No Data

00960 LONGFOR GROUP

- 11.120

- +0.200+1.83%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Will the sales of the top 100 real estate companies drop month-on-month in November? Will there be a strong finish in December?

① November is the second complete calendar month after the "926" easing policy. Overall, real estate companies' sales have declined compared to October; ② "It is expected that real estate companies will maintain strong promotional efforts in December to boost performance, and sales in top 100 companies and core cities are likely to continue improving on a month-on-month and year-on-year basis."

Hong Kong stocks have shown unusual movements, with mainland real estate generally rising. In November, the top 100 real estate companies' sales volume showed a clear rebound compared to the third quarter, with expectations for a major conference continui

Mainland real estate stocks generally rose, as of the time of publication, Shimao Group (00813) rose by 6.31%, to HK$1.18; RonshineChina (03301) rose by 5.68%, to HK$0.465; Sunac (01918) rose by 4.03%, to HK$2.58.

Follow up on Guangzhou! First-tier cities all cancel the standard of ordinary and non-ordinary residential properties, what is the market impact?

① With Guangzhou's official announcement today, all four first-tier cities have now canceled the standards for ordinary residences and non-ordinary residences. ② "For first-tier cities, after canceling the standards for ordinary residences and non-ordinary residences, it can significantly reduce the value-added tax costs in the second-hand housing trade process, lower transaction costs, and promote improving demand."

haitong int'l: Significant improvement in commodity housing sales in October, with a narrowing year-on-year decline in completion.

The current real estate sector's market cap as a percentage of economic value is not completely equivalent, indicating potential for value reassessment.

The unchanged LPR in November meets market expectations. Industry insiders do not rule out the possibility of further interest rate cuts next year along with the reverse repurchase rate.

① By the end of the year, the economic running is expected to continue its upward trend, with policy interest rates likely to remain stable and LPR quote also expected to stay unchanged. ② There is a high possibility of further reductions in deposit rates in the future, coupled with the issuance of special treasury bonds to support large state-owned commercial banks in replenishing their core tier one capital, which is expected to gradually alleviate the interest spread and operational pressure for commercial banks. It is possible that next year the LPR quote may be accompanied by further interest rate cuts on reverse repurchase agreements.

According to the Finger Research Institute, in October, the average price of second-hand residences in 100 cities dropped by 7.27% compared to the same period last year.

According to data monitoring by the China Index Academy, in October 2024, the average price of second-hand residences in 100 cities was 14,360 yuan per square meter, a month-on-month decrease of 0.60%, narrowing the decline by 0.10 percentage points compared to September; a year-on-year decrease of 7.27%.

Comments

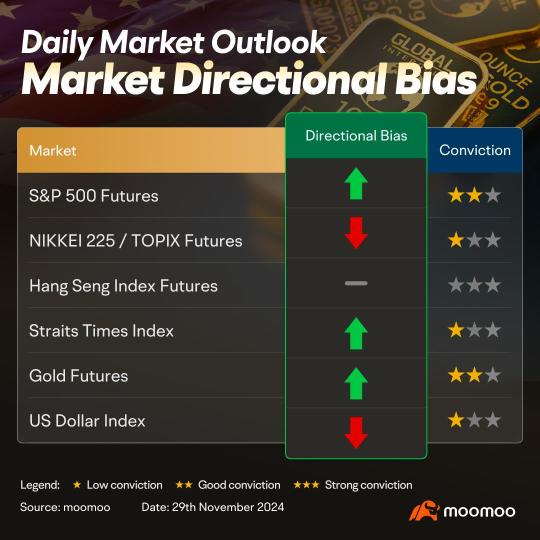

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias as we expect price to continue pushing towards 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 5970 suppo...

Coterra Energy Inc (CTRA US) $Coterra Energy (CTRA.US)$

Daily Chart -[BULLISH ↗ **]CTRA US pushed higher after shaping a bullish breakout. As long as price is holding above 25.20 support, a further push higher towards 26.95 resistance is expected. Technical indicators are advocating for a bullish scenario as well with bullish momentum building and MA golden cross is seen.

Alternatively: A daily candlestick closing below 25.20...

Analysis

Price Target

No Data

Business Data

No Data

104556909 : Ok

QiamTrader : nice

103677010 : noted

Ahmad Fiqri :