No Data

01024 KUAISHOU-W

- 45.700

- +1.350+3.04%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Everbright: Maintains "buy" rating for Kuaishou-W with a target price of HKD 60.3.

Everbright Securities released a research report stating that it maintains a "buy" rating for Kuaishou-W (01024). Considering the profit in Q3 2024 exceeded expectations, the adjusted net income forecast for 2024 is slightly raised to 17.6 billion yuan (an increase of 1.9% compared to the last forecast). The company's ecosystem remains healthy, with overseas and local lifestyle businesses having growth potential, and the target price remains at 60.3 Hong Kong dollars. Kuaishou Technology achieved total revenue of 31.1 billion yuan in Q3 2024, a year-on-year increase of 11.4% (vs consensus expectation of +11.1% year-on-year); the adjusted net income was 3.95 billion yuan, slightly exceeding expectations (vs consensus expectation of 3.9 billion).

Hong Kong stocks abnormal movement | Kuaishou-W (01024) rose more than 5% intraday, will be included in the Hang Seng Index constituent stocks at the beginning of next month. The company's DAU growth exceeded expectations.

Kuaishou-W (01024) rose more than 5%, as of the deadline, up 5.07%, trading at 46.6 Hong Kong dollars, with a turnover of 0.742 billion Hong Kong dollars.

Everbright: Maintain "buy" rating for Kuaishou-W (01024) with a target price of 60.3 HKD.

Everbright has revised its forecast for Kuaishou's adjusted net income in 2024 to 17.6 billion yuan.

Kuaishou (01024) accelerates the execution of buybacks, having repurchased over 0.1 billion shares this year.

After the market closed on November 22, Kuaishou-W (01024) announced that it will spend 0.128 billion Hong Kong dollars to repurchase 2.87 million shares at a repurchase price of HK$44.1 to HK$45.45 per share.

Kuaishou Technology to Become Constituent of Hong Kong's Hang Seng Index

【Special Contributor】Guo Jiayao: Market sentiment is cautious, and investors are paying attention to the trends in the exchange rates of the renminbi and corporate profitability.

King Wu Financial News | US stocks continued to perform well last Friday, with economic data showing ideal performance. The market anticipates continued corporate profit growth, and all three major indices closed with gains. The US dollar showed strong movement, with the US ten-year bond yield maintaining at 4.41%. Gold and oil prices rebounded significantly. Hong Kong stock pre-market securities were generally weak, and it is expected that the market will open lower in the early session. The Mainland stock market fell last Friday, with the SHCOMP opening high but falling low, the decline continued to widen, finally closing at the lowest point of the day, down 3.1%. The trading volume in the Shanghai and Shenzhen markets also slightly increased. Hong Kong stocks were pressured by the Mainland stock market, with the index dropping to a low of 19,100 points; however, the decline narrowed slightly at the end of the market.

Comments

HK market is done.. Strong earnings it drop 13% market open. who will invest and believe in HK market 🤔

$Hang Seng Index (800000.HK)$

$HSI Futures(NOV4) (HSImain.HK)$

➡️Online retail sales +16% (big improvement)✅

➡️Property Price Index -5.9% (slightly worsened)🔻

➡️Fixed asset investment +3.4% (same)

➡️Industrial production +5.3% (slightly worsened)🔻

➡️Unemployment rate 5.0% (slightly better)✅

China’s consumer economy is picking up a great deal of momentum in October and setting the stage for a strong 4Q for the likes of $BABA-W (09988.HK)$ $JD-SW (09618.HK)$ $PDD Holdings (PDD.US)$ $MEITUAN-W (03690.HK)$ $BILIBILI-W (09626.HK)$ $KUAISHOU-W (01024.HK)$ $Kraneshares Tr Bosera Msci China A Sh Etf (KBA.US)$ $iShares MSCI China ETF (MCHI.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$

TikTok-like $KUAISHOU-W (01024.HK)$ booms 10.7% on news the platform is entering the Brazil e-commerce market with Kwai Shop. They already have 60m users in the country for Kuaishou.

HK share premiums to ADRs as follows:

$BABA-W (09988.HK)$ +2.9% premium

$JD-SW (09618.HK)$ +2.4% pre...

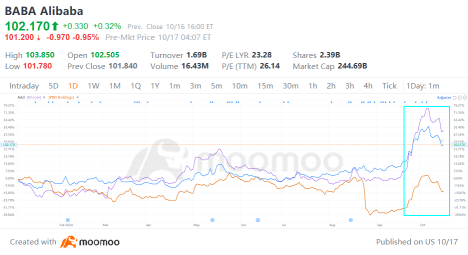

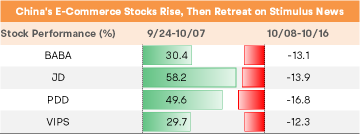

From September 24 to October 7, shares of China's top three e-commerce giants each surged over 30%, with $JD.com (JD.US)$ climbing nearly 60% and $PDD Holdings (PDD.US)$ almost 50%. However, since trading resumed after China's National Day holiday, thes...

Analysis

Price Target

No Data

Business Data

No Data

102385756 : Same same luh. US stock market also got such pattern

搞经济 抄底 加仓 OP 102385756 : Different, those i wasn't involved in it.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

yl859 : Really a scam, now my money is stuck here for months until it recovers

102385756 yl859 : Don't think will be months la. These guys don't have so much time to waste

yl859 102385756 : Welp if is shorter then is better. Anyways just bpught somemore during the dip, hope will speed up things