whisky888

赞了

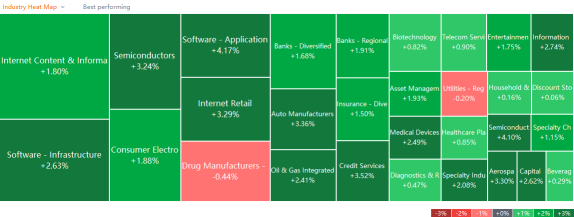

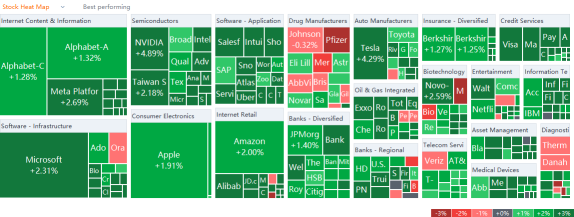

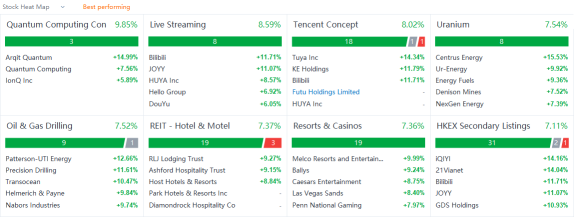

Hey mooers, check out today's hot sectors and hot stocks here!

+1

11

whisky888

赞了

whisky888

赞了

@Betterthangold @Pray4 tennis starlooking to buy options ..if I already have 100 shares of said stock how does that work? Do you guys know? Been reading up on this topic but slightly intimidated by the whole deal because I've never done this before ..options rookie I be. any help would be greatly appreciated

9

13

whisky888

赞了

$Foghorn Therapeutics (FHTX.US)$ 当天结束时23美元,加油!

已翻译

12

7

whisky888

赞了

Recently, I'm learning day trading strategies. And I want to share some points with mooers, also want masters to give me some advice.![]() @Dadacai @GratefulPanda @HopeAlways @Mars Mooo @Syuee @Mcsnacks H Tupack

@Dadacai @GratefulPanda @HopeAlways @Mars Mooo @Syuee @Mcsnacks H Tupack

The most important rules are Granville's 8 Rules, which principle is to use the resistance and support from MA to find out the best entry position points for trend trading investments.![]()

1. Four buying signals

Breakout Buy - It is a buying signal when the price rises from the bottom and breaks the MA of tendency level.

Call-back Buy - When the price goes beyond the MA, and the call-back does not fall below the MA can be considered as a buying signal.

Fake Breakout Buy - The price falls below the MA. However, if the MA is still rising and the short-term price goes back upon the MA, it is a buying signal.

Off-buy - When the price keeps falling and accumulates specific declines, and it begins to deviate from the moving average, it is a buying signal.

$AMC院线 (AMC.US)$ $苹果 (AAPL.US)$ $英伟达 (NVDA.US)$

2. Four selling signals

Breakout Sell - It is a selling signal when the price falls from above and breaks the MA of tendency level.

Bounce Sell - When the price goes below the MA and rebounds but does not exceed the MA, it is a selling signal.

Fake Breakout Sell - The price rises and breaks the MA. However, the MA is still falling, and the short-term price falls below the MA. It is a selling signal.

Off-sell - When the price keeps rising and accumulates specific increases and starts deviating from the MA, it is a selling signal.

$雾芯科技 (RLX.US)$ $阿里巴巴 (BABA.US)$ $阿里巴巴-W (09988.HK)$

I found that the intraday market rebounded quickly when the trending fell sharply. If you buy at a low point, you can significantly profit from the rebound. If you make an excellent stop-loss, the profit-loss ratio should be good. I will back-test $特斯拉 (TSLA.US)$ 's intraday trends to see its effectiveness. Here I use the five-minute bar for trading, and the corresponding moving average is VWAP.

We can see that $特斯拉 (TSLA.US)$ 's historical trend is in line with falling below the moving average at a rapid rate and then quickly rebounding back to the MA. It can be found that at the relatively lowest point, the needle-shaped k-line has been released and closed, and the angle of the downward movement below the moving average is enormous at the beginning. It looks very effective!![]()

But in actual combat, I don't know the success rate, so you still need to set a stop loss just in case. The buying point of this kind of disk shape is when it falls below the intraday moving average. After a period of rapid decline at a large angle, a heavy volume is accompanied by a needle-shaped k-line is the buying point, and the selling point is to rebound to the moving average. Nearby, the stop loss point is the lowest buying point k-line.

![]() I want to win $美国航空 (AAL.US)$ stock

I want to win $美国航空 (AAL.US)$ stock![]() Please like my post and follow my account

Please like my post and follow my account![]()

![]()

![]()

The most important rules are Granville's 8 Rules, which principle is to use the resistance and support from MA to find out the best entry position points for trend trading investments.

1. Four buying signals

Breakout Buy - It is a buying signal when the price rises from the bottom and breaks the MA of tendency level.

Call-back Buy - When the price goes beyond the MA, and the call-back does not fall below the MA can be considered as a buying signal.

Fake Breakout Buy - The price falls below the MA. However, if the MA is still rising and the short-term price goes back upon the MA, it is a buying signal.

Off-buy - When the price keeps falling and accumulates specific declines, and it begins to deviate from the moving average, it is a buying signal.

$AMC院线 (AMC.US)$ $苹果 (AAPL.US)$ $英伟达 (NVDA.US)$

2. Four selling signals

Breakout Sell - It is a selling signal when the price falls from above and breaks the MA of tendency level.

Bounce Sell - When the price goes below the MA and rebounds but does not exceed the MA, it is a selling signal.

Fake Breakout Sell - The price rises and breaks the MA. However, the MA is still falling, and the short-term price falls below the MA. It is a selling signal.

Off-sell - When the price keeps rising and accumulates specific increases and starts deviating from the MA, it is a selling signal.

$雾芯科技 (RLX.US)$ $阿里巴巴 (BABA.US)$ $阿里巴巴-W (09988.HK)$

I found that the intraday market rebounded quickly when the trending fell sharply. If you buy at a low point, you can significantly profit from the rebound. If you make an excellent stop-loss, the profit-loss ratio should be good. I will back-test $特斯拉 (TSLA.US)$ 's intraday trends to see its effectiveness. Here I use the five-minute bar for trading, and the corresponding moving average is VWAP.

We can see that $特斯拉 (TSLA.US)$ 's historical trend is in line with falling below the moving average at a rapid rate and then quickly rebounding back to the MA. It can be found that at the relatively lowest point, the needle-shaped k-line has been released and closed, and the angle of the downward movement below the moving average is enormous at the beginning. It looks very effective!

But in actual combat, I don't know the success rate, so you still need to set a stop loss just in case. The buying point of this kind of disk shape is when it falls below the intraday moving average. After a period of rapid decline at a large angle, a heavy volume is accompanied by a needle-shaped k-line is the buying point, and the selling point is to rebound to the moving average. Nearby, the stop loss point is the lowest buying point k-line.

+2

178

28

whisky888

赞了

5

2

whisky888

赞了

已翻译

13

4

whisky888

赞了

在星期五的交易中,公司的股票 $AMC院线 (AMC.US)$股票 $游戏驿站 (GME.US)$在200日均线以下交叉

CDC确认美国首例Omicron病例后,上周AMC股价下跌。在2019年疫情开始时,电影院关闭,不确定性的变异引发了对可能出现封锁措施的担忧。

AMC周五收盘下跌4.2%,报29.01美元,远低于股票的当日最低价25.31美元。

GameStop的股价也下跌,跟随着美国就业数据不及预期。

GameStop周五收盘下跌5.1%,报172.39美元,低于当日最低价159.05美元。

如果你现在有1000美元,你会买入AMC还是GME?

CDC确认美国首例Omicron病例后,上周AMC股价下跌。在2019年疫情开始时,电影院关闭,不确定性的变异引发了对可能出现封锁措施的担忧。

AMC周五收盘下跌4.2%,报29.01美元,远低于股票的当日最低价25.31美元。

GameStop的股价也下跌,跟随着美国就业数据不及预期。

GameStop周五收盘下跌5.1%,报172.39美元,低于当日最低价159.05美元。

如果你现在有1000美元,你会买入AMC还是GME?

已翻译

79

83

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)