No Data

01157 ZOOMLION

- 5.760

- +0.040+0.70%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Zhiyu Tong Hong Kong Stock Buyback Statistics | December 11.

Hong Kong stock repurchase Statistics | December 11.

ZOOMLION (01157.HK) spent HKD 1.2557 million to repurchase 0.2284 million shares on December 10.

On December 10th, Gelonghui announced that ZOOMLION (01157.HK) spent 1.2557 million Hong Kong dollars to buy back 0.2284 million shares on December 10, 2024, at a repurchase price of 5.48-5.5 Hong Kong dollars per share.

Zoomlion (000157.SZ): Since its listing, the total amount of dividends distributed is approximately 26.3 billion yuan.

On December 10th, Gelonghui reported that zoomlion (000157.SZ) stated on the investor interaction platform that while achieving its own high-quality development, the company has always placed great importance on returning benefits to all shareholders. It has continuously shared the fruits of its development with investors through cash dividends and share repurchase. Since going public, the cumulative dividend amount is approximately 26.3 billion yuan, far exceeding the amount of funds raised from the stock market. The historical overall dividend rate is about 43%, with a dividend rate of about 68% over the past three years, and the dividend yield has long been at the leading level in the industry. Over the past five years, the company has continuously carried out large-scale repurchases, with a total repurchase amount of nearly 48.

[Brokerage Focus] CMB International expects that the global expansion of China's construction machinery manufacturers will continue in 2025.

Kingwo Financial News | CMB International releases the outlook for china's industrial machinery sector in 2025. The bank expects that the global expansion of china's construction machinery manufacturers will continue in 2025, with the Middle East, Africa, and Latin America emerging markets providing explosive growth potential for various types of machinery. In china, the bank anticipates that the renewal cycle coupled with increased government policy stimulus will help stabilize machinery demand, although the bank's industry model has not yet incorporated aggressive assumptions. From a segmented market perspective, the bank expects excavators to achieve double growth in both china and export markets by 2025, while other machinery will see better growth overseas than in china. The bank's first...

Hong Kong stocks fluctuate | Zoomlion (01157) rises over 3% as the total sales volume of excavators in the country expands. The company expects demand to stabilize next year.

Zoomlion (01157) rose over 3%, as of the time of writing, up 3.28%, priced at 5.66 Hong Kong dollars, with a transaction amount of 68.3838 million Hong Kong dollars.

Hong Kong stock concept tracking | Domestic excavator sales are better than cme expectations. Under the background of domestic demand expansion, the valuation of the construction machinery sector is undergoing a repair (with related concept stocks attache

In November 2024, the domestic sales of excavators increased by 20.5% year-on-year, continuing to grow, better than cme expectations.

Comments

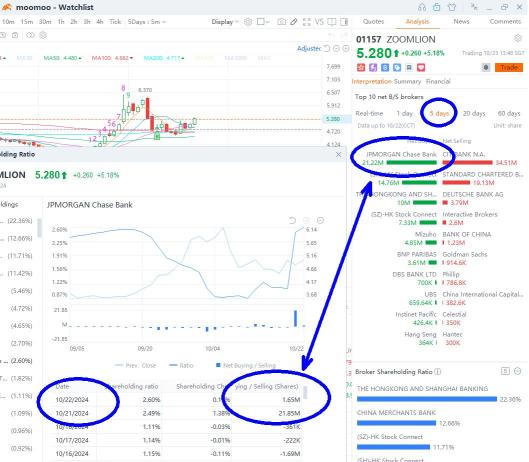

Holding on this - as long as JPM is holding it. Foundamentally this is good counter for China Recovery.

No Data

105584693 : the holding has changed today