APRoyalOak

讚了

所有三個指數均有望在積極的9月取得進展,盡管這個月傳統上和季節性上是看淡的。

這可能的原因是聯儲50個基點的利率降低,背後是美國經濟的良好基礎。

$道瓊斯指數 (.DJI.US)$ $道瓊斯指數ETF-SPDR (DIA.US)$ $美國超微公司 (AMD.US)$ $美國銀行 (BAC.US)$ $花旗集團 (C.US)$ $高盛 (GS.US)$ $Lendlease Reit (JYEU.SG)$ $羅素2000ETF-iShares (IWM.US)$ $蘋果 (AAPL.US)$ $Palantir (PLTR.US)$

這可能的原因是聯儲50個基點的利率降低,背後是美國經濟的良好基礎。

$道瓊斯指數 (.DJI.US)$ $道瓊斯指數ETF-SPDR (DIA.US)$ $美國超微公司 (AMD.US)$ $美國銀行 (BAC.US)$ $花旗集團 (C.US)$ $高盛 (GS.US)$ $Lendlease Reit (JYEU.SG)$ $羅素2000ETF-iShares (IWM.US)$ $蘋果 (AAPL.US)$ $Palantir (PLTR.US)$

已翻譯

來自YouTube

5

3

APRoyalOak

表達了心情

特斯拉和 Nvidia 分別上漲了 7% + 和 8% 以上。科技沉重的納斯達克指數上漲了 1.6%,這是自 7 月下旬以來最大的單日漲勢

有趣的是,10 年期國債債券收益率達到 2007 年 11 月以來的最高水平。萬一您不知道,債券收益率和股票市場通常會朝著單獨的方向發展。

有什麼東西要給?

$標普500指數ETF-SPDR (SPY.US)$ $標普500指數 (.SPX.US)$ $特斯拉 (TSLA.US)$ $英偉達 (NVDA.US)$ $3倍做多納指ETF-ProShares (TQQQ.US)$ $納指100ETF-Invesco QQQ Trust (QQQ.US)$ $3倍做空納指ETF-ProShares (SQQQ.US)$ $亞馬遜 (AMZN.US)$ $奈飛 (NFLX.US)$ $Adobe (ADBE.US)$ $微軟 (MSFT.US)$ $谷歌-A (GOOGL.US)$ $谷歌-C (GOOG.US)$ $Meta Platforms (META.US)$ $賽富時 (CRM.US)$ ...

有趣的是,10 年期國債債券收益率達到 2007 年 11 月以來的最高水平。萬一您不知道,債券收益率和股票市場通常會朝著單獨的方向發展。

有什麼東西要給?

$標普500指數ETF-SPDR (SPY.US)$ $標普500指數 (.SPX.US)$ $特斯拉 (TSLA.US)$ $英偉達 (NVDA.US)$ $3倍做多納指ETF-ProShares (TQQQ.US)$ $納指100ETF-Invesco QQQ Trust (QQQ.US)$ $3倍做空納指ETF-ProShares (SQQQ.US)$ $亞馬遜 (AMZN.US)$ $奈飛 (NFLX.US)$ $Adobe (ADBE.US)$ $微軟 (MSFT.US)$ $谷歌-A (GOOGL.US)$ $谷歌-C (GOOG.US)$ $Meta Platforms (META.US)$ $賽富時 (CRM.US)$ ...

已翻譯

6

10

APRoyalOak

參與了投票

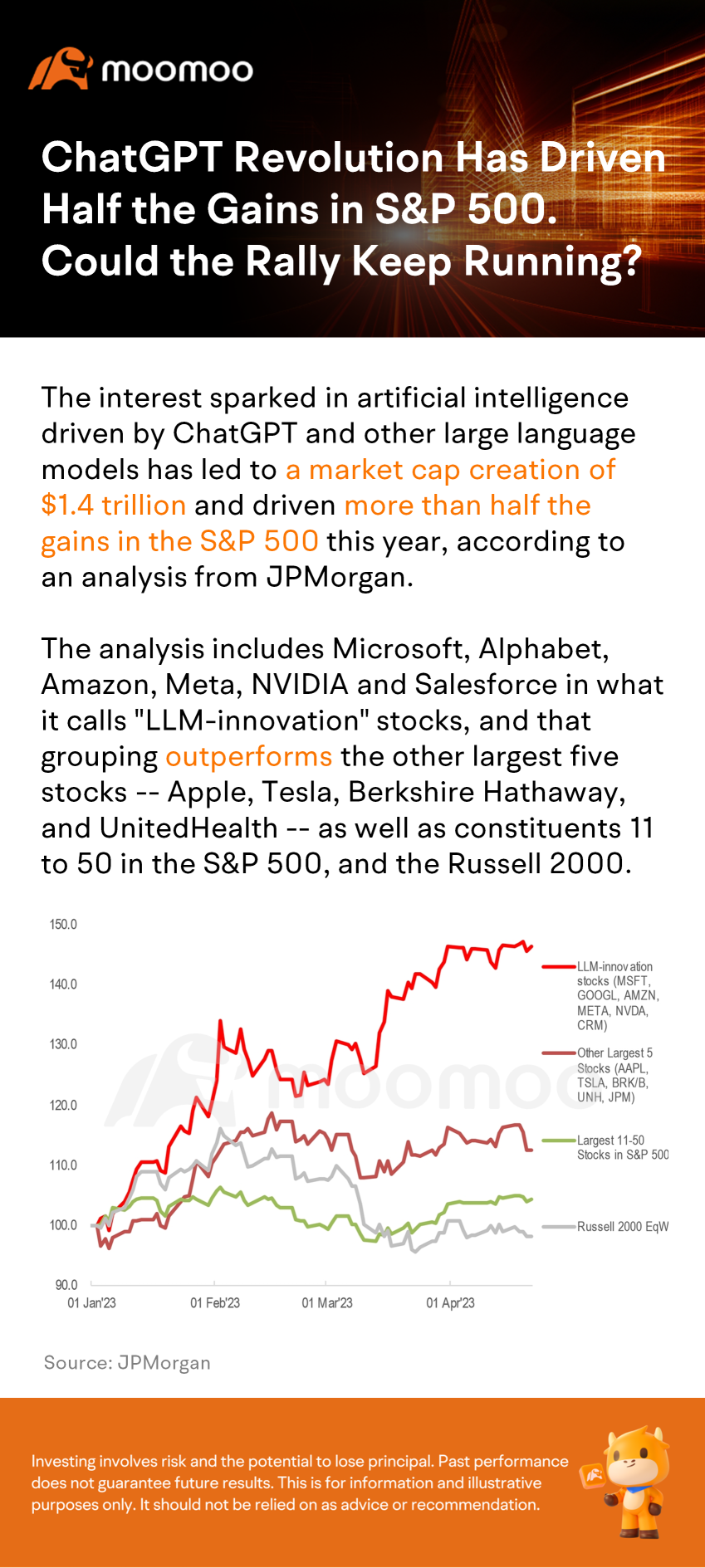

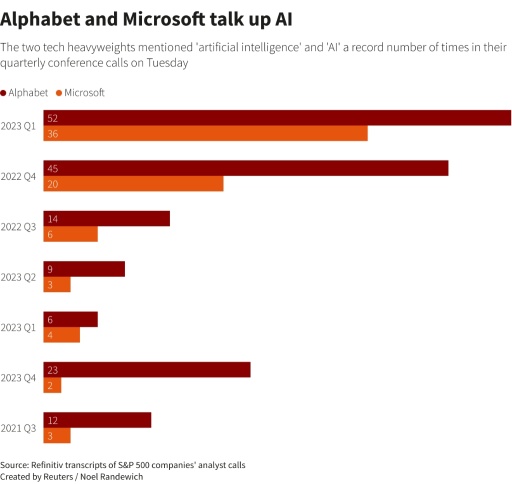

季度報告季即將開始,S&P 500公司在電話會議中使用「人工智能」一詞的頻率幾乎是上一季度的兩倍,路透社的分析顯示。

兩家公司表示AI已經在推動銷售了 提高銷售額 但是 兩者都未提及何時或是否開始分離出科技的銷售額、成本或利潤.

摩根大通(Dubravko Lakos-Bujas率領的團隊)做...

兩家公司表示AI已經在推動銷售了 提高銷售額 但是 兩者都未提及何時或是否開始分離出科技的銷售額、成本或利潤.

摩根大通(Dubravko Lakos-Bujas率領的團隊)做...

已翻譯

18

2

13

APRoyalOak

評論了

$3B家居 (BBBY.US)$ 每天上升1美元已經很開心了。

已翻譯

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)