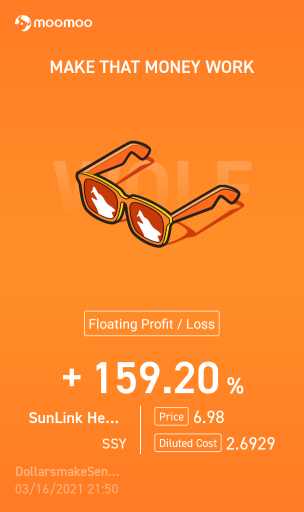

DollarsmakeSense

留下了心情

DollarsmakeSense

评论了

$Second Sight Medical Products Inc(EYES.US$

I think I was too late! I bought at 6.780, and it's been steady dropping 😩.

I'm really really new at this, and have been losing so far. anybody got any tips for a rookie?

I think I was too late! I bought at 6.780, and it's been steady dropping 😩.

I'm really really new at this, and have been losing so far. anybody got any tips for a rookie?

11

DollarsmakeSense

评论了

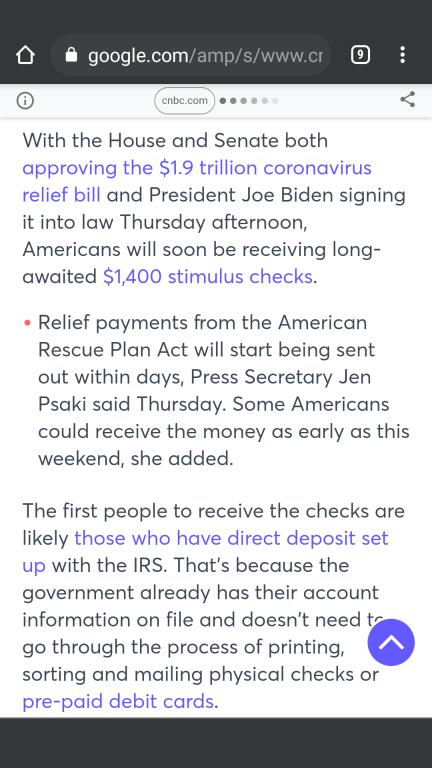

Wealth disparities have widened over time. In 1989, the bottom 90 percent of the U.S. population held 33 percent of all wealth. By 2016, the bottom 90 percent of the population held only 23 percent of the wealth. The wealth share of the top 1 percent increased from about 30 percent to about 40 percent over the same period.

Central Bank’s globally sought to stoke economic growth by inflating asset prices. Unfortunately, the consumption of the benefit was only those with savings and discretionary income to invest.In other words, the stock market became an “exclusive” club for the elite.While monetary policy increases the wealth of those that have wealth, the Fed mistakenly believed the “trickle-down” effect would be enough to stimulate the entire economy.It hasn’t.The sad reality is that these policies only acted as a transfer of wealth from the middle class to the wealthy. Such created one of the largest “wealth gaps” in human history.In 1990, incomes alone were no longer able to meet the standard of living. Therefore, consumers turned to debt to fill the “gap.”However, following the “financial crisis,” even the combined income and debt levels no longer filled the gap. Currently, there is almost a $2150 annual deficit facing t...

Central Bank’s globally sought to stoke economic growth by inflating asset prices. Unfortunately, the consumption of the benefit was only those with savings and discretionary income to invest.In other words, the stock market became an “exclusive” club for the elite.While monetary policy increases the wealth of those that have wealth, the Fed mistakenly believed the “trickle-down” effect would be enough to stimulate the entire economy.It hasn’t.The sad reality is that these policies only acted as a transfer of wealth from the middle class to the wealthy. Such created one of the largest “wealth gaps” in human history.In 1990, incomes alone were no longer able to meet the standard of living. Therefore, consumers turned to debt to fill the “gap.”However, following the “financial crisis,” even the combined income and debt levels no longer filled the gap. Currently, there is almost a $2150 annual deficit facing t...

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)