今天,讓我們談談如何透過設定參數準確辨識頂點和底部轉折點。

首先,只要你買了,就馬上賣出,股票就會上漲。

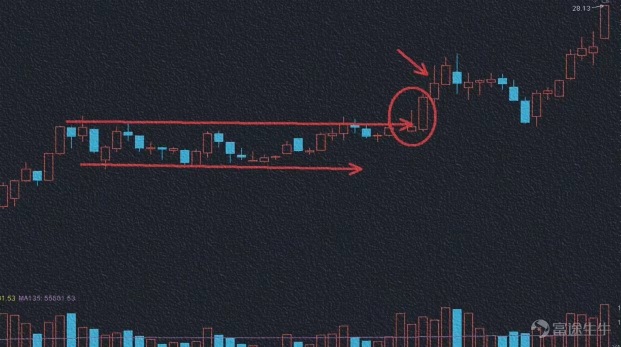

這個問題應該是許多我們股票交易朋友面臨的問題,例如,我們看看下面的圖表,當它強勢突破早期的最高點,形成一個大陽線,那麼在我們看來,這個買點確實是合...

首先,只要你買了,就馬上賣出,股票就會上漲。

這個問題應該是許多我們股票交易朋友面臨的問題,例如,我們看看下面的圖表,當它強勢突破早期的最高點,形成一個大陽線,那麼在我們看來,這個買點確實是合...

已翻譯

+22

12

1

5

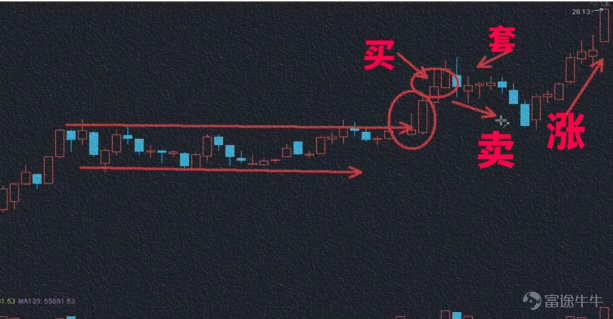

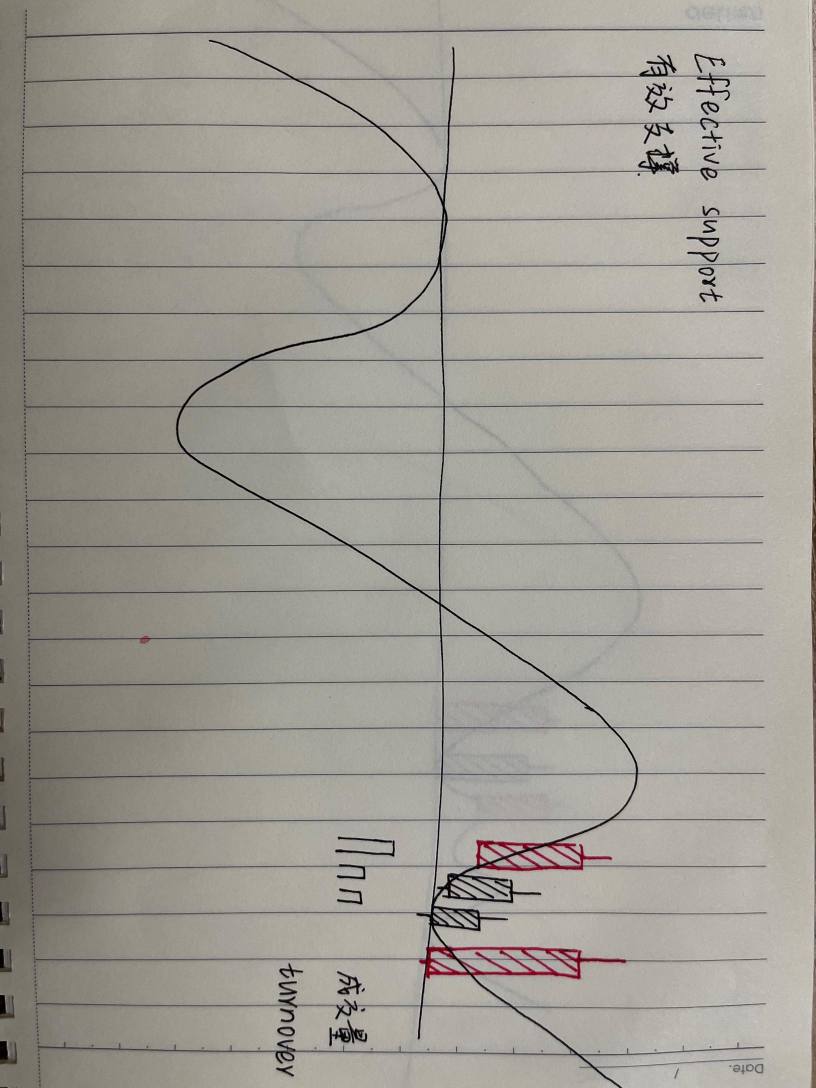

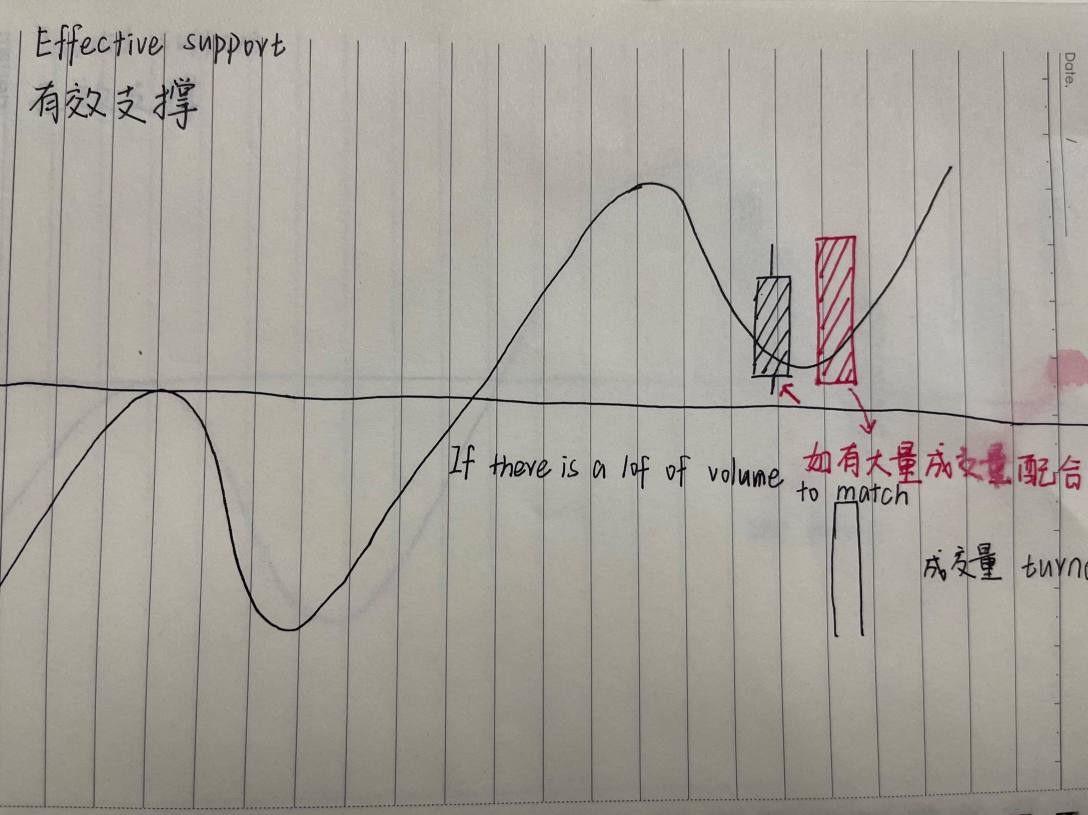

如果您沒有區分有效支撐位和無效支撐位,很容易在山谷底部到山腰之間複製或陷入困境。

今天,讓我們來討論如何判斷股價的支撐位是否有效。

首先,讓我們看看第一類有效支撐位 $英偉達 (NVDA.US)$

在拉升的趨勢中出現的陰線...

今天,讓我們來討論如何判斷股價的支撐位是否有效。

首先,讓我們看看第一類有效支撐位 $英偉達 (NVDA.US)$

在拉升的趨勢中出現的陰線...

已翻譯

+3

18

1

4

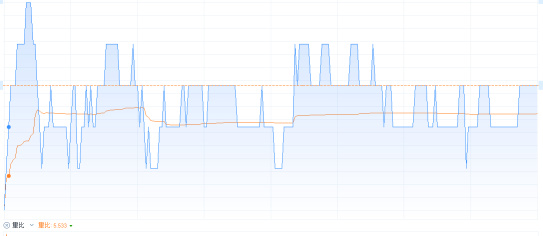

今天告訴你如何通過 K 線指標「獲利」和「底部讀數」

如何判斷股價波動的頂部和底部?或者如何判斷股價的上漲和下跌?

今天我想與您談談的是我多年來使用的方法來 ——— 頂部和底部打字。長期投機股票的朋友應該了解這種技術,但也應該有一些新投資者...

如何判斷股價波動的頂部和底部?或者如何判斷股價的上漲和下跌?

今天我想與您談談的是我多年來使用的方法來 ——— 頂部和底部打字。長期投機股票的朋友應該了解這種技術,但也應該有一些新投資者...

已翻譯

+1

11

4

4

專欄 MACD指標的使用技巧

Macd是股票交易過程中常用的技術指標,今天與大家分享一些我經常使用的Macd技巧,簡單易學。

首先,Macd的兩條趨勢線位於零軸線之上,屬於強勢市場,一條在上方,一條在下方,屬於半強勢市場,兩條都位於零軸線之下,屬於弱勢市場,在交易過程中建議只做強勢市場的股票。

第二,MACD的能源柱在零線以上,屬於...

首先,Macd的兩條趨勢線位於零軸線之上,屬於強勢市場,一條在上方,一條在下方,屬於半強勢市場,兩條都位於零軸線之下,屬於弱勢市場,在交易過程中建議只做強勢市場的股票。

第二,MACD的能源柱在零線以上,屬於...

已翻譯

+4

15

8

專欄 股票短期交易的貼士

如何判斷一支股票在短期內是否值得買入?為了分享一個小技巧給你,只要關注股票交易的前30分鐘,你就可以判斷最終是否值得買入,我總結了6個形式與你分享。

1. 在交易之前的30分鐘內,如果股價沒有相對大幅波動,那一天的趨勢不會有好的表現。

2. 在交易的前30分鐘內,股價先跌後漲,漲幅超過了開盤價,這意味著這支股票今天相對強勁,並且將繼續上升。

3. 在交易的前30分鐘內,股價先跌後漲,但未超過開盤價,這意味著這支股票相對較弱,不應該買入。

4. 在交易的前30分鐘內,股價先漲後跌,並跌破開盤價,表明此股票也相對較弱,不能買入。

在交易前30分鐘,股價先上漲後下跌,但沒有跌破開盤價,顯示做市商心虛,接下來很可能會拉升。

在交易前30分鐘,股價先上漲後下跌,然後又上漲,顯示多空基金在博弈,股價通常會向上震盪,可以在低點選擇買入。

如果您是新手交易者,可以多去看看,接下來我將分享更多交易提示。 $騰訊控股 (00700.HK)$ $AMC院線 (AMC.US)$ $富途控股 (FUTU.US)$ $京東集團-SW (09618.HK)$ $阿里巴巴 (BABA.US)$ $星巴克 (SBUX.US)$ $英偉達 (NVDA.US)$ $Amdocs (DOX.US)$ $小米集團-W (01810.HK)$

1. 在交易之前的30分鐘內,如果股價沒有相對大幅波動,那一天的趨勢不會有好的表現。

2. 在交易的前30分鐘內,股價先跌後漲,漲幅超過了開盤價,這意味著這支股票今天相對強勁,並且將繼續上升。

3. 在交易的前30分鐘內,股價先跌後漲,但未超過開盤價,這意味著這支股票相對較弱,不應該買入。

4. 在交易的前30分鐘內,股價先漲後跌,並跌破開盤價,表明此股票也相對較弱,不能買入。

在交易前30分鐘,股價先上漲後下跌,但沒有跌破開盤價,顯示做市商心虛,接下來很可能會拉升。

在交易前30分鐘,股價先上漲後下跌,然後又上漲,顯示多空基金在博弈,股價通常會向上震盪,可以在低點選擇買入。

如果您是新手交易者,可以多去看看,接下來我將分享更多交易提示。 $騰訊控股 (00700.HK)$ $AMC院線 (AMC.US)$ $富途控股 (FUTU.US)$ $京東集團-SW (09618.HK)$ $阿里巴巴 (BABA.US)$ $星巴克 (SBUX.US)$ $英偉達 (NVDA.US)$ $Amdocs (DOX.US)$ $小米集團-W (01810.HK)$

已翻譯

+3

21

3

8

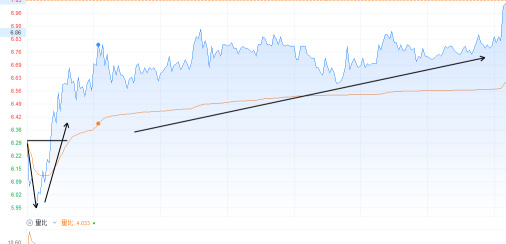

如今,綠色電已成為市場上的主要力量,其實根源在能源革命,老李之前也說,在碳中和的背景下,綠色電市場可以直到明年,而對於綠色電,我經常與大家分享其投資邏輯。有興趣的朋友可以前往我的主頁查看這些文章。

今天再次提醒您,電力將繼續飆升並以可持續的方式跟踪。

其實,在二級市場做投資,研究是一個方向,做正確的方向,即使一刻追高造成損失也不用擔心,一般趨勢也會推動你前進。走正確的方向,波浪的黃金平移動為戲劇。

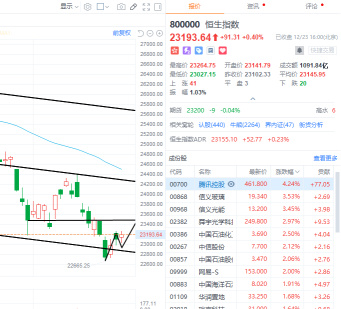

$恒生指數 (800000.HK)$恒生指數今天可以維持水衝擊,騰訊真的出現強勢,如果今天騰訊表現稍微弱,估計市場有突破新低點的可能性,從當前市場環境下跌還沒完全結束,需要注意重量和情緒是否有共鳴的可能性,通道下邊的技術水平每日水平才能獲得支撐,在這裡獲得支撐,這裡如果穩定,則開始攻擊向下通道軸,支撐可以看到上一個在 22700 附近的新低點,23500 上壓如果能突破,則將打開新的上行。

個別股票

$騰訊控股 (00700.HK)$騰訊早上強勁攻擊,推動股價再次回到 460 以上,儘管股價回到 460 以上,但需要注意,它還是左邊框衝擊,所以如果明天有反彈可以適當低吸力,不要追上,上壓 500 等待突破。

$比亞迪股份 (01211.HK)$比亞迪今天的表現有點差,周邊新能源行業急劇反彈,特斯拉股價已經回歸 1000 關卡,今天比亞迪只上漲了那麼多,實力顯然無法跟上, $特斯拉 (TSLA.US)$

比亞迪短期情況是價值高的短期看跌,只是看看市場這裡就是利用衝擊向下的方式,或者直接隨時的下跌,當前等待調整結束是支柱,以下支撐 240 不跌低於市場將以盒式衝擊方式進行調整。

$小米集團-W (01810.HK)$小米現在趨勢就越多看得越舒服,高點每天越高,技術指標 macd 也開始變紅了,唯一缺點是能量少了一點,能量的量我認為主要或市場整體相對較弱,資本等待看情緒相對強,如果小米出來了不錯的楊線,基金就是瘋狂地抓取芯片。明天如果有機會,我將在小米開張職位,如果明天沒有機會,最晚在聖誕節之後。

$藥明生物 (02269.HK)$昨天無錫生物的位置開盤,今天的振幅顯著減少,有點到節點變化,macd 陰線也在收縮,下一次上升變化的概率將更大,等待趨勢首先修復由看跌引起的陰線。

$京東集團-SW (09618.HK)$

今天再次提醒您,電力將繼續飆升並以可持續的方式跟踪。

其實,在二級市場做投資,研究是一個方向,做正確的方向,即使一刻追高造成損失也不用擔心,一般趨勢也會推動你前進。走正確的方向,波浪的黃金平移動為戲劇。

$恒生指數 (800000.HK)$恒生指數今天可以維持水衝擊,騰訊真的出現強勢,如果今天騰訊表現稍微弱,估計市場有突破新低點的可能性,從當前市場環境下跌還沒完全結束,需要注意重量和情緒是否有共鳴的可能性,通道下邊的技術水平每日水平才能獲得支撐,在這裡獲得支撐,這裡如果穩定,則開始攻擊向下通道軸,支撐可以看到上一個在 22700 附近的新低點,23500 上壓如果能突破,則將打開新的上行。

個別股票

$騰訊控股 (00700.HK)$騰訊早上強勁攻擊,推動股價再次回到 460 以上,儘管股價回到 460 以上,但需要注意,它還是左邊框衝擊,所以如果明天有反彈可以適當低吸力,不要追上,上壓 500 等待突破。

$比亞迪股份 (01211.HK)$比亞迪今天的表現有點差,周邊新能源行業急劇反彈,特斯拉股價已經回歸 1000 關卡,今天比亞迪只上漲了那麼多,實力顯然無法跟上, $特斯拉 (TSLA.US)$

比亞迪短期情況是價值高的短期看跌,只是看看市場這裡就是利用衝擊向下的方式,或者直接隨時的下跌,當前等待調整結束是支柱,以下支撐 240 不跌低於市場將以盒式衝擊方式進行調整。

$小米集團-W (01810.HK)$小米現在趨勢就越多看得越舒服,高點每天越高,技術指標 macd 也開始變紅了,唯一缺點是能量少了一點,能量的量我認為主要或市場整體相對較弱,資本等待看情緒相對強,如果小米出來了不錯的楊線,基金就是瘋狂地抓取芯片。明天如果有機會,我將在小米開張職位,如果明天沒有機會,最晚在聖誕節之後。

$藥明生物 (02269.HK)$昨天無錫生物的位置開盤,今天的振幅顯著減少,有點到節點變化,macd 陰線也在收縮,下一次上升變化的概率將更大,等待趨勢首先修復由看跌引起的陰線。

$京東集團-SW (09618.HK)$

已翻譯

+2

4

$恒生指數 (800000.HK)$恒生指數稍有震撼,原本良好的走勢被阿里突然看淡擊倒,目前市場情緒較為波動,若情緒回升,市場將有較大的反彈修復期待。技術上,恒生指數在日線層面仍處於下跌趨勢,但若未跌破前低,不必擔心,下方支撐位23000未破主要吸筹E低。

個別股票:

$騰訊控股 (00700.HK)$騰訊控股今日隨著再度回落後有所反彈,短期僅與指數共振,基本面在未改變前可以放心低吸,但互聯網製造商的情绪需要一些時間修復,騰訊仍處于交易左側,或主要以低吸為主,等待突破500以上開啟新的上行空間。

$小米集團-W (01810.HK)$小米這個位置基本確認停跌,昨日反包量後今日有一根低吞噬,現在缺乏一個起步信號,若能有陽線帶動情緒,小米有潛力成為此次恒生反彈的領頭者。若反彈站穩19元,可以看到進入23元附近的反彈浪。

$比亞迪股份 (01211.HK)$比亞迪今天再次反彈,但比亞迪的下行趨勢已經確認,因此這裡可以被視為下行校正的反轉,但新能母基的估值修復仍在進行中,短期內的反彈不適合參與,在支撐位240以下的日線將加速下行趨勢。

$中信証券 (06030.HK)$中信證券(adr),因券商公司整體板塊一呼百應,頹勢不成板塊效應,但AH聯動明顯,且分派後有修復下降的可能性,轉強的可能性極大,若樞要支撐位19.5 乃上車的良機。

$藥明生物 (02269.HK)$今天開始控制項在無錫生物制品上,事實上,對無錫的看法始於大跌當天,當時的核心觀點是存在很大的交易機會,但必須要有耐心,我之所以選擇今天,是為了等待第二波纠缠,第一波纠缠過後,有很多投资者帶著短期操作心態進場,那周一的下跌足以嚇退這些短期資金,經過昨天的震盪,今天的選擇进场无錫的資本更具價值,所以我选择了今天。

$京東集團-SW (09618.HK)$

個別股票:

$騰訊控股 (00700.HK)$騰訊控股今日隨著再度回落後有所反彈,短期僅與指數共振,基本面在未改變前可以放心低吸,但互聯網製造商的情绪需要一些時間修復,騰訊仍處于交易左側,或主要以低吸為主,等待突破500以上開啟新的上行空間。

$小米集團-W (01810.HK)$小米這個位置基本確認停跌,昨日反包量後今日有一根低吞噬,現在缺乏一個起步信號,若能有陽線帶動情緒,小米有潛力成為此次恒生反彈的領頭者。若反彈站穩19元,可以看到進入23元附近的反彈浪。

$比亞迪股份 (01211.HK)$比亞迪今天再次反彈,但比亞迪的下行趨勢已經確認,因此這裡可以被視為下行校正的反轉,但新能母基的估值修復仍在進行中,短期內的反彈不適合參與,在支撐位240以下的日線將加速下行趨勢。

$中信証券 (06030.HK)$中信證券(adr),因券商公司整體板塊一呼百應,頹勢不成板塊效應,但AH聯動明顯,且分派後有修復下降的可能性,轉強的可能性極大,若樞要支撐位19.5 乃上車的良機。

$藥明生物 (02269.HK)$今天開始控制項在無錫生物制品上,事實上,對無錫的看法始於大跌當天,當時的核心觀點是存在很大的交易機會,但必須要有耐心,我之所以選擇今天,是為了等待第二波纠缠,第一波纠缠過後,有很多投资者帶著短期操作心態進場,那周一的下跌足以嚇退這些短期資金,經過昨天的震盪,今天的選擇进场无錫的資本更具價值,所以我选择了今天。

$京東集團-SW (09618.HK)$

已翻譯

+3

19

今天恒生指數再次跌出股市災難的勢頭,面對的是一碗又一碗,這個市場越來越難玩!

趁著情緒的冷凍點,今天不管買什麼都是一碗麵,通常情緒冷凍點過後會有修復行情,但只是修復,別抱太大希望,數量不能上去,還會有反復震盪。

二级市场是交易的地方,有人的地方就一定会有不同的情绪,今天情绪冷冻点+被迫出逃恐慌盘,明天惯性下跌将是非常好的钓底机会。

短期操作需要坚强的心理素质,大局观,交易系统,技术图形是次要的,控制市场情绪是关键,“情绪”很难量化,但可以理解。

今天的交易正式开始:

$恒生指數 (800000.HK)$恒生指數跌破新低,短期有触底迹象加速下跌,所以位置没有必要恐慌,廉價籌碼也不要丢失,手上叠加周轉的外圍市場也不好,短期股指表現較强,所以現在內容以觀察為主,日期線壓力接近23500水平,如果再次站穩,有可能反彈。

日本股票

$騰訊控股 (00700.HK)$騰訊控股繼續跟隨指数共振下跌,許多人擔心騰訊股價將跌破新低。我只能說這種可能性不大,因為這裡的下跌與基本面無關,只是情緒所致,因此下方空間不大,切勿盲目殺低價籌碼交出。

$比亞迪股份 (01211.HK)$比亞迪再次下跌,目前估值和業績匹配度不夠,在市場預期修復估值的同時,加上新能源板塊周邊的弱化,出現短期破位的迹象。目前趨勢屬於下跌結構,不適合參與中期反彈,在240處提供支撐。

在概念股崩盤中,我們一定想知道何時適合觀望買入,降幅的核心是阿里,如果它停止下跌,可以大膽觀望買入。 $阿里巴巴-W (09988.HK)$在概念股崩盤中,我們一定想知道何時適合觀望買入,降幅的核心是阿里,如果它停止下跌,可以大膽觀望買入。

$京東集團-SW (09618.HK)$ $美團-W (03690.HK)$

趁著情緒的冷凍點,今天不管買什麼都是一碗麵,通常情緒冷凍點過後會有修復行情,但只是修復,別抱太大希望,數量不能上去,還會有反復震盪。

二级市场是交易的地方,有人的地方就一定会有不同的情绪,今天情绪冷冻点+被迫出逃恐慌盘,明天惯性下跌将是非常好的钓底机会。

短期操作需要坚强的心理素质,大局观,交易系统,技术图形是次要的,控制市场情绪是关键,“情绪”很难量化,但可以理解。

今天的交易正式开始:

$恒生指數 (800000.HK)$恒生指數跌破新低,短期有触底迹象加速下跌,所以位置没有必要恐慌,廉價籌碼也不要丢失,手上叠加周轉的外圍市場也不好,短期股指表現較强,所以現在內容以觀察為主,日期線壓力接近23500水平,如果再次站穩,有可能反彈。

日本股票

$騰訊控股 (00700.HK)$騰訊控股繼續跟隨指数共振下跌,許多人擔心騰訊股價將跌破新低。我只能說這種可能性不大,因為這裡的下跌與基本面無關,只是情緒所致,因此下方空間不大,切勿盲目殺低價籌碼交出。

$比亞迪股份 (01211.HK)$比亞迪再次下跌,目前估值和業績匹配度不夠,在市場預期修復估值的同時,加上新能源板塊周邊的弱化,出現短期破位的迹象。目前趨勢屬於下跌結構,不適合參與中期反彈,在240處提供支撐。

在概念股崩盤中,我們一定想知道何時適合觀望買入,降幅的核心是阿里,如果它停止下跌,可以大膽觀望買入。 $阿里巴巴-W (09988.HK)$在概念股崩盤中,我們一定想知道何時適合觀望買入,降幅的核心是阿里,如果它停止下跌,可以大膽觀望買入。

$京東集團-SW (09618.HK)$ $美團-W (03690.HK)$

已翻譯

20

本週以來,市場整體調整,只有少數幾個主題具有政策預期持續活躍。

會議強調了“適當推進製造行業投資”和“增加新能量源的吸收能力”,以及在國有企業改革中“推進電力網和鐵路等自然壟斷行業改革”,提高了行業併購的預期。

綠色能源大會強調“增加新能源吸收能力”,“促進煤炭和新能源優化結合”,直接惠及綠色能源,尤其是火電轉型。

[ 煤炭化工 ] 會議強調了“原材料能源不納入能源消耗總量控制”,意味著只要不燃燒煤,而是用來製造產品,就不算是能源消耗,從而可以大大加快項目審批進程,尤其是對優異的清潔煤化工領先企業。

[ 物流 ] 會議強調“加快內外聯通形成,安全高效的物流網絡”,此外週末還發布了“十四五”冷鏈物流發展規劃,物流和交通本身直接受益於品種的經濟復甦。

[ 氫能源 ] 隨著第十五期的啟動和行業的持續發展,國內氫能源發展框架,指導文件已經準備就緒。

會議繼續提及種子,並對種子法案進行進一步修訂,文檔一,等等。

[ 數字貨幣 ] 北京冬奧會是國內數字人民幣試點的重要場景,也是“名片”的重要公開展示,數字人民幣迎來重要推動機會。同時,2022年也將是數字人民幣到來的關鍵年份。

總的來說,我們現在正處於一輪新的國內宏觀政策開始階段,在這種情況下,帶有政策預期的行業將更具想像力,因此帶有工業政策期望的分支將在不久的將來保持活躍。

$恒生指數 (800000.HK)$恒生指數持續低波動,從今天的趨勢可以看到接近支撐位的低點,雖然恒生指數的技術水平下降已被控制,但尚無穩定的跡象。 如果跌破23,100點無法恢復指數重心下移以打開下跌空間,上方反彈壓力點24,000,恒生指數仍處於下跌通道,處於不明顯的止跌前不可盲目追跌。

個別股票:

$比亞迪股份 (01211.HK)$Jády持續下跌,符合預期,在短期內Jády頭部已形成,新能源汽車板塊周邊市場的共振下跌。 在估值修復上存在一些差異。 一方面,利潤增長,另一方面,乘用車的銷售是否會繼續增長,短期逃避是主要的事情。 目前,技術支撐位為240,如果跌破,有加速調整的風險,短期調整等待主要結束。

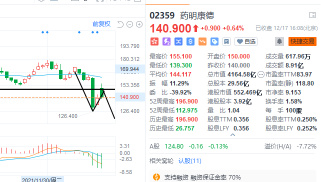

$藥明康德 (02359.HK)$伊曼努爾·康德持續朝負面方向下跌,但今天反彈後再次下跌。 從目前的基本面來看,一方面是負面的新聞情緒,另一方面是藥品基金估值的整體下調,主要短期維持震盪下行行為,修復在這裡很難立即結束,短期偏向觀望,日線壓力150無法突破繼續維持震盪下行。姚明生物短期主要是觀望。

特斯拉, $特斯拉 (TSLA.US)$ 一些看漲的股票,已確認在特斯拉的短期日常水平上持續下降趨勢,只需等待它跌破支撐位。至於基本面,持續的低評估已給市場帶來恐慌,隨後是較強的利率,不利的成長股估值,尤其是業績增長率的情況,市場上有一些差異,等待調整結束,技術層面的短期壓力在1000整數水平,下方支撐在$800。

2318平安低波動性,對整個市場而言,高低之間有轉換的跡象,成長股市場預計將上修,低值板塊機會很高,因此,顯然在不久的將來,平安拒絕跟隨指數調整,短期左側低吸為主,日內支撐約55元,63元是開啟反彈空間,為了安全起見,慢慢低吸,等待解套。

會議強調了“適當推進製造行業投資”和“增加新能量源的吸收能力”,以及在國有企業改革中“推進電力網和鐵路等自然壟斷行業改革”,提高了行業併購的預期。

綠色能源大會強調“增加新能源吸收能力”,“促進煤炭和新能源優化結合”,直接惠及綠色能源,尤其是火電轉型。

[ 煤炭化工 ] 會議強調了“原材料能源不納入能源消耗總量控制”,意味著只要不燃燒煤,而是用來製造產品,就不算是能源消耗,從而可以大大加快項目審批進程,尤其是對優異的清潔煤化工領先企業。

[ 物流 ] 會議強調“加快內外聯通形成,安全高效的物流網絡”,此外週末還發布了“十四五”冷鏈物流發展規劃,物流和交通本身直接受益於品種的經濟復甦。

[ 氫能源 ] 隨著第十五期的啟動和行業的持續發展,國內氫能源發展框架,指導文件已經準備就緒。

會議繼續提及種子,並對種子法案進行進一步修訂,文檔一,等等。

[ 數字貨幣 ] 北京冬奧會是國內數字人民幣試點的重要場景,也是“名片”的重要公開展示,數字人民幣迎來重要推動機會。同時,2022年也將是數字人民幣到來的關鍵年份。

總的來說,我們現在正處於一輪新的國內宏觀政策開始階段,在這種情況下,帶有政策預期的行業將更具想像力,因此帶有工業政策期望的分支將在不久的將來保持活躍。

$恒生指數 (800000.HK)$恒生指數持續低波動,從今天的趨勢可以看到接近支撐位的低點,雖然恒生指數的技術水平下降已被控制,但尚無穩定的跡象。 如果跌破23,100點無法恢復指數重心下移以打開下跌空間,上方反彈壓力點24,000,恒生指數仍處於下跌通道,處於不明顯的止跌前不可盲目追跌。

個別股票:

$比亞迪股份 (01211.HK)$Jády持續下跌,符合預期,在短期內Jády頭部已形成,新能源汽車板塊周邊市場的共振下跌。 在估值修復上存在一些差異。 一方面,利潤增長,另一方面,乘用車的銷售是否會繼續增長,短期逃避是主要的事情。 目前,技術支撐位為240,如果跌破,有加速調整的風險,短期調整等待主要結束。

$藥明康德 (02359.HK)$伊曼努爾·康德持續朝負面方向下跌,但今天反彈後再次下跌。 從目前的基本面來看,一方面是負面的新聞情緒,另一方面是藥品基金估值的整體下調,主要短期維持震盪下行行為,修復在這裡很難立即結束,短期偏向觀望,日線壓力150無法突破繼續維持震盪下行。姚明生物短期主要是觀望。

特斯拉, $特斯拉 (TSLA.US)$ 一些看漲的股票,已確認在特斯拉的短期日常水平上持續下降趨勢,只需等待它跌破支撐位。至於基本面,持續的低評估已給市場帶來恐慌,隨後是較強的利率,不利的成長股估值,尤其是業績增長率的情況,市場上有一些差異,等待調整結束,技術層面的短期壓力在1000整數水平,下方支撐在$800。

2318平安低波動性,對整個市場而言,高低之間有轉換的跡象,成長股市場預計將上修,低值板塊機會很高,因此,顯然在不久的將來,平安拒絕跟隨指數調整,短期左側低吸為主,日內支撐約55元,63元是開啟反彈空間,為了安全起見,慢慢低吸,等待解套。

已翻譯

+2

21

1

1

大家好,我是老莉

沒有市場只有上漲不下跌,也沒有市場只有跌倒卻不漲。跳得越高,跌倒的痛苦就越多,蹲得越深,以後跳得越高越遠。

儘管今天的市場再次創下新低,但這一新低可以作為中期市場的起點。因為悲觀主義更徹底地釋放,從交易量的角度來看,市場看起來,在指數處於新低之後,基金看起來就會進入市場。如果市場走出一個巨大的積極明天,這將進一步刺激增量資金的加速進入。

它對市場的短期流動性具有緩解作用。

$恒生指數 (800000.HK)$新低後恆生指數再度回升,短期市場風勢並沒有改變。但是,在市場持續下跌和外部市場的復蘇之後,指數下跌的空間不大,但短期內出現大幅反彈的可能性也不大。是的,等待低位收斂並選擇主要方向。在技術層面上,恒生指數繼續保持在下行通道,日內支撐 23,000,壓力高於 24,300 個等待選定方向。

$比亞迪股份 (01211.HK)$比亞迪完全再現了特斯拉低和高趨勢。值得注意的是,短期內估值過高。其次,雖然行業繁榮不變,但業績的增長率影響估值的調整,而隨著上游價格的上漲擠壓下游利潤,而接近年底,確實存在高低轉換的可能性。目前價格高,等待調整結束。如果盤中支撐 240 突破開向下空間,則向上反彈壓力 280 是向上趨勢線壓力。,等待調整結束。

$中芯國際 (00981.HK)$中芯國際今天繼續下跌,仍然保持著昨天的觀點。這種下降不是由壞消息引起的,情緒下降。Kdj 直接向上分歧,預計將形成一個金叉,以推動股價迎來反卡車。越來越仔細地這個位置成為一個金色的坑。

$中國平安 (02318.HK)$中國平安繼續鞏固可以看出,中國平安最近有明顯的走強跡象,並沒有跟隨指數波動。負面因素用盡之後,有望糾正一年中的下降情況。每日支援主要是 55 次討價還價狩獵,頂部是穩定和 63 開。反彈空間。

$騰訊控股 (00700.HK)$騰訊繼續下行趨勢,短期內再次測試先前低點。目前的股票價格在箱子的底部邊緣仍然波動。但是,可以看出,阿里巴巴的波動性 $阿里巴巴-W (09988.HK)$ , $美團-W (03690.HK)$,以及 $小米集團-W (01810.HK)$最近有所下降,基本面已用盡。

中國的概念股現在在左邊,左邊的賠率是足夠的,但穩定和上漲需要時間,並嘗試盡可能低的買入。

沒有市場只有上漲不下跌,也沒有市場只有跌倒卻不漲。跳得越高,跌倒的痛苦就越多,蹲得越深,以後跳得越高越遠。

儘管今天的市場再次創下新低,但這一新低可以作為中期市場的起點。因為悲觀主義更徹底地釋放,從交易量的角度來看,市場看起來,在指數處於新低之後,基金看起來就會進入市場。如果市場走出一個巨大的積極明天,這將進一步刺激增量資金的加速進入。

它對市場的短期流動性具有緩解作用。

$恒生指數 (800000.HK)$新低後恆生指數再度回升,短期市場風勢並沒有改變。但是,在市場持續下跌和外部市場的復蘇之後,指數下跌的空間不大,但短期內出現大幅反彈的可能性也不大。是的,等待低位收斂並選擇主要方向。在技術層面上,恒生指數繼續保持在下行通道,日內支撐 23,000,壓力高於 24,300 個等待選定方向。

$比亞迪股份 (01211.HK)$比亞迪完全再現了特斯拉低和高趨勢。值得注意的是,短期內估值過高。其次,雖然行業繁榮不變,但業績的增長率影響估值的調整,而隨著上游價格的上漲擠壓下游利潤,而接近年底,確實存在高低轉換的可能性。目前價格高,等待調整結束。如果盤中支撐 240 突破開向下空間,則向上反彈壓力 280 是向上趨勢線壓力。,等待調整結束。

$中芯國際 (00981.HK)$中芯國際今天繼續下跌,仍然保持著昨天的觀點。這種下降不是由壞消息引起的,情緒下降。Kdj 直接向上分歧,預計將形成一個金叉,以推動股價迎來反卡車。越來越仔細地這個位置成為一個金色的坑。

$中國平安 (02318.HK)$中國平安繼續鞏固可以看出,中國平安最近有明顯的走強跡象,並沒有跟隨指數波動。負面因素用盡之後,有望糾正一年中的下降情況。每日支援主要是 55 次討價還價狩獵,頂部是穩定和 63 開。反彈空間。

$騰訊控股 (00700.HK)$騰訊繼續下行趨勢,短期內再次測試先前低點。目前的股票價格在箱子的底部邊緣仍然波動。但是,可以看出,阿里巴巴的波動性 $阿里巴巴-W (09988.HK)$ , $美團-W (03690.HK)$,以及 $小米集團-W (01810.HK)$最近有所下降,基本面已用盡。

中國的概念股現在在左邊,左邊的賠率是足夠的,但穩定和上漲需要時間,並嘗試盡可能低的買入。

已翻譯

+1

109

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)