_JHAO

赞了

周市场回顾

股市期货在周日随着一周的失利之后波动,投资者继续应对新冠病例的复苏和美联储即将进行的宽松货币政策调整。

主要指数上周下跌, $标普500指数 (.SPX.US)$ 下降了1.9%。科技股重要指数 $纳斯达克综合指数 (.IXIC.US)$ 上周下跌了近3%,投资者抛售高飞的增长股,因为预期利率上升,而 $道琼斯指数 (.DJI.US)$ 下跌了1.7%。

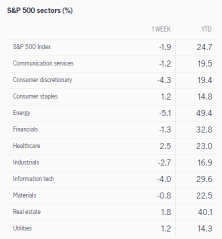

以下是S&P 500各行业的回报情况。

下周重点关注事项

世界各地的股票和债券市场将在圣诞节期间关闭。节日休息之前, 耐克 和 美光科技 周一报告, 黑莓 和 通用磨坊 周二,并且 车美仕、信达思和沛齐 周三。

这将是一个丰富多样的经济数据发布周。周一,会议委员会发布11月的领先经济指数,随后周三发布12月的消费者信心指数。

周四,经济分析局报告11月份的个人收入和消费支出情况。预计消费者收入将上涨0.6%,而支出将上升0.5%。美联储偏爱的通胀指标核心PCE价格指数预计在11月份将飙升4.5%。

此外,美国人口普查局将于周四发布11月耐用品报告,这将提供对经济中投资支出的窗口。预计新订单将上涨2.1%。本周还将公布房地产市场指标,包括周三的11月现有房屋销售数据和周四的11月新房销售数据。

星期一 12/20

$美光科技 (MU.US)$ 和 $耐克 (NKE.US)$ 报告季度结果。

会议委员会将发布11月领先经济指数。共识估计为119,比10月的水平高0.6%。会议委员会目前预测第四季度国内生产总值增长率为5%,2022年为2.6%的较慢但仍然强劲增长。

星期二 12/21

$黑莓 (BB.US)$, $辉盛研究系统 (FDS.US)$,并且 $通用磨坊 (GIS.US)$ 宣布盈利。

12/22 星期三

NAR报告11月份二手房销售。经济学家预计季调年销售640万套,略高于10月份,是今年年初以来的最高记录。

$车美仕 (KMX.US)$, $信达思 (CTAS.US)$,并且 $沛齐 (PAYX.US)$ 举行电话会议讨论季度业绩。

美国经济分析局报告三季度GDP的第三个和最后的预估。经济学家预计季调年增长率为2.1%,与11月份的第二个预估持平。

会议委员会发布12月份的消费者信心指数。预期为110,与11月份的数据大致相同。这一指数比今年6月疫情后的高峰低15%,原因是对物价上涨和新冠变异的担忧。

星期四 12/23

劳工部报告了截至12月18日的初始失业救济申请。11月和12月的失业救济金平均每周为225,667美元,并且终于达到了疫情前的水平。

人口普查局报告了11月的新住宅销售情况。一致预测是季节调整后年销售量为77万套新的独立屋,比10月多出2.5万套。10月份销售的新房的中位销售价格为407,700美元,平均销售价格为477,800美元,两者均创历史新高。

美国经济分析局报告了11月份的个人收入和消费支出情况。经济学家预测收入将月增长0.6%,消费将月增长0.5%。与10月份的分别增长0.5%和1.3%相比。美联储首选的通胀衡量指标核心PCE物价指数在10月同比增长4.1%,为1991年以来最快增速。预计11月份将飙升4.6%。

人口普查局公布了11月份的耐用品订单报告。耐用品制造业新订单预计将增长2.1%,达到2,656亿美元。不包括运输在内,新订单预计将增长0.6%,而10月份仅增长0.5%。

星期五 12/24

为庆祝圣诞节,美国股票市场和固定收益市场将关闭。

来源:CNBC,jhinvestments,道琼斯新闻社

股市期货在周日随着一周的失利之后波动,投资者继续应对新冠病例的复苏和美联储即将进行的宽松货币政策调整。

主要指数上周下跌, $标普500指数 (.SPX.US)$ 下降了1.9%。科技股重要指数 $纳斯达克综合指数 (.IXIC.US)$ 上周下跌了近3%,投资者抛售高飞的增长股,因为预期利率上升,而 $道琼斯指数 (.DJI.US)$ 下跌了1.7%。

以下是S&P 500各行业的回报情况。

下周重点关注事项

世界各地的股票和债券市场将在圣诞节期间关闭。节日休息之前, 耐克 和 美光科技 周一报告, 黑莓 和 通用磨坊 周二,并且 车美仕、信达思和沛齐 周三。

这将是一个丰富多样的经济数据发布周。周一,会议委员会发布11月的领先经济指数,随后周三发布12月的消费者信心指数。

周四,经济分析局报告11月份的个人收入和消费支出情况。预计消费者收入将上涨0.6%,而支出将上升0.5%。美联储偏爱的通胀指标核心PCE价格指数预计在11月份将飙升4.5%。

此外,美国人口普查局将于周四发布11月耐用品报告,这将提供对经济中投资支出的窗口。预计新订单将上涨2.1%。本周还将公布房地产市场指标,包括周三的11月现有房屋销售数据和周四的11月新房销售数据。

星期一 12/20

$美光科技 (MU.US)$ 和 $耐克 (NKE.US)$ 报告季度结果。

会议委员会将发布11月领先经济指数。共识估计为119,比10月的水平高0.6%。会议委员会目前预测第四季度国内生产总值增长率为5%,2022年为2.6%的较慢但仍然强劲增长。

星期二 12/21

$黑莓 (BB.US)$, $辉盛研究系统 (FDS.US)$,并且 $通用磨坊 (GIS.US)$ 宣布盈利。

12/22 星期三

NAR报告11月份二手房销售。经济学家预计季调年销售640万套,略高于10月份,是今年年初以来的最高记录。

$车美仕 (KMX.US)$, $信达思 (CTAS.US)$,并且 $沛齐 (PAYX.US)$ 举行电话会议讨论季度业绩。

美国经济分析局报告三季度GDP的第三个和最后的预估。经济学家预计季调年增长率为2.1%,与11月份的第二个预估持平。

会议委员会发布12月份的消费者信心指数。预期为110,与11月份的数据大致相同。这一指数比今年6月疫情后的高峰低15%,原因是对物价上涨和新冠变异的担忧。

星期四 12/23

劳工部报告了截至12月18日的初始失业救济申请。11月和12月的失业救济金平均每周为225,667美元,并且终于达到了疫情前的水平。

人口普查局报告了11月的新住宅销售情况。一致预测是季节调整后年销售量为77万套新的独立屋,比10月多出2.5万套。10月份销售的新房的中位销售价格为407,700美元,平均销售价格为477,800美元,两者均创历史新高。

美国经济分析局报告了11月份的个人收入和消费支出情况。经济学家预测收入将月增长0.6%,消费将月增长0.5%。与10月份的分别增长0.5%和1.3%相比。美联储首选的通胀衡量指标核心PCE物价指数在10月同比增长4.1%,为1991年以来最快增速。预计11月份将飙升4.6%。

人口普查局公布了11月份的耐用品订单报告。耐用品制造业新订单预计将增长2.1%,达到2,656亿美元。不包括运输在内,新订单预计将增长0.6%,而10月份仅增长0.5%。

星期五 12/24

为庆祝圣诞节,美国股票市场和固定收益市场将关闭。

来源:CNBC,jhinvestments,道琼斯新闻社

已翻译

+2

113

7

_JHAO

赞了

$特斯拉 (TSLA.US)$ hehehehehheh trust me

3

_JHAO

赞了

Trading with the following in mind is crucial to being a successful day trader.

Understanding The Market Requires You To Understand Market Psychology

Stock market intraday patterns – all times are in Eastern Standard Time!

When day trading the US stock market you may notice certain patterns, based on the time of day, that occur more often than not. These patterns, or tendencies, happen often enough for professional day traders to base their trading around them.

9:30am: The stock market opens, and there is an initial push in one direction. Highly volatile!

9:45am: The initial push often sees a significant reversal or pullback. This is often just a short-term shift, and then the original trending direction re-asserts itself.

10:00am: If the trend that began at 9:30am is still happening, it will often be challenged around this time. This tends to be another time where there is a significant reversal or pullback.

11:15am-11:30am: The market is heading into lunch hour, and London is getting ready to close. This is when volatility will typically die out for a few hours, but often the daily high or low will be tested around this time. European traders will usually close out positions or accumulate a position before they finish for the day. Whether the highs or lows are tested or not, the markets tend to ‘drift’ for the next hour or more.

11:45am-1:30pm: This is lunch time in New York, plus a bit of a time buffer. Usually, this is the quietest time of the day, and often, day traders like to avoid it.

1:30pm-2:00pm: If the lunch hour was calm, then expect a breakout of the range established during lunch hour. Often, the market will try to move in the direction it was trading in before the lunch hour doldrums set in.

2:00pm-2:45pm: The close is getting closer, and many traders are trading with the trend thinking it will continue into close. That may happen, but expect some sharp reversals around this time, because on the flip side, man traders are quicker to take profits or move their trailing stop losses closer to the current price.

3:00pm-3:30pm: These are big “Shake-out” points, in that they will force many traders out of their positions. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves.

As a day trader, its best to be nimble and not get tied into one position or direction. Many traders only trade the first hour and the last hour of every day, as these times are the most volatile.

3:30pm-4:00pm: The market closes at 4pm. After that, the liquidity dries up in nearly all stocks and ETFs, except for the very active ones. It’s common to close all positions a minute or more before the closing bell, unless you have orders placed to close your position on a closing auction or “cross”.

💰Wasnt sure where the “tips for day trading” event is or i wouldve posted this there. 🍻 @moomoo Event @moomoo Lily

Hope this provides some clarity to the workd of daytrading!

$Energy Focus (EFOI.US)$

Understanding The Market Requires You To Understand Market Psychology

Stock market intraday patterns – all times are in Eastern Standard Time!

When day trading the US stock market you may notice certain patterns, based on the time of day, that occur more often than not. These patterns, or tendencies, happen often enough for professional day traders to base their trading around them.

9:30am: The stock market opens, and there is an initial push in one direction. Highly volatile!

9:45am: The initial push often sees a significant reversal or pullback. This is often just a short-term shift, and then the original trending direction re-asserts itself.

10:00am: If the trend that began at 9:30am is still happening, it will often be challenged around this time. This tends to be another time where there is a significant reversal or pullback.

11:15am-11:30am: The market is heading into lunch hour, and London is getting ready to close. This is when volatility will typically die out for a few hours, but often the daily high or low will be tested around this time. European traders will usually close out positions or accumulate a position before they finish for the day. Whether the highs or lows are tested or not, the markets tend to ‘drift’ for the next hour or more.

11:45am-1:30pm: This is lunch time in New York, plus a bit of a time buffer. Usually, this is the quietest time of the day, and often, day traders like to avoid it.

1:30pm-2:00pm: If the lunch hour was calm, then expect a breakout of the range established during lunch hour. Often, the market will try to move in the direction it was trading in before the lunch hour doldrums set in.

2:00pm-2:45pm: The close is getting closer, and many traders are trading with the trend thinking it will continue into close. That may happen, but expect some sharp reversals around this time, because on the flip side, man traders are quicker to take profits or move their trailing stop losses closer to the current price.

3:00pm-3:30pm: These are big “Shake-out” points, in that they will force many traders out of their positions. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves.

As a day trader, its best to be nimble and not get tied into one position or direction. Many traders only trade the first hour and the last hour of every day, as these times are the most volatile.

3:30pm-4:00pm: The market closes at 4pm. After that, the liquidity dries up in nearly all stocks and ETFs, except for the very active ones. It’s common to close all positions a minute or more before the closing bell, unless you have orders placed to close your position on a closing auction or “cross”.

💰Wasnt sure where the “tips for day trading” event is or i wouldve posted this there. 🍻 @moomoo Event @moomoo Lily

Hope this provides some clarity to the workd of daytrading!

$Energy Focus (EFOI.US)$

113

3

_JHAO

参与了投票

_JHAO

赞了

这个变异个人猜测是雷声大,雨点小。因为这个变异可能就传染性强,致命性低,因为南非这么多案例,但暂时都没有致死案例报告 $Moderna (MRNA.US)$ $特斯拉 (TSLA.US)$ $苹果 (AAPL.US)$ $微软 (MSFT.US)$

18

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)