No Data

00285 BYD ELECTRONIC

- 40.300

- -1.250-3.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

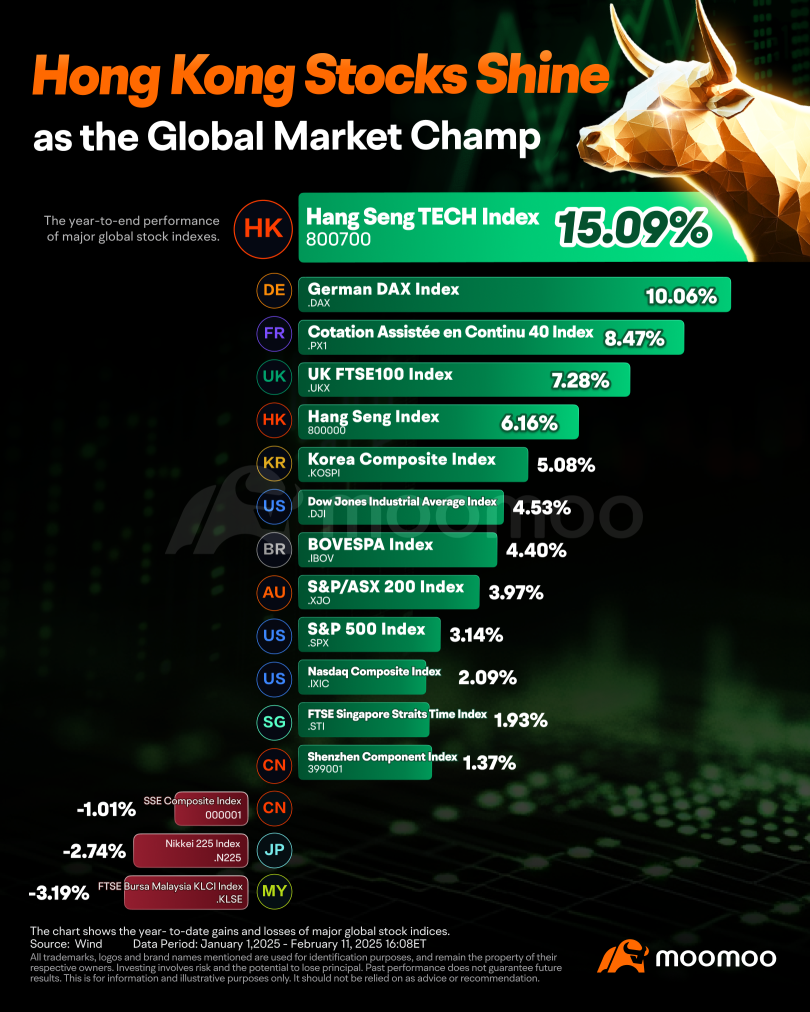

The pattern of "weak performance of the technology stocks" in the Hong Kong stock market is intensifying. What direction will the market take next?

① Currently, the profit growth of Hong Kong stocks mainly relies on the optimization of profit margins in the Technology Sector rather than revenue expansion. Does this imply that the foundation for sustained market growth in the future is relatively weak? ② For the "Adjustment of Technology Positions + Dividend Hedging" strategy proposed by CICC, how should investors balance the conflict between short-term volatility defense and long-term strategy adherence?

Brokerage morning meeting highlights: Focus on economic performance exceeding expectations or new catalysts in Technology, and emphasize structural opportunities in Technology and the pro-cyclical main line.

At today's Brokerage morning meeting, China Securities Co.,Ltd. suggested focusing on the economy exceeding expectations or new catalysts in Technology, emphasizing structural opportunities in Technology and pro-cyclical main lines; KSY Securities believes that the overall Hong Kong stock market has not yet entered a full bull market rally stage; HTSC stated that the overall lithium battery production scheduling in April has improved month-on-month, Bullish on the marginal continuous improvement of supply and demand in the Industry Chain.

DBS: Maintains "Buy" rating on BYD Electronics (00285), target price adjusted to HKD 66.5.

The bank has lowered its earnings per share forecast for BYD Electronics for the fiscal year 2025, reflecting lower profit margins.

Xiaomi Stock and the Rest of China's 'Terrific 10' Are the Tech Bet for 2025 -- Barrons.com

Citigroup: Lowers BYD Electronic's (00285) Target Price to HKD 45 and downgrades the rating to "Neutral".

The bank stated that the current stock price has fully reflected the company's growth this year, and short-term stock price catalysts may include the shipment of "H20 NVL16" and the launch of "Pura 80".

CITIC International: Raised the Target Price for BYD Electronics to HKD 53.2, with a rating of "Buy".

CICC released a Research Report stating that BYD Electronics (00285) performed below expectations in the second half of last year, and management expects future profits to improve due to various catalysts. Additionally, domestic demand for AI Servers continues to be released, and BYD Electronics' businesses such as liquid cooling, power supply, and server enclosures also have significant elasticity. The bank maintains a "Buy" rating for the group, raising the Target Price from HK$39.4 to HK$53.2.

Comments

my view, it is about outlook.. yesterday slide 10%..today din manage to bounce up..overall market is weak. not an inducement to buy or sell. I will choose to sit on the bench learn, observe how media release news n how prices are affected

why going down, anyone know?

Could be a potential bullish flag pattern here and if able to hold as a higher low around its HKD 48 regions, could breakout from its HKD 55+ main downtrend resistance until we see a further breakout.

Support: HKD 48.70 area

Resistance: HKD 50, HKD 54, HKD 56 areas

![BYD ELECTRONICS [Titan Weekend Chart Reviews]](https://sgsnsimg.moomoo.com/sns_client_feed/103290357/20250310/8279e7369b50aa6922d53c0b46f53167.jpg/thumb?area=104&is_public=true)

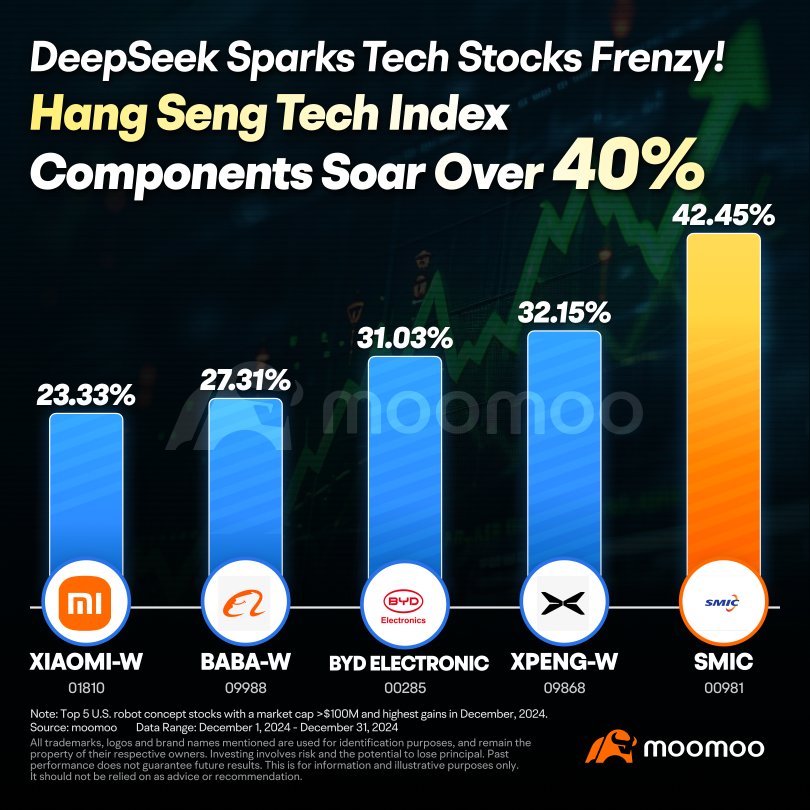

Among its components, $SMIC (00981.HK)$ gained 42...

COWmustMoo OP : today 27/3..many tech stock bounce up..this one hmm