失业率上升了0.1个百分点,达到3.9%,略高于预期的3.8%。就业增长为17.5万,低于预期的24万。家庭数据显示,全职就业岗位增加了94.9万,而兼职就业岗位减少了91.4万。工资数据表明,自2021年6月以来,逐年工资增长率首次下降到4%以下,所有私人工资年度增长率为3.9%。

债券收益率的反应是显著下降,收益率"直线下跌",这可能是由于联邦储备委员会的重点转向就业任务,通胀担忧减轻。股票在市场开盘时飙升。这是一段从鹰派转向鸽派情绪的最大变化。

债券收益率的反应是显著下降,收益率"直线下跌",这可能是由于联邦储备委员会的重点转向就业任务,通胀担忧减轻。股票在市场开盘时飙升。这是一段从鹰派转向鸽派情绪的最大变化。

已翻译

1

ADP就业报告显示,4月美国就业人数增加了192,000人,高于预期的180,000人。服务业增加了145,000个工作岗位,商品部门增加了47,000个工作岗位。休闲和酒店业板块新增了最多的56000个工作岗位。报告还显示了年薪增长略有增加,尤其是对于换工作的人,同比增长9.3%,低于3月的10.0%,但仍高于2月的7.3%。

市场正在淡化显示更好于预期的ADP数据...

市场正在淡化显示更好于预期的ADP数据...

已翻译

2024年第一季度,ECI季度同比增长1.2%,同比增长4.2%,超出预期,与前一个季度的增长率相匹配。私人工资和薪金环比增长了1.1%,同比增长4.3%,与前一个季度持平。私人工资的增长在各个职业中都比较广泛,销售业经历了显著的环比增长1.9%。值得注意的是,州和地方政府的工资和薪金环比增长了1.4%,同比增长5.0%,得益于医疗服务和公共管理工作。

已翻译

今天的欧洲数据表明,欧洲各国的通胀持续放缓。

• 西班牙四月份的CPI通胀率低于预期,核心CPI同比下降从3.3%降至2.9%。

• 德国的CPI通胀率也呈现低迷的结果,较预期略低,环比增长0.5%,同比增长2.2%,核心CPI同比下降从3.3%降至3.0%。

• 欧洲经济信心指数...

• 西班牙四月份的CPI通胀率低于预期,核心CPI同比下降从3.3%降至2.9%。

• 德国的CPI通胀率也呈现低迷的结果,较预期略低,环比增长0.5%,同比增长2.2%,核心CPI同比下降从3.3%降至3.0%。

• 欧洲经济信心指数...

已翻译

消费市场相当火爆,但收益大多受到能源价格上涨的影响。个人消费支出通胀反映了昨天意外的加速度。收益率可能会在今天回落,但我不确定这会转变为持续的走势。

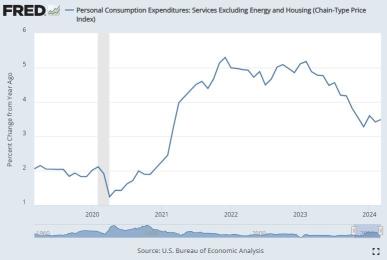

今年定价一次加息感觉刚刚好。请注意,服务业通胀仍然很顽固。个人消费支出服务(不包括能源、住房)通胀在3月份上升到了3.5%的同比,而2月份为3.4%的同比,并且今年一直在加速。

额外的悲观数据:个人消费者支出(不含能源和住房)(...

今年定价一次加息感觉刚刚好。请注意,服务业通胀仍然很顽固。个人消费支出服务(不包括能源、住房)通胀在3月份上升到了3.5%的同比,而2月份为3.4%的同比,并且今年一直在加速。

额外的悲观数据:个人消费者支出(不含能源和住房)(...

已翻译

白银正在测试上个十年8月份所设定的高点。

SLV昨日上涨3.7%,达到2.5年来的高点。TD证券的全球商品策略负责人认为,目前的联储政策对白银等贵金属有利,因为“在通胀目标达成之前,联储会大幅削减利率。”如果联储和其他央行削减经济增长,这可能对白银等贵金属产生积极的冲击。

$白银ETF-iShares (SLV.US)$

SLV昨日上涨3.7%,达到2.5年来的高点。TD证券的全球商品策略负责人认为,目前的联储政策对白银等贵金属有利,因为“在通胀目标达成之前,联储会大幅削减利率。”如果联储和其他央行削减经济增长,这可能对白银等贵金属产生积极的冲击。

$白银ETF-iShares (SLV.US)$

已翻译

1

巴尔的摩桥梁坍塌后,今天早上船舶行业受到了另一次打击。马士基(撞击桥梁的船舶的租船公司)和整个船舶行业很可能会面临下跌。

$Breakwave干散货航运ETF (BDRY.US)$ $A.P.莫勒 - 马士基 (AMKBY.US)$

$Breakwave干散货航运ETF (BDRY.US)$ $A.P.莫勒 - 马士基 (AMKBY.US)$

已翻译

1

美联储发言人今早走了一条鹰派板寸:

• 淡化商业地产风险

• 放大过早降息的风险

• 希望看到通胀进一步进展

• 伯斯蒂克预计2024年进行一次降息

• 古斯比仍预计2024年进行三次降息

美联储伯斯蒂克:

• 我希望避免资产负债表缩减带来的波动性。

• 美联储意识到商业房地产风险,但并不认为它们是广泛存在的。

• 过早降息可能会更具破坏性。

Goolsbee表示:

• 我们正处于通胀的一段模糊时期。

• ...

• 淡化商业地产风险

• 放大过早降息的风险

• 希望看到通胀进一步进展

• 伯斯蒂克预计2024年进行一次降息

• 古斯比仍预计2024年进行三次降息

美联储伯斯蒂克:

• 我希望避免资产负债表缩减带来的波动性。

• 美联储意识到商业房地产风险,但并不认为它们是广泛存在的。

• 过早降息可能会更具破坏性。

Goolsbee表示:

• 我们正处于通胀的一段模糊时期。

• ...

已翻译

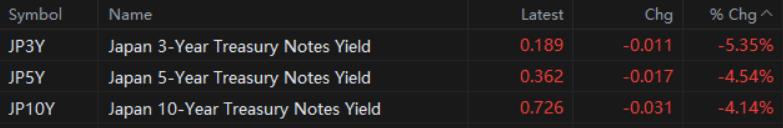

日本央行自2007年以来首次加息约8小时后,JGb收益率普遍下降。投资者并不相信政策转变会进一步正常化。的确,日本央行给自己留下了足够的空间保持鸽派。

$日本10年期国债收益率 (JP10Y.BD)$ $日本5年期国债收益率 (JP5Y.BD)$ $日本3年期国债收益率 (JP3Y.BD)$

$日本10年期国债收益率 (JP10Y.BD)$ $日本5年期国债收益率 (JP5Y.BD)$ $日本3年期国债收益率 (JP3Y.BD)$

已翻译

PPI很热,这证实了CPI高温背后的通货膨胀压力不是开玩笑。收益率上升,股票暴跌。我认为我们在三月份甚至四月份都会有点痛苦。

$标普500ETF-SPDR (SPY.US)$ $美国2年期国债收益率 (US2Y.BD)$

$标普500ETF-SPDR (SPY.US)$ $美国2年期国债收益率 (US2Y.BD)$

已翻译

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)