A couple things happened on Friday that (judging by history) make me think we could see more short-squeezes this week:

1) Borrow rates spiked for some popular shorts (often a sign of shorts pressing).

2) Legit small-cap growth stocks (some heavily shorted, some not) sold off en masse in tandem with heavily-shorted junk (

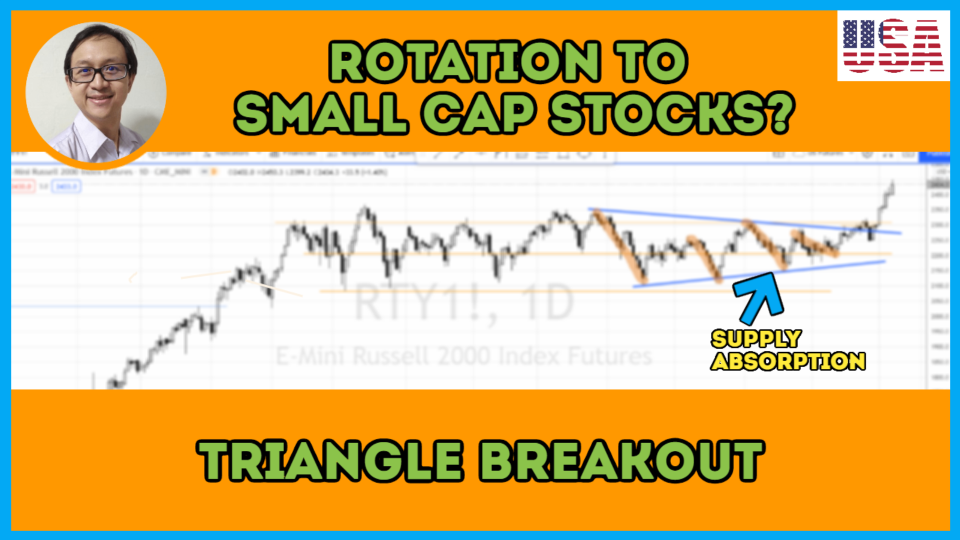

$罗素2000成长股指数ETF-iShares (IWO.US)$ was down 1.2%) . When this has happened in the past, these stocks have often later moved higher in tandem.

Throw in rates fallin...