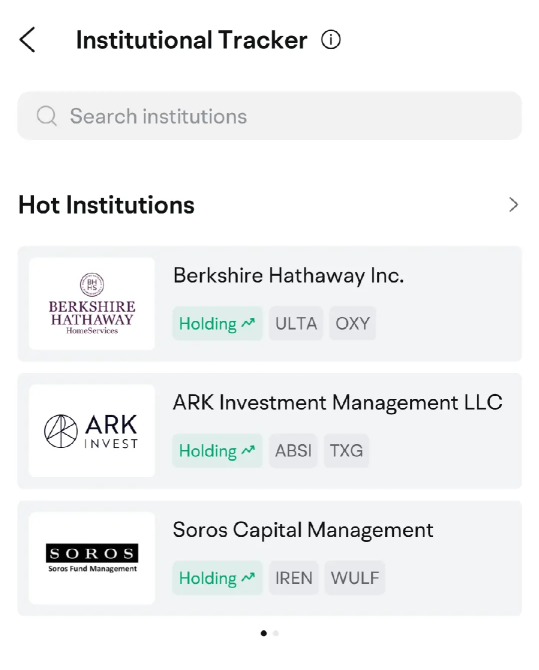

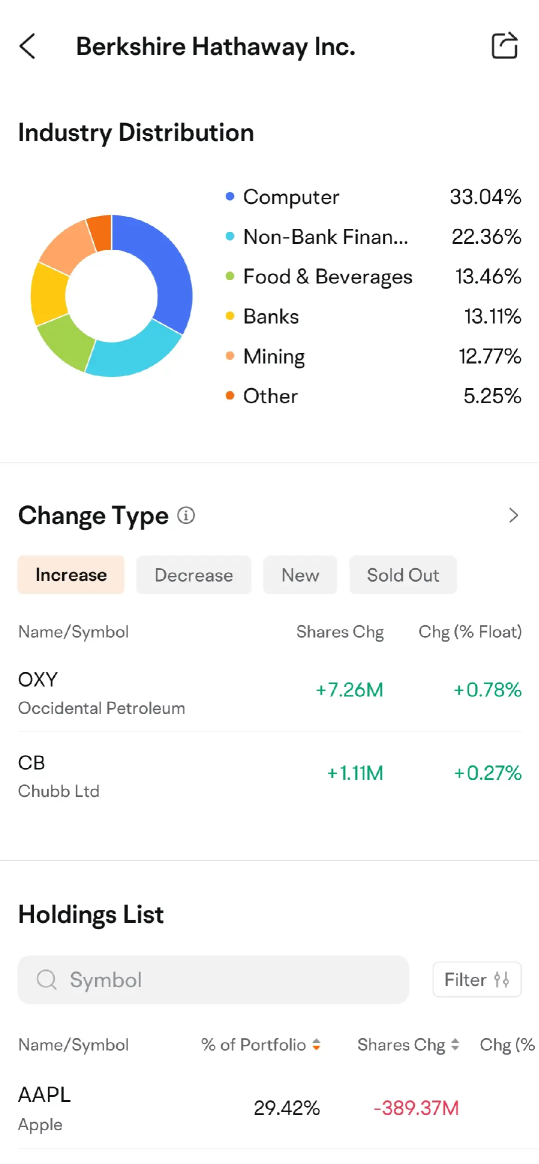

Welcome back to "Max Learns to Invest" – our story-driven series that explores moomoo's features through the eyes of Max, our avatar representing new investors like you. Max's journey mirrors the challenges many of you face when starting out in investing.

Got thoughts or questions? Share them below! We're rewarding 88 points for every comment that provides actionable suggestions or answers to our end-of-articl...

Got thoughts or questions? Share them below! We're rewarding 88 points for every comment that provides actionable suggestions or answers to our end-of-articl...

+1

52

21

Zus0505

reacted to

9

5

Zus0505

liked

$Vistra Energy (VST.US)$

Does anyone know what's going on? It dropped over 6%.

This is my trade from yesterday, was it too early to sell? It doesn't expire until next Friday.

Can you give me some advice? It's better than just leaving an emoji.![]() Let me correct one thing, I sold it at a price of 3.00. That was just a screenshot.

Let me correct one thing, I sold it at a price of 3.00. That was just a screenshot. ![]()

Can you provide some recommendations? It would be better than just using an emoji.![]()

I sold at 3.00. That's just a screenshot.![]()

Does anyone know what's going on? It dropped over 6%.

This is my trade from yesterday, was it too early to sell? It doesn't expire until next Friday.

Can you give me some advice? It's better than just leaving an emoji.

Can you provide some recommendations? It would be better than just using an emoji.

I sold at 3.00. That's just a screenshot.

Translated

9

12

Zus0505

voted

$ASML Holding (ASML.US)$ continued slump signaled divergence among chipmakers, with those with the biggest exposure to artificial intelligence led by $NVIDIA (NVDA.US)$ showing greater resilience. As expected, that's also spilling over to the options market.

ASML's American depositary receipts (ADRs) tumbled Wednesday, taking its two-day loss to almost 21%, after the Dutch company reported a day earlier that its net bookings shr...

ASML's American depositary receipts (ADRs) tumbled Wednesday, taking its two-day loss to almost 21%, after the Dutch company reported a day earlier that its net bookings shr...

37

6

Zus0505

liked

4

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)