No Data

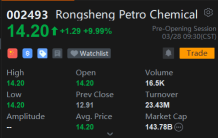

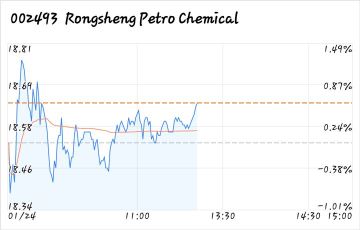

002493 Rongsheng Petro Chemical

- 9.78

- +0.12+1.24%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

MSCI Upgrades Rongsheng Petrochemical's ESG Rating to BBB for Advancing Green Practices

Guosheng Securities: The likelihood of oil price fluctuations will increase in 2025, and the petrochemical sector is expected to welcome global strategy-level configuration opportunities.

Therefore, before the stabilization of the global macroeconomic situation in the mid-term, oil prices may be suppressed by expectations of a downturn for a certain period of time.

The Three-year Earnings Decline Is Not Helping Rongsheng Petrochemical's (SZSE:002493 Share Price, as Stock Falls Another 3.7% in Past Week

Rongsheng Petrochemical Co., Ltd.'s (SZSE:002493) Biggest Owners Are Private Companies Who Got Richer After Stock Soared 4.2% Last Week

Research reports | gtja: Maintaining a 'shareholding' rating on rongsheng petro chemical, with a target price of 12.23 yuan.

Gtja research reports pointed out that the reason for the lower-than-expected performance of rongsheng petro chemical (002493.SZ) in the third quarter is the weak demand for chemicals, and the impact of new energy replacing finished oil, resulting in demand lower than market expectations. In addition, the significant fluctuations in oil prices in the third quarter have brought about some devaluation effects on performance. The company has signed multiple strategic agreements with Saudi Aramco, planning to expand downstream markets through mutual shareholding of subsidiaries, joint projects, and jointly develop overseas markets. On August 21, the company announced that the controlling shareholder intends to continue to increase its shareholding in the company by an amount not less than 0.5 billion yuan and not more than 1 billion yuan, without setting a shareholding price range. This major shareholder

Express News | Yulong Petrochemical Aims to Start Test Runs at Second 200,000-Bpd Crude Unit in January -Sources

Comments

$Luxshare Precision Industry (002475.SZ)$

$Hangzhou Hikvision Digital Technology (002415.SZ)$

$Muyuan Foods (002714.SZ)$

$NAURA Technology Group (002371.SZ)$

$CGN Power Co.,Ltd. (003816.SZ)$

$S.F. Holding (002352.SZ)$

$Bank Of Ningbo (002142.SZ)$

$Jiangsu Yanghe Distillery (002304.SZ)$

$Guosen (002736.SZ)$

$Iflytek Co.,ltd. (002230.SZ)$

$Focus Media Information Technology (002027.SZ)$

$Rongsheng Petro Chemical (002493.SZ)$

$Zhejiang Sanhua Intelligent Controls (002050.SZ)$

���������...