No Data

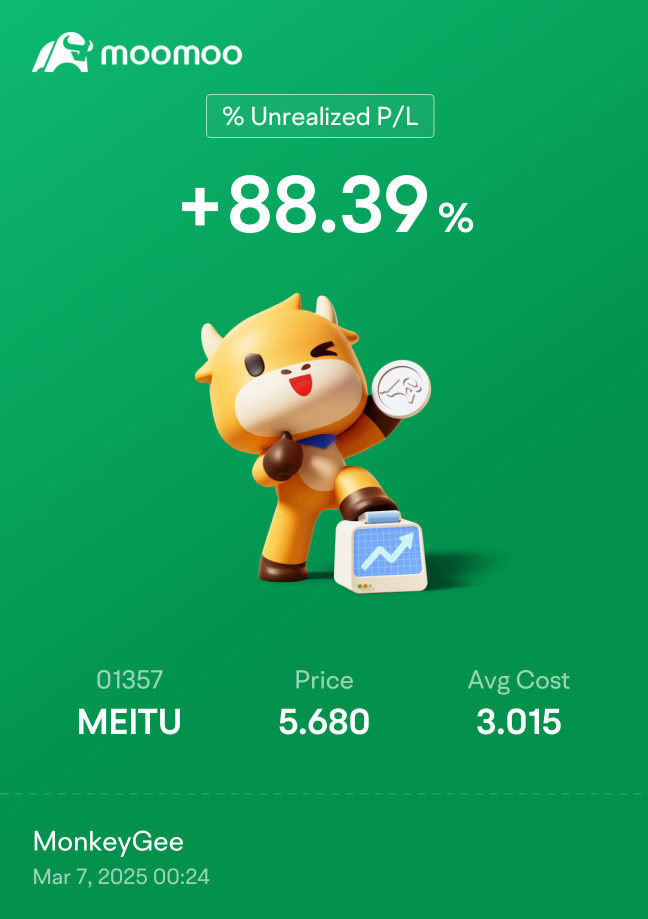

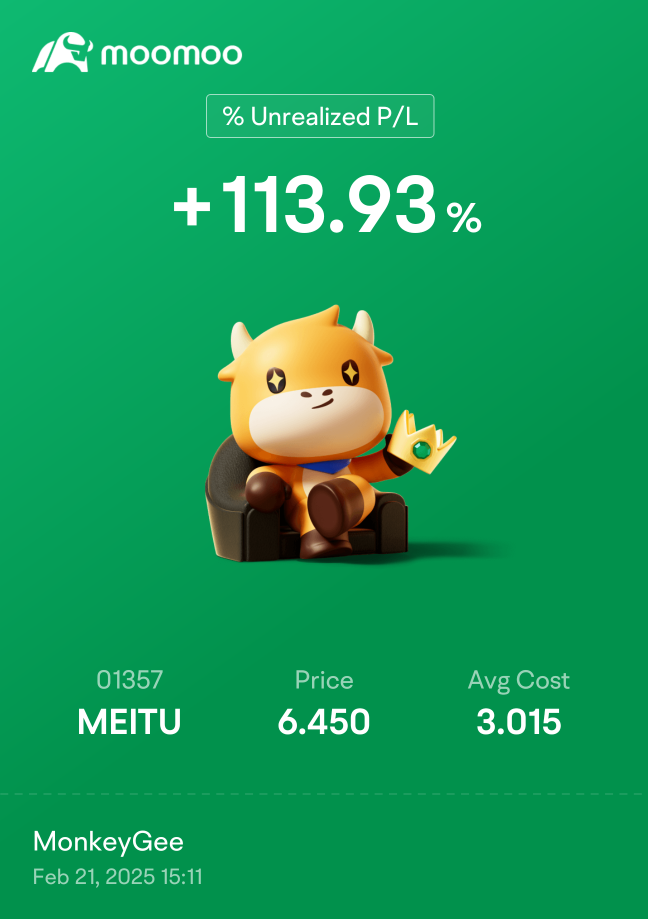

01357 MEITU

- 5.450

- +0.120+2.25%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Investing in Meitu (HKG:1357) Three Years Ago Would Have Delivered You a 464% Gain

In the context of trade tariffs and market fluctuations in the USA: Gold performs exceptionally well: Bitcoin faces challenges in the first quarter.

In the context of trade tariffs and market fluctuations in the USA: Gold performs exceptionally well: Bitcoin faces challenges in the first quarter.

A statement that shocked the market: Bitcoin experienced wild fluctuations and fell below 0.082 million, while Gold at 3089 saw safe-haven Bids soar.

One sentence shocks the market! Bitcoin experiences intense fluctuations and falls below 0.082 million, while Gold at 3089 sees a surge in safe-haven Bids!

MEITU's Wu Xinhong: Actively promoting the inclusive development of AI and the dissemination of traditional Chinese culture.

Sina Technology reported on March 31 evening that at the 2025 China Internet Media Forum "AI Empowering Positive Energy Creation" conference, the founder, Director, and CEO of MEITU, Wu Xinhong, stated that adhering to the mission of "bringing art and Technology beautifully together," MEITU has always promoted traditional culture through image and design products, spreading the beauty of China globally. At the forum, MEITU presented products such as Meitu Xiuxiu, Beauty Camera, Meitu Design Studio, Kaipai, and WHEE. Wu Xinhong introduced MEITU's recent initiatives through the "MEITU AI Inclusive Project" and the "MEITU China Traditional Culture Dissemination Project."

US Morning News Call | Gold Breaks Through $3,100, Up 20% YTD

[Brokerage Focus] Huaxin Securities gives Meitu (01357) an initial rating of "Buy", stating that the growth of overseas users and commercialization potential are worth looking forward to.

Jinwu Finance | Huaxin Securities released a Research Report indicating that MEITU (01357) relies on AI technology to deepen the innovation of imaging and design products, with significant growth expected in 2024, gross margin rising to 68.7%, and accelerating Global expansion. Core data shows that the company's annual revenue reached 3.341 billion Hong Kong dollars, an increase of 23.9% year-on-year, with net income attributable to the parent reaching 0.805 billion Hong Kong dollars, a substantial increase of 112.8% year-on-year. The income from imaging and design products accounts for 62.4%, becoming the core driving force, while the advertising Business achieves steady growth through AI-optimized recommendation efficiency. AI technology reshapes the product matrix, driven by a subscription model.