No Data

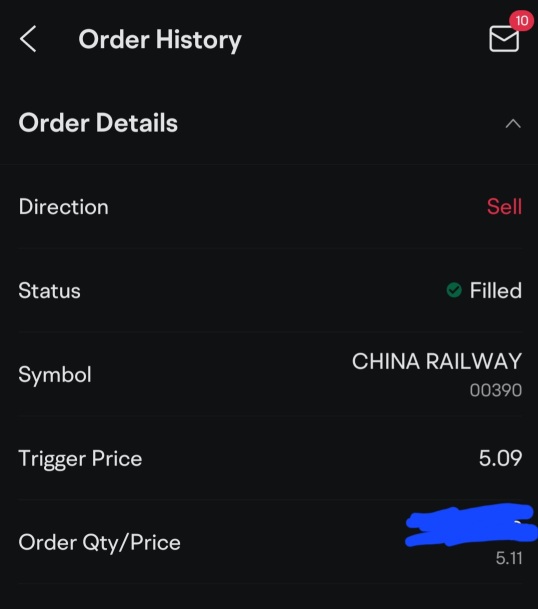

00390 CHINA RAILWAY

- 3.800

- -0.030-0.78%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

"No price limit" has sparked intense competition: in Peking, the two plots have attracted over 400 rounds of bidding, totaling nearly 18.2 billion.

At the beginning of 2025, the Peking land auction market welcomed a strong start, with two plots sold for nearly 18.2 billion yuan at a High Stock Price. Due to the absence of price limits on these two plots, developers fiercely competed, with a total of over 400 bidding rounds for the two plots.

Guosen 2025 Annual Industry strategy for the construction sector: Moving towards a balance sheet reduction era and welcoming valuation return.

The reason that construction companies have long-term negative equity is due to the increase in the proportion of long-term Assets and a decline in Asset quality. With the implementation of a series of debt restructuring policies, related receivables of construction companies are expected to be settled, leading to a recovery in Asset quality and a repair in PB valuation.

Infrastructure stocks are collectively under pressure, with China Railway (00390) down 3.54%. Institutions indicate that current state-owned general contractors are facing significant pressure on both the payment and receipt ends.

Jinwu Finance | Infrastructure stocks are collectively under pressure, with China Railway (00390) down 3.54%, TIMES ELECTRIC (03898) down 3.35%, CHINA COMM CONS (01800) down 3.1%, Metallurgical Corporation of China (01618) down 3.05%, China Railway Signal & Communication Corporation (03969) down 2.88%, and CRRC Corporation (01766) down 2.79%. Guosen stated that downstream demand in the construction Industry has declined, resulting in fewer new Orders for construction enterprises and slowing growth in output value. Major state-owned enterprises are seizing market share with lower financing costs, while private enterprises are experiencing a continuous decline in revenue performance. Due to engineering payment progress...

Hong Kong stocks are moving differently | Infrastructure stocks today generally fell, as the construction industry's demand showed a seasonal decline. Institutions state that the financial statements of construction companies are under continuous pressure

Infrastructure stocks fell broadly today. As of the time of reporting, China Railway (00390) dropped 3.79%, closing at 3.81 HKD; TIMES ELECTRIC (03898) fell 3.66%, closing at 31.6 HKD; CRRC Corporation (01766) decreased by 2.79%, closing at 4.87 HKD; China Railway Construction Corporation (01186) fell by 2.62%, closing at 5.58 HKD; China Communications Construction (01800) declined by 2.73%, closing at 5.34 HKD.

China Railway Prefabricated Construction (SZSE:300374) Pulls Back 11% This Week, but Still Delivers Shareholders Respectable 13% CAGR Over 5 Years

Does China Railway Hi-tech Industry (SHSE:600528) Have A Healthy Balance Sheet?

Comments

🔥Re-lending and Swap Facility: The People’s Bank of China launched initiatives to support stock buybacks and provide liquidity for invest...

$CHINA RAILWAY (00390.HK)$