美股期权个股详情

ITB241129C106000

- 13.10

- 0.000.00%

延时15分钟行情收盘价 11/29 13:00 (美东)

0.00最高价0.00最低价

13.10今开13.10昨收0张成交量3张未平仓合约数106.00行权价0.00成交额3044.73%隐含波动率-3.81%溢价2024/11/29到期日17.82内在价值100合约乘数-2天距到期日0.00时间价值100合约规模美式期权类型0.9848Delta0.0042Gamma6.80杠杆倍数-75.2230Theta0.0000Rho6.70有效杠杆0.0001Vega

美国房屋建筑业ETF-iShares股票讨论

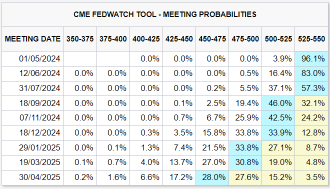

与上周五公布非农就业数据后相对平静的市场反应不同,本周三公布的超出预期的通胀数据对市场情绪造成了致命打击。 抛售后,交易员没有恢复信心,美国三大股指均出现亏损。此外,美国多期国债收益率飙升,而此前炙手可热的大宗商品黄金回落...

已翻译

35

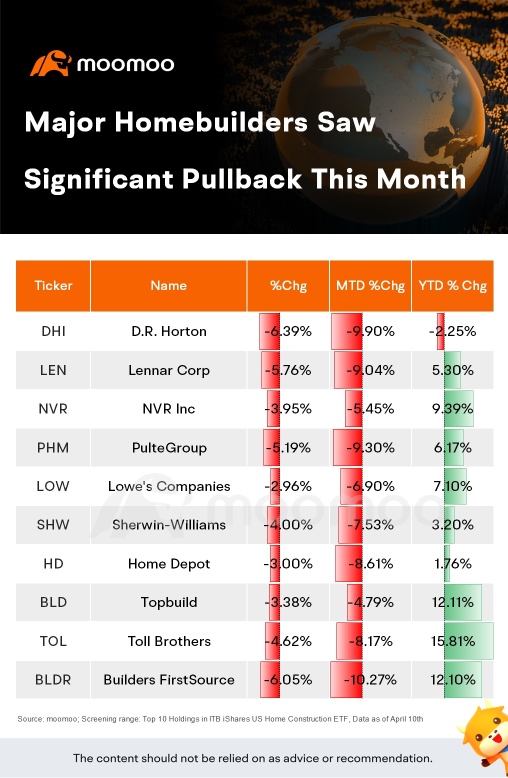

问一个投资者今年最令人兴奋的投资主题是什么,很可能会得到“人工智能”作为答案。

但很少有人知道,这些无聊的房地产开发商股票今年也表现出色。

美国房屋建筑业etf-ishares(ITB)今年以来飙升了36%,超过了标普500etf的15%涨幅。

在利率期货上涨的情况下,房屋建筑股票表现强劲,引发了一些问题。人们可能会预期较少的购房者和对新房...

但很少有人知道,这些无聊的房地产开发商股票今年也表现出色。

美国房屋建筑业etf-ishares(ITB)今年以来飙升了36%,超过了标普500etf的15%涨幅。

在利率期货上涨的情况下,房屋建筑股票表现强劲,引发了一些问题。人们可能会预期较少的购房者和对新房...

已翻译

6

$20+年以上美国国债ETF-iShares (TLT.US)$

价格已正式跌破了一个非常长期的支撑位。价格在20年来都没有突破过这个趋势性支撑位。

成交量随着每个蜡烛的通过而稳步增加,显示出抛售的强势动能。

MACD柱状图出现了每周看淡交叉。非常可怕![]()

只要记住,当每个人都害怕并朝另一个方向看时,市场可以迅速反转。在...

价格已正式跌破了一个非常长期的支撑位。价格在20年来都没有突破过这个趋势性支撑位。

成交量随着每个蜡烛的通过而稳步增加,显示出抛售的强势动能。

MACD柱状图出现了每周看淡交叉。非常可怕

只要记住,当每个人都害怕并朝另一个方向看时,市场可以迅速反转。在...

已翻译

8

72

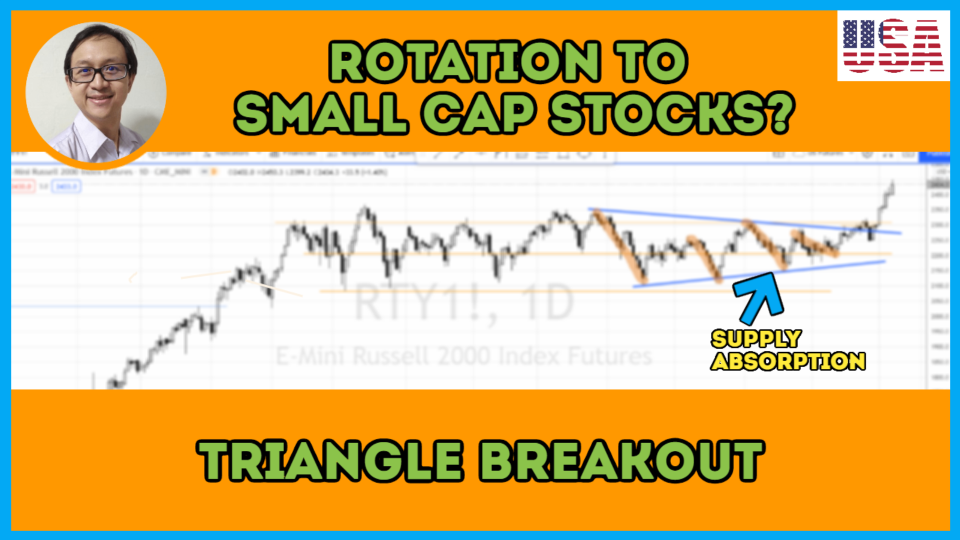

查看详细的市场更新 $标普500指数主连(2412) (ESmain.US)$ , $罗素2000指数主连(2412) (RTYmain.US)$ , $纳斯达克100指数主连(2412) (NQmain.US)$ 和 $道琼斯指数主连(2412) (YMmain.US)$ 使用 Wyckoff 技术。这段视频是从我的2021年11月7日周播会话中提取的。

关键要点

- 为什么在 Russell 2000( $罗素2000ETF-iShares (IWM.US)$ )中存在大量积累,通过顶点形态来实现。

- 如何预测潜在的板块轮动是否会发生 $标普500指数 (.SPX.US)$ , $纳斯达克综合指数 (.IXIC.US)$ 转为 $道琼斯指数 (.DJI.US)$ 和 $微型罗素2000指数主连(2412) (M2Kmain.US)$

- 为何指数可能处于脆弱状态,以及可以期待什么。

- 使用韦科夫法则——努力与结果来解释供应吸收,并判断上涨阶段的时机。

- 板块 etf 关注点: $工业指数ETF-SPDR (XLI.US)$ $WilderHill清洁能源ETF-Invesco (PBW.US)$ $美国房屋建筑业ETF-iShares (ITB.US)$ 和留意在中进行的大规模运行 $半导体指数ETF-VanEck (SMH.US)$

- 对于小盘,随意探索 $罗素2000成长股指数ETF-iShares (IWO.US)$ $罗素2000ETF-iShares (IWM.US)$ $罗素2000价值股指数ETF-iShares (IWN.US)$

观看下方视频

关键要点

- 为什么在 Russell 2000( $罗素2000ETF-iShares (IWM.US)$ )中存在大量积累,通过顶点形态来实现。

- 如何预测潜在的板块轮动是否会发生 $标普500指数 (.SPX.US)$ , $纳斯达克综合指数 (.IXIC.US)$ 转为 $道琼斯指数 (.DJI.US)$ 和 $微型罗素2000指数主连(2412) (M2Kmain.US)$

- 为何指数可能处于脆弱状态,以及可以期待什么。

- 使用韦科夫法则——努力与结果来解释供应吸收,并判断上涨阶段的时机。

- 板块 etf 关注点: $工业指数ETF-SPDR (XLI.US)$ $WilderHill清洁能源ETF-Invesco (PBW.US)$ $美国房屋建筑业ETF-iShares (ITB.US)$ 和留意在中进行的大规模运行 $半导体指数ETF-VanEck (SMH.US)$

- 对于小盘,随意探索 $罗素2000成长股指数ETF-iShares (IWO.US)$ $罗素2000ETF-iShares (IWM.US)$ $罗素2000价值股指数ETF-iShares (IWN.US)$

观看下方视频

已翻译

51

3

Although US housing prices have risen sharply, they may continue to rise before reaching the level of the last housing bubble.

Driven by factors such as historically low interest rates, a surge in new demand during the new crown pneumonia epidemic, and insufficient supply caused by supply chain bottlenecks, the U.S. property market will be extremely hot in 2021, and there will even be a phenomenon of home buyers queuing to "rob houses". In July, there were only 34,000 completed new houses in the US real estate market. Since 1973, the average number of completed new houses in July each year is 87,300.

A large number of unmet demand for home purchases has driven the rise of housing prices in the United States. A report issued by the Federal Housing Finance Agency (FHFA) on August 31 showed that in the 12 months ending in June, the U.S. housing price index rose by a record 18.8%.

"Barron's Weekly" believes that some of the factors driving the rise of US housing prices still exist, and prices will continue to rise in the future. However, the crash that some people worry about is unlikely to happen, because the property boom this time is different from the one at the beginning of this century. For investors, there are many investment opportunities in the field of real estate stocks under the expectation that housing prices will continue to rise.

$标普房屋建筑商ETF-SPDR (XHB.US)$ $美国房屋建筑业ETF-iShares (ITB.US)$ $Allegion (ALLE.US)$

Driven by factors such as historically low interest rates, a surge in new demand during the new crown pneumonia epidemic, and insufficient supply caused by supply chain bottlenecks, the U.S. property market will be extremely hot in 2021, and there will even be a phenomenon of home buyers queuing to "rob houses". In July, there were only 34,000 completed new houses in the US real estate market. Since 1973, the average number of completed new houses in July each year is 87,300.

A large number of unmet demand for home purchases has driven the rise of housing prices in the United States. A report issued by the Federal Housing Finance Agency (FHFA) on August 31 showed that in the 12 months ending in June, the U.S. housing price index rose by a record 18.8%.

"Barron's Weekly" believes that some of the factors driving the rise of US housing prices still exist, and prices will continue to rise in the future. However, the crash that some people worry about is unlikely to happen, because the property boom this time is different from the one at the beginning of this century. For investors, there are many investment opportunities in the field of real estate stocks under the expectation that housing prices will continue to rise.

$标普房屋建筑商ETF-SPDR (XHB.US)$ $美国房屋建筑业ETF-iShares (ITB.US)$ $Allegion (ALLE.US)$

5

Pending home sales in the US rose to a seven-month high in August, but high housing prices slowed down the momentum of the property market

$美国房屋建筑业ETF-iShares (ITB.US)$ Pending home sales in the United States rebounded to a seven-month high in August, but due to still tight supply, rising housing prices are slowing down the momentum of the housing market. Other data showed that last week's mortgage applications fell due to the rise in mortgage interest rates, after the Fed hinted that it might start reducing the monthly bond purchases as early as November. The National Association of Real Estate (NAR) announced that the US August pending home sales index rose 8.1% from the previous month to 119.5, which is the highest level since January. It had fallen for two consecutive months.

Article excerpted from Reuters Financial Morning Post

$美国房屋建筑业ETF-iShares (ITB.US)$ Pending home sales in the United States rebounded to a seven-month high in August, but due to still tight supply, rising housing prices are slowing down the momentum of the housing market. Other data showed that last week's mortgage applications fell due to the rise in mortgage interest rates, after the Fed hinted that it might start reducing the monthly bond purchases as early as November. The National Association of Real Estate (NAR) announced that the US August pending home sales index rose 8.1% from the previous month to 119.5, which is the highest level since January. It had fallen for two consecutive months.

Article excerpted from Reuters Financial Morning Post

暂无评论

I Am 102927471 :

Billy Badass 楼主 I Am 102927471 : 卖出锁定利润。

I Am 102927471 Billy Badass 楼主 : 恭喜