没有原因。

已翻译

面对大海春暖花开

参与了投票

2022年初,美联储开始实施量化收紧政策。从那时开始,股市一路下跌,毫不犹豫。但在2023年的第一个月,出现了一个惊人的情节转折。几乎所有的东西都疯狂上涨。

一些投资者从上涨的趋势中受益。然而,对未来持消极预期的其他人可能感觉就像被猛烈地击中了脸一样。

@Johnsh:波威尔的突然袭击形象 $SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$

���������...

一些投资者从上涨的趋势中受益。然而,对未来持消极预期的其他人可能感觉就像被猛烈地击中了脸一样。

@Johnsh:波威尔的突然袭击形象 $SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$

���������...

已翻译

+10

57

78

面对大海春暖花开

参与了投票

嗨,mooer们!![]()

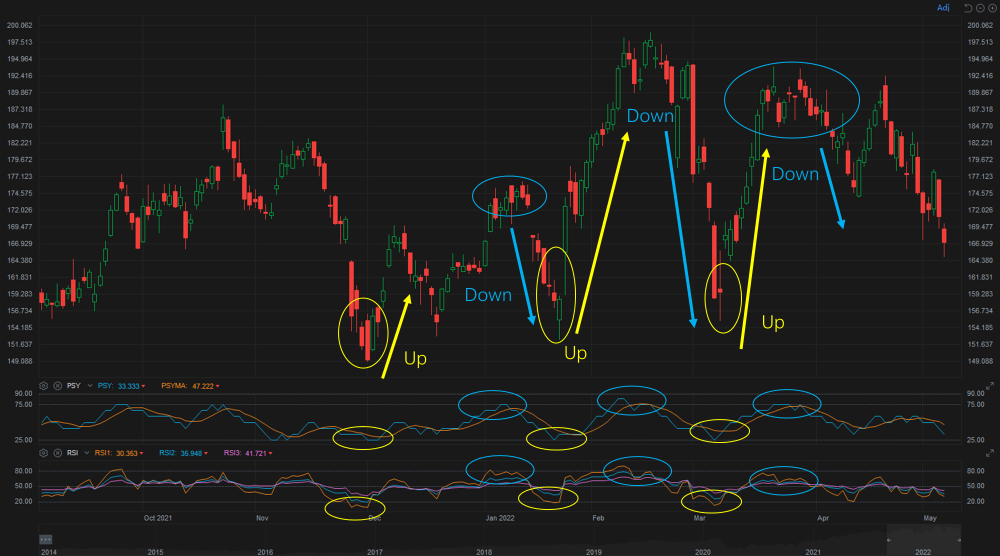

准备好再吃一顿丰盛的智力大餐了吗?滚动屏幕并让你的思维充盈。正如之前的帖子中提到的那样, 仅仅使用一个指标来分析入场或离场点是有风险的,PSY(心理线)指标也不例外。![]()

如果只使用PSY指标,你可能会错过机会。因此,我们需要将其与其他技术指标结合起来,做出进出决策。现在,请跟着我一起找出如何做到...

准备好再吃一顿丰盛的智力大餐了吗?滚动屏幕并让你的思维充盈。正如之前的帖子中提到的那样, 仅仅使用一个指标来分析入场或离场点是有风险的,PSY(心理线)指标也不例外。

如果只使用PSY指标,你可能会错过机会。因此,我们需要将其与其他技术指标结合起来,做出进出决策。现在,请跟着我一起找出如何做到...

已翻译

49

5

面对大海春暖花开

评论了

嘿, mooer们!在此帖子的末尾,您有机会 赢取积分!![]()

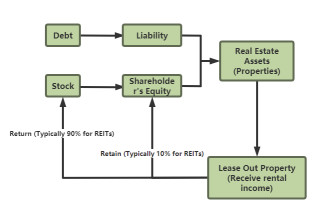

欢迎回来 REITs 101,从我们的完整教育性REIT投资中提升您的REITs投资知识。

您还记得我们在上次发帖中提出的问题吗? REITs 101:股权房地产投资信托的简史?

![]() 下一个问题来自Tiao Huang的问题。 :

下一个问题来自Tiao Huang的问题。 :

新加坡第一个REIT的名字是什么?

答案: 该公司的首次公开发行初始股价为1.00新加坡元,预计2002年和2003年的股息率分别为5.75%和6.05%。

你弄对了吗?恭喜那些答对的moomoo们,赢得了50分...

欢迎回来 REITs 101,从我们的完整教育性REIT投资中提升您的REITs投资知识。

您还记得我们在上次发帖中提出的问题吗? REITs 101:股权房地产投资信托的简史?

新加坡第一个REIT的名字是什么?

答案: 该公司的首次公开发行初始股价为1.00新加坡元,预计2002年和2003年的股息率分别为5.75%和6.05%。

你弄对了吗?恭喜那些答对的moomoo们,赢得了50分...

已翻译

25

8

面对大海春暖花开

参与了投票

不管你是否承认。

投资 和一个 关系 有共同之处。

![]() 有时候他们会欺骗你

有时候他们会欺骗你

@Yassien: $AMC院线 (AMC.US)$想象一下把钱投入到一个需要玩弄情绪和虚假代码的投资中,它们仍然不能让moaz发生。实际上这对猿人的诚信意味着很多。他们想要欺骗人们以赚钱。

![]() 有时很甜蜜(这是没有用的...

有时很甜蜜(这是没有用的...

投资 和一个 关系 有共同之处。

@Yassien: $AMC院线 (AMC.US)$想象一下把钱投入到一个需要玩弄情绪和虚假代码的投资中,它们仍然不能让moaz发生。实际上这对猿人的诚信意味着很多。他们想要欺骗人们以赚钱。

已翻译

+9

61

61

高位入场后持守,等下调20%后再买,假如再下调的话,再接着买咯。不过前提是这只股票值得持有,从公司财报到各证劵公司的分析评级和预期的目标价都要考虑权衡,如果真是选股不当那就及时止损,乘高解套吧。

面对大海春暖花开

赞了

Stock rebound may continue in Asia; bonds decline

A global rebound in stocks may continue in Asia on Wednesday as investor sentiment improves after being roiled by uncertainty over the omicron virus strain and stimulus outlook.

Futures for Japan and Hong Kong rose, while Australian shares edged up. U.S. contracts fluctuated after the $标普500指数 (.SPX.US)$ snapped three days of declines and the technology-heavy $纳斯达克100指数 (.NDX.US)$ climbed more than 2%. A gauge of Chinese shares traded in the U.S. surged about 7%.

Turkey markets rocked anew amid stock slump, record lira swings

Gyrations in Turkey's stocks and the lira signal volatility is here to stay, even after the government laid out emergency measures to bolster the currency.

The Borsa Istanbul 100 Index's 7.9% decline on Tuesday triggered yet another circuit breaker, as it headed for the biggest three-day loss in more than two decades. The currency whipsawed between gains and losses, after soaring as much as 20% against the U.S. dollar, sending both three-month and one-year volatility to all-time peaks.

Tuesday's market bounce could lead to a record 2022, Oppenheimer's top strategist says

Despite Covid-19 omicron risks, Oppenheimer Asset Management's John Stoltzfus suggests Tuesday's market bounce is real.

"We believe in it. We think investors should as well," the firm's chief investment strategist told CNBC,"The selling that we've seen over the last few days was overdone. Fundamentals are getting better going forward. Stocks are responding to that fact."

Crypto funds explode in boom year marked by first U.S. bitcoin ETF

Even beyond the launch of the first U.S. Bitcoin futures ETF, cryptocurrency funds notched some notable global milestones in 2021.

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020, according to Bloomberg Intelligence data. Assets soared to $63 billion, compared to $24 billion at the start of the year.

Musk tweet fund adminstrator isn't filing statements, judge says

A judge is questioning the status of a $40 million fund that was established from fines paid by Elon Musk and $特斯拉 (TSLA.US)$ over controversial tweets.

The firm appointed in May to administer distributions from the fund, set up by the U.S. SEC for harmed investors, hasn' filed required accounting statements, U.S. District Judge Alison Nathan said in an order Tuesday. She directed Rust Consulting to submit a status report by Jan. 7.

U.S. share buybacks hit record while capex lags pre-crisis level

Share repurchases more than doubled from a year earlier for S&P 500 companies to an all-time high of $234.6 billion, according to data released Tuesday from S&P Dow Jones Indices. Meanwhile, capital expenditures increased 21% to $189 billion, which is still down 3% from the final three months of 2019 before the pandemic shutdown the economy.

Part of the reason could be related to the pandemic, as a shift in consumer demand has fueled lots of uncertainty for businesses and makes it difficult for companies to plan ahead.

Super-luxury home sales surge across U.S., rising 35% in 2021

In 2021, at least 40 residential properties sold for more than $50 million in the U.S., according to data compiled by the appraiser Miller Samuel. Fueled by a booming stock market, low interest rates, and a pandemic-era's heightened emphasis on home life, prices for luxury houses have risen to stratospheric heights across the country.

UK offers 1 billion pounds to firms hit hardest by Omicron

Britain has announced £1 billion of extra support for businesses hit hardest by the wave of Omicron variant coronavirus cases. Finance minister Rishi Sunak said he would "respond proportionately and appropriately" if further Covid restrictions are imposed.

Under the support announced on Tuesday, hospitality and leisure firms in England will be eligible for grants of up to 6,000 pounds for each of their premises, accounting for almost 700 million pounds of the new package.

Source: Bloomberg, CNBC

A global rebound in stocks may continue in Asia on Wednesday as investor sentiment improves after being roiled by uncertainty over the omicron virus strain and stimulus outlook.

Futures for Japan and Hong Kong rose, while Australian shares edged up. U.S. contracts fluctuated after the $标普500指数 (.SPX.US)$ snapped three days of declines and the technology-heavy $纳斯达克100指数 (.NDX.US)$ climbed more than 2%. A gauge of Chinese shares traded in the U.S. surged about 7%.

Turkey markets rocked anew amid stock slump, record lira swings

Gyrations in Turkey's stocks and the lira signal volatility is here to stay, even after the government laid out emergency measures to bolster the currency.

The Borsa Istanbul 100 Index's 7.9% decline on Tuesday triggered yet another circuit breaker, as it headed for the biggest three-day loss in more than two decades. The currency whipsawed between gains and losses, after soaring as much as 20% against the U.S. dollar, sending both three-month and one-year volatility to all-time peaks.

Tuesday's market bounce could lead to a record 2022, Oppenheimer's top strategist says

Despite Covid-19 omicron risks, Oppenheimer Asset Management's John Stoltzfus suggests Tuesday's market bounce is real.

"We believe in it. We think investors should as well," the firm's chief investment strategist told CNBC,"The selling that we've seen over the last few days was overdone. Fundamentals are getting better going forward. Stocks are responding to that fact."

Crypto funds explode in boom year marked by first U.S. bitcoin ETF

Even beyond the launch of the first U.S. Bitcoin futures ETF, cryptocurrency funds notched some notable global milestones in 2021.

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020, according to Bloomberg Intelligence data. Assets soared to $63 billion, compared to $24 billion at the start of the year.

Musk tweet fund adminstrator isn't filing statements, judge says

A judge is questioning the status of a $40 million fund that was established from fines paid by Elon Musk and $特斯拉 (TSLA.US)$ over controversial tweets.

The firm appointed in May to administer distributions from the fund, set up by the U.S. SEC for harmed investors, hasn' filed required accounting statements, U.S. District Judge Alison Nathan said in an order Tuesday. She directed Rust Consulting to submit a status report by Jan. 7.

U.S. share buybacks hit record while capex lags pre-crisis level

Share repurchases more than doubled from a year earlier for S&P 500 companies to an all-time high of $234.6 billion, according to data released Tuesday from S&P Dow Jones Indices. Meanwhile, capital expenditures increased 21% to $189 billion, which is still down 3% from the final three months of 2019 before the pandemic shutdown the economy.

Part of the reason could be related to the pandemic, as a shift in consumer demand has fueled lots of uncertainty for businesses and makes it difficult for companies to plan ahead.

Super-luxury home sales surge across U.S., rising 35% in 2021

In 2021, at least 40 residential properties sold for more than $50 million in the U.S., according to data compiled by the appraiser Miller Samuel. Fueled by a booming stock market, low interest rates, and a pandemic-era's heightened emphasis on home life, prices for luxury houses have risen to stratospheric heights across the country.

UK offers 1 billion pounds to firms hit hardest by Omicron

Britain has announced £1 billion of extra support for businesses hit hardest by the wave of Omicron variant coronavirus cases. Finance minister Rishi Sunak said he would "respond proportionately and appropriately" if further Covid restrictions are imposed.

Under the support announced on Tuesday, hospitality and leisure firms in England will be eligible for grants of up to 6,000 pounds for each of their premises, accounting for almost 700 million pounds of the new package.

Source: Bloomberg, CNBC

94

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)