美股期权个股详情

SHY241115C89000

- 0.00

- 0.000.00%

延时15分钟行情交易中 11/08 09:30 (美东)

0.00最高价0.00最低价

0.00今开0.00昨收0张成交量0张未平仓合约数89.00行权价0.00成交额0.00%隐含波动率8.43%溢价2024/11/15到期日0.00内在价值100合约乘数7天距到期日0.00时间价值100合约规模美式期权类型--Delta--Gamma1641.60杠杆倍数--Theta--Rho--有效杠杆--Vega

美国国债1-3年ETF-iShares股票讨论

$20+年以上美国国债ETF-iShares (TLT.US)$ $iShares安硕10-20年国债ETF (TLH.US)$ $美国国债1-3年ETF-iShares (SHY.US)$不仅仅是大银行。债券正在寻找一些非常臭的东西。🦨

已翻译

4

专栏 美国国债投资指南

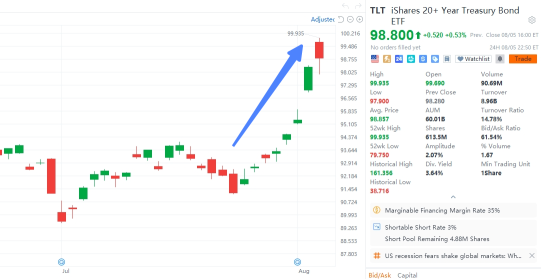

In early August, global stock markets plummeted, sparking fears of an economic recession and a looming bear market. Meanwhile, the bond market quietly surged, with the $20+年以上美国国债ETF-iShares (TLT.US)$ achieving an eight-day winning streak by August 5th.

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

已翻译

+5

285

79

随着世界形势的最近动荡变化,很难预测会发生什么。中东的冲突持续升级,而非洲之角正面临严重的人道主义危机。拉丁美洲左翼政治的复兴面临右翼反对,亚洲的经济和安全挑战展示了一个不断变化的局势。俄乌冲突仍未解决,全球贸易面临高通胀和供应链中断的阻力。

已翻译

+10

61

4

随着世界形势的最近动荡变化,很难预测会发生什么。中东的冲突持续升级,而非洲之角正面临严重的人道主义危机。拉丁美洲左翼政治的复兴面临右翼反对,亚洲的经济和安全挑战展示了一个不断变化的局势。俄乌冲突仍未解决,全球贸易面临高通胀和供应链中断的阻力。

已翻译

+10

4

$美国国债1-3年ETF-iShares (SHY.US)$现在moomoo上显示涨了0.105,但是网站上却显示跌了0.11,这是什么情况啊?

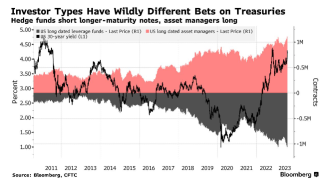

对冲基金将国债看空至历史水平,而资产管理公司则恰恰相反 👀

目前是哪些资产成员在购买较长期限的国债?

我站在对冲基金方面,似乎Ackman和巴菲特也是

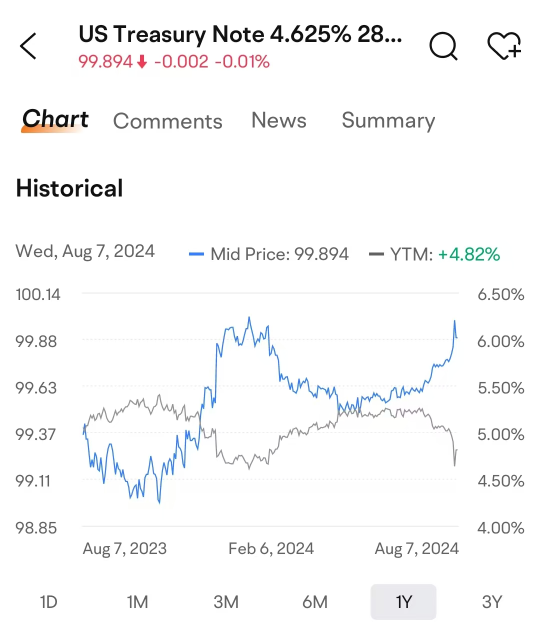

在长期利率下降之前,短期利率也必须下降,因为曲线可能呈倒置状态。或者长期利率必须上涨到新的"正常"水平。

后者看起来可能性更大 $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR 标普500指数ETF (SPY.US)$ $美国短期国债ETF-iShares (SHV.US)$ $美国国债1-3年ETF-iShares (SHY.US)$ $标普500指数 (.SPX.US)$ $纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$

目前是哪些资产成员在购买较长期限的国债?

我站在对冲基金方面,似乎Ackman和巴菲特也是

在长期利率下降之前,短期利率也必须下降,因为曲线可能呈倒置状态。或者长期利率必须上涨到新的"正常"水平。

后者看起来可能性更大 $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $SPDR 标普500指数ETF (SPY.US)$ $美国短期国债ETF-iShares (SHV.US)$ $美国国债1-3年ETF-iShares (SHY.US)$ $标普500指数 (.SPX.US)$ $纳斯达克综合指数 (.IXIC.US)$ $道琼斯指数 (.DJI.US)$

已翻译

4

我支持Ackman。![]()

![]()

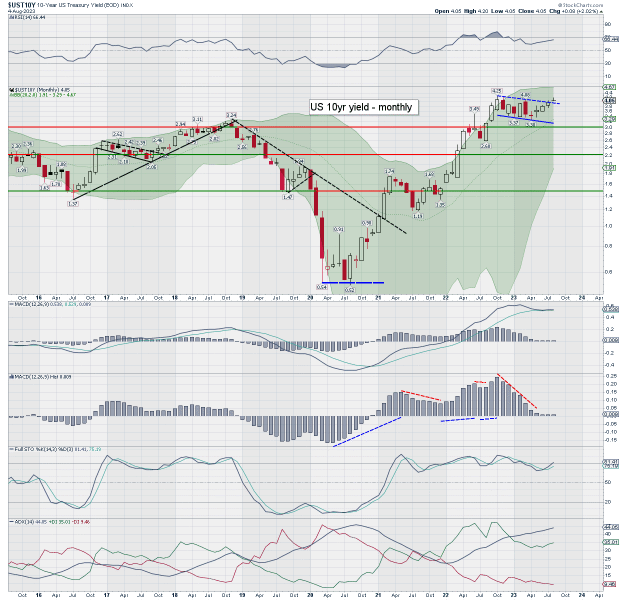

美国10年期收益率的多月结构是一个牛市标志,正在发挥作用。周五... 只是一些降温。软目标... 大约4.70%,心理关口5.00%,然后7.00%。

我开始怀疑巴菲特是否能活到看到联储再次降息。

$iShares安硕10-20年国债ETF (TLH.US)$ $美国国债1-3年ETF-iShares (SHY.US)$ $美国国债1-3月ETF-SPDR (BIL.US)$ $SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500指数 (.SPX.US)$

美国10年期收益率的多月结构是一个牛市标志,正在发挥作用。周五... 只是一些降温。软目标... 大约4.70%,心理关口5.00%,然后7.00%。

我开始怀疑巴菲特是否能活到看到联储再次降息。

$iShares安硕10-20年国债ETF (TLH.US)$ $美国国债1-3年ETF-iShares (SHY.US)$ $美国国债1-3月ETF-SPDR (BIL.US)$ $SPDR 标普500指数ETF (SPY.US)$ $纳指100ETF-Invesco QQQ Trust (QQQ.US)$ $标普500指数 (.SPX.US)$

已翻译

4

只有一个是正确的。亿万富翁投资者比尔·阿克曼表示他正在开多美国国债。如果长期通货膨胀率是3%而不是2%,30年期国债收益率可能上升到5.5%。与此形成对比,沃伦·巴菲特宣布在美国国债中建立多头头寸。目前做空美国10年期债券似乎是最拥挤的交易之一。

$伯克希尔-A (BRK.A.US)$ $伯克希尔-B (BRK.B.US)$ $标普500指数 (.SPX.US)$ $SPDR 标普500指数ETF (SPY.US)$ $美国短期国债ETF-iShares (SHV.US)$ $美国国债1-3月ETF-SPDR (BIL.US)$ $美国国债1-3年ETF-iShares (SHY.US)$ $iShares安硕10-20年国债ETF (TLH.US)$

$伯克希尔-A (BRK.A.US)$ $伯克希尔-B (BRK.B.US)$ $标普500指数 (.SPX.US)$ $SPDR 标普500指数ETF (SPY.US)$ $美国短期国债ETF-iShares (SHV.US)$ $美国国债1-3月ETF-SPDR (BIL.US)$ $美国国债1-3年ETF-iShares (SHY.US)$ $iShares安硕10-20年国债ETF (TLH.US)$

已翻译

2

暂无评论

Georgehx : 你是什么意思?

Derpy Trades 楼主 Georgehx : 摩根大通和至少一个其他主要银行正在抛售,而国债收益率正在下降。这往往是安全避风的强烈信号。

Georgehx Derpy Trades 楼主 : 你说得有道理,但目前我主要持有债券,因为市场波动性较大,并且债券在利率下降时往往会上涨,所以无论是25点还是50点基点都没关系,尤其是较长期的债券会表现良好,我这么说对吗?

Derpy Trades 楼主 Georgehx : 债券市场非常复杂,因此这是一个非常难回答的问题。在大多数情况下,债券在降息甚至预期降息时会反弹,但如果出现黑天鹅事件,联储可能不得不进行国债的货币化,长期利率可能会迅速飙升,债券可能会迅速贬值。