Fieryfury

投票しました

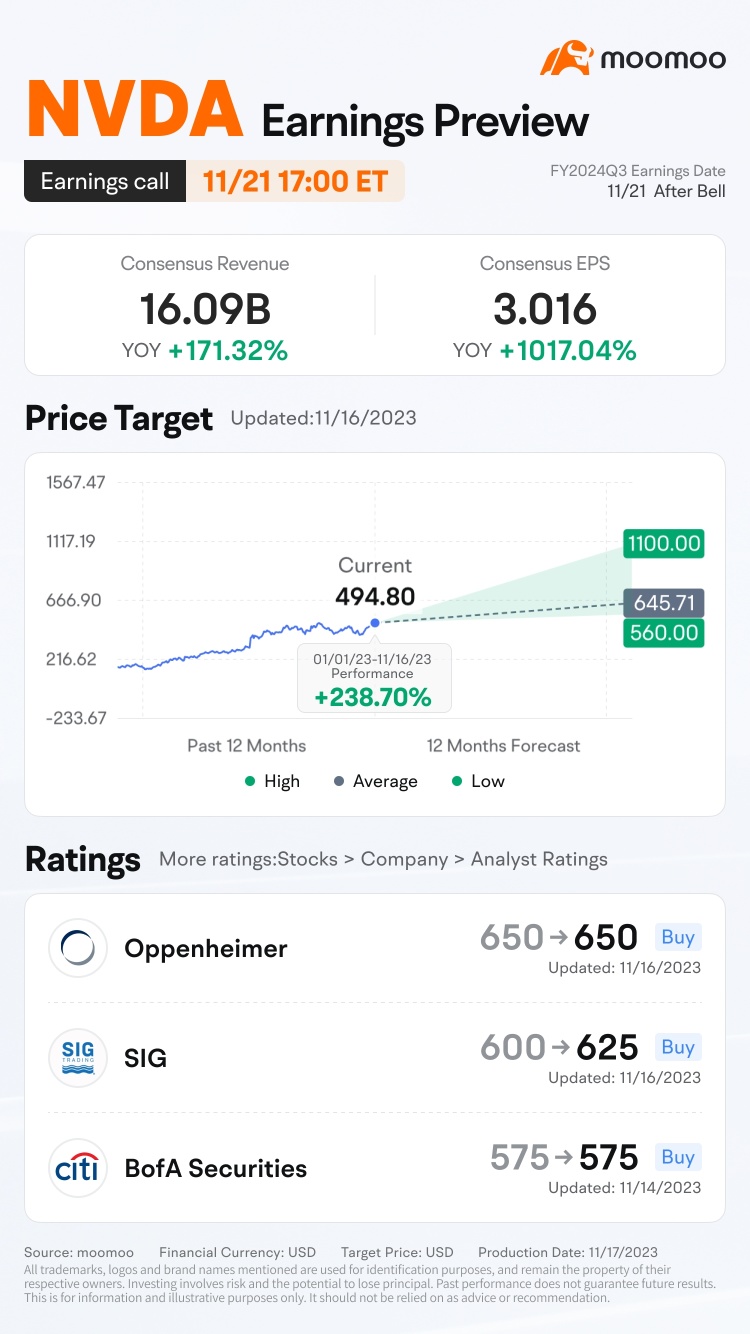

$エヌビディア (NVDA.US)$11月21日のベル後に、エヌビディアはQ3 FY24決算を発表します。![]()

会社の四半期業績に市場がどのように反応するでしょうか?回答を投票して参加しましょう!

報酬

10,000ポイントの平等なシェア: 正しく推測するMooerたちにアップルの $エヌビディア (NVDA.US)$'オープニング価格の 11月22日午前9時30分ET (例えば、50人のmooerが正解すると、それぞれ200ポイントを獲得できます!)

(投票が始まった時点で、プログラムが自動的に開始価格を指定します)

会社の四半期業績に市場がどのように反応するでしょうか?回答を投票して参加しましょう!

報酬

10,000ポイントの平等なシェア: 正しく推測するMooerたちにアップルの $エヌビディア (NVDA.US)$'オープニング価格の 11月22日午前9時30分ET (例えば、50人のmooerが正解すると、それぞれ200ポイントを獲得できます!)

(投票が始まった時点で、プログラムが自動的に開始価格を指定します)

翻訳済み

94

78

9

Fieryfury

投票しました

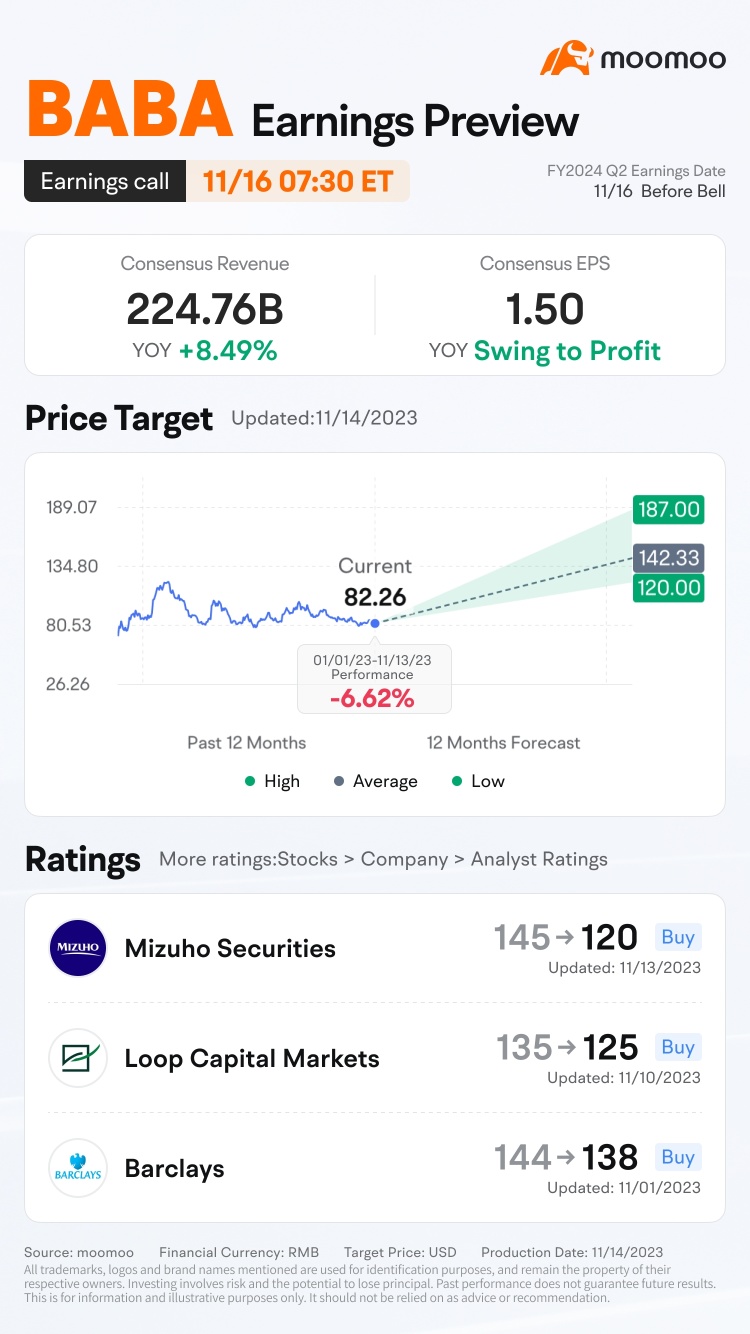

$アリババ・グループ (BABA.US)$企業は11月16日のベル前にQ2 FY2024の収益を発表します。

会社の四半期業績に市場がどのように反応するでしょうか?回答を投票して参加しましょう!

報酬

●1,000ポイントの均等配分:正解を当てたmooerたちアップルの $アリババ・グループ (BABA.US)$'オープニング価格の 16:00 PM ET 11月16日範囲を予想したmooerたちにそれぞれ20ポイントが与えられます。(例えば、50人のmooerが正しい予想をした場合、それぞれ20ポイントずつもらえます。)

(Vo...

会社の四半期業績に市場がどのように反応するでしょうか?回答を投票して参加しましょう!

報酬

●1,000ポイントの均等配分:正解を当てたmooerたちアップルの $アリババ・グループ (BABA.US)$'オープニング価格の 16:00 PM ET 11月16日範囲を予想したmooerたちにそれぞれ20ポイントが与えられます。(例えば、50人のmooerが正しい予想をした場合、それぞれ20ポイントずつもらえます。)

(Vo...

翻訳済み

40

20

3

Fieryfury

コメントしました

全セクターの3つの主要な指数は共に下落し、NASDAQは1%以上下落した。

$インベスコQQQ 信託シリーズ1 (QQQ.US)$米国株式市場は高く始まり、低く落ち続け、最近の下落を継続した。全ての3つの主要な株価指数が下落し、NASDAQは1%以上下落した。終値で、昨年11月に記録的な高値をつけて以来、10.5%下落し、技術的な修正範囲に入った。クローズ時点で、nyダウ指数は0.96%下落して、35028.65になりました; S & P 500 indexは...

$インベスコQQQ 信託シリーズ1 (QQQ.US)$米国株式市場は高く始まり、低く落ち続け、最近の下落を継続した。全ての3つの主要な株価指数が下落し、NASDAQは1%以上下落した。終値で、昨年11月に記録的な高値をつけて以来、10.5%下落し、技術的な修正範囲に入った。クローズ時点で、nyダウ指数は0.96%下落して、35028.65になりました; S & P 500 indexは...

翻訳済み

5

1

Fieryfury

がいいねしました

ポートフォリオに常に90-10のコンセプトを適用する;

投資とは、覚えておいてください。ない取引

投資=5年以上の財富増大

取引=勢いに乗るギャンブル

90%は長期投資

例:

-全市場基金のようなもの $バンガード・S&P 500 ETF (VOO.US)$ $iシェアーズ・コア S&P 500 ETF (IVV.US)$ $SPDR ポートフォリオS&P 500 ETF (SPLG.US)$

この強気市場で常に勢いの一部を所有するため

- 配当成長株式

あなた自身の...

投資とは、覚えておいてください。ない取引

投資=5年以上の財富増大

取引=勢いに乗るギャンブル

90%は長期投資

例:

-全市場基金のようなもの $バンガード・S&P 500 ETF (VOO.US)$ $iシェアーズ・コア S&P 500 ETF (IVV.US)$ $SPDR ポートフォリオS&P 500 ETF (SPLG.US)$

この強気市場で常に勢いの一部を所有するため

- 配当成長株式

あなた自身の...

翻訳済み

52

1

Fieryfury

がいいねしました

"アイスランドをインスパイアする」というアイスランド観光のマーケティングキャンペーンが公開した映像は、10月にFacebookが名称をMetaに変更することを発表したマーク・ザッカーバーグの動画を批判しています。動画の中で、ザッカーバーグは「メタバース」と呼ばれる仮想世界を熱唱するとともに、「モバイルインターネットの後継者になる」と強調しています。」![]()

![]()

![]()

アイスランドについて話すことが目的であれば、新しい観光ビデオは大成功です。![]()

![]()

![]()

メタバースの最も特徴的な品質は、「他の人と一緒にいるような存在感」と言ったZuckerberg。![]()

![]()

![]()

ビデオは、アイスランドの「完全に没入型」の体験、実際の岩、実際の人間、そして「裸眼で見ることができる空」などを賞賛しています。![]()

![]()

![]()

ビデオへの反応は圧倒的に肯定的で、アイスランドの公式による「オリンピックレベルのトローリング」を称賛する人々や、訪問したいという願望を表明する人々が多数います。

mooerたち、このビデオを見てアイスランドを訪れたいと思いましたか?![]()

![]()

![]()

アイスランドについて話すことが目的であれば、新しい観光ビデオは大成功です。

メタバースの最も特徴的な品質は、「他の人と一緒にいるような存在感」と言ったZuckerberg。

ビデオは、アイスランドの「完全に没入型」の体験、実際の岩、実際の人間、そして「裸眼で見ることができる空」などを賞賛しています。

ビデオへの反応は圧倒的に肯定的で、アイスランドの公式による「オリンピックレベルのトローリング」を称賛する人々や、訪問したいという願望を表明する人々が多数います。

mooerたち、このビデオを見てアイスランドを訪れたいと思いましたか?

翻訳済み

173

45

78

Fieryfury

がいいねしました

Q&Aは、機関投資家や個人投資家が経営陣に最も注目する質問を行う企業の業績会議の一環です。このページでは、この後数週間に株価に影響を与える可能性のある情報を確認できます。 $テンセント (TCEHY.US)$ $テンセント (00700.HK)$

態度:マネジメントは、業界の持続的な発展に貢献する新しい規制環境を積極的に受け入れています。

製品:『Wild Rift』は、本物のPC体験をモバイルデバイスに拡張することで、『League of Legends』ユーザーベースを拡大して再活性化することに成功しました。2021年10月、中国のすべてのモバイルゲームのDAUで2位にランクインしました。

アクティブなMini Programの数が前年同期比で40%以上増加しました。

メタバースにおけるあなたたちのポジションをどのように評価していますか、それは次なるインターネットの進化ですか。

メタバースについては、非常に興味深く、大きなコンセプト です。 その結果、既存の業種に成長をもたらす機会があると感じました。 例えば、ゲーム業界にも追加されます。また、ソーシャルネットワーキング業界にも追加されます。そして、ビジネスアプリケーションのようなリアルライフのアプリケーションがある場合には、それがその業界の成長エンジンにもなることが実際にあります。全体的に、私たちはメタバースの機会に向かうための多くの技術と能力の基盤を持っていると感じました。

ゲームの世界での中毒症状に重点を置いた重要性から、メタバースにおける規制立場をどのように見なすべきですか。

サービスに関しては、各地域の規制に準拠する必要があります。つまり、グローバル市場には一連の規制があります。中国の市場には別の一連の規制があります。ただし、メタバースの発展には本質的に反対するものではありません。メタバース自体は、技術駆動が主体になることになります。ジェームスが言及したように、開発に関連する技術が多数あり、ゲームの開発だけでなく、メタバースの開発にも関連する技術が多数あります。したがって、ユーザーエクスペリエンスが規制枠組みの下で提供される限り、中国政府はこのような技術の開発を支援するでしょう。結局、ユーザーエクスペリエンスが規制枠組みの下で提供される限り、中国政府はこのような技術の開発を支援するだろうと思われます。

教育、ゲーム、保険などのいくつかの挑戦的な業種について話し合ったことがありますが、これらの業種が広告ビジネスにどれだけ貢献しているかについてもう少し詳しく教えていただけませんか?

弱点を補完する観点から、数四半期にわたり弱点が続くとコメントしました。したがって、何四半期後に前の傾向に戻るとは考えていない形容詞「数」を強調したいと思います。それらのカテゴリがどれだけ貢献しているかに関しては、方向性として、ゲームは二桁の半ばから下の方向です。教育は現在一桁の低水準に減少し、保険は財務のサブセットですが、再び一桁の低水準の割合になります。比較的健康なカテゴリに関しては、保険を除く金融サービス、パーソナルケア製品、アパレル、食品飲料が挙げられます。

オンラインゲームの分野で、特に海外展開に関して、オンラインゲームの海外展開に向けたいくつかの課題について議論できますか?

今のところ、特に頭にある2つに触れますが、1つは人材獲得の競争です。私たちは、ゲーム業界は本当に才能のある人材に依存していると考えています。そのため、私たちは自社のスタジオだけでなく、投資先や子会社のスタジオと一緒に、最も適切な報酬プランを策定するために多くの時間を費やしています。各状況は少し異なるため、今後も素晴らしい状態に留まり続けることができると思います。これは私たちが多くの時間とエネルギーを注いでいることであり、良いポジションにいられると考えています。ゲーム業界のもう一つの問題は、モバイルゲーム全体でこれが最も重要な問題だと考えられているため、アプリストアの利益プールは、ゲーム開発者よりも大きいという点です。ゲーム業界は、本当に才能のある人材に依存している業種だと私たちは考えています。そのため、私たちは自社のスタジオだけでなく、投資先や子会社のスタジオと一緒に、最も適切な報酬プランを策定するために多くの時間を費やしています。各状況は少し異なるため、今後も素晴らしい状態に留まり続けることができると思います。これは私たちが多くの時間とエネルギーを注いでいることであり、良いポジションにいられると考えています。。私たちは自社スタジオで多くの時間を過ごし、また、投資先や傘下のスタジオと連携し、最適な報酬計画に取り組んでいます。そして、各状況は少し異なります。そして、私たちはそこにいると考えており、我々はそれに多くの時間とエネルギーを費やしているため、今後もその良好な状況を維持できると思います。ゲーム業界の別の問題は、業界全体でモバイルゲームが重要視されているためです。 ゲーム業界の別の課題は、モバイルゲーム全体でこれが最も重要な問題だと考えられているため、アプリストアの利益プールは、ゲーム開発者よりも大きいという点です。

WeChat、ミニプログラム、そしてそこでのeコマースGMVの成長と広告の成長についての最新情報をいただけますか?

ミニプログラムに関しては、GMVと広告の成長については、総じて言えることは、健全で強力な状態が続いているということです。トレンドが維持されている限り、今回の時点では具体的な数字については話しません。実際にミニプログラムの数が40%増加していることをご覧いただけます。つまり、非常に活気のあるエコシステムであり、さまざまな業種とアプリケーションの種類をカバーしています。そして、これがGMVと広告の成長の強力な要因の1つです。 非常に活気のあるエコシステムであり、さまざまな業種とアプリケーションの種類をカバーしています。そして、これがGMVと広告の成長の強力な要因の1つです。今回は、私たちが共有したいことを共有します。

CRM、SaaS、CDNの新しいバージョンに関しては、今年の終わりまでにTencent MeetingとWeComの間でより深い統合を提供するために新しいバージョンを導入する予定のようです。ですから、この即将到来的オンライン広告の機会について、どのように考えるべきでしょうか?

私たちは実際に異なる企業向けのSaaS間でより統合しています。そして、WeComとTencent MeetingとTencent DocsとCDN、および他のSaaSの間にもより多くの統合があるでしょう。また、WeComはWeChatエコシステムにリンクすることもできます。これらの異なるSaaSアプリが互いに話し合うことには、基本的な利点があると言えます。私たちのエンタープライズ向けの異なるSaaSの間の統合がより始まっていることに注目すると、Tencent MeetingとWeCom、Tencent DocsとCDN、そしてその他のSaaSの間にさらに多くの統合があるでしょう。こうすることで、1つまたは2つまたは多くのSaaSアプリケーションを使用したい企業顧客にとって、より統一されたエクスペリエンスを提供することができます。そして、これらのSaaSをWeixin内の消費者にコントロールされた、安全な方法で接続することができることは、企業だけでなく、消費者にとっても非常に役立ちます。そのため、私たちのエンタープライズ向けの異なるSaaSアプリケーションが互いにやり取りするようになると、1つまたは2つまたは多くのSaaSアプリケーションを使用したい企業顧客にとって、より統一されたエクスペリエンスを提供することができます。そして、これらのSaaSをWeixin内の消費者にコントロールされた、安全な方法で接続することができることは、企業だけでなく、消費者にとっても非常に役立ちます。

この記事は、TCEHYの決算説明会のQ&Aセッションからのスクリプトです。読みやすくするために、適切なカットを行っています。詳細を知りたい場合は、できるだけA:企業の金融財務の観点から考えると、ビットコイン市場にはかなりの流動性があることを認識しており、最初のポジションを構築する能力には素早く対応できました。後の3月に売却した際にも、非常に迅速に実行できました。

態度:マネジメントは、業界の持続的な発展に貢献する新しい規制環境を積極的に受け入れています。

製品:『Wild Rift』は、本物のPC体験をモバイルデバイスに拡張することで、『League of Legends』ユーザーベースを拡大して再活性化することに成功しました。2021年10月、中国のすべてのモバイルゲームのDAUで2位にランクインしました。

アクティブなMini Programの数が前年同期比で40%以上増加しました。

メタバースにおけるあなたたちのポジションをどのように評価していますか、それは次なるインターネットの進化ですか。

メタバースについては、非常に興味深く、大きなコンセプト です。 その結果、既存の業種に成長をもたらす機会があると感じました。 例えば、ゲーム業界にも追加されます。また、ソーシャルネットワーキング業界にも追加されます。そして、ビジネスアプリケーションのようなリアルライフのアプリケーションがある場合には、それがその業界の成長エンジンにもなることが実際にあります。全体的に、私たちはメタバースの機会に向かうための多くの技術と能力の基盤を持っていると感じました。

ゲームの世界での中毒症状に重点を置いた重要性から、メタバースにおける規制立場をどのように見なすべきですか。

サービスに関しては、各地域の規制に準拠する必要があります。つまり、グローバル市場には一連の規制があります。中国の市場には別の一連の規制があります。ただし、メタバースの発展には本質的に反対するものではありません。メタバース自体は、技術駆動が主体になることになります。ジェームスが言及したように、開発に関連する技術が多数あり、ゲームの開発だけでなく、メタバースの開発にも関連する技術が多数あります。したがって、ユーザーエクスペリエンスが規制枠組みの下で提供される限り、中国政府はこのような技術の開発を支援するでしょう。結局、ユーザーエクスペリエンスが規制枠組みの下で提供される限り、中国政府はこのような技術の開発を支援するだろうと思われます。

教育、ゲーム、保険などのいくつかの挑戦的な業種について話し合ったことがありますが、これらの業種が広告ビジネスにどれだけ貢献しているかについてもう少し詳しく教えていただけませんか?

弱点を補完する観点から、数四半期にわたり弱点が続くとコメントしました。したがって、何四半期後に前の傾向に戻るとは考えていない形容詞「数」を強調したいと思います。それらのカテゴリがどれだけ貢献しているかに関しては、方向性として、ゲームは二桁の半ばから下の方向です。教育は現在一桁の低水準に減少し、保険は財務のサブセットですが、再び一桁の低水準の割合になります。比較的健康なカテゴリに関しては、保険を除く金融サービス、パーソナルケア製品、アパレル、食品飲料が挙げられます。

オンラインゲームの分野で、特に海外展開に関して、オンラインゲームの海外展開に向けたいくつかの課題について議論できますか?

今のところ、特に頭にある2つに触れますが、1つは人材獲得の競争です。私たちは、ゲーム業界は本当に才能のある人材に依存していると考えています。そのため、私たちは自社のスタジオだけでなく、投資先や子会社のスタジオと一緒に、最も適切な報酬プランを策定するために多くの時間を費やしています。各状況は少し異なるため、今後も素晴らしい状態に留まり続けることができると思います。これは私たちが多くの時間とエネルギーを注いでいることであり、良いポジションにいられると考えています。ゲーム業界のもう一つの問題は、モバイルゲーム全体でこれが最も重要な問題だと考えられているため、アプリストアの利益プールは、ゲーム開発者よりも大きいという点です。ゲーム業界は、本当に才能のある人材に依存している業種だと私たちは考えています。そのため、私たちは自社のスタジオだけでなく、投資先や子会社のスタジオと一緒に、最も適切な報酬プランを策定するために多くの時間を費やしています。各状況は少し異なるため、今後も素晴らしい状態に留まり続けることができると思います。これは私たちが多くの時間とエネルギーを注いでいることであり、良いポジションにいられると考えています。。私たちは自社スタジオで多くの時間を過ごし、また、投資先や傘下のスタジオと連携し、最適な報酬計画に取り組んでいます。そして、各状況は少し異なります。そして、私たちはそこにいると考えており、我々はそれに多くの時間とエネルギーを費やしているため、今後もその良好な状況を維持できると思います。ゲーム業界の別の問題は、業界全体でモバイルゲームが重要視されているためです。 ゲーム業界の別の課題は、モバイルゲーム全体でこれが最も重要な問題だと考えられているため、アプリストアの利益プールは、ゲーム開発者よりも大きいという点です。

WeChat、ミニプログラム、そしてそこでのeコマースGMVの成長と広告の成長についての最新情報をいただけますか?

ミニプログラムに関しては、GMVと広告の成長については、総じて言えることは、健全で強力な状態が続いているということです。トレンドが維持されている限り、今回の時点では具体的な数字については話しません。実際にミニプログラムの数が40%増加していることをご覧いただけます。つまり、非常に活気のあるエコシステムであり、さまざまな業種とアプリケーションの種類をカバーしています。そして、これがGMVと広告の成長の強力な要因の1つです。 非常に活気のあるエコシステムであり、さまざまな業種とアプリケーションの種類をカバーしています。そして、これがGMVと広告の成長の強力な要因の1つです。今回は、私たちが共有したいことを共有します。

CRM、SaaS、CDNの新しいバージョンに関しては、今年の終わりまでにTencent MeetingとWeComの間でより深い統合を提供するために新しいバージョンを導入する予定のようです。ですから、この即将到来的オンライン広告の機会について、どのように考えるべきでしょうか?

私たちは実際に異なる企業向けのSaaS間でより統合しています。そして、WeComとTencent MeetingとTencent DocsとCDN、および他のSaaSの間にもより多くの統合があるでしょう。また、WeComはWeChatエコシステムにリンクすることもできます。これらの異なるSaaSアプリが互いに話し合うことには、基本的な利点があると言えます。私たちのエンタープライズ向けの異なるSaaSの間の統合がより始まっていることに注目すると、Tencent MeetingとWeCom、Tencent DocsとCDN、そしてその他のSaaSの間にさらに多くの統合があるでしょう。こうすることで、1つまたは2つまたは多くのSaaSアプリケーションを使用したい企業顧客にとって、より統一されたエクスペリエンスを提供することができます。そして、これらのSaaSをWeixin内の消費者にコントロールされた、安全な方法で接続することができることは、企業だけでなく、消費者にとっても非常に役立ちます。そのため、私たちのエンタープライズ向けの異なるSaaSアプリケーションが互いにやり取りするようになると、1つまたは2つまたは多くのSaaSアプリケーションを使用したい企業顧客にとって、より統一されたエクスペリエンスを提供することができます。そして、これらのSaaSをWeixin内の消費者にコントロールされた、安全な方法で接続することができることは、企業だけでなく、消費者にとっても非常に役立ちます。

この記事は、TCEHYの決算説明会のQ&Aセッションからのスクリプトです。読みやすくするために、適切なカットを行っています。詳細を知りたい場合は、できるだけA:企業の金融財務の観点から考えると、ビットコイン市場にはかなりの流動性があることを認識しており、最初のポジションを構築する能力には素早く対応できました。後の3月に売却した際にも、非常に迅速に実行できました。

翻訳済み

76

1

4

Fieryfury

がいいねしました

$Silverlake Axis (5CP.SG)$私はまだ損失を抱えています...保有し続けます...創業板。DYODD。

翻訳済み

7

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)