US Stock MarketDetailed Quotes

.IXIC Nasdaq Composite Index

- 17392.463

- +93.176+0.54%

Trading Apr 1 13:44 ET

17506.585High17149.358Low

17221.549Open17299.287Pre Close4.56BVolume20204.58152wk High1440Rise2.07%Amplitude15222.77752wk Low1687Fall17327.971Avg Price141Flatline

$Nasdaq Composite Index (.IXIC.US)$ 有人能告诉我为什么在关税执行前一天市场会暴力反弹吗?

3

$Nasdaq Composite Index (.IXIC.US)$ where is the fucking tariff????? where is the impact ???????

1

2

$Nasdaq Composite Index (.IXIC.US)$ as mention 17000 support all in buy bet rebound?or all in buy telca follow korean

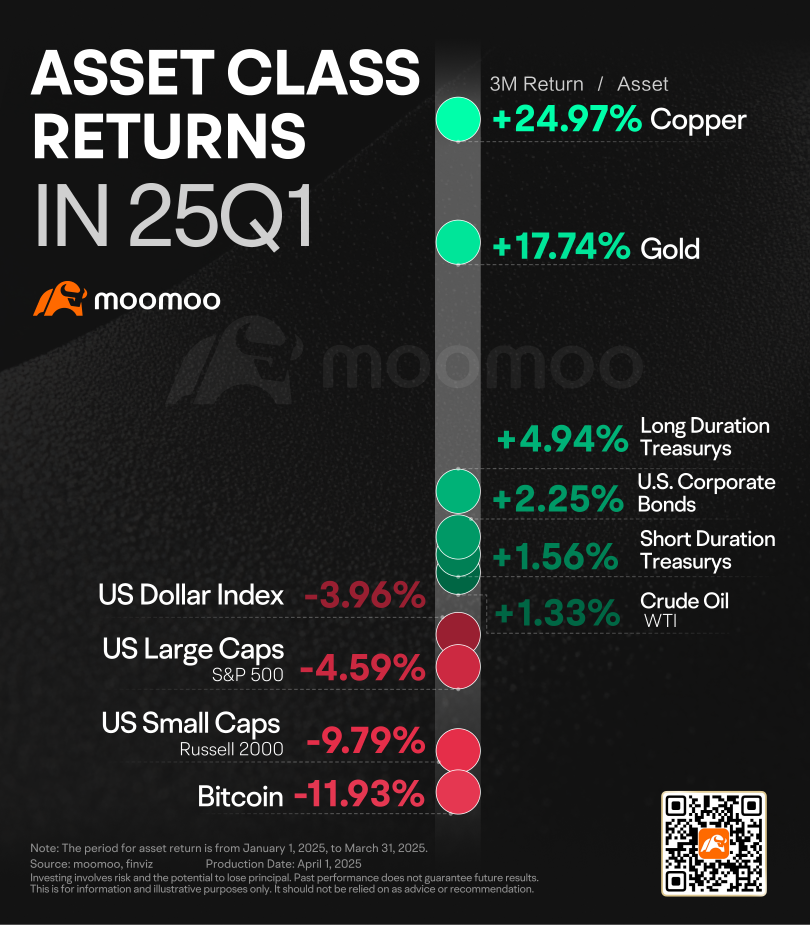

The first quarter of 2025 painted a clear picture of global asset performance: safe-haven assets surged while riskier bets stumbled. Fears of an economic downturn fueled gains in government bonds and gold, with the latter soaring over 17%. Meanwhile, copper stole the spotlight, climbing nearly 25%, propelled by tariff uncertainties and inflationary pressures.

U.S. equities, however, faced a turbulent Q1, rattled by the unpredictability of Trump-era po...

U.S. equities, however, faced a turbulent Q1, rattled by the unpredictability of Trump-era po...

7

8

$Nasdaq Composite Index (.IXIC.US)$ 17200 strong support...跌不破1

$Nasdaq Composite Index (.IXIC.US)$ HERE IT COMES!

White House aids have drafted the proposal that would impose tariffs of at least 20% on MOST imports coming into the US.

To put this in plain English,

the past two months of turbulence in the market has been centered around tariffs between Mexico Canada , China. President Trump has mentioned the pharmaceutical industry on Air Force One this past Sunday he's talked about tariffs on chips multiple times but nothing has happened specifically to t...

White House aids have drafted the proposal that would impose tariffs of at least 20% on MOST imports coming into the US.

To put this in plain English,

the past two months of turbulence in the market has been centered around tariffs between Mexico Canada , China. President Trump has mentioned the pharmaceutical industry on Air Force One this past Sunday he's talked about tariffs on chips multiple times but nothing has happened specifically to t...

1

8

$Nasdaq Composite Index (.IXIC.US)$ The line in the Sand

everyone witnessed the prior administration fail at foreign policies against what everybody would agree was the enemy.

their use of single words one syllable was the extent of their threats DONT

This was repeated by the senile person who occupied 1600 Pennsylvania avenue and the laughing hyena who was as brain dead as someone sitting in a hospital on life support.

We now have a new President and he is being tested.

Several weeks ago pre...

everyone witnessed the prior administration fail at foreign policies against what everybody would agree was the enemy.

their use of single words one syllable was the extent of their threats DONT

This was repeated by the senile person who occupied 1600 Pennsylvania avenue and the laughing hyena who was as brain dead as someone sitting in a hospital on life support.

We now have a new President and he is being tested.

Several weeks ago pre...

2

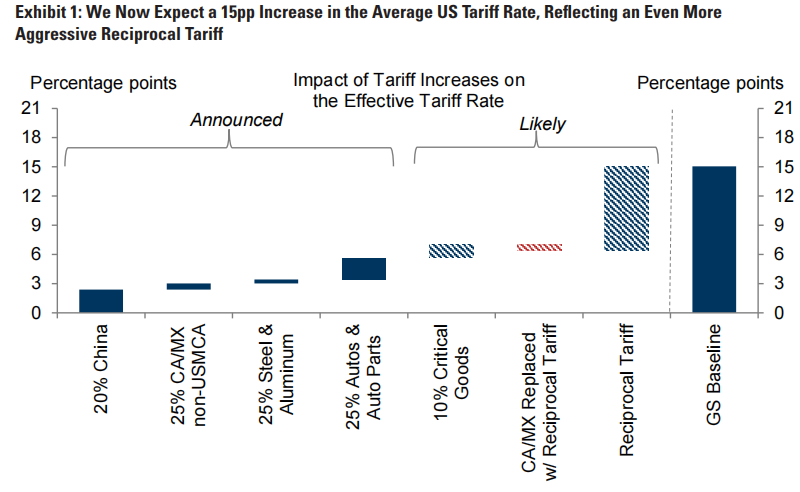

President Donald Trump's recent declaration that his forthcoming "reciprocal tariffs" plan will encompass all nations has stirred significant interest and apprehension across the financial markets. With April 2nd now labeled "Liberation Day" by Trump, speculation is rife about the potential impacts on U.S. and global trade dynamics.

Immediate Market Reactions and Future Speculations

Historically, tariff anno...

Immediate Market Reactions and Future Speculations

Historically, tariff anno...

23

9

26

On April 2, 2025, the Trump administration is set to announce a series of "reciprocal tariffs," a move Trump himself has called "Liberation Day." This marks the day America is supposedly freed from the "long-term exploitation" by its trading partners.

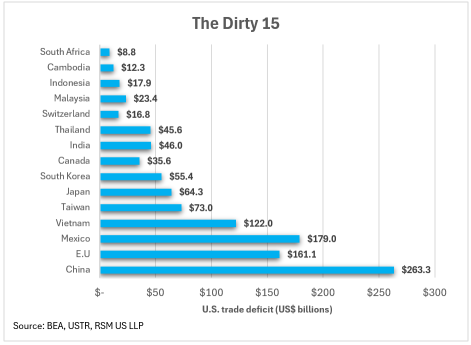

The push for these tariffs stems from concerns over the U.S. trade deficit. According to the concept of "Dirty 15," coined by Scott Bessent, the top 15 countries responsible for the largest U...

The push for these tariffs stems from concerns over the U.S. trade deficit. According to the concept of "Dirty 15," coined by Scott Bessent, the top 15 countries responsible for the largest U...

+6

11

1

No comment yet

?!

?!

091109110911 : Will there be a celebration the night before your wedding?

the night before your wedding?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

74349003 OP 091109110911 : I have never been married, so I don’t know.

Tan Sri Kaw : Is this also called violent rebound?