No Data

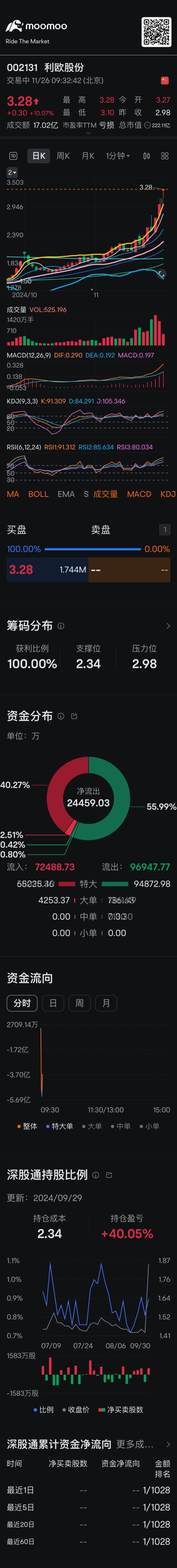

002131 Leo Group Co.,Ltd.

- 3.43

- +0.31+9.94%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

On the leaderboard, Leo Group Co.,Ltd. has achieved two consecutive涨停板, and Institutions have net bought 0.11 billion yuan.

Leo Group Co.,Ltd. (002131.SZ) hit the daily limit for two consecutive days, with a transaction amount of 5.014 billion yuan and a Turnover Ratio of 25.82%. According to the data from the stock market leader board, two Institutions ranked as the second and fifth buyers, with a total net purchase of 0.11 billion yuan; HK->SZ bought 0.129 billion yuan while selling 0.219 billion yuan, resulting in a net sell of 90.1759 million yuan; speculative funds 'Fang Xinxia' ranked as the third buyer, with a net purchase of 64.8194 million yuan. (Gelonghui)

Dragon Tiger List | SGSG Science&Technology received 0.23 billion yuan in capital speculation, with the retail investor 'Little Crocodile' fleeing T&S Communications.

The top three by investment amount are SGSG Science&Technology, T&S Communications, and Leo Group Co.,Ltd.

Leo Group Co., Ltd.'s (SZSE:002131) 30% Dip In Price Shows Sentiment Is Matching Revenues

The Byte Volcano Engine Developer Conference is about to begin, and the performance of domestic AI applications is expected to be rapidly released.

On December 19, the developer forum of the Volcanic Engine Winter FORCE Power Conference will be launched, focusing on the practices of the Volcanic Engine in the development, application, and implementation of large models. Northeast Securities' Wu Yuanheng believes that next year will be a significant year for domestic AI software and Hardware, driving rapid performance releases of related leading applications and Hardware companies.

Leo Group (SZSE:002131) Could Be Struggling To Allocate Capital

Leo Group Co.,Ltd. (002131.SZ): pb ratio is 2.82 times, rolling pe ratio is negative.

On December 5th, Gelonghui reported that leo group co.,ltd. (002131.SZ) issued a notice about severe abnormal fluctuations in stocks trading. According to data released by China Securities Index Co., Ltd., as of December 5, 2024, the company's pb is 2.82 times. The pb for the industry classification "L72 Business Services" is 1.89 times, indicating that the company's current pb is higher than the aforementioned industry pb. The rolling pe for the industry classification "L72 Business Services" is 25.88 times, while the company's rolling pe is negative.