BLsince2020

参与了投票

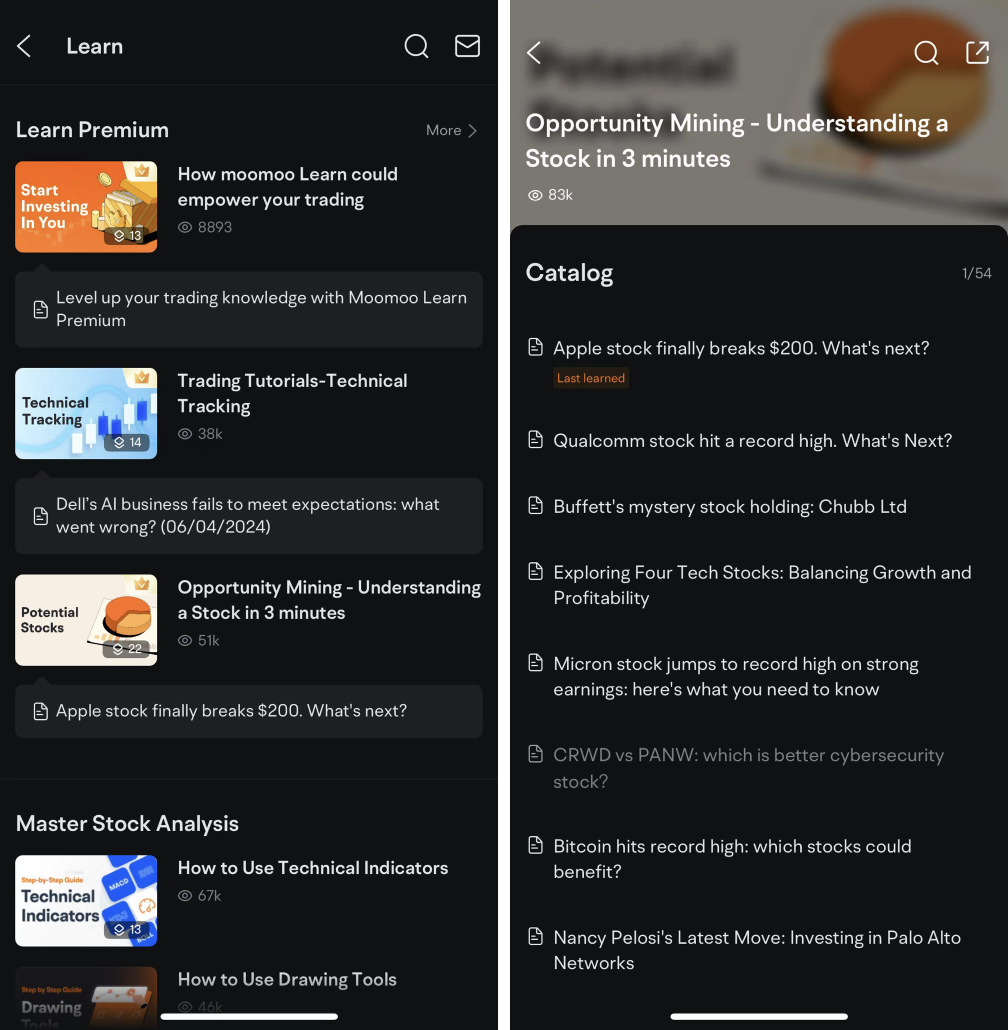

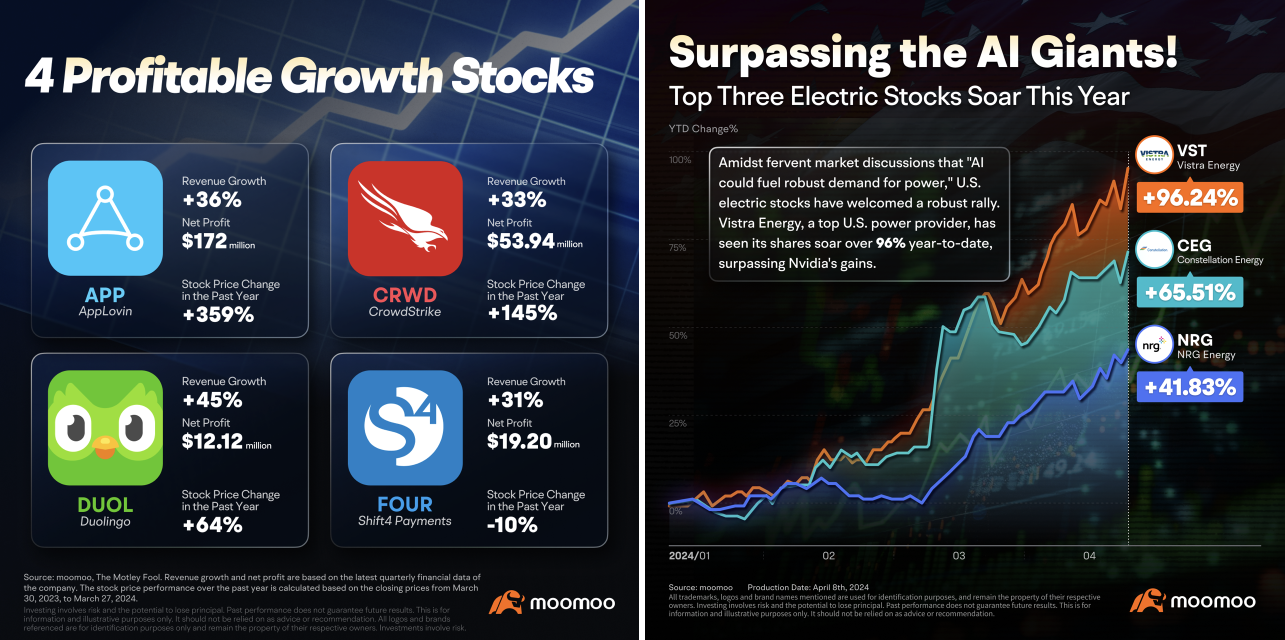

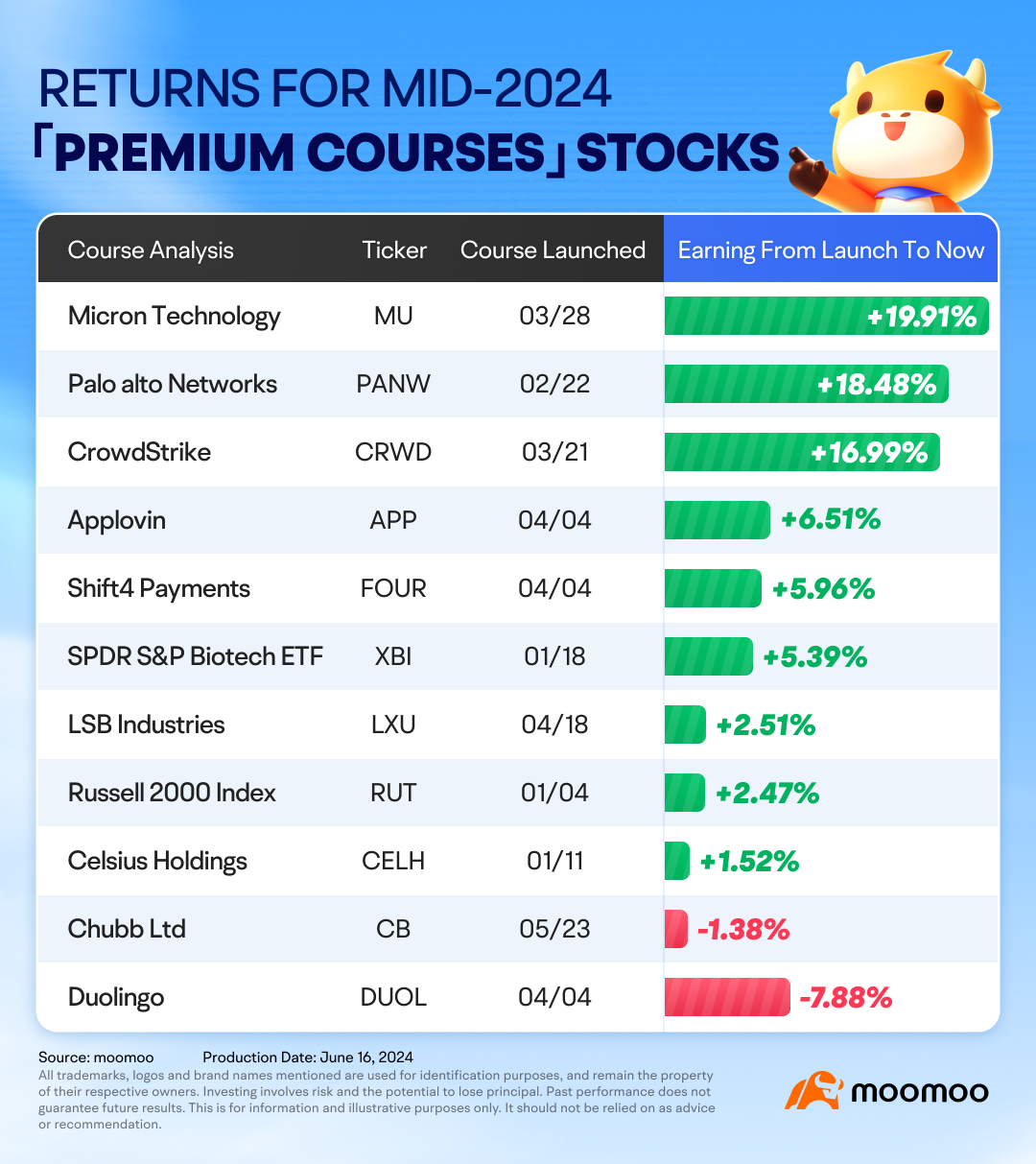

美国股市再次创下新高!恭喜!👏 如果您在年初开始投资美国市场,并且没有犯下任何重大错误,您可能已经看到了一些收益!🎉

我们来回顾一下我们的投教高阶权益学习之旅,随着人工智能和主要科技股的推动, $标普500指数 (.SPX.US)$ 和 $纳斯达克综合指数 (.IXIC.US)$ 已经多次达到新高...

我们来回顾一下我们的投教高阶权益学习之旅,随着人工智能和主要科技股的推动, $标普500指数 (.SPX.US)$ 和 $纳斯达克综合指数 (.IXIC.US)$ 已经多次达到新高...

已翻译

+5

437

226

34

BLsince2020

参与了投票

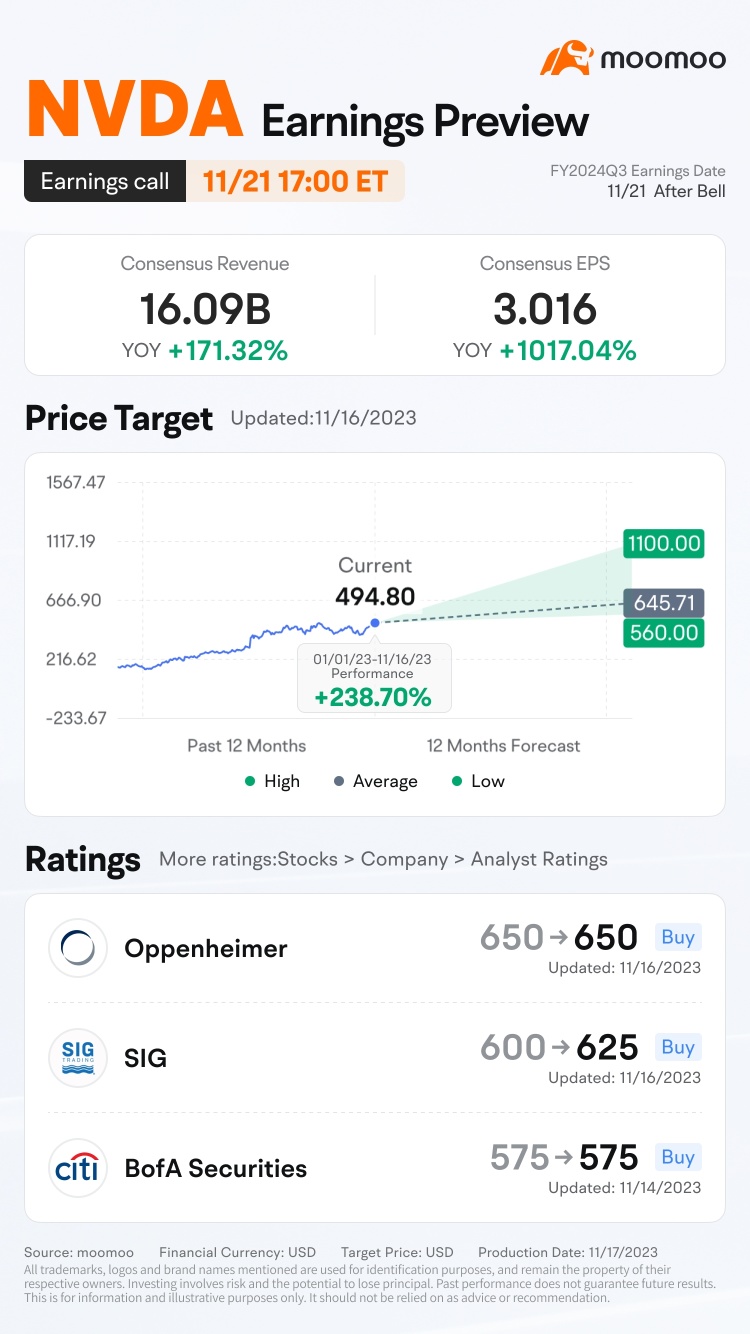

$英伟达 (NVDA.US)$ 将于11月21日盘后发布其Q3 FY24业绩。 ![]()

市场将如何对公司季度业绩做出反应? 投票您的答案参与!

积分商城

● 10000积分的均等分配: 对于猜中价格区间的mooer们 价格区间 $英伟达 (NVDA.US)$'s的开盘价 11月22日上午9:30美东时间 (例如,如果50名mooer猜对了,他们每人将获得200积分!)

(投票将...

市场将如何对公司季度业绩做出反应? 投票您的答案参与!

积分商城

● 10000积分的均等分配: 对于猜中价格区间的mooer们 价格区间 $英伟达 (NVDA.US)$'s的开盘价 11月22日上午9:30美东时间 (例如,如果50名mooer猜对了,他们每人将获得200积分!)

(投票将...

已翻译

94

78

9

BLsince2020

赞了

BLsince2020

赞并评论了

新加坡房地产投资信托在市场波动时能从它们的避险地位中受益,德意志银行的分析师在一份研究报告中表示。

他们表示,美联储对于利率上升路径的明确表态很可能会为新加坡信托带来更多的价格稳定性。

什么是房地产投资信托(REITs)?

房地产投资信托(REITs)是投资于港口的基金...

他们表示,美联储对于利率上升路径的明确表态很可能会为新加坡信托带来更多的价格稳定性。

什么是房地产投资信托(REITs)?

房地产投资信托(REITs)是投资于港口的基金...

已翻译

1537

1277

382

生日快乐moomoo!以前我只投资新加坡市场,但随着moomoo的推出,我也开始在美国市场投资!感谢您提供的低费用、超级应用和培训资料。

已翻译

BLsince2020

赞了

$苹果 (AAPL.US)$ 为什么这位顶级策略师说大型科技公司仍有上升空间-- Barrons.com 提到的公司:苹果、亚马逊、ASML、微软、SAP作者:Reshma Kapadia

Nicholas Colas为基金经理撰写了一份广泛阅读的早间笔记,他的职业生涯有30年的华尔街经历, 能够从经济数据、市场动态、投资者心理和颠覆性趋势中获得见解。

Colas是DataTrek研究公司的联合创始人,在二十世纪八十年代,当共同基金行业兴起时,他首次接触华尔街是从现在的Alliance Bernstein的邮房开始的。Colas于1991年开始了他的正式华尔街职业生涯,作为一名股票分析师,为瑞士信贷银行cover汽车行业。后来,他曾在SAC Capital工作,在那里从对冲基金经理Steve Cohen学会了理解情绪在投资中的重要性,并在其他公司担任市场策略师和研究负责人的职位,于2017年创立了DataTrek。多年来,Colas一直对大型科技公司和颠覆力量持看好态度,并在2013年开始撰写比特币的相关文章。

《巴伦周刊》与科拉斯讨论了为什么他仍然喜欢美国股票,尽管通胀、高估值和奥密克战的风险存在。在这篇经过编辑的对话中,我们还了解到他为什么说,学习金融模型和关注加密货币的发展对投资者至关重要。

《巴伦周刊》:疫情引起的最大变化对投资者最为相关的是什么?

尼古拉斯·科拉斯:通胀。这是经济中最大的变化。物价上涨了--不是一点点,而是很多,而且持续了两年。食品上涨了15%;工资没有增长。作为投资者,我们必须考虑通胀如何起伏并影响企业的盈利能力。对于大公司来说,这对利润是有利的。

担心通胀对企业盈利的影响是不是误解了?

如今,很少有分析师知道如何对一家公司进行建模。我受到在20世纪70年代建立自己职业生涯的人们的培训。这归结为理解成本如何通过利润表的流动。人们认为,如果PPI(生产者价格指数)上涨4%,通胀上涨4%,则利润不增长。这是完全错误的。每家公司都有一个固定的成本结构,不会随通胀而变动。我们从数据中看到了这一点:20世纪70年代,企业利润的增长速度与通货膨胀的增长速度一样快--股市增长的速度也与盈利增长一样快。

这个市场的关键是--且一直是--企业盈利。明年,考虑到S&P 500的盈利预计达到240美元,而市场预期则为222美元。作为对比,疫情之前的几年里,我们的盈利约为162到163美元。我们在企业盈利中设立了一个新的台阶--而且看起来是永久的。

即使公司面临劳动力成本上升、供应链问题和监管压力,利润率如何保持较高?

定价能力。标普500指数与其他任何指数都非常不同。它主要适用于美国经济,而且美国的财政和货币政策比欧洲和亚洲更加积极。因此,这是一个巨大的推动力,并使利润率在经济衰退期间没有降至零。

我们正在谈论的是那些在规模和范围上对较小公司具有巨大优势的大型美国公司,由于它们从美国业务中产生的现金流,它们在海外拥有更强大的竞争地位。我们最重要的是大技术。无法估量有多么重要的是在标普500指数中有20%的[Alphabet的]谷歌[ticker:GOOGL],苹果[AAPL]和微软[MSFT]。根本没有办法将这些商业模式与其他任何东西对齐。

这些公司多年来一直是赢家,它们真的能够持续下去吗?

动量有人类的偏见,但坚持动量也有投资上的合法性。我不是在谈论动量[作为因素],而是谈论那些保持和增强竞争地位的基本因素。我认为科技利润率不会回到平均水平,因为这些公司具有我们以前从未见过的竞争地位,也许除了洛克菲勒的石油公司和范德比尔特的铁路之外。石油相关的60年发展是重要的,所以当人们说数据是新的石油时,这意味着数据具有比传统商业模式更长的竞争窗口。

投资者应该在这些股票出现低点时买入吗?

这是关于投资者对全球经济复苏有多少信心的讨论。可能在第二季度,你会看到对同步全球复苏的热情迸发 - 并且你可能会看到大型科技股在一两个季度内表现不佳,因为人们对金融业感到热情。

Nicholas Colas为基金经理撰写了一份广泛阅读的早间笔记,他的职业生涯有30年的华尔街经历, 能够从经济数据、市场动态、投资者心理和颠覆性趋势中获得见解。

Colas是DataTrek研究公司的联合创始人,在二十世纪八十年代,当共同基金行业兴起时,他首次接触华尔街是从现在的Alliance Bernstein的邮房开始的。Colas于1991年开始了他的正式华尔街职业生涯,作为一名股票分析师,为瑞士信贷银行cover汽车行业。后来,他曾在SAC Capital工作,在那里从对冲基金经理Steve Cohen学会了理解情绪在投资中的重要性,并在其他公司担任市场策略师和研究负责人的职位,于2017年创立了DataTrek。多年来,Colas一直对大型科技公司和颠覆力量持看好态度,并在2013年开始撰写比特币的相关文章。

《巴伦周刊》与科拉斯讨论了为什么他仍然喜欢美国股票,尽管通胀、高估值和奥密克战的风险存在。在这篇经过编辑的对话中,我们还了解到他为什么说,学习金融模型和关注加密货币的发展对投资者至关重要。

《巴伦周刊》:疫情引起的最大变化对投资者最为相关的是什么?

尼古拉斯·科拉斯:通胀。这是经济中最大的变化。物价上涨了--不是一点点,而是很多,而且持续了两年。食品上涨了15%;工资没有增长。作为投资者,我们必须考虑通胀如何起伏并影响企业的盈利能力。对于大公司来说,这对利润是有利的。

担心通胀对企业盈利的影响是不是误解了?

如今,很少有分析师知道如何对一家公司进行建模。我受到在20世纪70年代建立自己职业生涯的人们的培训。这归结为理解成本如何通过利润表的流动。人们认为,如果PPI(生产者价格指数)上涨4%,通胀上涨4%,则利润不增长。这是完全错误的。每家公司都有一个固定的成本结构,不会随通胀而变动。我们从数据中看到了这一点:20世纪70年代,企业利润的增长速度与通货膨胀的增长速度一样快--股市增长的速度也与盈利增长一样快。

这个市场的关键是--且一直是--企业盈利。明年,考虑到S&P 500的盈利预计达到240美元,而市场预期则为222美元。作为对比,疫情之前的几年里,我们的盈利约为162到163美元。我们在企业盈利中设立了一个新的台阶--而且看起来是永久的。

即使公司面临劳动力成本上升、供应链问题和监管压力,利润率如何保持较高?

定价能力。标普500指数与其他任何指数都非常不同。它主要适用于美国经济,而且美国的财政和货币政策比欧洲和亚洲更加积极。因此,这是一个巨大的推动力,并使利润率在经济衰退期间没有降至零。

我们正在谈论的是那些在规模和范围上对较小公司具有巨大优势的大型美国公司,由于它们从美国业务中产生的现金流,它们在海外拥有更强大的竞争地位。我们最重要的是大技术。无法估量有多么重要的是在标普500指数中有20%的[Alphabet的]谷歌[ticker:GOOGL],苹果[AAPL]和微软[MSFT]。根本没有办法将这些商业模式与其他任何东西对齐。

这些公司多年来一直是赢家,它们真的能够持续下去吗?

动量有人类的偏见,但坚持动量也有投资上的合法性。我不是在谈论动量[作为因素],而是谈论那些保持和增强竞争地位的基本因素。我认为科技利润率不会回到平均水平,因为这些公司具有我们以前从未见过的竞争地位,也许除了洛克菲勒的石油公司和范德比尔特的铁路之外。石油相关的60年发展是重要的,所以当人们说数据是新的石油时,这意味着数据具有比传统商业模式更长的竞争窗口。

投资者应该在这些股票出现低点时买入吗?

这是关于投资者对全球经济复苏有多少信心的讨论。可能在第二季度,你会看到对同步全球复苏的热情迸发 - 并且你可能会看到大型科技股在一两个季度内表现不佳,因为人们对金融业感到热情。

已翻译

12

BLsince2020

赞了

$Meta Platforms (FB.US)$ $苹果 (AAPL.US)$ 2022年将是VR和元宇宙的关键一年。苹果、Meta和其他厂商将推出新一代的VR产品。随着内容制造商合作开发游戏和社交网络等元宇宙服务,并且NFT和虚拟货币非常火爆,预计2022年元宇宙的生态实施将加速。

已翻译

17

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)