No Data

01361 361 DEGREES

- 3.830

- +0.070+1.86%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Investors Will Want 361 Degrees International's (HKG:1361) Growth In ROCE To Persist

Brokerage Focus: The Pacific Securities maintains a "buy" rating on 361 degrees (01361), indicating that its performance in the weak consumer environment still leads its peers.

The Pacific Securities Research Institute issued a research report, indicating that 361 Degrees (01361) recently released the 2024Q3 retail operation data. In 2024Q3, offline adult clothing sales increased by about 10% year-on-year, offline children's clothing sales increased by about 10% year-on-year, and e-commerce sales increased by over 20% year-on-year. The sales performance met expectations. The institute mentioned that in the overall weak domestic consumer environment in 24Q3, the company's sales still achieved steady and rapid growth, leading the industry in performance. Additionally, inventory and discount indicators maintained a healthy level. Coupled with a 30%+ increase in online sales during the National Day golden week and a 20%+ year-on-year increase in offline sales, the institute is bullish on the company.

361 Degrees International Limited (HKG:1361) CEO Wuhao Ding, the Company's Largest Shareholder Sees 6.3% Reduction in Holdings Value

[Brokerage Focus] Shanxi maintains a "buy-B" rating for 361 degrees (01361), indicating that the offline channel upgrade optimization is expected to drive store efficiency improvement.

Jingu Finance | Shanxi Securities issued a research report, pointing out that in the third quarter of 2024, 361 Degrees (01361) released its company business data. In March 202403, the offline retail revenue of 361 Degrees' main brand increased by 10% year-on-year, the offline retail revenue of 361 Degrees' children's clothing brand increased by 10% year-on-year, and the online retail revenue of 361 Degrees' e-commerce platform increased by over 20% year-on-year. The bank indicated that in Q3, the offline revenue growth of the main brand continued, and the growth of the e-commerce channel was faster than that of the offline channel. Q3 retail discounts and channel inventory turnover remained stable, and the upgrade optimization of offline channels is expected to drive store efficiency improvement. The bank pointed out that in the third quarter of 2024, in the domestic consumer sector

CICC Securities: In the medium to long term, under the background of focusing on cost-effective consumption, 361 degrees (01361) will continue to benefit. It is rated as 'buy'.

Citic Securities expects 361 degrees (01361) to achieve a net income attributable to the parent company of 1.09/1.23/1.37 billion yuan from 2024 to 2026.

gtja: Maintain a shareholding rating of 361 degrees (01361), Q3 revenue meets expectations, strong National Day sales.

gtja predicts that the net profit attributable to the mother from 2024 to 2026 will be 1.09/1.27/1.46 billion yuan.

Comments

Earnings Update: 361 Degrees International Limited (HKG:1361) Just Reported Its Yearly Results And Analysts Are Updating Their Forecasts

Earnings Update: 361 Degrees International Limited (HKG:1361) Just Reported Its Yearly Results And Analysts Are Updating Their ForecastsCommunity is to deepen the brand image and bring users closer to each other.

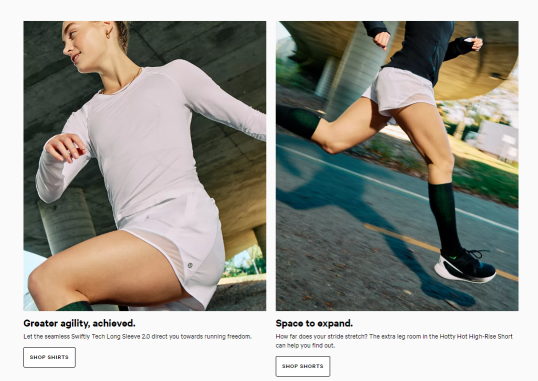

For example, On "Weekly Runs," Nike's "Nike Run Club," GymShark's "66-day challenge", Lululemon's "Sweatlife Community," Nobull's CrossFit community, and Discontinuity's Ironman community.

Brand community building is the accumulation of brand assets

Allbirds into Silicon Valley street shoes, Nobull is the CrossFit code word, Alo Yoga fashion and healthy li...

In the latest announcement of the third quarter earnings, revenue rose 28% year-on-year. However, inventor...

Analysis

Price Target

No Data

No Data