SuLK

赞了

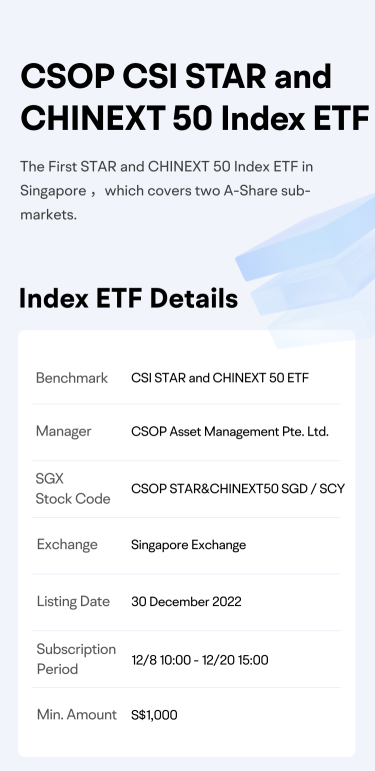

$恒生指数 (800000.HK)$ 11月份录得27%的增幅,创下1998年以来的最大月度增长。这一趋势在12月初持续,并在上周宽松限制措施的进一步加强下得到了进一步强化。

随着中国的疫情政策进一步放松,华尔街呼吁买入中国概念股的声音越来越大。

您是否也想分享新兴中国公司带来的好处?

为......

随着中国的疫情政策进一步放松,华尔街呼吁买入中国概念股的声音越来越大。

您是否也想分享新兴中国公司带来的好处?

为......

已翻译

+2

125

872

SuLK

赞了

进入2022年的下半年,市场正在发出投资者进一步降低对股票的估值,消费者面临持续的挑战,股票投资者更加看淡的信号。

以下是摩根史坦利首席投资官兼首席美国股票策略师迈克·威尔逊在播客中提出的关键要点。 市场展望.

你将获得:

1. 消费者、科技和拥挤的能源等不同板块的观点...

以下是摩根史坦利首席投资官兼首席美国股票策略师迈克·威尔逊在播客中提出的关键要点。 市场展望.

你将获得:

1. 消费者、科技和拥挤的能源等不同板块的观点...

已翻译

173

53

SuLK

赞了

By Jimmy

嘿,mooer们!以下是在开盘之前你需要知道的事情:

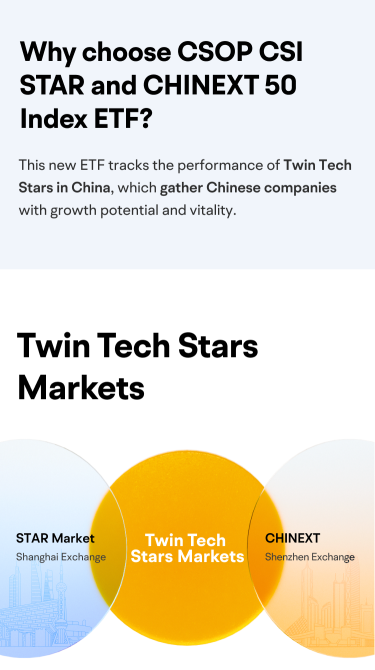

- 美国股票期货在周一的盘前交易中大幅上涨。

- 华尔街预测师预计,由于估值降低、经济扩张和超低利率,2022年市场将上升。

市场快照

美国股指期货在周一盘前交易中大幅上涨,投资者对经济克服疫情和恢复增长能力表示希望。

嘿,mooer们!以下是在开盘之前你需要知道的事情:

- 美国股票期货在周一的盘前交易中大幅上涨。

- 华尔街预测师预计,由于估值降低、经济扩张和超低利率,2022年市场将上升。

市场快照

美国股指期货在周一盘前交易中大幅上涨,投资者对经济克服疫情和恢复增长能力表示希望。

已翻译

+1

61

6

SuLK

赞了

嘿,mooer们![]()

![]()

2022新年快乐![]()

![]() ! 祝愿大家在新的一年里一切顺利!

! 祝愿大家在新的一年里一切顺利!

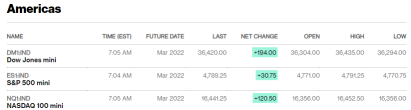

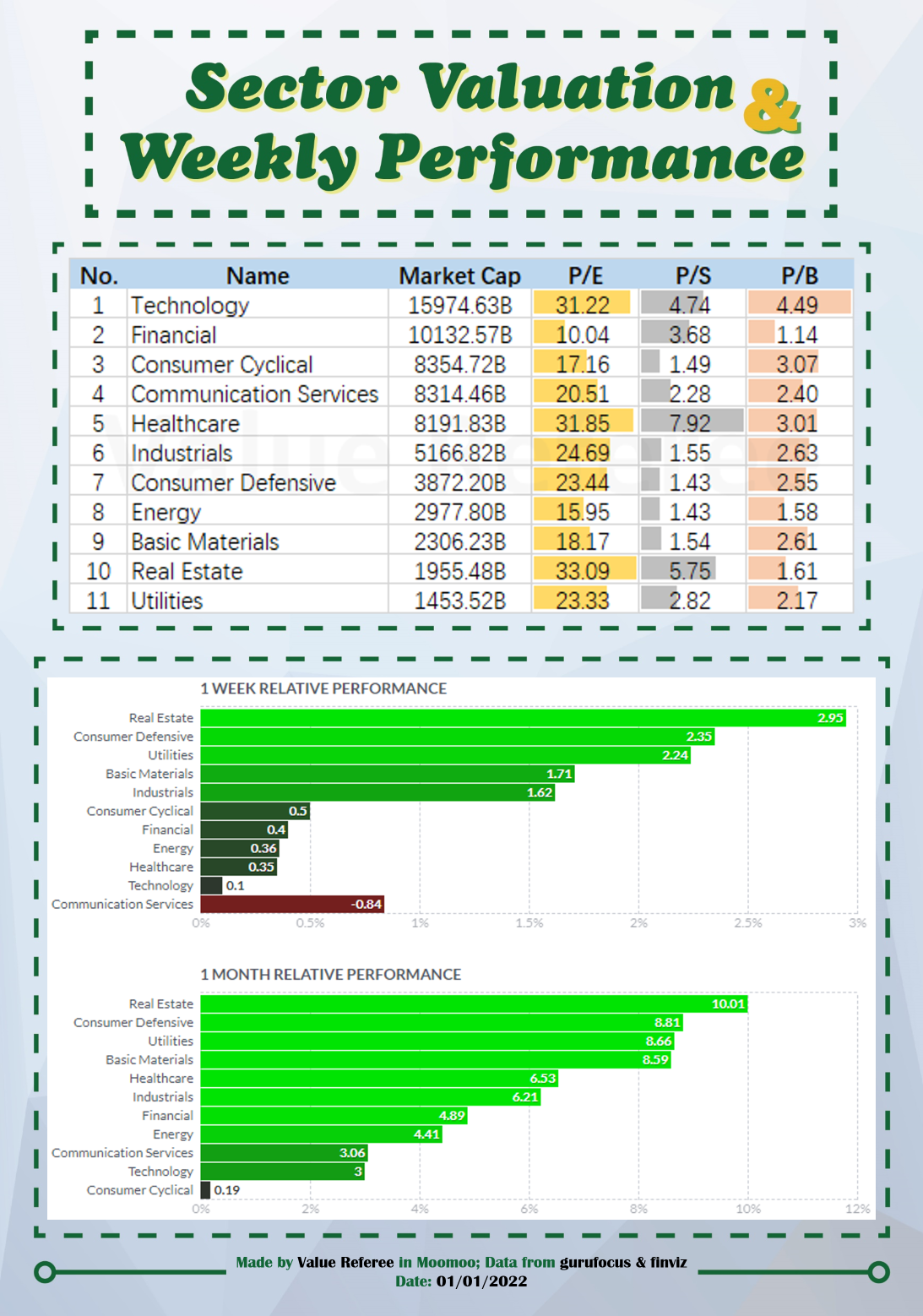

对于本周的 板块基金流动板块 我包含了 2021年收益最高的板块etf。 让我们看看这些板块etf在2021年的表现如何!

从这个图表中,你将能够找出哪些板块etf有最多的基金流入。基金流入往往被视为该板块和相关etf的看好指标!

^每周板块基金流入排行榜:基于...

2022新年快乐

对于本周的 板块基金流动板块 我包含了 2021年收益最高的板块etf。 让我们看看这些板块etf在2021年的表现如何!

从这个图表中,你将能够找出哪些板块etf有最多的基金流入。基金流入往往被视为该板块和相关etf的看好指标!

^每周板块基金流入排行榜:基于...

已翻译

36

4

SuLK

赞了

$苹果 (AAPL.US)$ 据报道,美国银行的一位分析师认为苹果可能计划开发一款增强现实(AR)技术设备,这将有助于其股价进一步上涨。

周二,美国银行分析师Wamsi Mohan将苹果的股票评级从中立调升为买入,部分原因是他对潜在的AR头戴设备持乐观态度,他认为这些设备可能会在2022年底或2023年初推出。

他在客户描述中写道:“我们认为这项技术将改变游戏规则,因为它将使许多新应用成为可能,而这些应用将需要高性能硬件和更快的访问速度。”

文章摘自美国股票研究机构

周二,美国银行分析师Wamsi Mohan将苹果的股票评级从中立调升为买入,部分原因是他对潜在的AR头戴设备持乐观态度,他认为这些设备可能会在2022年底或2023年初推出。

他在客户描述中写道:“我们认为这项技术将改变游戏规则,因为它将使许多新应用成为可能,而这些应用将需要高性能硬件和更快的访问速度。”

文章摘自美国股票研究机构

已翻译

12

SuLK

赞了

The Federal Reserve holds its two-day meeting on Dec.14 and 15. If the Fed decides to taper its bond purchases more quickly, it could also begin to raise interest rates faster. Investors will be closely watching for the Feds new interest rate forecasts.

There are three topics that investors would focus on.

Firstly, the central bank is expected to discuss speeding up the end of its bond-buying program.

ING says, With no opposition raised by other Fed officials, despite the uncertainty presented by the emergence of the Omicron variant, next week’s meeting look set to see the Fed announce an acceleration in QE tapering, with a $30bn reduction for January (to $60bn of purchases) and a further $30bn reduction in February.

This would mean the Fed wrapping up the programme by the beginning of March, leaving the Federal Reserve with $8.8tn of assets on its balance sheet.

Secondly, Investors will be closely watching for the Fed's new interest rate forecasts -- especially Dot Plot.

If the Fed decides to taper its bond purchases more quickly, it could also begin to raise interest rates faster.

“The Fed is running out of time,” said Tom Graff, head of fixed income at Brown Advisory, in a phone interview. “These inflation reads need to show a clear deceleration, or they’re going to wind up hiking as soon as the tapering is over.” Graff said he expects the Fed may raise its benchmark interest rate three times next year, potentially beginning as soon as April.

Economists at Bank of America expect the dot plot to show two rate rises in 2022, and six across 2023 and 2024. Michael Feroli, chief US economist at JPMorgan, said the Fed could proceed at a faster clip, with one more rate increase tacked on to each year.

(If you don't know how to analyze Dot Plot, you could read my another article: Analyzing Dot Plot and Understanding How the Fed Forecasts

Last but not the least, investors would pay attention to what Powell says.

With Jerome Powell having suggested that the “transitory” description of inflation should be “retired”, there are also going to be additional changes to the accompanying statement. They will acknowledge the upside surprises for inflation and the tighter jobs market but are set to keep the line “longer‑term inflation expectations remain well-anchored at 2 percent” even if the consumer survey evidence and break-even inflation rates on Treasuries, are less categorical.

p.s you could find more opinions from CNBC, Yahoo Finance, Bloomberg, etc.

$道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$ $标普500指数 (.SPX.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $纳斯达克100指数 (.NDX.US)$

There are three topics that investors would focus on.

Firstly, the central bank is expected to discuss speeding up the end of its bond-buying program.

ING says, With no opposition raised by other Fed officials, despite the uncertainty presented by the emergence of the Omicron variant, next week’s meeting look set to see the Fed announce an acceleration in QE tapering, with a $30bn reduction for January (to $60bn of purchases) and a further $30bn reduction in February.

This would mean the Fed wrapping up the programme by the beginning of March, leaving the Federal Reserve with $8.8tn of assets on its balance sheet.

Secondly, Investors will be closely watching for the Fed's new interest rate forecasts -- especially Dot Plot.

If the Fed decides to taper its bond purchases more quickly, it could also begin to raise interest rates faster.

“The Fed is running out of time,” said Tom Graff, head of fixed income at Brown Advisory, in a phone interview. “These inflation reads need to show a clear deceleration, or they’re going to wind up hiking as soon as the tapering is over.” Graff said he expects the Fed may raise its benchmark interest rate three times next year, potentially beginning as soon as April.

Economists at Bank of America expect the dot plot to show two rate rises in 2022, and six across 2023 and 2024. Michael Feroli, chief US economist at JPMorgan, said the Fed could proceed at a faster clip, with one more rate increase tacked on to each year.

(If you don't know how to analyze Dot Plot, you could read my another article: Analyzing Dot Plot and Understanding How the Fed Forecasts

Last but not the least, investors would pay attention to what Powell says.

With Jerome Powell having suggested that the “transitory” description of inflation should be “retired”, there are also going to be additional changes to the accompanying statement. They will acknowledge the upside surprises for inflation and the tighter jobs market but are set to keep the line “longer‑term inflation expectations remain well-anchored at 2 percent” even if the consumer survey evidence and break-even inflation rates on Treasuries, are less categorical.

p.s you could find more opinions from CNBC, Yahoo Finance, Bloomberg, etc.

$道琼斯指数 (.DJI.US)$ $纳斯达克综合指数 (.IXIC.US)$ $标普500指数 (.SPX.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $纳斯达克100指数 (.NDX.US)$

36

11

SuLK

赞了

$纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500指数 (.SPX.US)$ 您有何想法?

公布的通胀数据被低估了。所有者等效租金 (OER) 依靠房主的调查来估计住房成本的通胀情况。这是一种非常不精确的指标。单一家庭租赁市场提供了更准确的数据。今天公布的核心CPI中,OER的年同比增长率为3.5%。

全国范围内的单一家庭租赁的最大所有者报告了17%的年同比租金增长率。OER占核心CPI计算的30%,占公布的CPI的24%。在计算中使用更经验主义的测量方法,今天的核心CPI从4.9%增加到9.0%,CPI从6.8%增加到10.1%。

根据供需趋势,住房通胀不太可能减弱。家庭实际经历的通胀情况非常严重,远超过政府公布的统计数据。

公布的通胀数据被低估了。所有者等效租金 (OER) 依靠房主的调查来估计住房成本的通胀情况。这是一种非常不精确的指标。单一家庭租赁市场提供了更准确的数据。今天公布的核心CPI中,OER的年同比增长率为3.5%。

全国范围内的单一家庭租赁的最大所有者报告了17%的年同比租金增长率。OER占核心CPI计算的30%,占公布的CPI的24%。在计算中使用更经验主义的测量方法,今天的核心CPI从4.9%增加到9.0%,CPI从6.8%增加到10.1%。

根据供需趋势,住房通胀不太可能减弱。家庭实际经历的通胀情况非常严重,远超过政府公布的统计数据。

已翻译

184

11

SuLK

赞了

市场快照:

凯西·伍德-led 方舟投资 周四出售了40,861股股票,估计价值4100万美元 $Tesla (TSLA.US) $,尽管最近下跌,但该股仍在为这位以低得多的水平购买TSLA股票的受欢迎的基金经理获利。

周四,特斯拉股价收盘下跌6.10%,至每股1003.80美元。该股今年迄今已上涨约37.5%。

每日名言:

第一条规则是永远不要亏钱。第 2 条规则是永远不要忘记第 1 条规则。- 沃伦·巴菲特

$纳斯达克 (NDAQ.US)$ $标普500指数 (.SPX.US)$ $道琼斯指数 (.DJI.US)$

凯西·伍德-led 方舟投资 周四出售了40,861股股票,估计价值4100万美元 $Tesla (TSLA.US) $,尽管最近下跌,但该股仍在为这位以低得多的水平购买TSLA股票的受欢迎的基金经理获利。

周四,特斯拉股价收盘下跌6.10%,至每股1003.80美元。该股今年迄今已上涨约37.5%。

每日名言:

第一条规则是永远不要亏钱。第 2 条规则是永远不要忘记第 1 条规则。- 沃伦·巴菲特

$纳斯达克 (NDAQ.US)$ $标普500指数 (.SPX.US)$ $道琼斯指数 (.DJI.US)$

已翻译

![[每日名言] 第一条规则是永远不要亏钱...](https://ussnsimg.moomoo.com/3375471630415006959.png/thumb)

30

1

SuLK

赞了

各个平台的前5只股票是来自主要投资平台和社交媒体的热门股票的集合,为投资者提供了一个跨地区的热门股票列表。

moomoo从Robinhood和moomoo选出了最热门的股票代码;从Yahoo Finance和Investing.com选出了最热门的股票代码;从Stocktwits选出了最活跃的股票代码。

$特斯拉 (TSLA.US)$ $苹果 (AAPL.US)$ $AMC院线 (AMC.US)$

moomoo从Robinhood和moomoo选出了最热门的股票代码;从Yahoo Finance和Investing.com选出了最热门的股票代码;从Stocktwits选出了最活跃的股票代码。

$特斯拉 (TSLA.US)$ $苹果 (AAPL.US)$ $AMC院线 (AMC.US)$

已翻译

长图

长图 29

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)