Timothy Roberts

留下了心情并评论了

$SPDR 标普500指数ETF (SPY.US)$ 你这些“买入低点”的人即将上了一堂艰难而昂贵的教训,因为南非奥密克戎病例在24小时内翻了一番(今天)。

“其实有可能在未来我们会看到严重病例翻倍甚至翻三倍,就像随着时间推移或者本周逐步展开一样,” 世界卫生组织的区域病毒学家Nicksy Gumede-Moeletsi博士告诉美联社。

“其实有可能在未来我们会看到严重病例翻倍甚至翻三倍,就像随着时间推移或者本周逐步展开一样,” 世界卫生组织的区域病毒学家Nicksy Gumede-Moeletsi博士告诉美联社。

已翻译

15

6

Timothy Roberts

留下了心情

$Zoom视频通讯 (ZM.US)$ 失去了提前进入下一个阶段并转变为远程办公平台的时机,集成更多功能,如文档存储、电子签名和消息传递。

它可以通过合作伙伴关系、收购或内部开发来实现这些。

我不明白为什么他们变得如此自满,未能打造Zoom的未来。

现在为时已晚,显而易见的事情最终发生了,甚至可以说是 $微软 (MSFT.US)$ 礼貌地让Zoom提前启动了。

它可以通过合作伙伴关系、收购或内部开发来实现这些。

我不明白为什么他们变得如此自满,未能打造Zoom的未来。

现在为时已晚,显而易见的事情最终发生了,甚至可以说是 $微软 (MSFT.US)$ 礼貌地让Zoom提前启动了。

已翻译

13

3

Timothy Roberts

赞并评论了

$OceanPal (OP.US)$

开盘价为3.56(也是当天最低价)。

当天最高价为12.09。

收盘价为5.22。

盘后交易价为8.27。

市场先生在寻找新分拆公司的价值方面遇到了严重问题。

DSX交易下跌了5%+

开盘价为3.56(也是当天最低价)。

当天最高价为12.09。

收盘价为5.22。

盘后交易价为8.27。

市场先生在寻找新分拆公司的价值方面遇到了严重问题。

DSX交易下跌了5%+

已翻译

19

3

Timothy Roberts

留下了心情并评论了

$Block (SQ.US)$ 作为公司继续专注于发展区块链技术解决方案,公司将更名为Block。

股票在盘后交易中上涨1.1%。

在组织结构上不会有任何变化,Square、Cash App、TIDAL和TBD54566975将继续保持各自的品牌。

由于更名,公司专注于推进比特币的独立项目Square Crypto也将更名为Spiral。

据公司表示,法定名称"Square,Inc."预计将在今年12月10日左右正式更改为"Block,Inc.",公司的纽交所股票代码"SQ"暂时不会改变。

“Block是一个新的名字,但我们的经济赋能目标保持不变,” Square联合创始人兼CEO杰克·多西说。

此前(11月29日),Square首席执行官杰克·多西辞去了Twitter的首席执行官职务。

股票在盘后交易中上涨1.1%。

在组织结构上不会有任何变化,Square、Cash App、TIDAL和TBD54566975将继续保持各自的品牌。

由于更名,公司专注于推进比特币的独立项目Square Crypto也将更名为Spiral。

据公司表示,法定名称"Square,Inc."预计将在今年12月10日左右正式更改为"Block,Inc.",公司的纽交所股票代码"SQ"暂时不会改变。

“Block是一个新的名字,但我们的经济赋能目标保持不变,” Square联合创始人兼CEO杰克·多西说。

此前(11月29日),Square首席执行官杰克·多西辞去了Twitter的首席执行官职务。

已翻译

32

12

$Grab Holdings (GRAB.US)$ $Altimeter Growth Corp (AGC.US)$ Grab's Q3 adjusted net sales stand at $429mn, 22% decline QoQ. Grab's Q3 revenue also declined 13% QoQ. This implies incentives to consumers declined 27% QoQ. It is a comfort to see that revenue is less sensitive to consumer incentives. A more worrying sign would be increasing adjusted net sales (or incentives) and declining revenue. Since incentives to consumers declined more than revenue, there isn't evidence suggesting an anomaly or discrepancy. Rather, the decline is more likely to stern from the business environment, which is what Grab has reminded investors about in Q2.

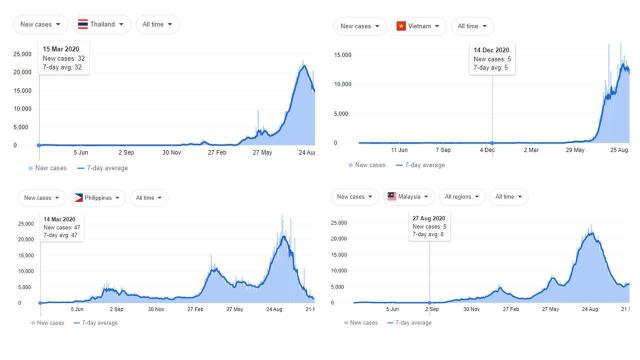

In Q2, Grab warned investors about potential severe COVID19-related mobility restrictions in Southeast Asia. During the period, Grab's full-year 2021 projection has considered the potential of partial and total lockdowns in various countries where the company operates as a consequence of COVID19's continued expansion. Grab's fear came true as COVID cases in SEA countries reached a new all-time high in Q3 due to the Delta variant. The Philippines reimposed lockdowns on Sept. 9, a day after announcing the lifting of stay-at-home orders for more than 13mn people. In August, Vietnam has also imposed a strict stay-at-home order in Ho Chi Minh City's southern suburbs and dispatched the army to assist quarantined citizens.

Therefore, it is no surprise that Grab attributed the decline in overall revenue to the lockdown, especially in Vietnam. This claim is accurate. By referring to Table 1, we can see that the decrease in revenue is mainly derived from its mobility segment. If we expand our analysis time period, we can observe that Grab's underperformance (drop in revenue) in 2021 is caused mainly by its mobility segment. Grab's Q2 mobility segment revenue, and total revenue dropped $27mn and $35mn QoQ, respectively. Grab's Q3 mobility segment revenue and total dropped $30mn and $23mn QoQ, respectively. The decline in the mobility segment coincides with increases in COVID19 cases across SEA (Figure 4). Therefore, Grab's claim that its decline in revenue is contributed by the lockdowns and travel restrictions across SEA.

Despite the drop in revenue, activities (GMV) on the company's platform actually increased 5% during the period. This may not seem like a big deal, but this statistic actually invalidated one of our previous hypotheses (maturing market). In Q2, Grab's GMV only increased 6.5% in spite of a 27% increase in incentives. This suggested that Grab's market is reaching maturity. However, Grab's GMV increased 4.1% (QoQ) in spite of a 27% (QoQ) decline in Q3. This means that Grab's GMV growth isn't fueled by incentives as much as initially thought.

Following Grab's narrative, monthly transacting users (MTU) also declined due to lockdowns. This is also expected. However, what was unexpected is GMV per MTU actually increased. This further proves that Grab indeed has a network effect where activities (GMV) of existing users increase. This is crucial to Grab's overall growth for several reasons:

It is unlikely for Grab to expand beyond SEA. This is because Grab, Uber, and DiDi (NYSE:DIDI) share equity with one another. Therefore, it is unlikely for them to compete with one another.

Due to the limited geographical expansion, it is clear that Grab has to upsell and cross-sell new products to the existing userbase to increase the revenue stream.

For these very reasons, Grab's increase in GMV and GMV per MTU is a positive takeaway. With UBER as comps, Grab has to grow at 35% CAGR on top of a fully recovered pre-pandemic mobility segment over the next five years. This feat is very challenging. Firstly, the majority of Grab's revenue is derived from its mobility segment. Based on the relationship between COVID19 cases and Grab's mobility segment (Figure 4 and Table 1), we expect Grab's Q4 mobility segment to be in between Q1's and Q2's, somewhere around $135mn. This figure only represents around 6.75% of the pre-pandemic level (approximately $2bn). Hence, there is still a very long way to go. Secondly, we don't expect food delivery to grow materially from here as we expect the need for food delivery to decrease when the economy reopens. Hence, food delivery is not expected to contribute to Grab's overall growth. Thirdly, financial service and enterprise & new initiatives' overall contribution to revenue is only marginal. Hence, it is difficult to justify Grab at its current $52bn valuation.

Moreover, investors will lose the $10 NAV safety net once the Grab-AGC merger is completed. This adds to investors' downside risks. In addition, the overall macroeconomy conditions add to the difficulty in investing in high-growth companies. High inflation erodes the value of future earnings, while any form of tapering or rate hikes will devalue Grab's intrinsic value.

In Q2, Grab warned investors about potential severe COVID19-related mobility restrictions in Southeast Asia. During the period, Grab's full-year 2021 projection has considered the potential of partial and total lockdowns in various countries where the company operates as a consequence of COVID19's continued expansion. Grab's fear came true as COVID cases in SEA countries reached a new all-time high in Q3 due to the Delta variant. The Philippines reimposed lockdowns on Sept. 9, a day after announcing the lifting of stay-at-home orders for more than 13mn people. In August, Vietnam has also imposed a strict stay-at-home order in Ho Chi Minh City's southern suburbs and dispatched the army to assist quarantined citizens.

Therefore, it is no surprise that Grab attributed the decline in overall revenue to the lockdown, especially in Vietnam. This claim is accurate. By referring to Table 1, we can see that the decrease in revenue is mainly derived from its mobility segment. If we expand our analysis time period, we can observe that Grab's underperformance (drop in revenue) in 2021 is caused mainly by its mobility segment. Grab's Q2 mobility segment revenue, and total revenue dropped $27mn and $35mn QoQ, respectively. Grab's Q3 mobility segment revenue and total dropped $30mn and $23mn QoQ, respectively. The decline in the mobility segment coincides with increases in COVID19 cases across SEA (Figure 4). Therefore, Grab's claim that its decline in revenue is contributed by the lockdowns and travel restrictions across SEA.

Despite the drop in revenue, activities (GMV) on the company's platform actually increased 5% during the period. This may not seem like a big deal, but this statistic actually invalidated one of our previous hypotheses (maturing market). In Q2, Grab's GMV only increased 6.5% in spite of a 27% increase in incentives. This suggested that Grab's market is reaching maturity. However, Grab's GMV increased 4.1% (QoQ) in spite of a 27% (QoQ) decline in Q3. This means that Grab's GMV growth isn't fueled by incentives as much as initially thought.

Following Grab's narrative, monthly transacting users (MTU) also declined due to lockdowns. This is also expected. However, what was unexpected is GMV per MTU actually increased. This further proves that Grab indeed has a network effect where activities (GMV) of existing users increase. This is crucial to Grab's overall growth for several reasons:

It is unlikely for Grab to expand beyond SEA. This is because Grab, Uber, and DiDi (NYSE:DIDI) share equity with one another. Therefore, it is unlikely for them to compete with one another.

Due to the limited geographical expansion, it is clear that Grab has to upsell and cross-sell new products to the existing userbase to increase the revenue stream.

For these very reasons, Grab's increase in GMV and GMV per MTU is a positive takeaway. With UBER as comps, Grab has to grow at 35% CAGR on top of a fully recovered pre-pandemic mobility segment over the next five years. This feat is very challenging. Firstly, the majority of Grab's revenue is derived from its mobility segment. Based on the relationship between COVID19 cases and Grab's mobility segment (Figure 4 and Table 1), we expect Grab's Q4 mobility segment to be in between Q1's and Q2's, somewhere around $135mn. This figure only represents around 6.75% of the pre-pandemic level (approximately $2bn). Hence, there is still a very long way to go. Secondly, we don't expect food delivery to grow materially from here as we expect the need for food delivery to decrease when the economy reopens. Hence, food delivery is not expected to contribute to Grab's overall growth. Thirdly, financial service and enterprise & new initiatives' overall contribution to revenue is only marginal. Hence, it is difficult to justify Grab at its current $52bn valuation.

Moreover, investors will lose the $10 NAV safety net once the Grab-AGC merger is completed. This adds to investors' downside risks. In addition, the overall macroeconomy conditions add to the difficulty in investing in high-growth companies. High inflation erodes the value of future earnings, while any form of tapering or rate hikes will devalue Grab's intrinsic value.

22

2

Timothy Roberts

赞并评论了

$苹果 (AAPL.US)$ I believe these will sell in greater numbers than in years past, as people come to terms with their decreased discretionary income resulting from inflation. The subsidized versions from prepaid carriers should sell very well. They are a relative bargain so long as Google can't manage to compel Android phone OEMs to continue security updates for 4-5 years as Apple pushes to its cheaper phones. Apple's able to differentiate its budget iPhone thanks to what appears to be either laziness or else an unwillingness on Google's part to enforce security standards on OEMs licensing its code. This is demonstrated by indie Android OS's like LineageOS providing security updates based on Google's open source AOSP code for old phones from 2014 like the Samsung Galaxy S3

https://wiki.lineageos.org/devices/s3ve3gds/

Apple has limited cannibalization of the more expensive Apple phones' sales by keeping the screen on the smaller end, although the processor and overall quality remains high relative to Androids priced at these levels.

https://wiki.lineageos.org/devices/s3ve3gds/

Apple has limited cannibalization of the more expensive Apple phones' sales by keeping the screen on the smaller end, although the processor and overall quality remains high relative to Androids priced at these levels.

27

5

$纳斯达克100指数 (.NDX.US)$ From a technical analysis viewpoint, anybody seeing the daily nasdaq trend forming a clear "head and shoulders"?

20

4

Timothy Roberts

赞并评论了

热门拉丁美洲新兴数字银行 $Nu Holdings (NU.US)$ 周二,该公司缩减了即将到来的美巴二次上市IPO规模,估计这笔上市交易的市值较之前预期将多了30亿美元。 $腾讯控股 (00700.HK)$同时,NuBank重申计划通过发行最多约28920万股A类股进行销售,公司缩减并修改了承销商“超额配售选择权”的条款。 $伯克希尔-A (BRK.A.US)$ $伯克希尔-B (BRK.B.US)$与NU的IPO前投资者此前计划提供大约4340万股A类股作为超额配售,该银行现在改为授予承销商从NuBank直接购买约2860万股这类股票的选择权。

该数字银行还首次披露了一些顶级投资者表达了非约束性兴趣,共同购买价值13亿美元的A类股IPO。

购买者包括主要的IPO前支持者红杉资本和Tiger Global Management,以及与贝利吉福、龙骧投资、景顺、摩根士丹利、Sands Capital Management和软银有关系的实体。

NU在提交给美国证券交易委员会的修订F-1文件中写道,现在公司预计A类股的定价将从之前预测的每股10-11美元下调至每股8-9美元。

此外,NuBank还减少了承销商超额配售选择权的规模和条款。

该创新银行还披露,首次有一批顶级投资者表示有兴趣共同购买其价值13亿美元的A类IPO股票。

该公司还计划向员工和机构投资者提供大约3220万美元的巴西存托凭证(或“BDRs”),同时还将部分用于客户忠诚计划。这些BDRs将在巴西证券交易所交易,每份价值相当于1/6的A类股。

此外,努银行重申了为公司联合创始人David Osorno,Cristina Zingaretti Junqueira和Adam Wible或其关联公司提供B类股票的计划。每份B类股票将拥有20票,相比每份A类股票的1票,使联合创始人拥有公司投票权的86.9% - 其中,奥索尔诺的投票权达到了75%,他还担任该银行的首席执行官。

总之,努银行预计在发行后将拥有大约46亿A类和B类股份。这将使公司的估值在未稀释的基础上约为369亿美元至471亿美元,具体取决于承销商购买了多少超额配售股,并且IPO价格在其预测区间内的位置。相比之下,IPO的初期条件将NU的未稀释价值定为高达500亿美元。

8岁的努银行一直在撼动拉丁美洲的金融服务行业,通过运行首选数字化业务,为消费者提供信用卡、个人贷款、寿险等服务。这家知名银行在巴西、哥伦比亚和墨西哥拥有超过4800万客户。

除了红杉资本和老虎环球,NU的其他主要IPO前支持者还包括腾讯控股和DSt,而沃伦·巴菲特的伯克希尔·哈撒韦在6月份投资了50000万。

努银行在其修订后的F-1文件中写道,如果IPO价格为中间价8.50美元/份,预计将获得约24亿美元,如果承销商完全行使其超额配售选择权,将增加至约26亿美元。

该银行表示,计划将筹集的资金用于营运资金、营业费用、资本支出、可能的收购以及其他一般企业用途。

该数字银行还首次披露了一些顶级投资者表达了非约束性兴趣,共同购买价值13亿美元的A类股IPO。

购买者包括主要的IPO前支持者红杉资本和Tiger Global Management,以及与贝利吉福、龙骧投资、景顺、摩根士丹利、Sands Capital Management和软银有关系的实体。

NU在提交给美国证券交易委员会的修订F-1文件中写道,现在公司预计A类股的定价将从之前预测的每股10-11美元下调至每股8-9美元。

此外,NuBank还减少了承销商超额配售选择权的规模和条款。

该创新银行还披露,首次有一批顶级投资者表示有兴趣共同购买其价值13亿美元的A类IPO股票。

该公司还计划向员工和机构投资者提供大约3220万美元的巴西存托凭证(或“BDRs”),同时还将部分用于客户忠诚计划。这些BDRs将在巴西证券交易所交易,每份价值相当于1/6的A类股。

此外,努银行重申了为公司联合创始人David Osorno,Cristina Zingaretti Junqueira和Adam Wible或其关联公司提供B类股票的计划。每份B类股票将拥有20票,相比每份A类股票的1票,使联合创始人拥有公司投票权的86.9% - 其中,奥索尔诺的投票权达到了75%,他还担任该银行的首席执行官。

总之,努银行预计在发行后将拥有大约46亿A类和B类股份。这将使公司的估值在未稀释的基础上约为369亿美元至471亿美元,具体取决于承销商购买了多少超额配售股,并且IPO价格在其预测区间内的位置。相比之下,IPO的初期条件将NU的未稀释价值定为高达500亿美元。

8岁的努银行一直在撼动拉丁美洲的金融服务行业,通过运行首选数字化业务,为消费者提供信用卡、个人贷款、寿险等服务。这家知名银行在巴西、哥伦比亚和墨西哥拥有超过4800万客户。

除了红杉资本和老虎环球,NU的其他主要IPO前支持者还包括腾讯控股和DSt,而沃伦·巴菲特的伯克希尔·哈撒韦在6月份投资了50000万。

努银行在其修订后的F-1文件中写道,如果IPO价格为中间价8.50美元/份,预计将获得约24亿美元,如果承销商完全行使其超额配售选择权,将增加至约26亿美元。

该银行表示,计划将筹集的资金用于营运资金、营业费用、资本支出、可能的收购以及其他一般企业用途。

已翻译

19

10

Timothy Roberts

赞并评论了

$Rivian Automotive (RIVN.US)$ 这是有史以来最容易的开空之一。利用我可以输掉的钱,如果他们继续推动这种恐慌买入的垃圾股,我会逐步加仓。这个市场充斥着这些恐慌买入的机会,因为所有人都在做博彩。

已翻译

19

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Timothy Roberts Sweety Reality : 你会为年轻人推荐什么股票?