特斯拉首席執行官馬斯克正在制定“史詩”總體規劃4。期待大量的機器人。-- Barrons.com

講好Tesla故事,吃好Tesla大餅。

“畫餅”(其實是按計劃有步驟地進行着遠景的基礎工作)務虛的利多時,倉位重的可以兌現一些浮盈;所謂的“利空”信息滿天飛,股價大跌時,勇敢地走出空虛寂寞,大膽地分梯度分批次,有計劃有步驟地,離散型隨機變量,開倉佈局。

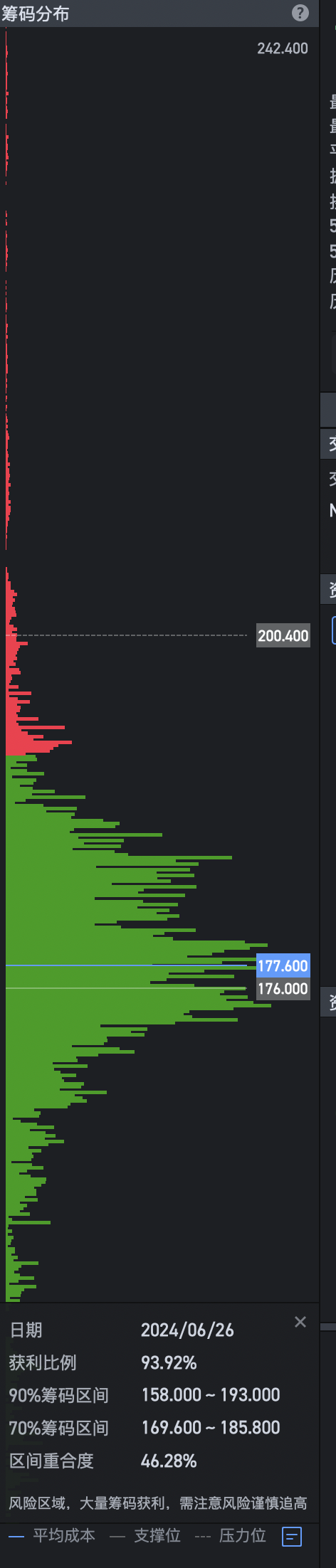

大量籌碼都是被套,處於浮虧狀態。拉升阻力很大,絕大多數人遠遠沒有解套。摩通和大摩確實厲害。他們現在華麗轉身變成Tesla的大多頭,只是現在Tesla基本面還沒有出現重大變化的苗頭之前,在相對技術高位,大機構是不太願意出資大力拉升的。絕大多數散戶等解套了,或者微利就會逃跑。等下一次看到跌不下去,最好又漲了,他們才又開始願意買進,他們稱之爲跟着趨勢走。週而復始。

Tesla CEO Musk Is Working On 'Epic' Master Plan 4. Expect Plenty of Robots. -- Barrons.com

特斯拉CEO馬斯克正在制定“史詩級”第四項大計劃。預計會有大量機器人。-- Barrons.com

Al Root

To his detractors, Tesla CEO Elon Musk overpromises and underdelivers. To his supporters, he is the key to generating trillions in shareholder value from not only all-electric cars, but from robots, robotaxis, and artificial intelligence computing.

在他的反對者眼中,特斯拉CEO埃隆·馬斯克過於誇大其詞並未兌現承諾。而在他的支持者看來,他不僅可以通過全電動汽車,還可以通過機器人、機器人出租車和人工智能計算爲股東創造數萬億的價值。

The debate between the two factions is about to get a lot louder as Musk works on his "Master Plan 4," which promises to usher in an era of robotics that no one is expecting.

兩派之間的爭論即將升級,因爲馬斯克正在制定他的“第四項總體計劃”,承諾帶來一個沒有人預料的機器人時代。

"Working on the Tesla Master Plan 4," Musk tweeted on June 17. "It will be epic."

馬斯克於6月17日發推文稱:“正在制定特斯拉第四項總體計劃,將是史詩級別。”

Tesla only released Master Plan 3 in April 2023. Exactly when Master Plan 4 will be unveiled is anyone's guess. Tesla didn't respond to a request for comment about when it would be ready.

特斯拉僅於2023年4月發佈了第三項總體計劃。特斯拉何時公佈第四項計劃還是一個未知數。特斯拉沒有回應關於何時準備就緒的請求。

Musk is accelerating his planning process though. Master Plan 1 came out in 2006. It detailed Tesla's ambition to use the experience acquired by making a high-priced luxury all-electric car to produce an affordable all-electric car. Musk did it. The Model 3 came out in 2016. By automotive standards, it was a wild success.

儘管如此,馬斯克正在加速計劃進程。第一項計劃於2006年發佈,闡述了特斯拉利用製作高價位豪華全電動汽車獲得的經驗,生產廉價全電動汽車的雄心壯志。馬斯克做到了。Model 3於2016年問世,按照汽車標準,它是一個巨大的成功。

Master Plan 2, or Part Deux as Tesla named it, arrived in 2016. It detailed Tesla's plans to offer more models and started Tesla, and Tesla investors, down the path of autonomous driving.

第二項計劃於2016年發佈,名稱爲“Part Deux”,詳細介紹了特斯拉的計劃,並開始讓特斯拉和特斯拉的投資者走上自動駕駛之路。

Musk has done some of that. Tesla has expanded its product lineup. It's making semi-trucks. It started delivering the Cybertruck in 2023. A lower-priced Tesla model is due in 2025.

馬斯克已經開始着手其中的一些計劃,特斯拉擴大了產品線,製造半掛車,於2023年開始交付Cybertruck,一個價格更低的特斯拉車型將於2025年推出。

Fully self-driving Teslas aren't here yet, though. Tesla is hosting a Robotaxi Day on August 8. Investors will expect to see a robotaxi prototype and hear about artificial intelligence-trained software improvements.

然而完全自動駕駛的特斯拉還沒有出現。特斯拉將於8月8日舉辦一個機器人出租車日。投資者期待看到機器人出租車的原型,並了解經過人工智能訓練的軟件改進。

Master Plan 3 arrived in 2023. It was about the opportunity in solar and battery storage to wean the world off fossil fuels. Electric cars, renewable power generation, and battery storage to save electricity for when the sun isn't shining and the wind isn't blowing have always been part of Musk's vision.

第三份總體計劃於2023年發佈,旨在通過太陽能和電池存儲的機會遠離化石燃料。電動汽車,可再生能源發電和電池存儲,即使在沒有陽光和風的情況下也可以節約電力,一直是馬斯克願景的一部分。

Plan 3 is partly done, too. Tesla deployed roughly 15 gigawatt hours of battery storage over the past year. That's enough electricity to power roughly 1,500 U.S. homes for a year.

第三個計劃已經部分完成。特斯拉在過去一年中部署了大約15吉瓦時的電池儲存。這足夠爲大約1500戶美國家庭提供一年的電力。

"We expect Master Plan 4 to be underpinned by Tesla's commercial ambitions in A.I., robotics, hybrid-compute...that spans from cloud to edge," wrote Morgan Stanley analyst Adam Jonas in a recent report.

“我們預計第四項總體計劃將以特斯拉在人工智能、機器人、混合計算領域的商業野心爲支撐……從雲到邊緣。”大摩資源lof分析師亞當·喬納斯在最近的一份報告中寫道。

"Hybrid-compute" at the edge can refer to using computers in Teslas to do work, and earn money, while the cars aren't being driven.

“邊緣混合計算”可以指使用特斯拉中的計算機進行工作和賺錢,而車輛未被駕駛。

Hybrid-compute is new for investors. Robots aren't. Tesla is building a humanoid robot called Optimus and Musk has said the robotics business could be bigger than the car business one day. That's an aspirational statement. There are no robots for sale just yet. They could be used in manufacturing operations or personal droids.

混合計算對投資者而言是新的概念。但機器人並不新鮮。特斯拉正在製造一個名爲Optimus的人形機器人,馬斯克曾表示,機器人業務有朝一日可能比汽車業務更大。這是一個雄心勃勃的聲明。現在還沒有出售機器人。它們可以用於製造業務或個人機器人。

"Who doesn't want a C-3PO," said Musk at his company's annual shareholder meeting on June 13, referring to the humanoid droid from the Star Wars movie franchise.

“誰不想要一個C-3PO,”馬斯克在6月13日公司的年度股東大會上說,指的是來自《星球大戰》電影系列的人形機器人。

When Master Plan 4 is released, Tesla will have three plans in various stages of completion. Detractors will question whether that's smart and if any of the remaining items will come to fruition. Acolytes will insist things will work out.

當特斯拉發佈第四項總體計劃時,特斯拉將擁有三個處於不同完成階段的計劃。反對者會質疑這是否明智,是否有剩下的計劃將會實現。信徒將堅持認爲一切都會成功。

What working out means is Tesla re-achieving its trillion-dollar market valuation. Tesla first hit a $1 trillion market value in late 2021. Today, Tesla's market value is about $570 billion.

實現的意思是特斯拉重新獲得萬億美元的市場價值。特斯拉在2021年年底首次達到1萬億美元的市值。而今天,特斯拉的市值約爲5700億美元。

Coming into Tuesday's trading, Tesla stock was down about 27% so fa this year while the Nasdaq Composite was up about 17%. Slowing car sales have weighed on investor sentiment. Wall Street expects Tesla to deliver about 1.8 million cars in 2024, flat with 2023 volumes. At the start of the year, that projection was about 2.1 million.

截至週二的交易時,特斯拉股票今年迄今已下跌約27%,而納斯達克綜合指數已上漲約17%。汽車銷量放緩使投資者信心受到打擊。華爾街預計特斯拉在2024年交付的汽車數量將約爲180萬輛,與2023年的交付量相當。而在年初,這個預測是210萬輛左右。

Write to Al Root at allen.root@dowjones.com

請寫信給Al Root,地址爲allen.root@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

此內容由Barron's創建,由Dow Jones & Co.運營。Barron's獨立於Dow Jones Newswires和華爾街日報發行。

Tesla delivery results are coming. this is the real number to watch, and it's worrying 特斯拉交付結果即將公佈。這是實際需要關注的數字,而且令人擔憂。

Tesla's second-quarter delivery results have the power to move the stock. In which direction depends, of course, on what the electric-vehicle maker reports and what investors expect.

特斯拉第二季度的交付結果有能力影響股票價格。股票的漲跌取決於這家電動汽車製造商所報告的內容以及投資者的期望。

Tesla typically reports quarterly deliveries on the second day of a new quarter. For the second quarter of 2024, the Wall Street consensus call compiled by FactSet is about 440,00o cars delivered, down from about 466,000 cars delivered in the second quarter of 2023.

特斯拉通常在新季度的第二天發佈季度交付情況。根據FactSet組織的華爾街共識,2024年第二季度交付量約爲44萬輛,低於2023年第二季度的約46.6萬輛。

The 440,00 figure is too high. Analysts don't always update numbers at the same rate. They can get stale. The most recent estimates are lower. That's a better guide for investors looking to see how the stock will react.

44萬輛的數字過高。分析師們並不總是以相同的頻率更新數據,有時數據會陳舊。最新的估計更低,這對想知道股票將如何反應的投資者來說是更好的指導。

RBC analyst Tom Narayan took his second-quarter delivery estimate down to 410,000 from 433,000 on Tuesday. He looks at app downloads and registration data, among other things to come up with his number.

週二,RBC分析師湯姆·奈拉揚將他的第二季度交付預期從433,000下調至410,000。他會查看應用下載量和註冊數據等信息來得出他的數字。

Narayan rates Tesla shares Buy and has a $227 price target for the stock. Guggenheim analyst Ronal Jewsikow rates them Sell. His price target is $126.

納拉揚給特斯拉股票評級爲買入,股票的目標價爲227美元。Guggenheim分析師Ronald Jewsikow給特斯拉股票評爲賣出,他的目標價格爲126美元。

Also on Tuesday, Jewsikow moved his estimate up to 419,000 from 409,000 cars.

同樣在週二,Jewsikow將他的估計從409,000輛汽車上調至419,000輛。

Other recent updates have come from New Street Research's Pierre Ferragu, independent researcher Troy Teslike, and Barclays' Dan Levy. The average of their new numbers is about 419,000.

最近還有來自新街研究公司的Pierre Ferragu、獨立研究員Troy Teslike和巴克萊銀行的Dan Levy的更新。他們新的估計平均約爲419,000輛。

What all this means for investors is a number between 415,000 and 420,000 deliveries should be good enough to support the stock, no matter where the final consensus number lands.

對於投資者來說,這意味着在415,000輛和420,000輛之間的交付量足以支撐股票,無論最終共識數字落在哪裏。

Stock support in the short run is great, but a result in that range still implies a drop of more than 10% year over year. That would be the second consecutive year-over-year decline for Tesla.

在短期內支撐股票是好事,但在那個範圍內的結果仍意味着同比下降超過10%。這將是特斯拉連續第二年同比下降。

The lack of growth in 2024 has weighed on Tesla's stock. Through Tuesday trading, shares were down about 25% so far this year while the Nasdaq Composite was up about 18%.

2024年的增長不足已經壓低了特斯拉的股價。截至週二的交易,特斯拉的股價已經下跌了約25%,而納斯達克綜合指數則上漲了約18%。

Wall Street expects sales to pick up later in the year and growth to resume in 2025, powered by more Cybertruck deliveries and a new lower-priced Tesla.

華爾街預計銷售額將在年底後提振,2025年將恢復增長,由更多的Cybertruck交付和一個新的價格更低的特斯拉推動。

For 2024 Wall Street expects about 1.8 million cars sold, essentially flat with 2023. For 2025, the current consensus call is for 2.1 million cars sold.

2024年,華爾街預計銷售約180萬輛,基本與2023年相同。對於2025年,目前的共識是將銷售210萬輛。

免責聲明:社區由Moomoo Technologies Inc.提供,僅用於教育目的。

更多信息

評論

登錄發表評論

102764470 : 200 以上籌碼這樣少嗎

Elias Chen 樓主 : 大量籌碼都是被套,處於浮虧狀態。拉升阻力很大,絕大多數人遠遠沒有解套。摩通和大摩確實厲害。他們現在華麗轉身變成Tesla的大多頭,只是現在Tesla基本面還沒有出現重大變化的苗頭之前,在相對技術高位,大機構是不太願意出資大力拉升的。絕大多數散戶等解套了,或者微利就會逃跑。等下一次看到跌不下去,最好又漲了,他們才又開始願意買進,他們稱之爲跟着趨勢走。週而復始。