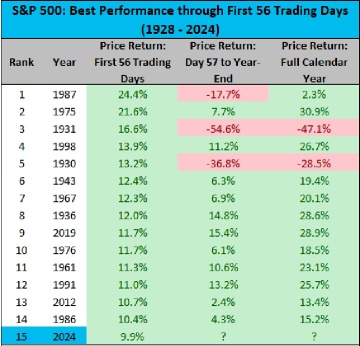

昨天晚些时候受到大量抛售冲击,但标普500期货上涨,抹去了下跌

标普500期货上涨25点,这将抹去昨天交易的最后一小时的下跌。值得注意的是,过去两天已经出现了两次尾盘下跌。这可能是季末再平衡的迹象。我今天将继续关注情况。

$道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$ $标普500指数 (.SPX.US)$

标普500期货上涨25点,这将抹去昨天交易的最后一小时的下跌。值得注意的是,过去两天已经出现了两次尾盘下跌。这可能是季末再平衡的迹象。我今天将继续关注情况。

$道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$ $标普500指数 (.SPX.US)$

已翻译

1

4

5

4

1

1

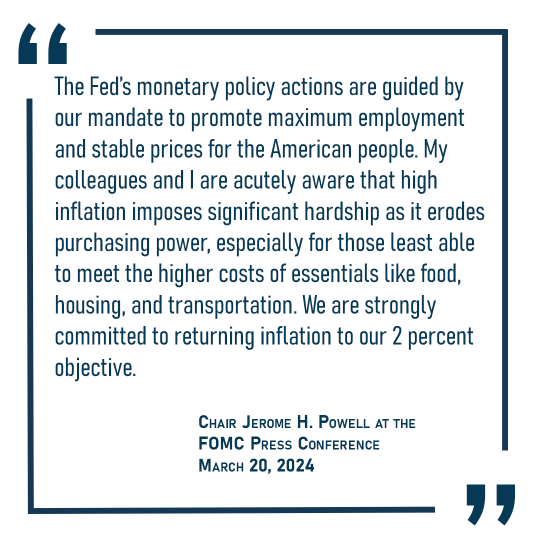

随着美联储三月份的点阵图或许只暗示今年会有两次25个基点的降息而不是三次,美国2年期收益率回归5%的可能性正在增加。这一转变是在美国CPI数据显示通胀放缓后出现的,表明利率可能需要保持更高更长时间。

美联储在预期两次降息和预期三次降息之间的分歧很小,如果支持三次降息的成员转向支持两次降息,可能会采取更鹰派的立场。最近升高的美国CPI数据支持任何考虑更鹰派立场的美联储成员。

美联储在预期两次降息和预期三次降息之间的分歧很小,如果支持三次降息的成员转向支持两次降息,可能会采取更鹰派的立场。最近升高的美国CPI数据支持任何考虑更鹰派立场的美联储成员。

已翻译

3

$SPDR 标普500指数ETF (SPY.US)$ | 美银 将其2024年标准普尔500指数盈利预测从235美元上调至250美元,理由是人工智能的“良性循环”,并且这是华尔街最高的预测,年同比增长12%。

公司在第四季度再次突破预期,我们的经济学家将2024年的GDP预测上调至+2.7%年同比增长(11月为+1.4%),策略师指出。

预计这一GDP增长将提振每股收益增长5个百分点。

尽管2023年预计EPS增长率比预期低3个百分点,但美银预计2024年将会出现反弹...

公司在第四季度再次突破预期,我们的经济学家将2024年的GDP预测上调至+2.7%年同比增长(11月为+1.4%),策略师指出。

预计这一GDP增长将提振每股收益增长5个百分点。

尽管2023年预计EPS增长率比预期低3个百分点,但美银预计2024年将会出现反弹...

已翻译

2

In a speech on Friday, Biden “bet” that the Fed would be cutting interest rates soon.

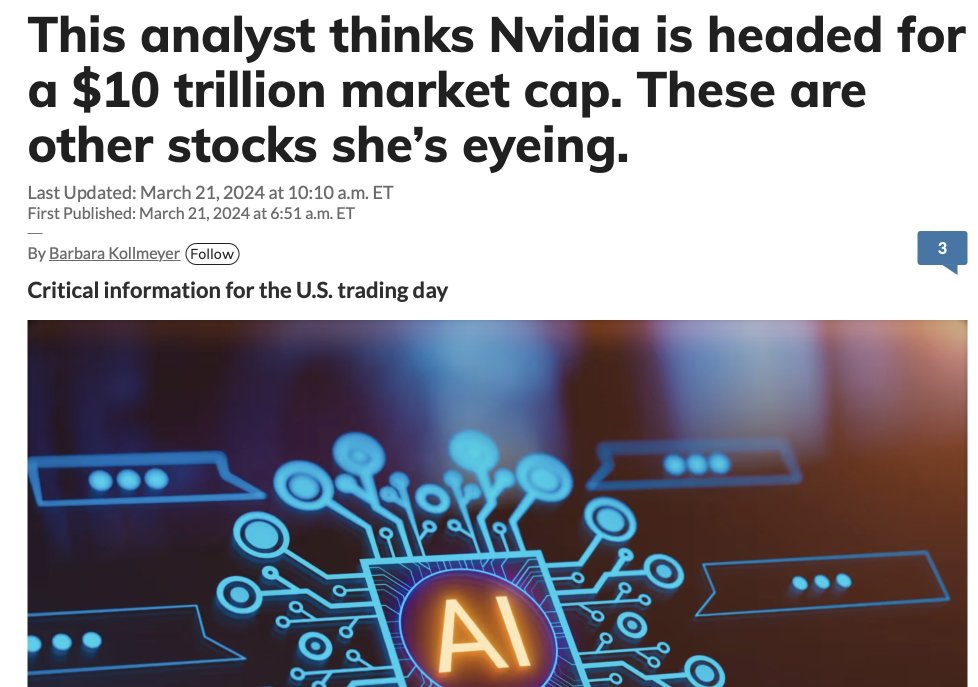

It is extremely rare for a President not named Trump to comment on Federal Reserve policy. This comes after a climax run in $英伟达 (NVDA.US)$ stock and a volatile week that had the market on the cusp of a much needed pause or pullback.

Yet now, if market participants take this comment seriously and believe Biden has inside information about Powell’s plan, ...

It is extremely rare for a President not named Trump to comment on Federal Reserve policy. This comes after a climax run in $英伟达 (NVDA.US)$ stock and a volatile week that had the market on the cusp of a much needed pause or pullback.

Yet now, if market participants take this comment seriously and believe Biden has inside information about Powell’s plan, ...

5

4

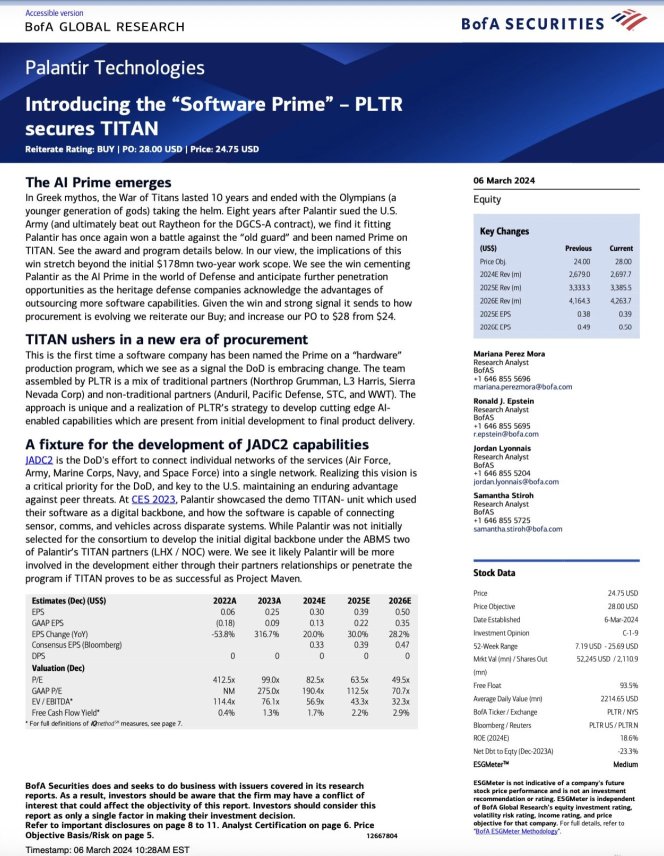

$Palantir (PLTR.US)$ 美国银行分析师玛丽安娜将palantir目标价格上调至28美元

$SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$

$SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$

已翻译

6

US yields are trending higher as the March dot plot from the Federal Reserve may signal only two 25bps interest rate cuts this year, down from the previously expected three reductions. The core PCE's monthly growth rate hitting a one-year high in January indicates that inflation remains a concern, supporting the Fed's stance on keeping interest rates elevated.

The split between Fed members projecting two vs. three rate cuts was close, with a shift f...

The split between Fed members projecting two vs. three rate cuts was close, with a shift f...

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)