No Data

00939 CCB

- 6.620

- +0.090+1.38%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Huayu Expressway Group Arm Secures 300 Million Yuan Banking Facility

【Brokerage Focus】CITIC SEC expects fluctuations in the capital market in February, with the annual credit expansion pace possibly showing a "low at both ends and high in the middle".

Jinwu Finance | CITIC SEC stated that looking at the forward financial data, due to factors at the beginning of the year combined with a high base figure, the bank expects the increase in RMB loans in January to approach 5 trillion yuan, and the growth rate of social financing is expected to maintain around 8.0%. The favorable start to lending at the beginning of the year and the government's proactive fiscal measures, along with the multidimensional effects of precise regulation by monetary authorities, have resulted in a neutral to tight funding environment in January. Looking ahead, the sustainability of the favorable start to lending, the pace of government bond issuance, and the intensity of liquidity injections by the central bank may be core determining factors for the funding market and credit market in the next stage. The funding market in February is expected to have space for fluctuations, and the pace of credit expansion for the whole year may present.

CITIC SEC: The Banks Sector returns to the fundamental framework, focusing on absolute return opportunities.

The difference between the dividend yield and the risk-free yield has widened, which also implies an enhancement in the potential allocation strength of Banks stocks.

UH Law Center Alumni and Students Help Houston Artist Secure a Copyright Settlement Against Warner Bros. Discovery and TLC

The central bank: In January, the operations of the standing lending facility for Financial Institutions totaled 17.105 billion yuan.

In January 2025, the People's Bank conducted standing lending facility operations for Financial Institutions totaling 17.105 billion yuan, including 11.335 billion yuan for overnight, 1.77 billion yuan for 7-day, and 4 billion yuan for 1-month periods.

After the emergence of DeepSeek, multiple Banks have initiated in-depth research testing, and the implementation of large models in the Industry is still in open exploration.

Several Banks' fintech leaders have expressed to the Financial Associated Press that they are already paying attention to and beginning to study the impact of DeepSeek on bank fintech. As models like DeepSeek can greatly reduce training and usage costs, they will provide significant assistance for the future widespread application of large models in Banks. However, large models in the banking system are still in the phase of open exploration.

Comments

hodling these forever ❤️

and use dividends to buy more 😁

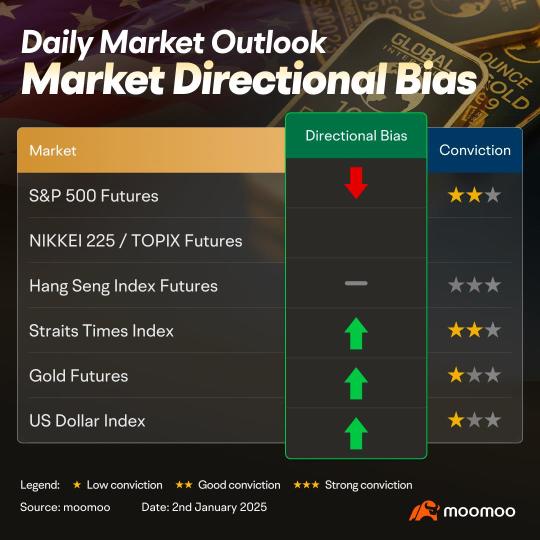

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ **]We turn bearish as price has dropped past previous support levels. As long as price stays below 5985 resistance level, we expect price to continue dropping towards support level at 5870. Technical indicators are advocating for a bearish scenario as well.

Alternatively: A 4 hour candlesti...

🔥Re-lending and Swap Facility: The People’s Bank of China launched initiatives to support stock buybacks and provide liquidity for invest...

hopefully I can maintain and further improve winning rate in future

loading...

105716756 : Have been doing this for Almost a decade. Initially holding 120000 shares to now more than 350000 shares.

933199333 : Smart.. Deserve to be rich.